Wood Adhesives Market Size 2024-2028

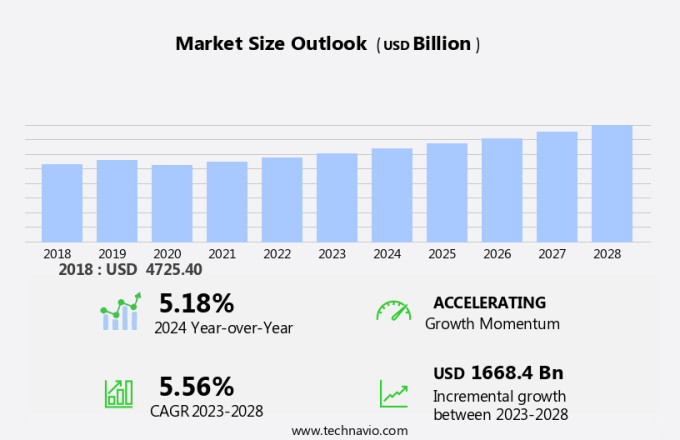

The wood adhesives market size is forecast to increase by USD 1.67 billion at a CAGR of 5.56% between 2023 and 2028. The market is driven by the expansion of the real estate and construction sector, which increases the demand for adhesives in the production of medium-density fiberboard (MDF) and other wood-based products. A notable trend in the market is the rising preference for eco-friendly adhesives, particularly those based on starch, corn, and other bio-sources. However, the use of volatile organic compounds (VOCs) in traditional adhesives, such as urea-formaldehyde (UF) resin and melamine urea-formaldehyde resin, poses environmental concerns and is subject to stringent regulations. Isocyanates, including methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), are also under scrutiny due to their potential health hazards.

The market is experiencing significant growth due to the increasing demand for eco-friendly and green furniture. With the rise of environmental consciousness, consumers are increasingly preferring furniture made from engineered wood panels, which are more sustainable than solid wood. Wood panel manufacturers are, therefore, focusing on the adoption of innovative product development and advanced technology to meet this demand. Adhesive production plays a crucial role in wood-based panel manufacturing. Formaldehyde emissions, a common concern with traditional adhesives, are being addressed through the use of eco-friendly alternatives such as soy-based adhesives, polyurethane adhesives, and polyvinyl acetate adhesives.

Moreover, these adhesives not only offer superior performance but also contribute to the sustainability of the manufacturing process. The market is fragmented, with several manufacturers catering to the residential and commercial construction sectors. Residential construction is the primary driver of the market due to the high demand for eco-friendly furniture and flooring. Wooden flooring, in particular, is a significant application area for wood adhesives. Low-VOC (volatile organic compounds) adhesives and water-based technology are becoming increasingly popular due to their environmental benefits. Solvent-based adhesives, on the other hand, are being phased out due to their high VOC content and negative impact on the environment.

Further, the renovations are another area where wood adhesives find extensive use. The versatility of these adhesives makes them suitable for various applications, from bonding engineered wood panels to repairing furniture and flooring. The resin types used in wood adhesives include phenolic, urea-formaldehyde, melamine formaldehyde, and isocyanate. Each resin type offers unique benefits in terms of performance, durability, and environmental impact. The technology used in wood adhesive manufacturing is constantly evolving, with a focus on reducing formaldehyde emissions and improving bonding performance. Innovative product development is a key trend in the market, with manufacturers investing in research and development to create new, eco-friendly adhesive solutions.

In conclusion, the market is a dynamic and growing industry, driven by the demand for eco-friendly and sustainable furniture and wood-based panel manufacturing. With a focus on reducing formaldehyde emissions, improving performance, and adopting innovative product development, the future of the market looks promising.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Water based adhesive

- Solvent based adhesive

- Others

- Application

- Furniture

- Flooring

- Doors and windows

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

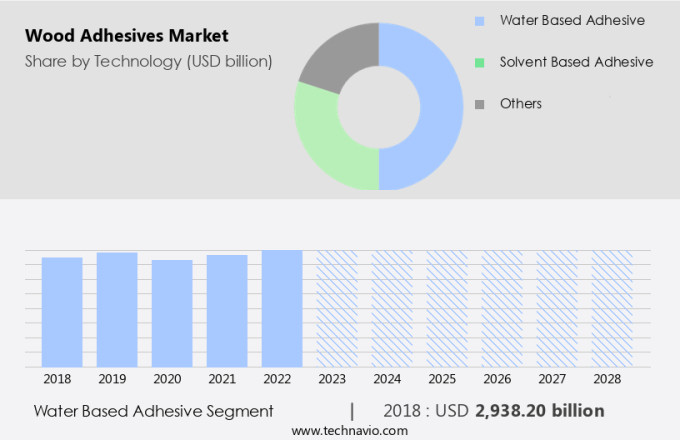

By Technology Insights

The water based adhesive segment is estimated to witness significant growth during the forecast period. Water-based adhesives, or emulsion adhesives, hold significant importance in the woodworking and furniture industry due to their eco-friendliness and low volatile organic compound (VOC) content. These adhesives are formulated using water as the primary solvent, making them a preferred choice for sustainable and durable bonding solutions. The market, particularly in the US, is witnessing growth due to the increasing demand for moisture-resistant adhesives in furniture manufacturing and residential construction. Henkel AG and Co. KGaA is one of the leading companies in this market, offering a comprehensive range of water-based adhesives under the brand name "Purbond." These adhesives cater to various applications within the woodworking and furniture industry, including furniture manufacturing, cabinetry, flooring, and panel lamination.

