Advanced Energy Market Size 2024-2028

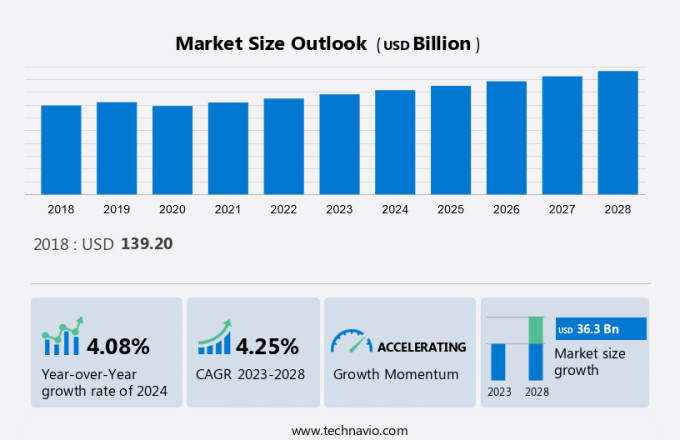

The advanced energy market size is estimated to grow by USD 36.3 billion at a CAGR of 4.25% between 2023 and 2028. Advanced energy markets are experiencing significant growth due to various factors. Firstly, substantial investments are being made in the development and implementation of clean energy technologies. Secondly, innovative advancements in energy technologies, such as energy storage solutions and renewable energy sources, are driving market expansion. Lastly, increasing government support through incentives and regulations is fostering a favorable environment for the growth of advanced energy markets. These factors are collectively propelling the market forward, ensuring its continued development and progress.

To learn more about this report, View Report Sample

Advanced Energy Market Trends

A significant trend in the Advanced energy market is the rise of zero-energy buildings (ZEBs). Especially in the residential sector, a substantial portion of electricity, notably in Europe, is consumed for heating. The construction industry is implementing energy-efficient measures such as improved designs and materials to reduce greenhouse gas emissions and fossil fuel energy usage while promoting health and productivity.

ZEBs generate their energy from renewables like solar PV, fuel cells, and energy storage technologies. Supported by interior design strategies, these buildings reduce electricity consumption, aligning with low-carbon energy systems. Government legislation and directives are driving the practical implementation of ZEB concepts in some countries. The increasing adoption of ZEBs is expected to boost the utilization of solar PV systems, driving market growth in the forecast period.

Largest-Growing Segments

Application Analysis

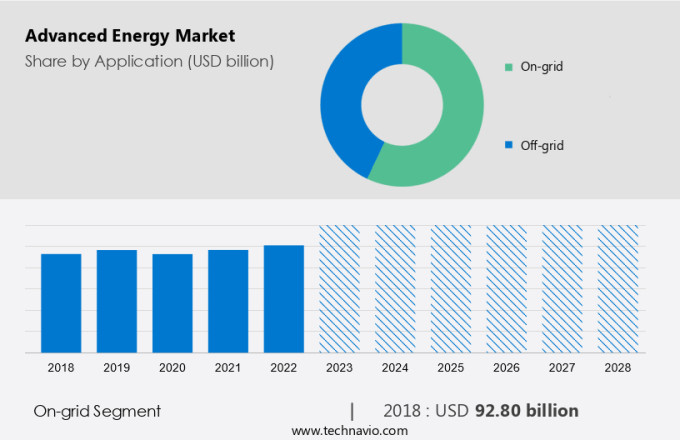

The market share growth by the On-grid segment will be significant during the market forecast period. The global advanced energy market by application can be segmented into various categories, one of which is the on-grid segment. The advancement of on-grid technologies will primarily focus on coordination between Renewable Energy, efficient energy use, and the Smart Grid. The major driver for the growth of the on-grid segment is the growing adoption of the smart grid and the integration of various clean energy such as solar and wind and technologies, including storage systems.

Get a glance at the market contribution of various segments View the PDF Sample

The growth rate of the on-grid segment has been driven by lower costs for solar PV plants and high levels of Government support, which have made it more feasible to install solar PV systems in a public utility or residential sector. On-grid installation in the residential sector is also expected to drive the growth of the segment during the forecast period.

