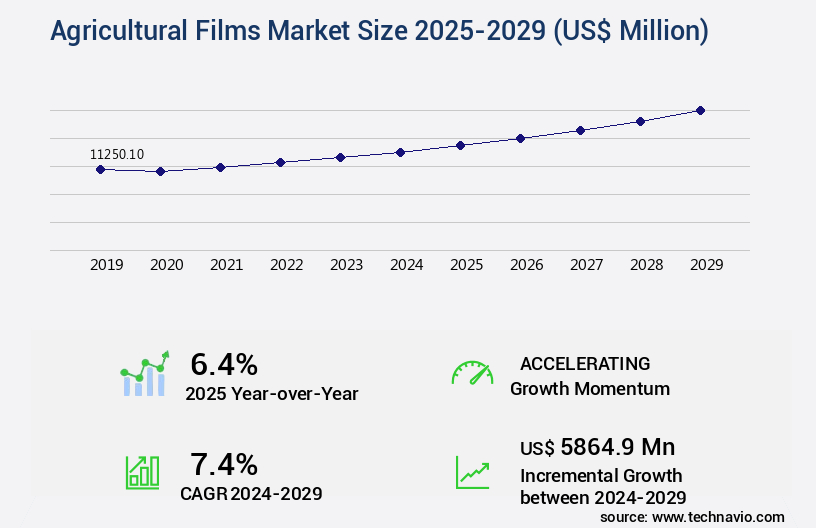

Agricultural Films Market Size 2025-2029

The agricultural films market size is valued to increase USD 5.86 billion, at a CAGR of 7.4% from 2024 to 2029. Need to increase agricultural yield will drive the agricultural films market.

Major Market Trends & Insights

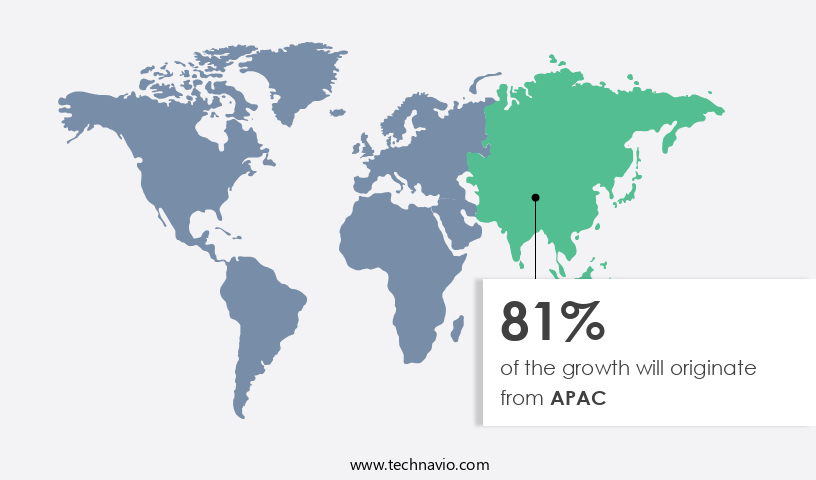

- APAC dominated the market and accounted for a 81% growth during the forecast period.