Moreover, their use contributes to enhanced performance and sustainability in these applications. Innovative product development is a key trend in the market, with a focus on improving moisture resistance and enhancing bonding strength. This fragmented market is served by several other notable companies, such as 3M, H.B. Fuller, and Sika AG. As the demand for eco-friendly and durable bonding solutions continues to rise, the market for water-based adhesives is expected to grow steadily in the US and North America.

Get a glance at the market share of various segments Request Free Sample

The water-based adhesive segment was valued at USD 2,938.20 billion in 2018 and showed a gradual increase during the forecast period.

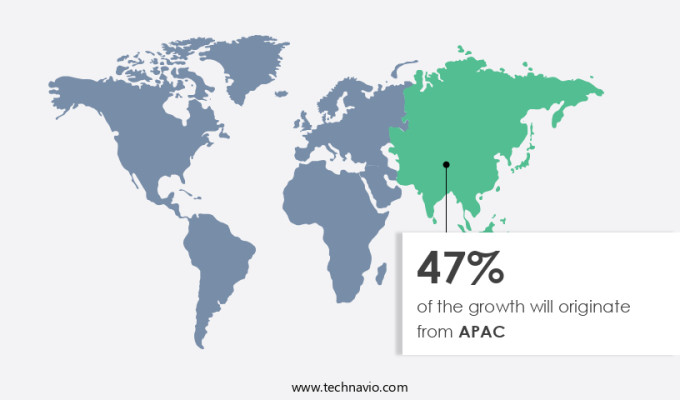

Regional Insights

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific region is experiencing notable expansion, providing potential opportunities for market participants. APAC is a significant consumer and manufacturer of wood-based products, encompassing furniture, building materials, and engineered wood products. The escalating demand for these items is propelling the expansion of the market in this region. One of the primary catalysts fueling the growth of the market in APAC is the rapid urbanization and industrialization occurring in countries such as China, India, and Southeast Asian nations. These countries are undergoing substantial infrastructure development, construction activities, and urban housing projects. For example, India's construction industry's contribution to the country's GDP has risen from USD35 billion in 2013 to USD100 billion in 2020.

Moreover, two main categories of wood adhesives are natural resin adhesives and synthetic resin adhesives. Natural resin adhesives, derived from renewable sources, include solvent-based adhesives and hot-melt adhesives. Synthetic resin adhesives, on the other hand, are derived from petrochemicals and include thermosetting resin adhesives and thermoplastic resin adhesives. These adhesives are extensively used in various applications, such as bonding cabinets, decks, windows, and doors. The technology employed in the production of wood adhesives is continually evolving, with a focus on enhancing bond strength, reducing emissions, and improving application methods. As a result, companies in the market are consistently introducing innovative products to cater to the evolving needs of their customers.

In conclusion, the market in the Asia Pacific region is witnessing substantial growth due to the increasing demand for wood-based products and the ongoing urbanization and industrialization in the region. The market offers significant opportunities for companies, with natural and synthetic resin adhesives being used in various applications, including furniture, construction materials, and engineered wood products. The continuous advancements in technology are driving the development of innovative adhesive solutions to meet the evolving needs of the industry.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growth of real estate and construction industry is the key driver of the market. The real estate sector's expansion in the United States has driven a significant increase in the construction of offices, commercial complexes, and residential buildings. This trend has fueled the demand for eco-friendly and green furniture, particularly engineered wood panels, in the market. The rise of single-person and two-person households has led to a wave in residential construction activities, further boosting the demand for wood-based panel manufacturing. The aging population, known as Baby Boomers, and the urbanization trend have created a growing need for customized wooden furniture. Additionally, changing lifestyle patterns among Millennials have added to the demand for wooden furniture.

Moreover, portability and compactness are key factors influencing furniture purchases, as space constraints are common in urban areas. The demand for multipurpose furniture is also on the rise due to the limited space available in urban settings. In response to these trends, wood panel manufacturers have been focusing on the production of adhesives, such as soy-based, polyurethane, and polyvinyl acetate adhesives, to meet the increasing demand for eco-friendly and high-performance adhesives in wood-based panel manufacturing. Refurbishment and renovation activities are also contributing to the growth of the market. The need for cost-effective and efficient adhesives for these projects has led to an increased focus on research and development in the industry. Overall, the market is expected to continue its growth trajectory in the coming years, driven by the increasing demand for wooden furniture and the need for eco-friendly and high-performance adhesives.

