Advanced Authentication Market Size 2025-2029

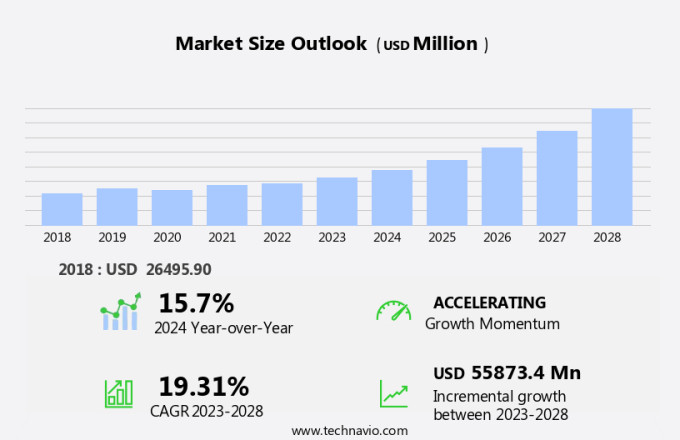

The advanced authentication market size is forecast to increase by USD 75.58 billion, at a CAGR of 21.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing volume of online transactions. The digital transformation and the shift towards contactless interactions have accelerated the adoption of advanced authentication solutions. One of the key trends in this market is the introduction of out-of-band (OOB) authentication, which adds an extra layer of security by verifying user identity through a separate communication channel. The market is experiencing significant growth due to the increasing adoption of biometric technologies, such as voice recognition, fingerprint scanning, facial recognition, iris scanning, and behavioral analytics, in various industries.

- Despite the higher cost, the need for secure authentication methods is paramount to protect against cyber threats and maintain customer trust. Companies must carefully evaluate the benefits and costs of various authentication solutions to effectively capitalize on market opportunities and navigate these challenges. However, this trend comes with its challenges. The increasing cost of One-Time Password (OTP) tokens is a major obstacle for businesses looking to implement advanced authentication solutions. Machine learning algorithms and artificial intelligence are also playing a crucial role in improving authentication performance optimization and threat modeling.

What will be the Size of the Advanced Authentication Market during the forecast period?

- The market is experiencing significant growth and innovation, driven by the increasing importance of securing digital identities and protecting against cyber threats. Authentication security, risk assessment, and threat analysis are crucial components of this market, with companies offering advanced solutions to mitigate attack vectors and ensure compliance with regulations. Authentication reporting and monitoring enable real-time visibility into access attempts and suspicious activity, while governance and certification ensure best practices are followed. Authentication frameworks and standards, such as Multi-Factor Authentication (MFA) and Single Sign-On (SSO), are essential for effective authentication deployment and implementation. Authentication testing and recovery solutions ensure business continuity in the event of a breach, while incident response strategies are vital for minimizing damage.

- Companies offer a range of solutions to meet diverse business needs, from risk assessment and reporting to deployment and incident response. Privacy concerns continue to shape the market, while regulations and certification programs provide assurance and drive adoption.

How is this Advanced Authentication Industry segmented?

The advanced authentication industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Biometrics

- Multi-factor authentication

- Type

- Large enterprise

- SME

- Deployment

- Cloud-based

- On-premises

- End-user

- BFSI

- Healthcare

- Government and defense

- IT and telecom

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- Rest of World (ROW)