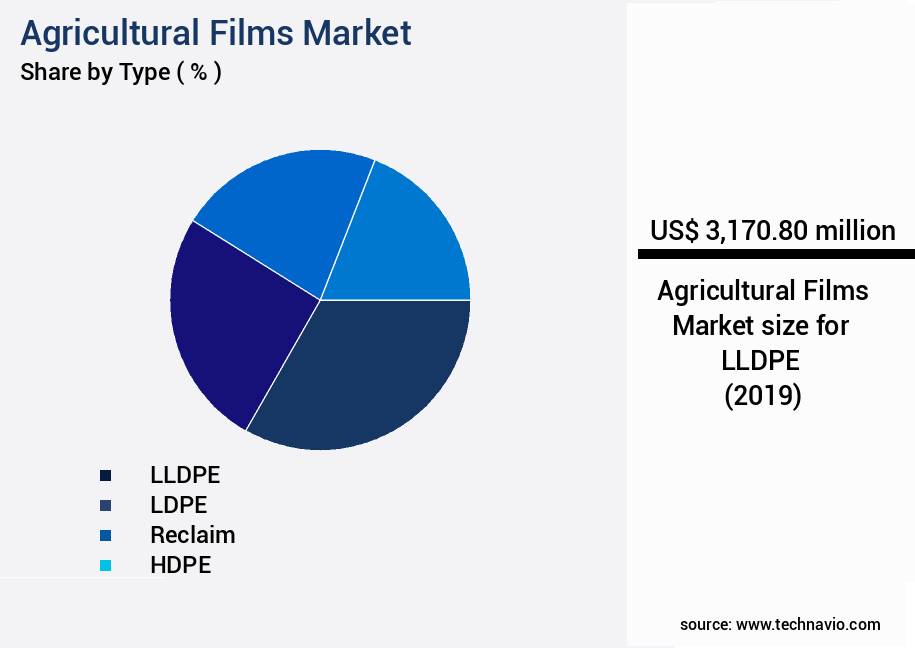

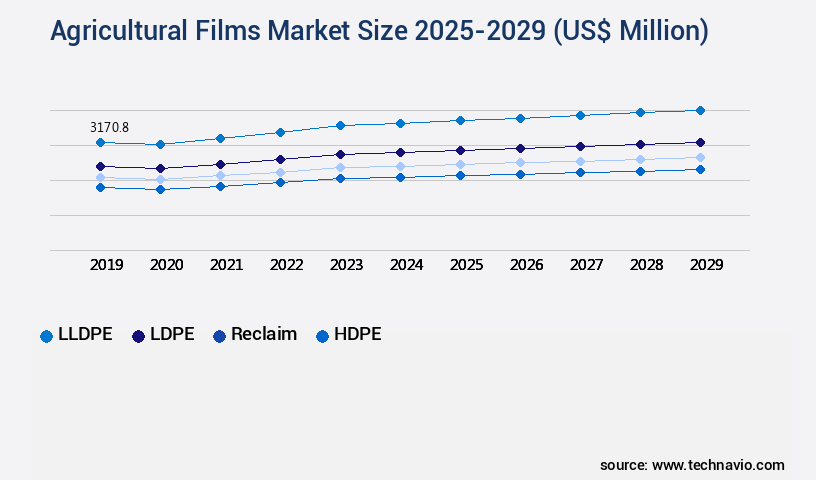

- By Type - LLDPE segment was valued at USD 3.17 billion in 2023

- By Application - Mulch films segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 73.42 million

- Market Future Opportunities: USD 5,864.90 million

- CAGR : 7.4%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and application of films used to protect and enhance agricultural productivity. This market is characterized by continuous evolution, driven by core technologies such as biodegradable mulch films and advanced greenhouse films. Biodegradable mulch films, for instance, account for over 30% of the market share, as farmers increasingly adopt sustainable practices to increase agricultural yield. Simultaneously, the high establishment cost for greenhouses and the growing demand for year-round production have fueled the demand for advanced greenhouse films.

- However, regulations and environmental concerns pose challenges, with governments worldwide implementing stringent guidelines to ensure sustainable agricultural practices. Looking forward, the market is poised for significant growth, with increasing demand for films that enhance crop yield, protect against pests, and improve overall agricultural efficiency.

What will be the Size of the Agricultural Films Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Agricultural Films Market Segmented and what are the key trends of market segmentation?

The agricultural films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- LLDPE

- LDPE

- Reclaim

- HDPE

- Others

- Application

- Mulch films

- Greenhouse films

- Silage films

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The lldpe segment is estimated to witness significant growth during the forecast period.

The market encompasses various film types, including biodegradable films, which are gaining traction due to their eco-friendly nature. Polymer blend compatibility plays a crucial role in enhancing film properties, leading to improved crop yields and moisture retention rates. For instance, EVA film properties, such as flexibility and resistance to temperature changes, make them suitable for agricultural applications. Agricultural films exhibit diverse characteristics, including UV stabilization additives, high-density polyethylene (HDPE) and polypropylene film, and film lamination techniques. Film elongation properties and film tensile strength are essential factors in ensuring durability and resistance to film stress cracking. UV-resistant polymers and anti-fog film coatings enhance film performance under various environmental conditions.

Controlled-release films and water vapor transmission rates are integral to optimizing nutrient delivery and maintaining optimal moisture levels for crops. Greenhouse film durability and light transmission levels are vital for enhancing plant growth and productivity. Film tear resistance and thermal conductivity are essential factors in maintaining film integrity and preventing damage during the extrusion process. Microbial degradation and film perforation patterns are critical aspects of agricultural film sustainability. Weed control efficacy and soil warming effects are essential for improving crop yields and overall agricultural productivity. Plastic film recycling and mulch film thickness are crucial factors in minimizing environmental impact and reducing production costs.

The LLDPE segment was valued at USD 3.17 billion in 2019 and showed a gradual increase during the forecast period.