Market Trends

Growing focus on the adoption of bio-based adhesives is the upcoming trend in the market. The market is witnessing a significant shift towards the use of eco-friendly and sustainable adhesives derived from renewable resources. Bio-based adhesives, such as those made from starch, corn, and other plant-based materials or agricultural by-products, are gaining popularity due to their environmental benefits. These adhesives have a lower carbon footprint and do not contribute to greenhouse gas emissions during production, making them a more sustainable alternative to traditional synthetic adhesives derived from volatile organic compounds (VOCs) like urea-formaldehyde (UF) resin and melamine urea-formaldehyde resin. Environmental regulations and concerns are driving the demand for bio-based adhesives. For instance, regulations limiting the use of formaldehyde in adhesives due to its health hazards are pushing manufacturers to explore alternatives.

Additionally, consumers are increasingly demanding sustainable and eco-friendly products, creating a market opportunity for bio-based adhesives. Bio-based adhesives are also used in medium-density fiberboard (MDF) production, which is a significant application area for wood adhesives. Isocyanates, such as methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), are commonly used as raw materials in the production of bio-based adhesives. The use of these bio-based adhesives not only reduces the environmental impact but also improves the overall sustainability of the wood industry.

Market Challenge

Government regulations associated with the manufacturing of adhesives is a key challenge affecting the market growth. Wood adhesives play a crucial role in sustainable construction and remodeling projects, particularly in the use of materials such as plywood, oriented strand board (OSB), particle board, and other engineered wood products. In the service sector, office spaces and corporate buildings are increasingly adopting these materials due to their cost-effectiveness and environmental benefits. However, concerns regarding the environmental impact of wood adhesives, specifically the emission of volatile organic compounds (VOCs) and formaldehyde, have led to stricter regulations. Governments and regulatory bodies have imposed stringent limits on VOC emissions from adhesives to safeguard human health, minimize air pollution, and mitigate the negative effects of adhesive manufacturing and usage on the environment.

However, adhesive resins, a key component of wood adhesives, are often derived from non-renewable sources. In response, the market for bio-based adhesives is growing, offering a more sustainable alternative. Bio-based adhesives, derived from renewable resources, offer a more eco-friendly alternative to traditional adhesives. These adhesives are gaining popularity in the construction industry due to their lower environmental impact and compliance with regulations. As living standards continue to rise and the demand for sustainable construction solutions increases, the use of bio-based adhesives is expected to increase significantly. In conclusion, the market is undergoing a shift towards more sustainable and eco-friendly solutions.

Similarly, regulatory compliance and environmental concerns are driving the demand for bio-based adhesives, which offer a more sustainable alternative to traditional adhesives. The use of these adhesives in the construction of office spaces, corporate buildings, and other structures is expected to increase, contributing to a more sustainable future.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Koff Club Pvt. Ltd. - The company offers wood adhesives such as polyvinyl acetate adhesives.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Aica Kogyo Co. Ltd.

- Akzo Nobel NV

- Arkema SA

- Ashland Inc.

- Asian Paints Ltd.

- Astral Ltd.

- Beardow and Adams Adhesives Ltd.

- Bhiwadi Polymers Ltd.

- Bolton Group Srl

- Britannia Adhesives Ltd.

- Cattie Adhesives

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Jowat SE

- Jubilant Industries Ltd.

- Pidilite Industries Ltd

- Sika AG

- Technical Adhesives Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for eco-friendly and green furniture. Wood-based panel manufacturing, including engineered wood panels like plywood, oriented strand board (OSB), particle board, and medium-density fiberboard (MDF), relies heavily on adhesives for bonding solutions. Soy-based adhesives and bio-based adhesives made from starch, corn, and other natural sources are gaining popularity due to their lower formaldehyde emissions. Adhesive production plays a crucial role in wood-based panel manufacturing, with resin types including urea-formaldehyde (UF) resin, melamine urea-formaldehyde resin, phenol-formaldehyde, polyurethane, and polyvinyl acetate. Innovative product development in low-VOC (volatile organic compounds) adhesives and water-based technology is driving market growth.

Moreover, the furniture industry, including residential and commercial construction, infrastructure projects, and mass timber construction, as well as refurbishment, renovation activities, and sustainable construction, are major consumers of wood adhesives. Adhesive manufacturers focus on improving adhesive quality, durability, and performance to meet the demands of various applications. The service sector, including office spaces, corporate buildings, and housing components, also contributes to the market growth. Customizable furniture, flooring solutions, and construction activities require high-performance adhesives. Cabinets, decks, windows and doors, and other wooden components are essential applications for wood adhesives. Natural resin adhesives and synthetic resin adhesives, including thermosetting resin adhesives and thermoplastic resin adhesives, cater to diverse industry needs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.56% |

|

Market Growth 2024-2028 |

USD 1,668.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.18 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

China, US, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Aica Kogyo Co. Ltd., Akzo Nobel NV, Arkema SA, Ashland Inc., Asian Paints Ltd., Astral Ltd., Beardow and Adams Adhesives Ltd., Bhiwadi Polymers Ltd., Bolton Group Srl, Britannia Adhesives Ltd., Cattie Adhesives, H.B. Fuller Co., Henkel AG and Co. KGaA, Jowat SE, Jubilant Industries Ltd., Koff Club Pvt. Ltd., Pidilite Industries Ltd, Sika AG, and Technical Adhesives Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch