Flexible Packaging Market Size 2024-2028

The flexible packaging market size is valued to increase by USD 45.1 billion, at a CAGR of 3.93% from 2023 to 2028. Rising focus on improving shelf life of products will drive the flexible packaging market.

Major Market Trends & Insights

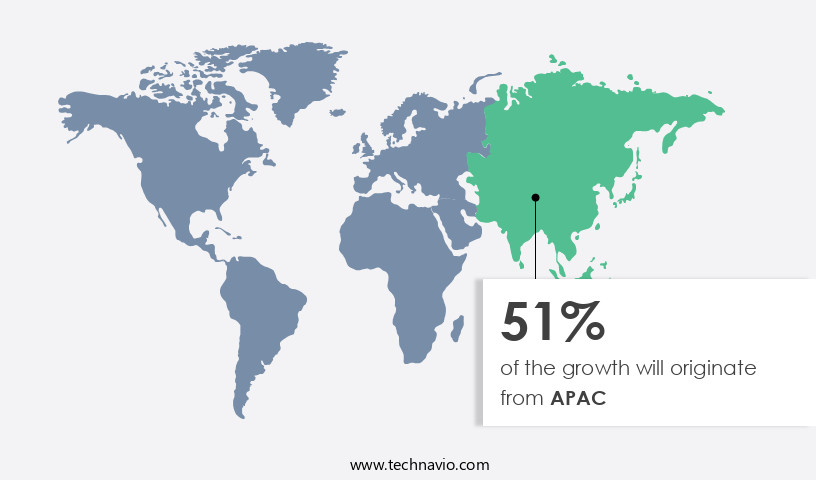

- APAC dominated the market and accounted for a 51% growth during the forecast period.

- By Product - Pouches segment was valued at USD 76.90 billion in 2022

- By Type - Food and beverage segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 35.64 billion

- Market Future Opportunities: USD 45.10 billion

- CAGR from 2023 to 2028 : 3.93%

Market Summary

- The market is witnessing significant growth due to the rising focus on extending product shelf life and enhancing product protection. This trend is particularly prevalent in industries such as food and beverage, pharmaceuticals, and consumer goods, where preserving product quality and freshness is crucial. However, the high cost involved in manufacturing flexible packaging remains a challenge for market participants. Despite this, advancements in technology are driving innovation in the industry. For instance, the adoption of nanotechnology and biodegradable materials is enabling the production of eco-friendly and sustainable packaging solutions. Moreover, the integration of smart technology into flexible packaging is enabling real-time monitoring of product conditions and improving supply chain efficiency.

- For example, a leading food and beverage company implemented a Smart Packaging solution that monitors temperature and humidity levels in real-time. By using this technology, the company was able to reduce spoilage and improve operational efficiency, resulting in a significant cost savings. According to recent studies, the implementation of smart packaging solutions has led to a reduction in food waste by up to 20%. In conclusion, the market is experiencing robust growth, driven by the need for extended shelf life and product protection. Despite the high manufacturing costs, advancements in technology are enabling the production of eco-friendly and sustainable packaging solutions, while also improving operational efficiency and reducing costs.

What will be the Size of the Flexible Packaging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Flexible Packaging Market Segmented ?

The flexible packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Pouches

- Bags

- Films and wraps

- Others

- Type

- Food and beverage

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The pouches segment is estimated to witness significant growth during the forecast period.

Flexible packaging continues to evolve, with innovations in material science leading to advancements in pouches and films. Stand-up pouches, a popular choice for food and liquid packaging, boast airtight closures and impressive shelf life extension. These pouches feature multiple barrier layers, ensuring product protection from moisture, dirt, and bacteria. Material compatibility is crucial in flexible packaging, leading to the use of sustainable materials and high-barrier films. Package design software and printing technologies, such as gravure printing and lamination techniques, enhance the visual appeal and functionality of these packages. Quality control testing is essential in maintaining product integrity, with seal strength testing and moisture barriers crucial for Food Packaging regulations.

Lightweight packaging and supply chain optimization are key priorities, with waste reduction strategies and e-commerce packaging also gaining importance. Flexible films, including Modified Atmosphere Packaging and barrier coatings, offer UV protection and oxygen scavengers, further extending shelf life. Packaging Machinery, including flexographic printing and Retort Pouches, enable efficient production and automation. Overall, the market continues to adapt and innovate, driven by consumer demands and advancements in polymer properties and packaging technology. (116 words)

The Pouches segment was valued at USD 76.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Flexible Packaging Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth, driven by the expanding end-user industries, particularly in developing economies like China and India. This region is projected to become a major contributor to The market's revenue growth. The rapid expansion of sectors such as e-commerce, fast-moving consumer goods (FMCG), and Personal Care is a primary factor fueling market growth. Notably, countries like China, India, and Japan have a burgeoning e-commerce sector, with Alibaba Group Holdings Ltd. Being a prominent player. This trend is further propelled by the increasing customer preference for convenient shopping experiences and the growing popularity of online retailers.