- North America

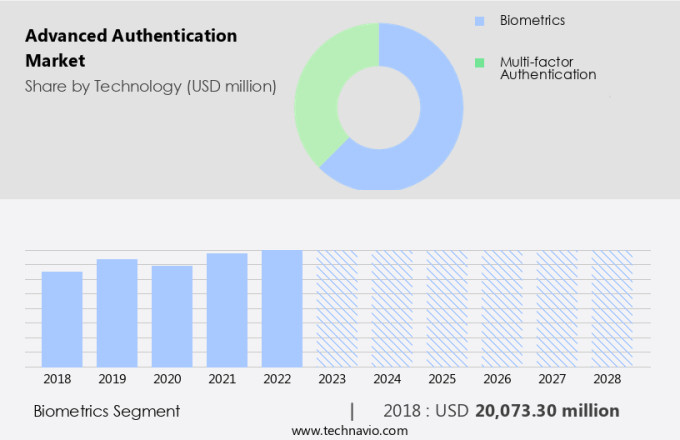

By Technology Insights

The biometrics segment is estimated to witness significant growth during the forecast period. Biometric technologies offer enhanced security and convenience as they are more accurate than traditional authentication methods, eliminating the need for users to carry hardware tokens or smart cards for identity verification. Furthermore, the integration of biometric sensors in smartphones has become increasingly common, making biometric authentication more accessible and convenient. However, connectivity issues in certain regions may hinder the adoption of phone-based authentication solutions.

The Advanced Authentication Market is evolving rapidly as businesses seek robust security solutions. Security tokens are integral to preventing unauthorized access, while certificate authority (CA) services ensure secure digital transactions. Hardware-based security keys provide enhanced protection against cyber threats. Emerging technologies like machine learning (ML) and artificial intelligence (AI) are revolutionizing authentication by enabling adaptive security mechanisms. Efficient authentication lifecycle management streamlines processes, ensuring seamless integration and compliance. Additionally, a focus on user experience (UX) is driving innovations in authentication, balancing security with ease of access.

Compliance standards, such as PCI DSS and Zero Trust Security, are driving the implementation of multi-factor authentication, hybrid authentication, and adaptive authentication. Additionally, cloud security, authentication cost optimization, and user experience are key considerations for businesses in the market. Certificate authorities, FIDO Alliance, and biometric sensor manufacturers are collaborating to provide secure and standardized authentication solutions. Authentication integration, API security, and security incident response are essential components of a robust authentication strategy. Passwordless authentication, risk-based authentication, and security awareness training are also gaining popularity to enhance security and reduce the risk of phishing attacks. Cryptographic algorithms, risk management, and user behavior analysis are integral to ensuring secure authentication practices.

The Biometrics segment was valued at USD 22.53 billion in 2019 and showed a gradual increase during the forecast period.

Privacy concerns continue to shape the authentication landscape, with companies focusing on privacy-preserving technologies and frameworks. The future of authentication lies in continuous innovation, with emerging trends including biometric authentication, blockchain-based solutions, and AI-driven threat detection. Authentication companies offer a range of solutions to meet diverse business needs, from small businesses to large enterprises. Regulations, such as GDPR and HIPAA, are driving the adoption of authentication technologies and solutions, while certification programs, such as SOC 2 and ISO 27001, provide assurance of security and compliance. In summary, the market is dynamic and evolving, with a focus on security, innovation, and compliance.

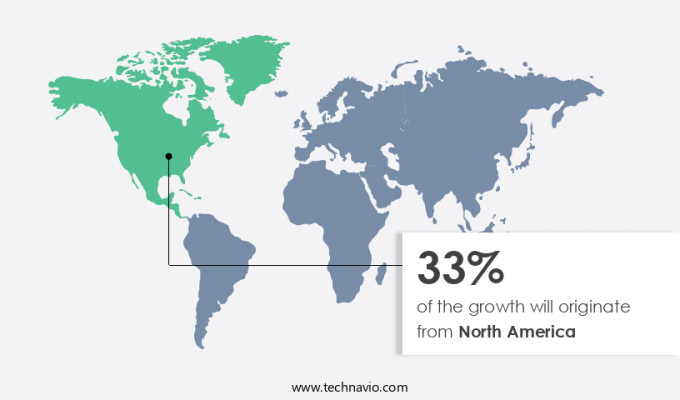

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the increasing adoption of advanced authentication models in various applications. The US and Canada lead the market due to their high demand for secure access control solutions. In the US, the healthcare sector is the largest application for advanced authentication, with a focus on securing sensitive patient data. Biometric systems, including fingerprint scanning, facial recognition, and iris scanning, are increasingly used for identity verification in government organizations due to their high accuracy, convenience, and time efficiency. Network security and endpoint security are other major applications for advanced authentication, with a growing emphasis on multi-factor authentication and risk-based authentication.

