Plastic Films Market Size 2024-2028

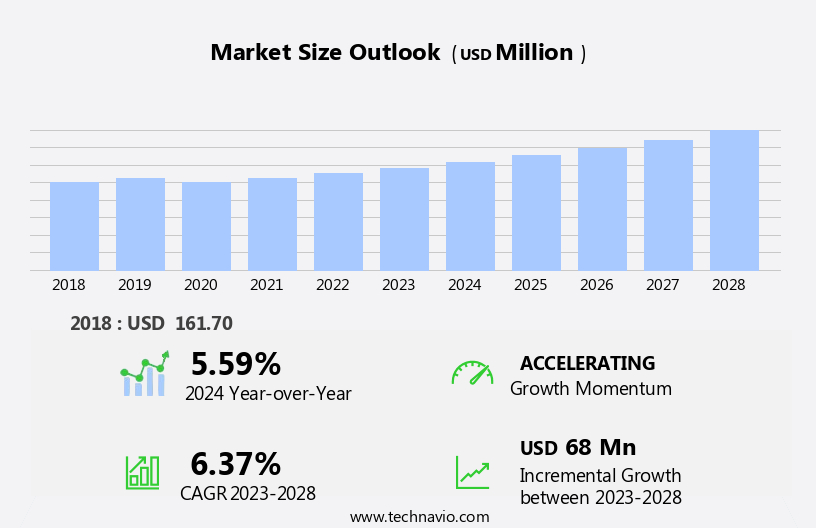

The plastic films market size is forecast to increase by USD 68 million, at a CAGR of 6.37% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for barrier packaging solutions. This trend is attributed to the rising consumer preference for extended shelf life and improved product preservation. Another key driver is the increasing use of Linear Low Density Polyethylene (LLDPE) over other forms of Polyethylene (PE) due to its superior properties, such as better clarity, improved impact resistance, and enhanced sealability. However, the market faces challenges due to its high degree of fragmentation, leading to intense competition among players.

- This fragmentation makes it difficult for companies to establish a strong market position and maintain profitability. Additionally, the market is subject to regulatory pressures, as governments and consumers push for more sustainable packaging solutions, which could potentially limit the growth of traditional plastic films. To capitalize on opportunities and navigate these challenges effectively, companies must focus on innovation, cost competitiveness, and sustainable solutions.

What will be the Size of the Plastic Films Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in film extrusion technologies and the expanding applications across various sectors. Film extrusion processes, such as cast film extrusion and blown film extrusion, play a pivotal role in producing films with diverse properties, including shrink films, barrier films, and industrial films. Automotive applications represent a significant market for plastic films, with a focus on lightweighting and fuel efficiency driving the demand for films with high tensile strength and UV resistance. Meanwhile, agricultural applications require films with a moisture barrier and UV resistance for optimal crop growth. Supply chain management and raw materials sourcing are crucial aspects of the plastic films industry, with a focus on ensuring quality control and efficient manufacturing processes.

Polyvinyl chloride (PVC) remains a popular raw material due to its versatility and cost-effectiveness. The ongoing development of new film technologies, such as conductive films, antistatic films, and multilayer films, offers opportunities for innovation and growth. The market for packaging films, including consumer packaging and protective films, continues to expand, driven by the increasing demand for product lifecycle management and recycling processes. The market is characterized by its continuous dynamism, with evolving patterns in application specific films, manufacturing efficiency, and film properties, such as film clarity, heat sealability, and puncture resistance. The industry's focus on sustainability and waste management is also shaping the market, with a growing emphasis on recycling processes and the development of high-barrier films for food packaging and medical packaging applications.

How is this Plastic Films Industry segmented?

The plastic films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Polyethylene (PE)

- Biaxially-oriented polypropylene (BOPP)

- Biaxially-oriented polyethylene terephthalate (BOPET)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Material Insights

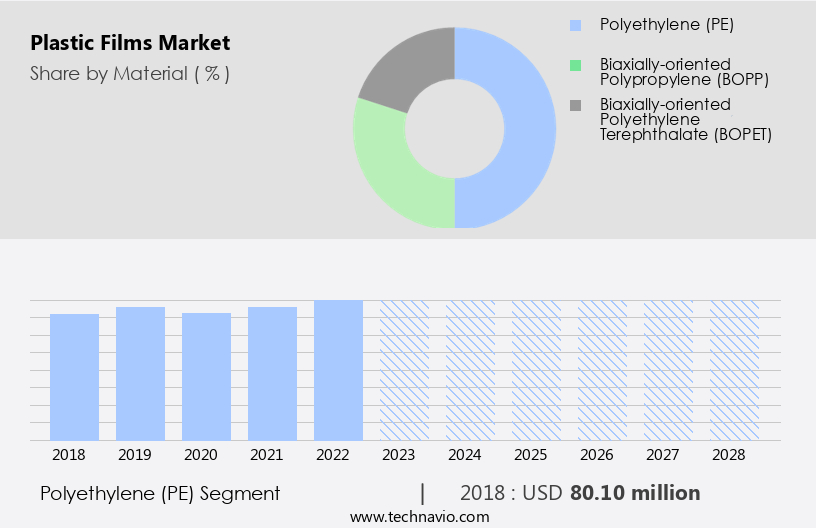

The polyethylene (PE) segment is estimated to witness significant growth during the forecast period.