According to recent market studies, the market is expected to grow by 15% in the upcoming year, driven by the increasing demand for sustainable agricultural practices and the growing focus on enhancing crop productivity. Moreover, the market is projected to expand by 12% over the next five years, fueled by the continuous innovation in film technology and the increasing adoption of advanced film solutions. These trends underscore the evolving nature of the market and its applications across various sectors. As a professional, knowledgeable assistant, it is essential to stay informed about these ongoing developments and their implications for businesses in the agricultural industry.

Regional Analysis

APAC is estimated to contribute 81% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Agricultural Films Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific region, the market is experiencing significant growth due to the increasing adoption of advanced farming techniques. Countries such as China, India, and Australia are leading this trend, with farmers favoring agricultural films over traditional glass coverings for greenhouses. The demand for agricultural films is driven by the need to boost agricultural productivity to meet the demands of expanding populations. These films offer benefits such as trapping moisture and heat, as well as preventing weeds and pests.

As a result, the use of agricultural films in the region is estimated to increase crop yield by approximately 30%. The popularity of these films is further fueled by their ability to contribute to the growth of crops like maize, cotton, and wheat. Overall, the market in APAC is poised for continued growth, with farmers recognizing the advantages these films bring to modern farming practices.

Market Dynamics

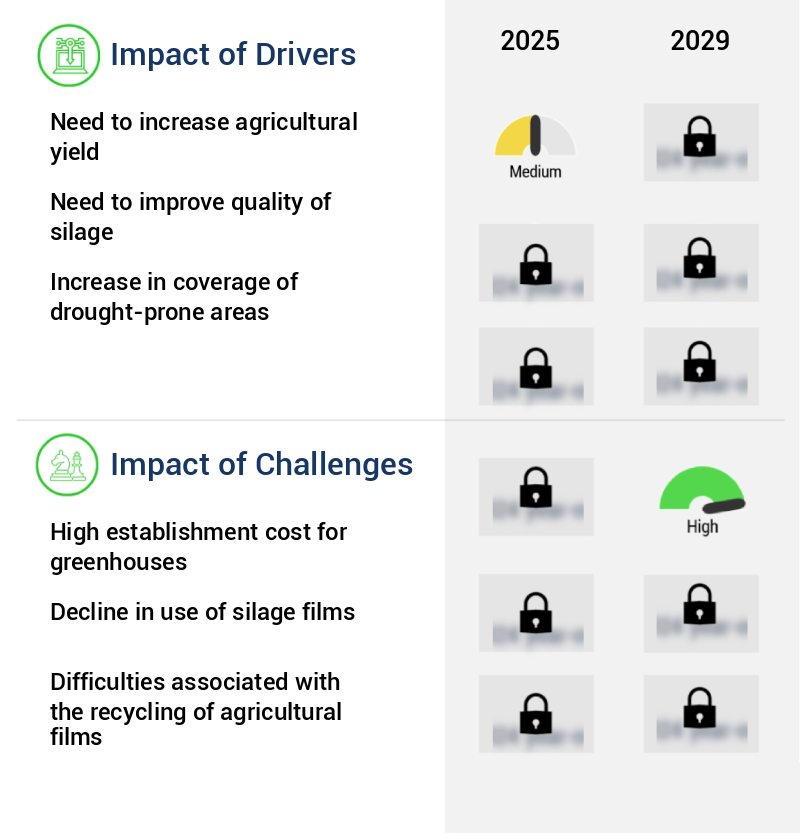

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a broad range of plastic films utilized in modern farming practices. These films, primarily made of polyethylene, play a crucial role in optimizing greenhouse conditions, enhancing soil warming, and improving crop protection. However, challenges such as UV degradation and weed control require continuous innovation. Biodegradable mulch films, an emerging trend, offer superior properties, including reduced herbicide use and improved soil moisture retention. Their decomposition in soil, however, varies, with some biodegradable films taking up to two years to fully decompose. In contrast, traditional polyethylene films have a longer lifespan, but their UV degradation can lead to reduced light transmission and decreased tensile strength over time.

Film thickness significantly impacts both weed control and water vapor transmission rates. Thicker films generally provide better weed control but hinder water vapor transmission, while thinner films allow for better water transmission but may not offer adequate weed control. Manufacturers focus on enhancing film durability through surface treatments and polymer blend compatibility in film extrusion. UV stabilizers are essential to mitigate UV degradation, extending film lifespan. Controlled-release fertilizer films offer a solution to optimize nutrient delivery, while soil moisture retention films help maintain optimal moisture levels. Comparing film types, biodegradable films have a lower oxygen permeability than traditional polyethylene films, which can impact crop growth.