Compliance standards, such as PCI DSS and HIPAA, also mandate the use of advanced authentication solutions. Machine learning and artificial intelligence are key technologies driving innovation in the market, enabling real-time threat detection and behavioral analytics. Cloud-based authentication and single sign-on are also gaining popularity for their convenience and cost savings. The market is expected to continue its growth trajectory, with a focus on user experience, cost optimization, and threat intelligence. Certificate authorities, FIDO Alliance, and biometric sensor manufacturers are key players in the market, offering solutions for various applications and industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Advanced Authentication market drivers leading to the rise in the adoption of Industry?

- The significant rise in the number of online transactions is the primary catalyst fueling market growth. Advanced authentication has become a critical component in securing online transactions as the frequency of cyberattacks continues to rise. Companies, such as Gemalto, offer various authentication solutions to mitigate these risks. Their offerings include hardware OTP tokens with payment functionality for banking transactions, such as Ezio Talk Token, EZIO onCard PAD, and EZIO Pico. These tokens provide an additional layer of security, making online transactions more secure. With the increasing number of online services and subsequent online transactions, the need for robust authentication methods has become essential.

- Risk-based authentication, security awareness training, behavioral biometrics, cryptographic algorithms, and hashing algorithms are some of the strategies employed to enhance security. User provisioning, security auditing, hybrid authentication, adaptive authentication, on-premise authentication, security incident response, and digital signature are other essential components of advanced authentication systems. These measures ensure secure and reliable online transactions, providing peace of mind for both businesses and consumers.

What are the Advanced Authentication market trends shaping the Industry?

- Out-of-band (OOB) authentication is gaining popularity in the market as a mandatory security measure. This authentication method involves the transmission of authentication data outside of the primary communication channel to enhance security. Advanced authentication is a critical component of access control for businesses seeking to enhance network security and protect against cyber threats. Out-of-Band (OOB) authentication, a type of multi-factor authentication (MFA), is gaining popularity due to its ability to prevent fraud and secure high-risk transactions. OOB authentication uses two separate networks to verify a user's identity, making it more challenging for hackers to gain unauthorized access, even if they obtain security credentials.

- Anomaly detection, threat intelligence, and identity governance are integral components of advanced authentication systems. Vulnerability assessments and threat modeling help identify potential risks and vulnerabilities, while authentication performance optimization ensures seamless user experience. Digital certificates and endpoint security add an additional layer of protection, making advanced authentication a comprehensive solution for securing access to critical systems and data. This technology is cost-effective compared to complex biometric technologies and is essential for both financial and non-financial transactions.

How does Advanced Authentication market faces challenges face during its growth?

- The escalating costs of One-Time Password (OTP) tokens pose a significant challenge to the industry's growth trajectory. This trend is a major concern for businesses relying on OTPs for securing online transactions and customer authentication. The market is witnessing an increasing adoption of various authentication protocols, such as OpenID Connect, to enhance security and provide seamless user experience. Compliance with stringent security standards is a key driver for the market, with machine learning and biometric authentication, including iris scanning and voice recognition, gaining significant traction. Single sign-on (SSO) and multi-factor authentication are also popular solutions, ensuring secure API security and authentication integration.

- The market is dominated by a few key players, leading to a lack of competition and higher costs. Passwordless authentication and behavioral analytics are emerging trends, offering potential cost savings and enhanced security. Overall, the market is poised for growth, with a focus on providing secure and seamless authentication solutions to businesses worldwide. Despite the benefits, high initial deployment and replacement costs remain a challenge for market growth. These costs comprise the pricing and licensing model, infrastructure and hardware requirements, token warranty, and resources needed for implementation and management.