Plastic films, primarily made from polyethylene (PE), have become indispensable in various industries due to their versatile properties. PE films, a combination of polymers and ethynyls, are widely used in packaging applications, particularly in the food and agriculture sectors, due to their moisture and chemical barrier properties. PE films are utilized in the production of diverse packaging products such as shrink and stretch films, food packaging films, large plastic bags, shipping bags, grease-resistant multilayer packaging, liners, and institutional bags, and consumer products packaging. The global demand for PE resins is projected to increase during the forecast period, driven by rising consumer spending on packaged food and expanding applications in manufacturing activities across industries like plastic packaging, automotive, agriculture, textiles, and electronics.

PE films are also used in the creation of specialized products, including cast film extrusion for automotive applications, barrier films for medical packaging and waste management, and high-barrier films for food packaging and construction applications. Additionally, film properties such as tensile strength, heat sealability, film clarity, and puncture resistance are crucial factors influencing the market's dynamics. Manufacturers focus on optimizing supply chain management, raw materials sourcing, and quality control to meet the evolving demands of various industries. Film thickness, manufacturing efficiency, and sustainability are also essential considerations in the production process. Furthermore, advancements in printing technologies, including rotogravure printing, flexographic printing, and gravure printing, enable the creation of customized and application-specific films.

The market for plastic films is a dynamic and innovative space, continually adapting to meet the demands of various industries and consumers.

The Polyethylene (PE) segment was valued at USD 80.10 million in 2018 and showed a gradual increase during the forecast period.

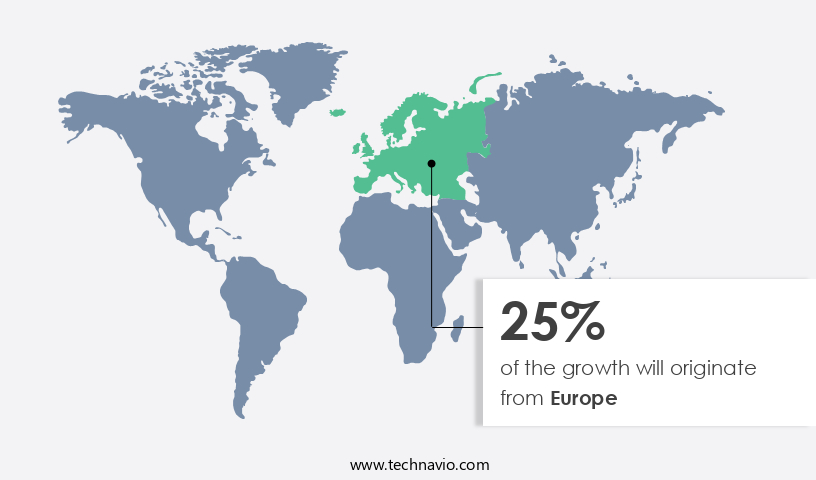

Regional Analysis

Europe is estimated to contribute 25% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth due to the rising demand for agriculture films, stretch films, and shrink films. Shrink films, which offer superior seal and moisture barrier properties compared to stretch films, are extensively used in corrugated trays as a case overwrap. In the Asia Pacific region, the trend toward flexible plastic packaging is gaining momentum over rigid plastic packaging. This shift is driven by the increasing preference for lightweight and recyclable packaging solutions in the food and pharmaceutical industries. Flexible plastic packaging offers several advantages, including ease of use, recyclability, barrier properties, variation in sizes and designs, and ease of decoration.

Furthermore, the automotive industry's increasing adoption of lightweight and fuel-efficient vehicles is driving the demand for cast film extrusion and barrier films with enhanced UV resistance and puncture resistance. Manufacturers focus on improving manufacturing efficiency, product lifecycle management, and quality control through supply chain management and raw materials sourcing. Industrial films, antistatic films, and multilayer films are also witnessing growing demand due to their unique properties, such as tear resistance, heat sealability, and moisture barrier. The construction industry's growing emphasis on sustainable and energy-efficient buildings is boosting the demand for protective films. Overall, the market in Asia Pacific is evolving, with a focus on innovation, sustainability, and efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Plastic Films Industry?

