Wood Fiber Insulation Market Size 2025-2029

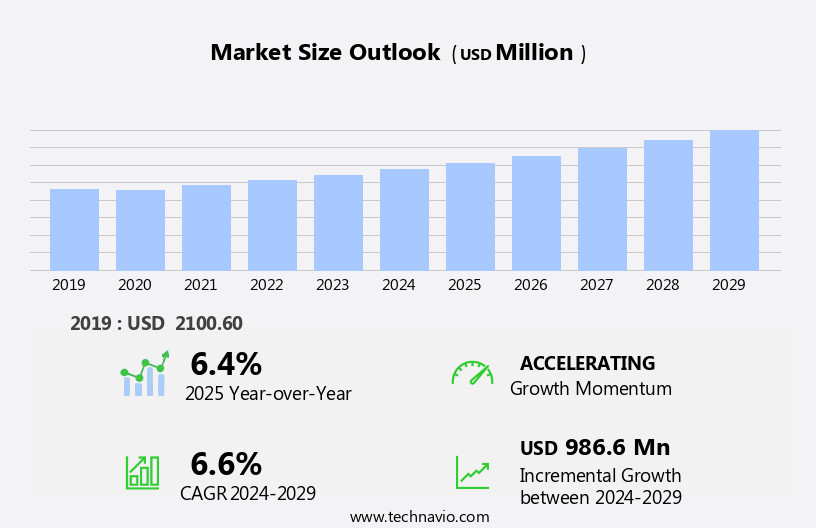

The wood fiber insulation market size is forecast to increase by USD 986.6 million at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth driven by the rising demand for sustainable and eco-friendly building materials. This trend is being fueled by increasing environmental consciousness and stringent regulations aimed at reducing carbon emissions and promoting energy efficiency. Strategic partnerships among market players are also contributing to market expansion, as companies collaborate to develop innovative products and broaden their reach. However, competition from alternative insulation materials, such as mineral wool and polystyrene, presents a challenge.

- Manufacturers must differentiate themselves through superior product performance, competitive pricing, and effective marketing to capture market share. Companies seeking to capitalize on this market's opportunities must stay abreast of regulatory developments, invest in research and development, and build strong partnerships to remain competitive.

What will be the Size of the Wood Fiber Insulation Market during the forecast period?

- The market in the United States continues to gain momentum as eco-conscious consumers and building codes prioritize sustainable building design. This market encompasses a range of applications, including insulation for walls, basements, barns, sheds, attics, roofs, garages, floors, and insulation batts. The affordability and convenience of wood fiber insulation, coupled with its high-performance and sustainable attributes, make it an attractive option for residential buildings and renovations. Building energy performance is a significant factor driving market growth, with green building codes increasingly mandating the use of eco-friendly insulation materials.

- The market's size and direction reflect a strong commitment to reducing energy consumption and carbon emissions while maintaining comfortable living conditions. Wood fiber insulation's versatility and effectiveness as a sustainable building material contribute to its growing popularity and the ongoing evolution of the insulation industry.

How is this Wood Fiber Insulation Industry segmented?

The wood fiber insulation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial

- Residential

- Type

- Rigid board insulation

- Flexible insulation

- Loose-fill insulation

- Geography

- Europe

- France

- Germany

- UK

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Application Insights

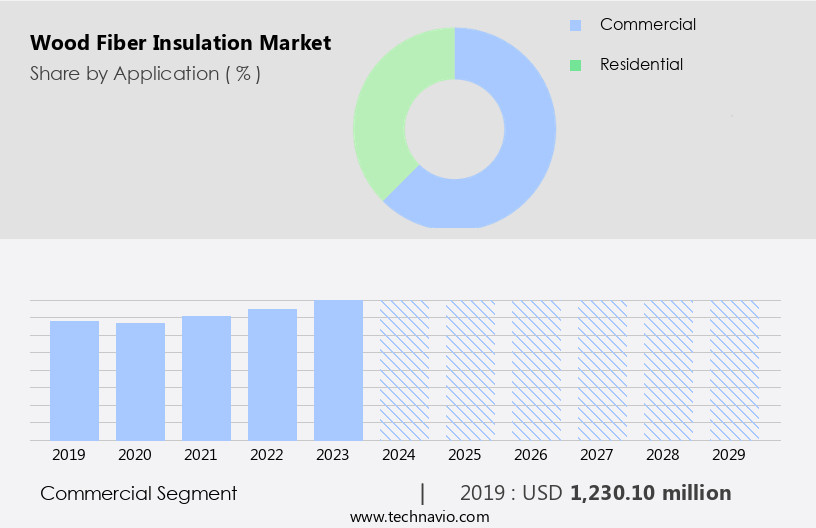

The commercial segment is estimated to witness significant growth during the forecast period.