Exclusive Customer Landscape

The advanced authentication market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the advanced authentication market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, advanced authentication market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atos SE - This company specializes in providing sophisticated authentication solutions, including CERT Services and a Security Operation Center.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atos SE

- Beyond Identity Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Entrust Corp.

- FEITIAN Technologies Co. Ltd.

- ForgeRock Inc.

- Fujitsu Ltd.

- FusionAuth

- Infineon Technologies AG

- International Business Machines Corp.

- Mastercard Inc.

- Microsoft Corp.

- NEC Corp.

- Okta Inc.

- OneSpan Inc.

- Open Text Corp.

- Oracle Corp.

- Thales Group

- Versasec AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Advanced Authentication Market

- In January 2024, Microsoft announced the global availability of its new Multi-Factor Authentication (MFA) solution, Azure MFA and Azure Conditional Access, which significantly enhances security by adding an additional verification layer to user sign-ins. This development underscores Microsoft's commitment to advanced authentication, as the company aims to protect businesses against increasing cyber threats.

- In March 2025, Google Cloud and Okta, a leading identity and access management provider, announced a strategic partnership to integrate Okta's Identity Cloud with Google Cloud Platform. This collaboration enables seamless authentication and authorization for Google Cloud services, offering enhanced security and convenience to businesses.

Research Analyst Overview

The market continues to evolve, integrating various technologies to enhance security and access control. Anomaly detection, fingerprint scanning, network security, and vulnerability assessment form the foundation of robust authentication systems. Facial recognition, endpoint security, digital certificates, threat intelligence, identity governance, cloud-based authentication, and authentication performance optimization are essential components that seamlessly integrate into this dynamic landscape. OpenID Connect and authentication protocols ensure secure user authentication and authorization. Compliance standards, machine learning, passwordless authentication, and biometric authentication add layers of security. Iris scanning, single sign-on, behavioral analytics, API security, multi-factor authentication, and authentication integration offer additional security measures.

Biometric sensors, voice recognition, security keys, artificial intelligence, user self-service, and cloud security are emerging trends that continue to reshape the market. Authentication cost optimization, user experience, certificate authority, FIDO Alliance, and risk management are critical factors that influence market activities. Threat modeling, penetration testing, phishing prevention, risk-based authentication, security awareness training, behavioral biometrics, cryptographic algorithms, risk management, and hashing algorithms are essential elements of a comprehensive authentication strategy. Hybrid authentication, adaptive authentication, on-premise authentication, security auditing, and security incident response complete the evolving authentication ecosystem.

The Advanced Authentication Market is growing rapidly as businesses and individuals prioritize security. Strong authentication strategies ensure data protection, while leading authentication vendors provide innovative solutions. Adhering to authentication best practices during authentication implementation enhances authentication privacy and compliance with authentication regulations. Standardization through authentication standards and authentication certifications strengthens security frameworks. Continuous authentication auditing and authentication monitoring enable proactive risk management. Effective authentication management and authentication governance mitigate vulnerabilities through authentication risk assessment and authentication threat analysis. Addressing authentication attack vectors with authentication mitigation techniques enhances resilience. In case of breaches, authentication forensics, authentication incident response, and authentication recovery play a crucial role. Future advancements in authentication innovation will shape security trends and enhance global authentication security.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Advanced Authentication Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.6% |

|

Market growth 2025-2029 |

USD 75.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.2 |

|

Key countries |

US, Germany, China, UK, Canada, France, India, Japan, Italy, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Advanced Authentication Market Research and Growth Report?

- CAGR of the Advanced Authentication industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the advanced authentication market growth of industry companies

We can help! Our analysts can customize this advanced authentication market research report to meet your requirements.