- The significant rise in consumer preference for protective packaging, commonly referred to as barrier packaging, serves as the primary market catalyst.

- Plastic films have become indispensable in various industries due to their excellent barrier properties. These films protect products from environmental factors, preserving their quality and integrity. The food and pharmaceutical sectors, in particular, rely heavily on plastic films for packaging applications. The need for extended shelf life and product protection is driving the demand for these films. Transparent barrier films are increasingly popular due to their versatility. They are used in the production of various packaging products, including clamshell packaging, skin packaging, windowed packaging, and blister packaging. These films prevent the infusion of water, light, moisture, oil, aroma, and flavor, ensuring the product's integrity.

- Manufacturing efficiency is another significant factor driving the growth of the market. Advanced technologies like gravure printing enable the production of high-quality films with consistent film properties. Puncture resistance is another essential feature of plastic films, making them suitable for various applications, including protective films and packaging films. The demand for plastic films is expected to continue growing due to their numerous benefits. They offer excellent protection, are cost-effective, and are easy to manufacture and transport. As a result, plastic films are becoming the go-to solution for various industries seeking reliable and efficient packaging solutions.

What are the market trends shaping the Plastic Films Industry?

- The usage of low-density polyethylene (LDPE) over other forms of polyethylene (PE) is becoming more prevalent in the market due to its numerous advantages. This trend is driven by LDPE's superior flexibility, excellent sealability, and increased recyclability compared to other PE types.

- The market encompasses the production and application of films made from various polymers, with low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE) being the most commonly used materials. LLDPE has gained significant traction over LDPE due to its superior properties, including increased flexibility, improved mechanical strength, and excellent optical clarity. This versatile polymer is extensively used in the manufacturing of films for packaging and non-packaging applications, such as automotive, industrial, and agricultural sectors. In automotive applications, LLDPE films are utilized for making shrink films and barrier films, which offer enhanced protection against environmental factors and ensure improved supply chain management.

- Cast film extrusion is a popular method used in the production of LLDPE films, which results in films with superior tensile strength and uniform thickness. Raw materials sourcing and quality control are crucial aspects of the market. Polyvinyl chloride (PVC) and other polymers are essential raw materials, and their sourcing and pricing can significantly impact the market dynamics. Ensuring the highest quality standards in the production process is essential to meet the evolving demands of various industries and end-users. LLDPE films offer numerous advantages, such as being more pliable and softer than LDPE, making them ideal for applications requiring high impact absorption without puncture or tearing.

- The market is expected to continue growing due to the increasing demand for these films in various industries.

What challenges does the Plastic Films Industry face during its growth?

- The intense competition resulting from the market's high fragmentation poses a significant challenge to industry growth.

- The market is characterized by a high level of competition among numerous international and local players. Local companies offer innovative solutions at competitive prices, posing a challenge to international players in terms of market penetration. In response to the growing demand for plastic films, packaging companies are expanding their offerings through both organic and inorganic growth strategies. For instance, Uflex, an Indian company, provides a comprehensive range of flexible packaging solutions globally. Plastic films are widely used in various applications, including agricultural, medical packaging, and industrial. Agricultural applications require films with specific properties, such as UV resistance and heat sealability.

- In medical packaging, antistatic films and moisture barriers are essential. Conductive films are increasingly being used in electronic applications. Film clarity and multilayer structures are critical factors influencing the choice of plastic films. Blown film extrusion and rotogravure printing are common manufacturing processes. The market's growth is driven by the increasing demand for lightweight, cost-effective, and sustainable packaging solutions. The use of plastic films in various industries, including food and beverage, pharmaceuticals, and electronics, is expected to fuel market growth.