Advanced Energy Market Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

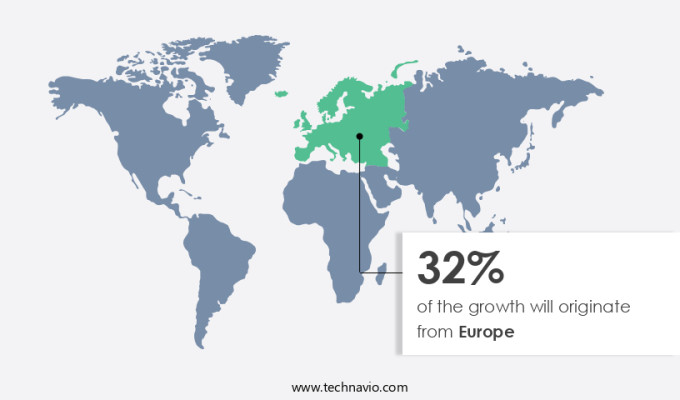

Europe is estimated to contribute 32% to the growth of the global market during the market forecasting period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The region held the major share of the market in 2023. Another region offering significant growth is APCA. The market in APAC will grow significantly during the forecast period. In 2020, the major leading countries in the region were China, Japan, India, Australia, and South Korea. The major growth of the market in APAC is due to financial incentive programs such as subsidies in China, India, and other countries in the region.

Advanced Energy Market Dynamics

The advanced energy market is witnessing significant growth due to the increasing focus on reducing greenhouse gas emissions and the shift towards renewable energy sources. Natural gas, particularly Renewable Natural Gas (RNG) derived from methane sources, is gaining popularity as a cleaner alternative to coal and oil for power generation and as a transportation fuel. The global supply and demand dynamics of natural gas are being influenced by various factors, including LNG imports, mergers and acquisitions among integrated energy firms, pipeline operators, storage facilities, and local distribution companies. Energy efficiency programs and the adoption of renewable energy sources are also driving the market growth. Green hydrogen production through renewable energy sources is expected to play a crucial role in the future of the energy sector. The use of carbon capture technology is another promising area that can help reduce carbon emissions from traditional energy sources. The residential and commercial sectors are expected to be the major consumers of advanced energy solutions, with a focus on reducing energy consumption and carbon footprint. Overall, the advanced energy market is poised for robust growth in the coming years, driven by the need to address climate change and the increasing demand for cleaner energy solutions.

Key Market Driver

The increasing investments in clean energy technologies are notably driving the market growth analysis. Nearly half of the electricity consumed is provided to commercial and residential buildings across the U.S. One of the main electricity users is the residential sector. Similarly, in Europe, a large part of electricity is consumed for heating purposes in the residential sector. The construction industry is adopting multiple energy efficiency measures, including improved designs and materials that promote a healthy and productive environment, minimize the issues associated with GHG emissions, and reduce fossil fuel-based energy consumption. The concept of ZEBs is an energy-efficient technology where the building generates its own power from renewable sources. To prevent leaks of heating and cooling, ZEBs are built and equipped with the use of specific materials like well-insulated building structures in order to ensure that construction efficiency is increased.

however, To generate the power required by buildings, renewable energy sources such as solar PVs, fuel cells, and energy storage technologies are used. The power required by buildings is generated using low-carbon energy systems, and the interior design mechanism of the building supports reducing the amount of power consumed. The major advantages of ZEBs are on-site renewable energy production and energy efficiency. In order to achieve a cleaner and greener future, ZEBs are using synergies between these two factors for the purpose of producing emissions less energy. Therefore, these ZEBs help level the peak energy demand by providing clean energy back to the grid. The use of solar PV will increase as more ZEBs become available, which is forecast to fuel the market growth over the coming years.

Major Market Challenge

The lack of standardization is the major challenge faced by the energy market. As a result of the lack of standardization within the grid system, there is an increased gap between power systems' interoperability. A wide range of advanced energy systems and technologies, such as energy storage that is embedded in the main server, are part of smart grids. The deployment of systems that are interoperable has not yet been completed by utilities. Thus, the implementation of security standards within diverse networking systems is a serious challenge faced by utilities. Authorities can resolve this complexity by enforcing standardized security practices, which can be applied to utilities.

There are technologies that promise various levels of performance, security, cost, and development by adhering to different standards, such as the standards developing organizations, industry user group standards, and proprietary standards. The resulting divergence in standards results in a significant mismatch of system compatibilities that constitutes an obstacle to the deployment of advanced energy technology, thereby affecting the smooth and secure functioning of the Energy System. Thus, a lack of standardization is expected to hinder the growth of the market during the market research and growth period.