Biodegradable film tear resistance is also lower, at approximately 15 N/mm², compared to polyethylene films' tear resistance of around 30 N/mm². Recycling methods for agricultural plastic films are under development, aiming to reduce environmental impact and improve sustainability. Evaluating the thermal properties of agricultural films and the effects of film perforation on crop growth are ongoing areas of research.

What are the key market drivers leading to the rise in the adoption of Agricultural Films Industry?

- The primary motivation driving the market is the necessity to enhance agricultural yield.

- The global population growth and industrialization have resulted in urbanization, leading to a significant loss of arable land. Since 1993, approximately 75 billion tons of soil have eroded from worldwide agricultural lands, equating to a substantial annual loss of around USD400 billion in the agriculture sector. The production of major crops, such as wheat and maize, which account for 70% of global cereal production, has declined due to water and nutrient scarcity, particularly in arid regions. Consequently, increasing food production has become crucial. By employing innovative farming techniques, such as precision agriculture and sustainable farming, and investing in technologies like vertical farming and hydroponics, the agricultural sector can mitigate the impact of land loss and ensure food security for the growing population.

- The adoption of these methods has shown promising results, with increased crop yields and reduced water usage. The agricultural industry's continuous evolution and adaptation to the challenges posed by population growth and environmental concerns are essential for ensuring food security and sustainable development.

What are the market trends shaping the Agricultural Films Industry?

- The use of biodegradable mulch films is gaining increasing popularity as the latest market trend. This eco-friendly alternative to traditional plastic mulch films is expected to see significant growth in adoption.

- Agricultural films play a crucial role in modern farming, providing benefits such as maintaining soil temperature, reducing moisture, and increasing crop yield by limiting weed growth. However, the disposal of these films, particularly those made of polyethylene, poses environmental concerns. Soil and water pollution ensue from the improper disposal of these films, leading to health hazards and harm to aquatic life. Moreover, burning agricultural film waste releases hazardous gases, contributing to air pollution and health issues. In response, farmers are adopting eco-friendly alternatives, primarily biodegradable mulch films. These films offer similar benefits as their plastic counterparts while mitigating the environmental concerns.

- The shift to biodegradable films signifies a significant trend in sustainable agriculture, as farmers prioritize the long-term health of their land and the well-being of their communities. Incorporating biodegradable films into agricultural practices not only addresses environmental concerns but also enhances overall farm productivity. This transition represents a progressive step towards a more sustainable and responsible farming industry.

What challenges does the Agricultural Films Industry face during its growth?

- The high establishment costs for greenhouses represent a significant challenge that can hinder the growth of the greenhouse industry. This financial hurdle can be attributed to various factors, including the initial investment required for constructing and equipping the greenhouses, as well as ongoing expenses related to energy consumption, maintenance, and labor. Overcoming this challenge necessitates exploring cost-effective solutions, such as utilizing energy-efficient technologies and optimizing operational processes.

- The market faces a significant challenge due to the high cost of establishment and operation. While the cost for individual growers to set up a greenhouse is manageable, commercial crop cultivation requires substantial investments in large farmlands, permanent structures, and supporting facilities. The cost of agricultural films alone is approximately USD 0.71 per square foot for greenhouse applications. Additionally, the installation cost of a permanent greenhouse structure ranges from USD 23 to USD 26 per square foot, depending on the cultivation area. Beyond the high installation cost, the use of advanced technologies like sensors, ventilation, and air-conditioning systems increases operational expenses.

- These factors have led to a decline in the adoption of agricultural films among farmers, affecting the market's growth prospects. Despite these challenges, the market continues to evolve, with ongoing research and development efforts aimed at improving efficiency and reducing costs. This dynamic market environment underscores the importance of staying informed about the latest trends and advancements.

Exclusive Customer Landscape

The agricultural films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Agricultural Films Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ab Rani Plast Oy - This company specializes in manufacturing and supplying agricultural films for various applications, including silage films, bale wrap, and silage bags.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ab Rani Plast Oy

- Achilles Corp.

- AL PACK Enterprises Ltd.

- Armando Alvarez Group

- Barbier Group

- BASF SE

- Berry Global Inc.

- C.I. TAKIRON Corp.

- Coveris Management GmbH

- Essen Multipack Ltd.

- Exxon Mobil Corp.

- Industrial Development Co. sal

- KURARAY Co. Ltd.

- LyondellBasell Industries NV

- Novamont S.p.A.

- PLASTIKA KRITIS SA

- Polypak Packaging Corp.

- RKW SE

- SHANDONG LONGXING PLASTIC FILM TECHNOLOGY CORP. LTD.