The commercial sector is a significant market for wood fiber insulation, with a focus on constructing durable and energy-efficient spaces for business activities. Office buildings, a primary type of commercial construction, benefit from wood fiber insulation by enhancing energy efficiency, reducing heating and cooling costs, and contributing to a comfortable working environment. Additionally, this insulation type supports soundproofing, essential for maintaining a productive office atmosphere. Retail centers, including malls and shopping centers, also benefit from wood fiber insulation, as it provides excellent thermal insulation, moisture resistance, and acoustic properties. With increasing consumer awareness and building regulations emphasizing environmental performance, the use of eco-friendly building materials, such as wood fiber insulation made from renewable resources like wood shavings and sawdust, is becoming more prevalent.

These insulation solutions offer environmental advantages, including lower energy consumption, biodegradability, and reduced volatile organic compounds (VOCs) compared to synthetic insulation materials like foam. Incentives, such as subsidies and tax credits, further encourage the adoption of sustainable insulation materials and practices in the construction sector. Manufacturing facilities and industrial buildings also benefit from wood fiber insulation's thermal insulation properties, fire resistance, and sound absorption capabilities, making it a versatile insulation material for various building types. Sustainable construction practices continue to evolve, with technological advancements leading to hybrid insulation products that combine the benefits of wood fiber insulation with those of other materials, such as cellulose.

As energy efficiency, fire resistance, and environmental consciousness become increasingly important, wood fiber insulation is poised to play a significant role in the insulation materials market.

Get a glance at the market report of share of various segments Request Free Sample

The Commercial segment was valued at USD 1230.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

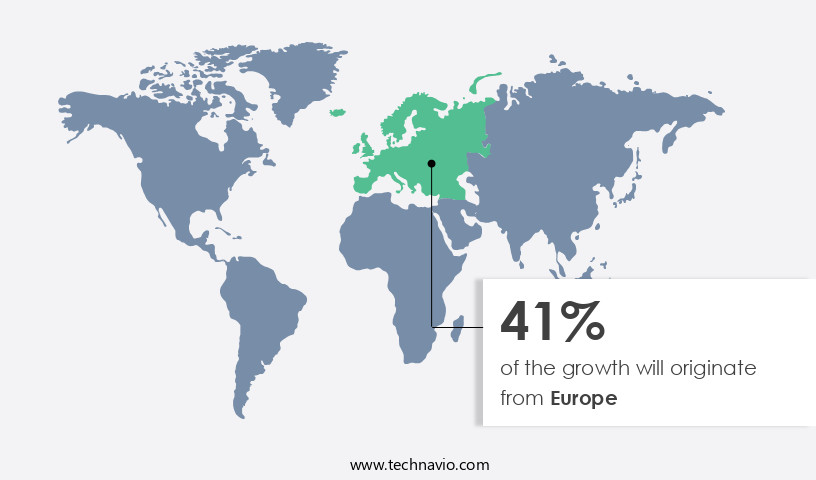

Europe is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market for wood fiber insulation is experiencing significant growth due to stringent building regulations and increasing consumer awareness of environmental performance. The European Union's Green Buildings Pact aims to improve insulation and energy efficiency in both residential and commercial buildings, with a goal of doubling renovation rates by 2030. This commitment to sustainability is reflected in the EU's ambitious targets, which include upgrading the worst 15% of residential buildings by 2030 and continuing improvements through 2033. Wood fiber insulation, derived from sustainable wood resources such as wood shavings and sawdust, offers environmental advantages over traditional insulation materials like fiberglass and foam.

