Workforce Analytics Market Size 2025-2029

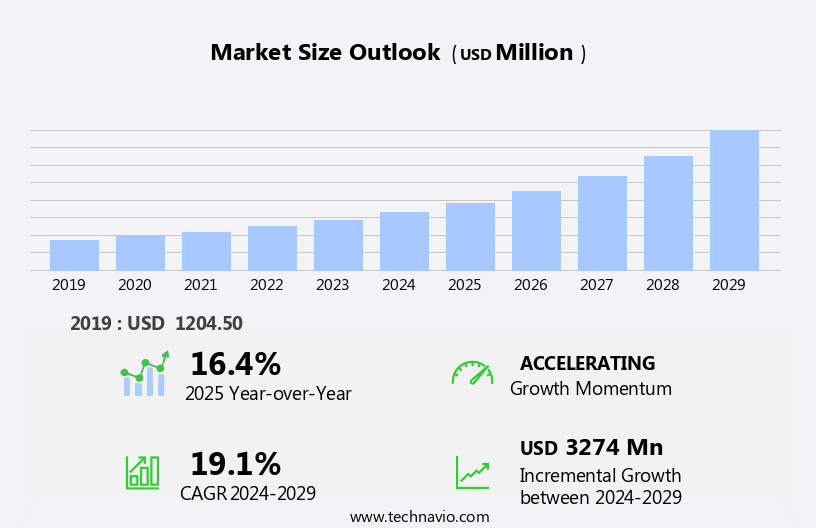

The workforce analytics market size is forecast to increase by USD 3.27 billion, at a CAGR of 19.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for efficient workforce management and recruitment. Companies are recognizing the value of leveraging data-driven insights to optimize their workforce, leading to increased adoption of workforce analytics solutions. Another key trend in the market is the growing use of mobile applications for workforce analytics, enabling real-time access to data and analytics from anywhere. However, the market also faces challenges, including the lack of a skilled workforce capable of effectively implementing and utilizing these advanced analytics tools.

- As the market continues to evolve, companies seeking to capitalize on opportunities and navigate challenges effectively must prioritize investments in workforce analytics solutions and focus on building a skilled workforce to maximize the value of their data.

What will be the Size of the Workforce Analytics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing importance of data-driven decision making in various sectors. Cost optimization, data visualization, and data warehousing are integral components of workforce analytics, enabling organizations to gain valuable insights from their workforce data. Process automation and employee development are also key areas of focus, as they help streamline operations and enhance employee skills. Performance management and organizational network analysis provide valuable insights into employee productivity and team dynamics. ETL processes and risk management ensure data accuracy and security, while recruitment optimization and career pathing facilitate effective talent acquisition and retention.

Predictive modeling and sentiment analysis aid in anticipating workforce trends and employee sentiment, respectively. Data security and strategic workforce planning are essential for mitigating risks and ensuring long-term success. Machine learning and natural language processing are advanced technologies that are increasingly being adopted for data analysis and processing. Workforce analytics encompasses a range of applications, from compensation analysis and employee satisfaction to diversity and inclusion and leadership development. These areas are interconnected and evolve continuously, with new technologies and trends shaping the market landscape. The ongoing integration of these applications into comprehensive workforce analytics solutions enables organizations to optimize their workforce and gain a competitive edge.

How is this Workforce Analytics Industry segmented?