Additionally, flexible packaging offers operational efficiency gains and cost reductions, making it a preferred choice for businesses seeking to comply with evolving sustainability regulations. According to estimates, the market in APAC is expected to grow at a compound annual rate of over 6%, reaching a value of around USD70 billion by 2025.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to its numerous advantages over traditional Rigid Packaging. Seal strength testing methods are crucial in ensuring the reliability and efficiency of flexible packaging solutions. Flexible packaging material selection plays a vital role in achieving the desired properties, such as high barrier film lamination processes for extended shelf life and sustainable flexible packaging materials for eco-conscious consumers. Sustainability is a key trend in the market, with recyclable flexible packaging solutions gaining popularity. Modified atmosphere packaging techniques and oxygen scavenger film effectiveness are essential for maintaining product freshness and prolonging shelf life, particularly in the food industry. E-commerce is driving innovation in flexible packaging design, with the need for lightweight and compact packaging that can withstand transportation and handling. Package design software capabilities, digital printing for flexible packaging, and gravure printing for high-volume packaging enable customization and cost-effectiveness. Flexible packaging automation systems and supply chain optimization strategies are essential for improving efficiency and reducing costs. UV protection in flexible packaging films and barrier coating application methods are critical for ensuring regulatory compliance with food packaging standards. Polymer properties and barrier performance are crucial factors in the selection of flexible packaging materials. Lightweight flexible packaging design is a growing trend, with the focus on reducing waste and transportation costs. Package integrity testing procedures are essential to ensure the reliability and safety of the final product. Overall, the market offers numerous benefits and continues to evolve to meet the changing needs of consumers and industries.

What are the key market drivers leading to the rise in the adoption of Flexible Packaging Industry?

- The increasing prioritization of extending product shelf life serves as the primary market catalyst.

- Flexible packaging has emerged as a game-changer in various industries by enhancing product shelf life and ensuring product protection. According to recent studies, flexible packaging can extend the shelf life of perishable goods, such as food and beverages, by up to 30%. For instance, fruits like bananas ripen more slowly in flexible packaging, increasing their marketability and reducing wastage. In the pharmaceutical sector, flexible packaging helps maintain the efficacy of medicines by shielding them from environmental factors. Additionally, the use of flexible packaging in the transportation and export of these products minimizes damage due to its adaptability to different shapes and sizes.

- This not only improves business efficiency but also enhances decision-making capabilities by providing real-time insights into inventory levels and product freshness.

What are the market trends shaping the Flexible Packaging Industry?

- The flexible packaging industry is experiencing significant advancements, which represents the latest market trend.

- The market is undergoing significant transformation, with a growing emphasis on sustainability, innovation, and advanced functionality. One key trend is the adoption of eco-friendly materials, such as recyclable and compostable options, to address environmental concerns and cater to consumers' increasing preference for sustainable packaging solutions. Manufacturers are focusing on producing packaging films and pouches using bio-based plastics derived from renewable sources like Corn Starch or sugarcane, thereby reducing reliance on traditional petroleum-based plastics. For instance, in July 2023, Berry Global introduced NordiVent, a high-performance form-fill-seal film containing 50% recycled content. This innovative film, which offers waterproof properties and resistance to dust and moisture, is an ideal choice for powdered products and aligns with customers' sustainability objectives.

- Another significant development is the integration of smart technologies into flexible packaging, enabling enhanced product protection, extended shelf life, and improved supply chain visibility. These advancements are expected to drive growth and innovation within the market.

What challenges does the Flexible Packaging Industry face during its growth?

- The high cost of manufacturing flexible packaging is a significant challenge that hinders growth in the industry. This issue, which is mandatory for industry professionals to address, stems from the complex production processes and materials required to create flexible packaging solutions.

- Flexible packaging, a global market characterized by continuous evolution, primarily utilizes plastics such as PE and PP as its primary raw materials. Recent research indicates a notable increase in the prices of these materials, with PP experiencing a rise of approximately 6.2% in the first quarter of 2022. This trend poses a significant challenge for market participants, as the escalating production costs threaten to erode profit margins.

- Despite these challenges, the market remains a robust and dynamic industry, catering to diverse applications in various sectors, including food, pharmaceuticals, and consumer goods.