These benefits include superior thermal insulation, moisture resistance, acoustic properties, and indoor air quality, all while being a biodegradable and renewable resource. Additionally, the manufacturing process for wood fiber insulation has lower volatile organic compound (VOC) emissions compared to synthetic insulation materials. As energy efficiency and environmental consciousness become increasingly important, the demand for eco-friendly building materials like wood fiber insulation is expected to continue growing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wood Fiber Insulation Industry?

- Rising demand for sustainable and eco-friendly building materials is the key driver of the market.

- The market is experiencing significant growth due to the increasing emphasis on sustainable construction practices and environmental consciousness. This market is driven by the renewable and eco-friendly properties of wood fiber insulation, which is produced from by-products of the timber industry, such as wood chips and shavings. The low carbon footprint of this insulation material makes it an attractive choice for the construction industry, as it contributes to reducing CO2 emissions and meeting climate targets.

- Government initiatives and organizational efforts to promote the use of sustainable materials in construction further boost the demand for wood fiber insulation. As the world moves towards a more sustainable future, the market is poised for continued growth.

What are the market trends shaping the Wood Fiber Insulation Industry?

- Strategic partnerships is the upcoming market trend.

- The market growth is being driven by strategic partnerships that expand distribution networks, enhance technological advancements, and promote sustainability. For instance, on May 29, 2024, Saint-Gobain, via its subsidiary CertainTeed Inc., formed a partnership with TimberHP, a Maine-based manufacturer of high-performance wood fiber insulation. This collaboration grants CertainTeed exclusive distribution rights to TimberHP's products in North America, particularly in Canada. This partnership aligns with Saint-Gobain's commitment to leading in light and sustainable construction, broadening its range of eco-friendly building materials, and addressing customer demand for sustainable insulation solutions.

What challenges does the Wood Fiber Insulation Industry face during its growth?

- Competition from alternative insulation materials is a key challenge affecting the industry growth.

- The market encounters significant competition from alternative insulation materials, which offer advantages in cost, performance, or accessibility. Traditional insulation materials, including fiberglass, mineral wool, polyurethane foam, and cellulose insulation, maintain a dominant market position due to their well-established production processes, affordability, and wide availability. Fiberglass insulation, in particular, remains a preferred choice due to its fire resistance, ease of installation, and reliable thermal performance.

- In regions such as North America and Europe, builders often prefer fiberglass insulation for its low initial investment costs and proven thermal efficiency in both residential and commercial construction projects. This competitive landscape underscores the importance of fiberglass insulation's affordability and reliability in the global insulation market.