The workforce analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Retail

- BFSI

- Telecom and IT

- Healthcare

- Others

- Application

- Large enterprises

- Small and medium sized enterprise

- Deployment

- Cloud

- On-premise

- Service

- Consulting Services

- System Integration

- Managed Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

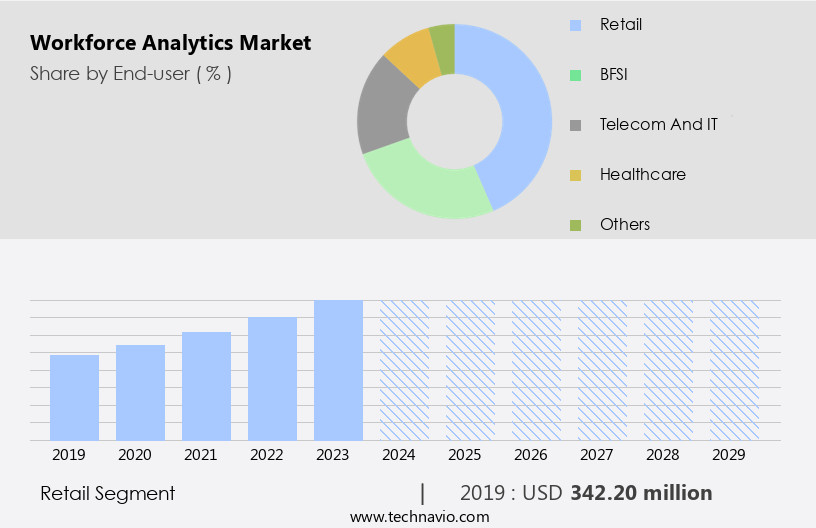

The retail segment is estimated to witness significant growth during the forecast period.

In today's dynamic business environment, retail organizations face increasing pressure to optimize their workforce to stay competitive. The retail industry's growth is driven by factors such as changing market economics, rising competition from e-commerce, and evolving customer demands. To meet these challenges, retailers are investing in their workforce, recognizing its crucial role in driving business success. Workforce optimization strategies encompass various approaches, including 360-degree feedback, organizational network analysis, and social network analysis, to enhance employee performance and engagement. Headcount planning, aided by cloud computing, enables retailers to manage their workforce effectively and adapt to seasonal fluctuations.

Regression analysis, statistical analysis, and time series analysis help retailers identify trends and make data-driven decisions. Strategic workforce planning, succession planning, and talent acquisition are essential components of a robust workforce strategy. Employee development, cost optimization, data cleaning, and natural language processing are critical for maintaining a skilled and productive workforce. Data mining, ETL processes, data warehousing, and business intelligence provide valuable insights into workforce performance and trends. Retention strategies, such as career pathing and employee engagement, are crucial for reducing employee turnover. Training effectiveness, performance reviews, and process automation contribute to enhancing employee skills and productivity.

Predictive modeling, predictive algorithms, and decision support systems enable retailers to anticipate workforce needs and optimize resources. Data governance, data security, and bias detection are essential for maintaining data integrity and ensuring fairness in workforce management. Compensation benchmarking and diversity and inclusion initiatives contribute to a fair and inclusive work environment. In conclusion, retailers must leverage advanced analytics and workforce optimization strategies to stay competitive in today's fast-paced business landscape.

The Retail segment was valued at USD 342.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

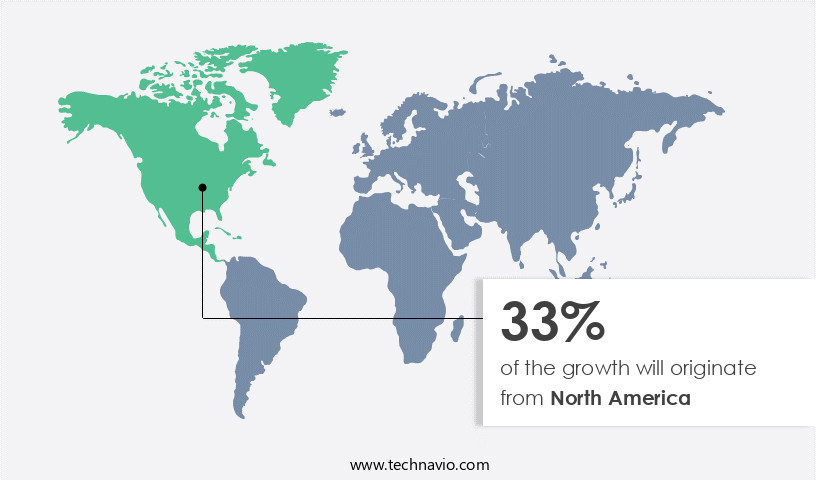

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing significant growth as organizations increasingly rely on data analytics to optimize their workforce and enhance employee productivity and engagement. Key drivers of this market include the adoption of cloud-based solutions, the demand for data-driven HR decisions, and the need to improve employee engagement and retention. The use of big data, regression analysis, data transformation, skills gap analysis, predictive modeling, and other advanced analytics techniques is becoming increasingly prevalent in talent acquisition, performance management, and workforce planning. Additionally, the integration of data lakes, data warehousing, and data visualization tools enables organizations to gain valuable insights from their workforce data.

