Next Generation 3D Display Market Size 2024-2028

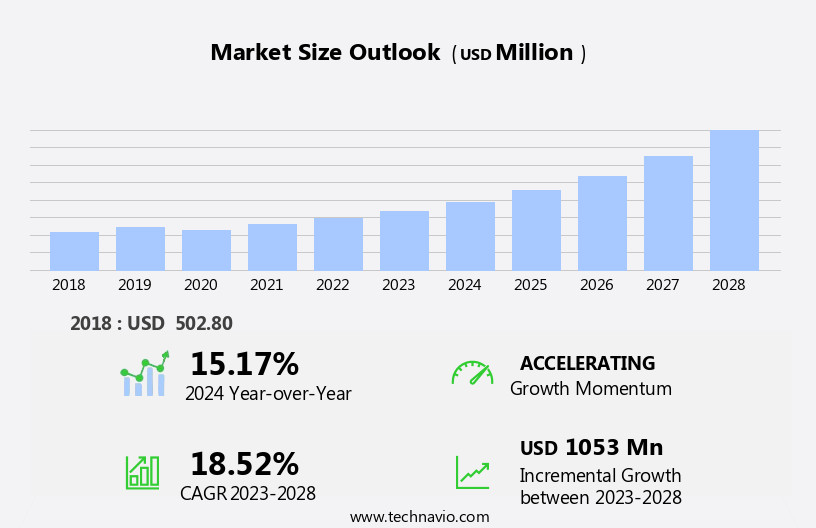

The next generation 3d display market size is forecast to increase by USD 1.05 billion at a CAGR of 18.52% between 2023 and 2028.

What will be the Size of the Next Generation 3D Display Market During the Forecast Period?

How is this Next Generation 3D Display Industry segmented and which is the largest segment?

The next generation 3d display industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Consumer electronics

- Automotive

- Healthcare

- Others

- Product

- Stereoscopic display

- Volumetric display

- HMD

- Others

- Geography

- APAC

- China

- South Korea

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Component Insights

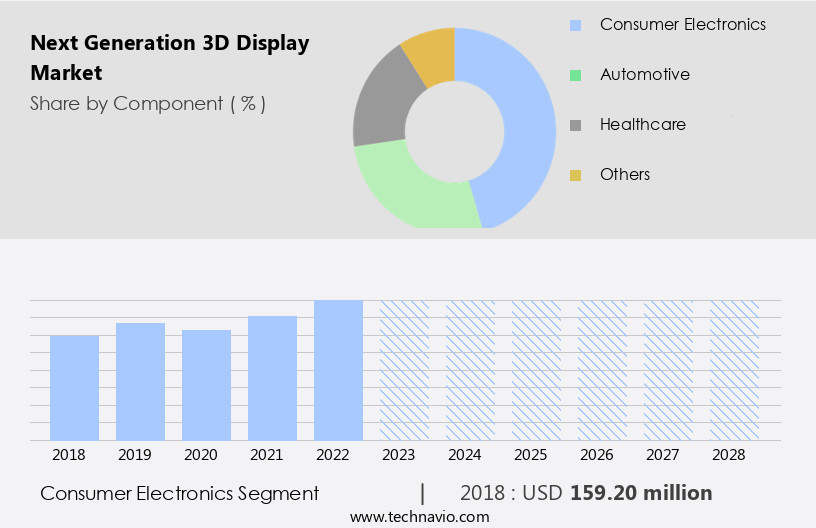

- The consumer electronics segment is estimated to witness significant growth during the forecast period.

The 3D display market encompasses a range of consumer electronics, including 3D projectors, gaming consoles, holographic displays, smartphones, tablets, personal computers, and TVs. These devices require intricate and advanced electronics and technology to ensure seamless 3D functionality. The emergence of augmented reality (AR) and virtual reality (VR) technology, based on binocular vision display and light field display, is driving the future growth of holographic displays. This presents significant opportunities for next-generation 3D displays In the consumer electronics sector. For instance, Facebook entered the VR market with the release of the Oculus Go and Quest, a standalone and tethered headset, respectively.

The advancement of 5G deployment, industrial automation, and high-definition graphics in various industries further boosts the demand for superior image quality and response time in 3D displays. Key applications include PC gaming, VR, 3D movies, animations, and video games. As disposable income increases and standards of living rise, the consumer base for these advanced electronic devices expands, particularly among the middleclass population. Key players In the industry include Ericsson, HMS Networks, and Samsung Electronics, among others. 3D technology continues to revolutionize consumer electronics, offering immersive experiences in home entertainment, gaming industries, and digital photo frames, among others.