Market Customer Landscape

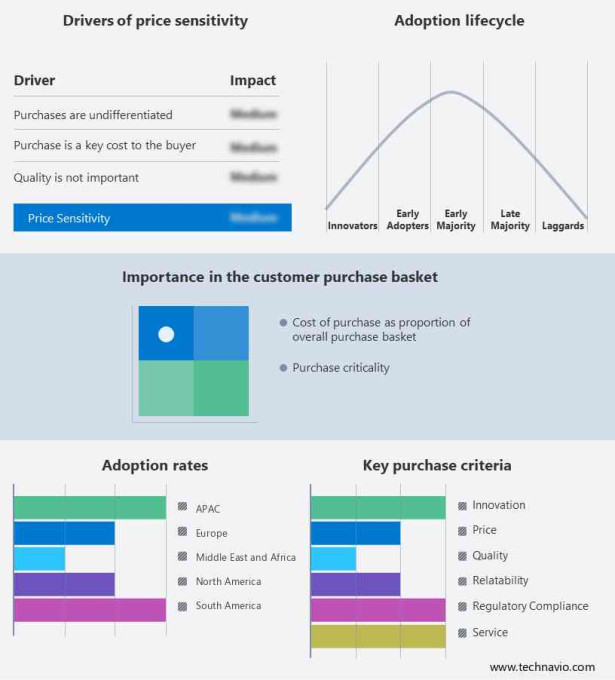

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Advanced Energy Market Customer Landscape

Major Advanced Energy Market Companies

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd. - The company offers advanced energy solutions for electrical energy through power plants.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- ABB Ltd.

- BYD Co. Ltd.

- Electricite de France SA

- EOS Energy Enterprises Inc.

- General Electric Co.

- Hitachi Ltd.

- INEOS Group Holdings SA

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- NEC Corp.

- Panasonic Holdings Corp.

- S and C Electric Co.

- Samsung SDI Co. Ltd.

- Schneider Electric SE

- Sensata Technologies Inc.

- Tesla Inc.

- The AES Corp.

- Toshiba Corp.

- TotalEnergies SE

- UCAP Power Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- On-grid

- Off-grid

- End-user Outlook

- Residential

- Non-residential

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Brazil

- Argentina

- Chile

- North America

You may also be interested in:

- Advanced Energy Storage Systems (AESS) Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, Japan, Germany, France - Size and Forecast

- Smart Energy Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Germany, France, UK - Size and Forecast

- High Purity Alumina Market Analysis APAC, North America, Europe, South America, Middle East and Africa - China, Taiwan, US, South Korea, Japan - Size and Forecast

Market Analyst Overview

Advanced Energy Marketing: Harnessing the Power of Methane and Renewable Natural Gas (RNG) in the Energy Landscape Methane, a potent greenhouse gas, has emerged as a significant player in the global energy market. Its role extends beyond natural gas to Renewable Natural Gas (RNG), an eco-friendly alternative fuel derived from biodegradable waste. In the residential and commercial sectors, RNG is gaining traction as a power generating source and transportation fuel. The energy industry's demand dynamics are influenced by various factors, including global supply, geopolitical dependence, national security, and emerging economies. The supply-demand chain for conventional fuels like coal and oil faces challenges from increasing energy efficiency programs and the adoption of renewable energy sources. Business expansion methods, technology advancements, mergers, and partnerships among integrated energy firms, pipeline operators, storage facilities, and local distribution companies are shaping the energy landscape. RNG production from biogas and landfills is a promising area for cleantech firms, leveraging data analytics, AI, and machine learning for optimized production. RNG's role in power generation and transportation fuel is on the rise, with LNG imports playing a crucial role in meeting the demand. The use of RNG in place of conventional fuels reduces greenhouse gas emissions significantly. Furthermore, green hydrogen production, carbon capture, and storage are emerging areas for RNG's application. The energy market's future lies in the integration of renewable energy sources, energy efficiency, alternative fuels, and advanced technologies to create a sustainable, efficient, and low-carbon energy ecosystem.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.25% |

|

Market growth 2024-2028 |

USD 36.3 billion |

|

Market structure |

USD Fragmented |

|

YoY growth 2023-2024(%) |

4.08 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 32% |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., BYD Co. Ltd., Electricite de France SA, EOS Energy Enterprises Inc., General Electric Co., Hitachi Ltd., INEOS AG, LG Chem Ltd., LyondellBasell Industries N.V., NEC Corp., Panasonic Holdings Corp., S and C Electric Co., Samsung SDI Co. Ltd., Schneider Electric SE, Sensata Technologies Inc., Tesla Inc., The AES Corp., Toshiba Corp., TotalEnergies SE, and UCAP Power Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Advanced Energy Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market industry across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.