The market is further propelled by the increasing use of machine learning, text analytics, and sentiment analysis to enhance recruitment optimization, training effectiveness, and employee development. Data security and risk management are also critical considerations in the market, as organizations seek to protect their sensitive workforce data. Overall, the North American the market is a dynamic and evolving landscape, with a focus on enhancing operational efficiency, reducing costs, and improving organizational performance through data-driven insights.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In today's data-driven business landscape, the market plays a pivotal role in optimizing organizational performance through data-backed insights. This market encompasses advanced technologies like machine learning, artificial intelligence, and predictive analytics, applied to workforce data for talent acquisition, performance management, and succession planning. It facilitates workforce forecasting, identifying trends, and predicting future needs, enabling businesses to make data-driven decisions regarding staffing, training, and retention. The market caters to various sectors, including healthcare, finance, retail, and education, offering customized solutions for workforce optimization. It addresses critical challenges such as skills gap analysis, employee engagement, and compliance with labor regulations. Ultimately, the market empowers organizations to leverage their human capital effectively, driving productivity, innovation, and competitiveness.

What are the key market drivers leading to the rise in the adoption of Workforce Analytics Industry?

- The demand for an efficient workforce, achieved through effective management and recruitment, serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand for effective workforce management and recruitment. Workforce analytics solutions enable organizations to gain valuable insights into employee productivity, engagement, and retention, which are crucial for optimizing HR processes and reducing costs. With the intensifying competition for talent, these solutions have become essential for businesses seeking to improve employee engagement and retain top performers. Workforce analytics tools offer real-time data analysis capabilities, allowing organizations to monitor key HR metrics such as employee turnover rates, performance levels, and recruitment costs. Predictive modeling, regression analysis, skills gap analysis, and compensation benchmarking are some of the advanced analytics techniques used to gain deeper insights into workforce trends and identify potential issues.

- Moreover, employee surveys, data transformation, and data governance are essential components of workforce analytics solutions, ensuring data accuracy and security while providing valuable feedback from employees. Decision support systems, data lakes, and predictive modeling are also crucial elements, enabling organizations to make informed decisions based on data-driven insights. Effective workforce planning, talent acquisition, and employee satisfaction are critical factors for business success, and workforce analytics solutions provide the necessary data and insights to help organizations achieve these goals. By leveraging the power of big data, organizations can gain a competitive edge and make informed decisions that lead to improved workforce performance and overall business growth.

What are the market trends shaping the Workforce Analytics Industry?

- The use of mobile applications for workforce analytics is gaining significant traction in the current market. This trend signifies a notable shift towards more flexible and remote work solutions, enabling organizations to make data-driven decisions in real-time.

- The market is experiencing significant growth, driven by the increasing demand for data-driven decision-making in human resources. One trend transforming workforce analytics is the use of mobile applications, such as Visier and SAP SuccessFactors, which enable access to key workforce metrics and insights from anywhere. This mobility is essential for managers, who often work remotely or on the go, allowing them to address performance issues and opportunities promptly. Mobile applications also enhance the user experience through intuitive and user-friendly interfaces. Moreover, workforce analytics offers various benefits, including cost optimization through data visualization and process automation, employee development through performance management and career pathing, and risk management through organizational network analysis and ETL processes.

- Additionally, recruitment optimization and succession planning are crucial aspects of workforce analytics, ensuring a skilled and prepared workforce. Training effectiveness is also a significant concern, which can be addressed through data warehousing and social network analysis. Overall, the adoption of workforce analytics is a harmonious blend of technology and human resources, emphasizing data-driven insights to optimize organizational performance.

What challenges does the Workforce Analytics Industry face during its growth?

- The insufficient supply of skilled labor represents a significant obstacle to the expansion and growth of the industry.