Get a glance at the Next Generation 3D Display Industry report of share of various segments Request Free Sample

The Consumer electronics segment was valued at USD 159.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

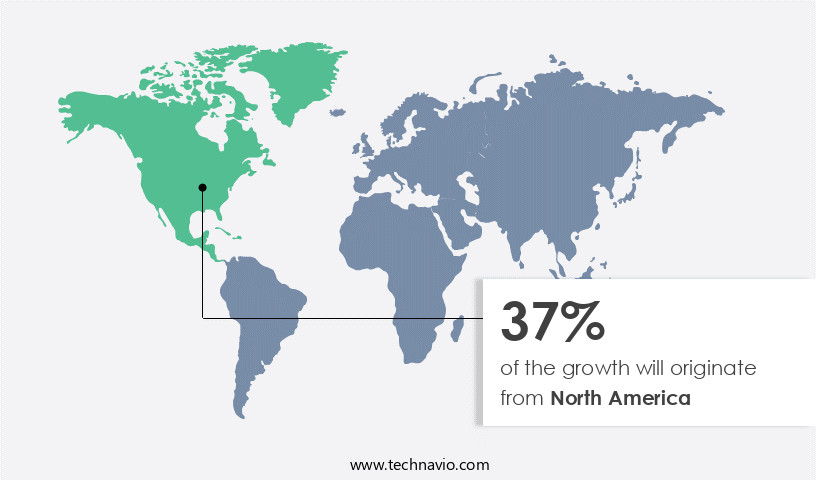

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region, with advanced consumer electronics industries in countries like China, Taiwan, and South Korea, is expected to lead the market by 2023. The region's well-established electronics supply chain will continue to fuel market growth. APAC is a significant hub for consumer electronics manufacturers, producing TVs, smartphones, tablets, and wearables. The expansion of this industry will increase demand for advanced electronic devices, propelling the market forward. Key applications include 8K television, visual comfort for smart TVs, industrial automation, PC gaming, VR, and 3D displays for consumer devices like monitors, TVs, digital photo frames, notebook computers, and projectors.

Industries like healthcare, digital cinema, and HMD displays are also adopting 3D technology. Companies like Samsung Electronics, ZTE, Nubia, Acer, Asus, and Ericsson are investing in 3D displays, driven by consumer demand and 5G deployment. The market will be shaped by high-definition graphics, response time, and image quality, with technologies like Micro OLED, stereoscopic displays, DLP, PDP, and LED panels. The gaming industries, home entertainment, and electronic devices will benefit from these advancements, as will the middle class population with increasing disposable income. Standards of living and digitalization will further influence market growth. Keywords: the market, Asia Pacific, consumer electronics, 8K television, visual comfort, smart TV, industrial automation, PC gaming, VR, 3D displays, digital cinema screens, HMD display, Micro OLED, stereoscopic displays, DLP, PDP, LED panels, image quality, response time, Samsung Electronics, ZTE, Nubia, Acer, Asus, Ericsson.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Next Generation 3D Display Industry?

Increasing advent of VR in gaming is the key driver of the market.

What are the market trends shaping the Next Generation 3D Display Industry?

Increasing usage of 3D display in medical industry is the upcoming market trend.

What challenges does the Next Generation 3D Display Industry face during its growth?

High cost associated with 3D displays is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The next generation 3d display market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the next generation 3d display market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, next generation 3d display market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alphabet Inc. - Google LLC, a subsidiary of the tech conglomerate, spearheads the market with advanced technology and innovation. This cutting-edge display solution offers enhanced depth perception and visual experience, setting new standards In the industry. With a focus on delivering superior image quality and immersive viewing, the company's 3D display technology is poised to revolutionize various sectors, including gaming, healthcare, education, and entertainment. The technology's ability to create lifelike images and provide a more engaging user experience positions it as a game-changer In the digital world.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- AUO Corp.

- Avalon Holographics Inc.

- Avegant Corp.

- Continental AG

- CREALÂ SA

- Dimenco BV

- FoVI3D

- Holografika Kft.

- LG Electronics Inc.

- Looking Glass Factory Inc.

- NVIDIA Corp.

- Ostendo Technologies Inc.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- SeeReal Technologies SA

- Sharp Corp.

- Toshiba Corp.

- VividQ Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as technology advances and consumer demand for immersive visual experiences increases. This market encompasses various applications, including consumer electronics, industrial automation, digital photo frames, notebook computers, and more. The 3D display industry is driven by several factors. Firstly, the gaming industries are a major contributor to the market's growth, as gamers seek more realistic and engaging experiences. Additionally, home entertainment is another significant application, with 3D TVs and monitors offering a more cinematic experience for movies and animations. The technology behind 3D displays has evolved significantly over the years. Autostereoscopic technology, which allows for 3D viewing without the need for special glasses, is becoming increasingly popular.

This technology is used in various displays, such as smartphones, tablets, and monitors. Another technology gaining traction is holographic and micro-OLED displays. These displays offer high definition graphics and image quality, making them suitable for various applications, including digital cinema screens and VR headsets. Moreover, the 3D display market is being influenced by the ongoing digital transformation and the increasing adoption of 5G networks. The deployment of 5G networks is expected to accelerate the growth of the 3D display market, as it enables faster data transfer and lower latency, enhancing the user experience. The market for 3D displays is also being driven by the growing middleclass population and increasing disposable income.

As standards of living improve, consumers are willing to invest in high-end electronic devices, including 3D displays. The 3D display market is a dynamic and competitive landscape. Companies are investing heavily in research and development to innovate and differentiate themselves. The market is expected to continue growing, driven by technological advancements and increasing consumer demand for immersive visual experiences. In conclusion, the market is poised for significant growth, driven by various applications, technological advancements, and increasing consumer demand. The market is expected to continue evolving, offering innovative and immersive visual experiences for various industries and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.52% |

|

Market growth 2024-2028 |

USD 1053 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.17 |

|

Key countries |

US, China, South Korea, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Next Generation 3D Display Market Research and Growth Report?

- CAGR of the Next Generation 3D Display industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the next generation 3d display market growth of industry companies

We can help! Our analysts can customize this next generation 3d display market research report to meet your requirements.