- The Dow Chemical Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Agricultural Films Market

- In January 2024, Sealed Air Corporation, a leading provider of food safety and security solutions, announced the launch of its new line of agricultural films, "AgilityX," designed to enhance crop yield and reduce water usage. The films incorporate Sealed Air's proprietary technology, which improves gas transmission rates and provides better UV protection (Sealed Air Corporation Press Release, 2024).

- In March 2024, BASF SE, the world's largest chemical producer, and RKW AG, a global manufacturer of flexible packaging, formed a strategic partnership to expand their offerings in the market. The collaboration aims to combine BASF's expertise in agriculture and RKW's film technology to develop innovative, sustainable solutions for farmers (BASF SE Press Release, 2024).

- In May 2024, LG Chem, a South Korean chemical company, secured a USD 100 million investment from the South Korean government to expand its production capacity for agricultural films. The investment is part of the government's initiative to support the growth of the domestic agricultural industry and increase self-sufficiency in food production (Yonhap News Agency, 2024).

- In April 2025, Dow Inc., a leading materials science company, received regulatory approval from the European Commission for its new line of agricultural films, which contain less than 0.1% of certain hazardous substances. This approval marks a significant step forward in Dow's efforts to provide sustainable and eco-friendly agricultural solutions (Dow Inc. Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Agricultural Films Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 5864.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

China, India, Japan, South Korea, US, Australia, Canada, UK, Brazil, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving market, biodegradable film types continue to gain traction due to their environmental benefits. These films, often made from polymers like ethylene vinyl acetate, offer improved crop yield through enhanced moisture retention and reduced evapotranspiration. Polymer blend compatibility plays a crucial role in the agricultural films' performance. For instance, high-density polyethylene (HDPE) and polypropylene film combinations exhibit superior UV stabilization additives, ensuring film durability against degradation. Moreover, film elongation properties and oxygen permeability rates are essential factors in determining the films' suitability for various agricultural applications. UV-resistant polymers and film lamination techniques contribute to extended agricultural film lifespan and better light transmission levels.

- Film tear resistance and tensile strength are vital for maintaining the structural integrity of agricultural films, while film extrusion processes enable mass production with consistent quality. Comparatively, anti-fog film coatings and surface treatments enhance the films' resistance to stress cracking and weathering, ensuring optimal performance under diverse conditions. Controlled-release films and water vapor transmission rates contribute to improved soil warming effects and weed control efficacy, respectively. However, microbial degradation and film perforation patterns can impact the overall performance of agricultural films. Plastic film recycling is a growing concern in the market, with various techniques like lamination, perforation, and lamination-perforation being employed to enhance recyclability.

- In summary, the market is characterized by continuous innovation and adaptation to meet the evolving needs of modern agriculture. From biodegradable film types to advanced polymer properties and film processing techniques, the industry remains at the forefront of agricultural technology.

What are the Key Data Covered in this Agricultural Films Market Research and Growth Report?

-

What is the expected growth of the Agricultural Films Market between 2025 and 2029?

-

USD 5.86 billion, at a CAGR of 7.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (LLDPE, LDPE, Reclaim, HDPE, and Others), Application (Mulch films, Greenhouse films, and Silage films), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Need to increase agricultural yield, High establishment cost for greenhouses

-

-

Who are the major players in the Agricultural Films Market?

-

Key Companies Ab Rani Plast Oy, Achilles Corp., AL PACK Enterprises Ltd., Armando Alvarez Group, Barbier Group, BASF SE, Berry Global Inc., C.I. TAKIRON Corp., Coveris Management GmbH, Essen Multipack Ltd., Exxon Mobil Corp., Industrial Development Co. sal, KURARAY Co. Ltd., LyondellBasell Industries NV, Novamont S.p.A., PLASTIKA KRITIS SA, Polypak Packaging Corp., RKW SE, SHANDONG LONGXING PLASTIC FILM TECHNOLOGY CORP. LTD., and The Dow Chemical Co.

-

Market Research Insights

- The market encompasses a diverse range of innovative film solutions, incorporating advanced technologies to enhance crop productivity and sustainability. Two key areas of development are high-strength films with improved light transmission enhancement and film permeability control. Simultaneously, films with enhanced moisture barrier properties are gaining traction, reducing water evaporation by up to 70% and contributing to improved water management. These films also offer additional benefits, such as reduced herbicide use, soil temperature regulation, and weed suppression methods.

- With ongoing research in polymer film additives, film thermal properties, and film degradation pathways, the market is poised for continuous growth and innovation. Durable agricultural films with controlled-release technology, UV protection measures, and enhanced nutrient delivery are increasingly adopted for flexible film applications, contributing to improved crop yields and sustainable farming practices.

We can help! Our analysts can customize this agricultural films market research report to meet your requirements.