- The market faces a significant challenge due to the lack of a skilled workforce capable of executing complex data analysis, statistical modeling, and business strategy initiatives. This issue arises from the rapid pace of technological advancements, increasing demand for data-driven decision-making, and the relatively new nature of the field. Workforce analytics is a multifaceted discipline that involves data cleaning, sentiment analysis, text analytics, time series analysis, predictive algorithms, talent management, productivity metrics, data security, natural language processing, learning analytics, statistical analysis, and bias detection.

- To address this challenge, organizations must invest in training and upskilling their existing workforce or partner with external experts. Cloud computing solutions can also provide access to advanced analytics tools and services, enabling operational efficiency and improved productivity metrics. Companies must prioritize data security and bias detection to ensure accurate and unbiased insights.

Exclusive Customer Landscape

The workforce analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the workforce analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, workforce analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company delivers workforce analytics, including ADP's DataCloud solution. This tool offers people analytics and HR benchmarking, enabling measurement, comparison, prediction, and application of insights derived from extensive ADP data.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Automatic Data Processing Inc.

- Brightfield

- Bullhorn Inc.

- Ceridian HCM Holding Inc.

- Cezanne HR

- Cornerstone OnDemand Inc.

- International Business Machines Corp.

- Jobvite Inc.

- Koch Industries Inc.

- Kronos Inc.

- NorthgateArinso

- Oracle Corp.

- Paycor HCM Inc.

- Salesforce Inc.

- SAP SE

- TalentSoft

- Ultimate Software

- Visier Inc.

- Workday Inc.

- WorkForce Software LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Workforce Analytics Market

- In January 2024, IBM announced the acquisition of HCL's workforce analytics business, marking a significant strategic move to strengthen its human capital management solutions (IBM Press Release, 2024). This acquisition brought IBM over 3,000 HCL employees and expanded its workforce analytics capabilities, enabling the company to offer advanced data-driven HR solutions to a broader clientele (IBM Investor Relations, 2024).

- In March 2024, SAP and Google Cloud entered into a strategic partnership to integrate SAP's SuccessFactors workforce analytics solution with Google Cloud's BigQuery data analytics platform. This collaboration aimed to provide businesses with real-time, data-driven insights into their workforce performance and talent management (SAP News Center, 2024).

- In May 2024, Oracle Corporation announced the launch of its new AI-driven workforce analytics solution, Oracle Talent Analytics Cloud. This solution was designed to help organizations gain real-time insights into workforce performance, predict talent trends, and improve overall workforce efficiency (Oracle Corporation Press Release, 2024).

- In February 2025, Microsoft and Adobe signed a partnership agreement to integrate Microsoft Power BI with Adobe Experience Cloud. This integration aimed to provide businesses with a comprehensive solution for analyzing customer experience data alongside workforce analytics, enabling more informed decision-making and improved employee engagement (Microsoft News Center, 2025).

Research Analyst Overview

- The market is witnessing significant growth as organizations seek to optimize their human capital through data-driven insights. Qualitative data analysis plays a crucial role in interpreting employee feedback, while change management initiatives are enhanced by comparative analysis and scenario planning. Stress management and employee well-being are essential components of employee value proposition, with correlation analysis and experimental design aiding in causal inference. Internal mobility and conflict resolution are key aspects of people management, addressed through talent analytics and prescriptive analytics.

- HR technology facilitates survey design, knowledge management, and learning and development, enabling performance improvement. Employee experience is further enriched through A/B testing, what-if analysis, and mixed-methods research. Simulation modeling, cluster analysis, and burnout prevention contribute to organizational culture, while factor analysis and real-time analytics foster external mobility. Overall, these techniques promote a data-driven approach to employee relations, enhancing organizational effectiveness and driving business success.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Workforce Analytics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.1% |

|

Market growth 2025-2029 |

USD 3274 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.4 |

|

Key countries |

US, Canada, China, Germany, UK, India, France, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Workforce Analytics Market Research and Growth Report?

- CAGR of the Workforce Analytics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the workforce analytics market growth of industry companies

We can help! Our analysts can customize this workforce analytics market research report to meet your requirements.