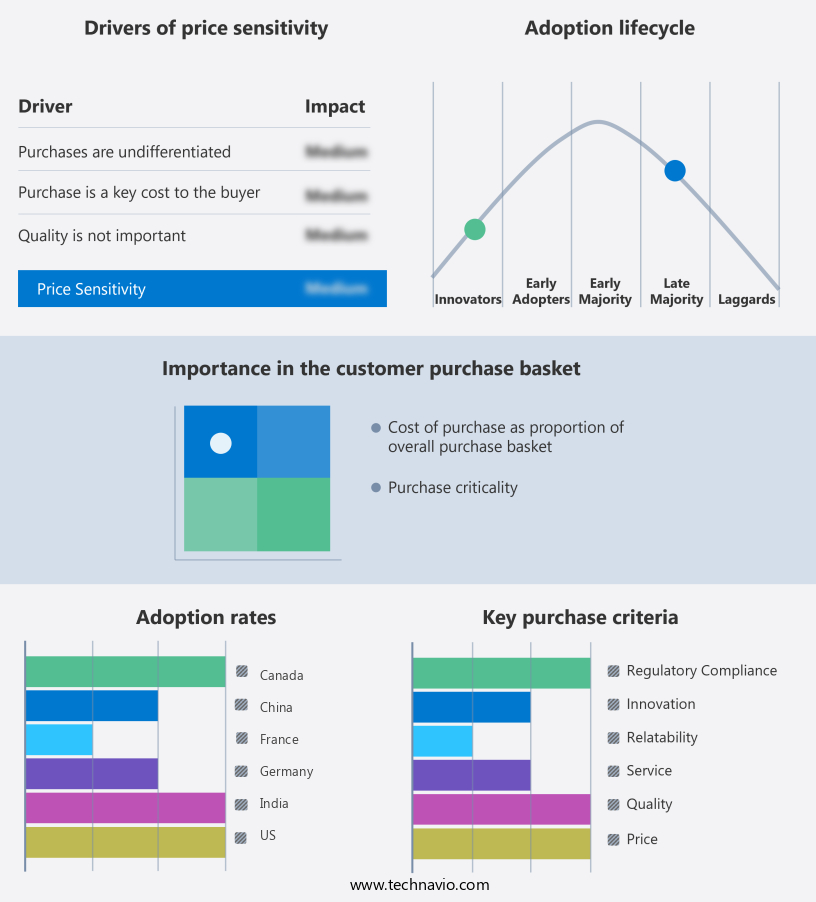

Exclusive Customer Landscape

The plastic films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plastic films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plastic films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AEP Group - This company specializes in producing high-quality plastics films for various applications, including vertical and horizontal packaging, secure envelopes, and garment film and covers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AEP Group

- Altopro Inc.

- Amcor Plc

- Berry Global Inc.

- Cheever Specialty Paper and Film

- Copol International Ltd.

- Cosmo First Ltd.

- Inteplast Group

- Jindal Poly Films Ltd.

- Novolex

- Oben Holding Group

- Poligal SA

- Polyplex Corp. Ltd

- Sealed Air Corp.

- SRF Ltd.

- Taghleef Industries SpA

- Toray Industries Inc.

- Toyobo Co. Ltd.

- UFlex Ltd.

- Vitopel

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plastic Films Market

- In January 2024, LyondellBasell Industries N.V., a leading plastics manufacturer, announced the launch of its new Metocene XT-1010XL high-performance polyethylene (HDPE) resin for blow molded containers in the food and beverage industry (LyondellBasell press release). This innovation aimed to enhance the barrier properties and improve the sustainability of plastic films used in these applications.

- In March 2024, Amcor plc, a global packaging company, entered into a strategic partnership with Danish biotech company Danimer Scientific to develop and commercialize biodegradable and compostable plastic films using Danimer's proprietary polyhydroxyalkanoate (PHA) technology (Amcor press release). This collaboration was expected to reduce the environmental impact of plastic films and cater to the growing demand for eco-friendly packaging solutions.

- In May 2024, Indorama Ventures Public Company Limited, a leading global chemical producer, completed the acquisition of the polyethylene terephthalate (PET) business of TotalEnergies for â¬3.3 billion (Indorama Ventures press release). This acquisition significantly expanded Indorama's PET capacity and market presence, making it a major player in the global PET resin market.

- In April 2025, the European Commission approved the use of biodegradable and compostable plastic films based on PLA (polylactic acid) for food contact applications (European Commission press release). This approval opened new opportunities for companies producing biodegradable plastic films and aligned with the EU's circular economy goals to reduce plastic waste.

Research Analyst Overview

- The market encompasses various types of films, including cast polypropylene (CPP) and high-density polyethylene (HDPE), each offering distinct thermal, optical, and mechanical properties. Ink technology and surface treatment advancements have enabled superior color consistency in roll stock applications. Vacuum forming and die cutting processes have gained traction in manufacturing, while anti-fog coatings and anti-scratch coatings enhance the end-use experience. Material science innovations have led to the development of oriented polypropylene (OPP) and low-density polyethylene (LDPE) films with superior barrier properties.

- Regulatory compliance and food safety standards are crucial considerations in the industry, with plastic additives playing a vital role in ensuring product safety. Metallized films, derived from EPDM, offer enhanced surface treatment and packaging design possibilities. The market's dynamic nature reflects the continuous evolution of polymer chemistry and the pursuit of superior film performance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plastic Films Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.37% |

|

Market growth 2024-2028 |

USD 68 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.59 |

|

Key countries |

China, US, Germany, India, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plastic Films Market Research and Growth Report?

- CAGR of the Plastic Films industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plastic films market growth of industry companies

We can help! Our analysts can customize this plastic films market research report to meet your requirements.