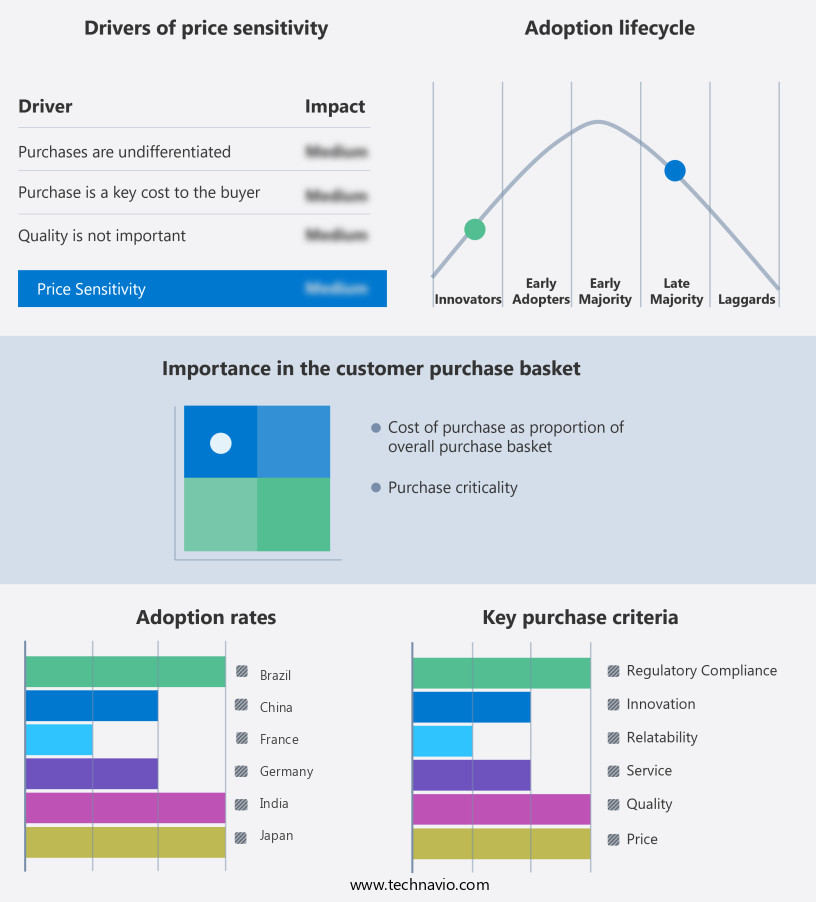

Exclusive Customer Landscape

The wood fiber insulation market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wood fiber insulation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wood fiber insulation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BANGSHANG INTERNATIONAL Co. LTD - Company X is a leading provider of China-sourced white wood cellulose fiber. This eco-friendly material is a valuable component in various industries, including construction. Its applications span plaster, tile adhesives, and other binding agents. By utilizing renewable resources, this fiber contributes to sustainable manufacturing processes and reduced carbon footprints. The versatility of white wood cellulose fiber makes it a preferred choice for numerous applications, enhancing performance and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BANGSHANG INTERNATIONAL Co. LTD

- Beltermo

- BISCHOFF SCHAFER Holz GmbH

- Celotech Chemical Co. Ltd.

- Compagnie de Saint-Gobain SA

- GUTEX Holzfaserplattenwerk H. Henselmann GmbH Co. KG

- ISOCELL GmbH and Co KG

- Knauf Insulation

- Lignotrend

- Lime Green Products Ltd

- Schneider GmbH

- SOPREMA SAS

- Steico Groups

- The Western India Plywoods Ltd

- TimberHP

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wood fiber insulation has emerged as a popular alternative to traditional insulation materials in various building types due to its environmental performance and sustainable properties. This insulation solution is derived from natural wood shavings, chips, and fibers, making it a renewable resource and a more eco-friendly choice compared to synthetic materials. The government's increasing focus on energy-efficient buildings and sustainable construction practices has fueled the growth of the market. The environmental consciousness of consumers and building regulations have also played a significant role in driving demand for this insulation material. Wood fiber insulation offers several advantages over other insulation materials.

It has excellent thermal insulation properties, which help maintain optimal indoor temperatures, reducing heating and cooling expenses. Additionally, it provides sound absorption capabilities, making it an ideal choice for soundproofing applications. One of the key benefits of wood fiber insulation is its biodegradable nature. It is a renewable material that does not contribute to the accumulation of waste in landfills. Moreover, its production process is less energy-intensive compared to synthetic insulation materials. The manufacturing facilities that produce wood fiber insulation have implemented sustainable industrial processes to minimize their carbon footprint. These processes ensure that the wood fibers are sourced from sustainable forests and that the production methods are environmentally friendly.

Despite its numerous advantages, the adoption of wood fiber insulation is not without challenges. One of the main concerns is its moisture resistance. Proper installation and treatment of the insulation material are essential to ensure it remains effective and does not absorb moisture. Another challenge is the lack of consumer awareness regarding the benefits of wood fiber insulation. While some building codes have recognized the environmental advantages of this insulation material, more education and promotion are needed to increase its adoption. The market is expected to grow as technological advancements continue to improve the production technologies and performance of this insulation material.

Hybrid insulation products that combine wood fiber insulation with other materials, such as foam or cellulose, are also gaining popularity due to their enhanced energy efficiency and fire resistance. In , the market is poised for growth as more building owners and developers recognize the environmental advantages and sustainable properties of this insulation material. With continued innovation and education, wood fiber insulation is set to become a preferred choice for insulation solutions in various building types.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 986.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wood Fiber Insulation Market Research and Growth Report?

- CAGR of the Wood Fiber Insulation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wood fiber insulation market growth of industry companies

We can help! Our analysts can customize this wood fiber insulation market research report to meet your requirements.