Exclusive Technavio Analysis on Customer Landscape

The flexible packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flexible packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Flexible Packaging Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, flexible packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aluflexpack AG - This company specializes in the development and distribution of innovative sports products, leveraging advanced technology and research to enhance athlete performance and consumer experience. Their offerings cater to various sports and fitness categories, setting industry standards for quality and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aluflexpack AG

- Amcor Plc

- Berry Global Inc.

- Bischof Klein SE and Co. KG

- CCL Industries Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- DS Smith Plc

- DuPont de Nemours Inc.

- Glenroy Inc.

- Huhtamaki Oyj

- Mondi Plc

- Parkside Flexibles Ltd.

- Printpack Inc.

- ProAmpac Holdings Inc.

- Reynolds Packaging

- Sealed Air Corp.

- Sonoco Products Co.

- UFlex Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Flexible Packaging Market

- In January 2025, Amcor, a global leader in flexible packaging, announced the launch of its new plant-based flexible packaging material, named "Bio-based PET," in Europe. This innovation is expected to reduce the carbon footprint of the packaging industry by up to 74% (Amcor press release).

- In March 2025, Sealed Air and Dow announced a strategic collaboration to develop and commercialize recyclable, flexible packaging solutions using Dow's polyolefin resins. This partnership aims to address the growing demand for sustainable packaging solutions (Dow press release).

- In May 2025, Berry Global, a leading flexible packaging solutions provider, completed the acquisition of AEP Industries, a US-based manufacturer of flexible packaging products. This acquisition is expected to strengthen Berry Global's position in the North American market and expand its product offerings (Berry Global press release).

- In August 2025, the European Union approved the use of biodegradable and compostable flexible packaging for fresh Fruits And Vegetables. This decision is a significant step towards reducing plastic waste and promoting sustainable packaging solutions in the region (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Flexible Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.93% |

|

Market growth 2024-2028 |

USD 45.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.63 |

|

Key countries |

US, China, UK, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in material science and technology. Form-fill-seal machines enable the production of recyclable packaging solutions, such as flexible pouches, which are increasingly popular due to their lightweight nature and compatibility with various materials. Sustainable materials, like plant-based plastics, are gaining traction as consumers demand eco-friendly alternatives. Stand-up pouches, a prominent application of flexible packaging, are expected to grow by 5% annually, driven by supply chain optimization and printing technologies like gravure printing and lamination techniques. Quality control testing ensures product protection and compliance with food packaging regulations, while moisture barriers and UV protection films extend shelf life.

- Package design software and printing technologies, including digital printing and flexographic printing, enhance customization and design flexibility. High barrier films, modified atmosphere packaging, and oxygen scavengers further improve product protection and shelf life. An example of the market's continuous unfolding is the adoption of e-commerce packaging, which has seen a significant increase in demand due to the surge in online shopping. This shift necessitates the development of new packaging solutions, such as lightweight and recyclable materials, and automation in packaging machinery. Waste reduction strategies, like the use of barrier coatings and seal strength testing, are essential as the industry strives for more sustainable practices.

- Polymer properties and lamination techniques continue to be explored, offering potential for further innovation in the market.

What are the Key Data Covered in this Flexible Packaging Market Research and Growth Report?

-

What is the expected growth of the Flexible Packaging Market between 2024 and 2028?

-

USD 45.1 billion, at a CAGR of 3.93%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Pouches, Bags, Films and wraps, and Others), Type (Food and beverage, Healthcare, and Others), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising focus on improving shelf life of products, High cost involved in manufacturing flexible packaging

-

-

Who are the major players in the Flexible Packaging Market?

-

Aluflexpack AG, Amcor Plc, Berry Global Inc., Bischof Klein SE and Co. KG, CCL Industries Inc., Clondalkin Group Holdings BV, Constantia Flexibles Group GmbH, Coveris Management GmbH, DS Smith Plc, DuPont de Nemours Inc., Glenroy Inc., Huhtamaki Oyj, Mondi Plc, Parkside Flexibles Ltd., Printpack Inc., ProAmpac Holdings Inc., Reynolds Packaging, Sealed Air Corp., Sonoco Products Co., and UFlex Ltd.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous innovation and adaptation to consumer preferences and regulatory requirements. With a global production capacity of over one million metric tons annually, this market caters to various sectors, including food, beverages, pharmaceuticals, and industrial applications. One notable trend is the increasing emphasis on sustainability metrics, with an industry-wide growth expectation of over 4% per annum.

- For instance, a leading food manufacturer reported a 25% increase in sales by transitioning to flexible packaging solutions that utilized thinner films and reduced material usage. This shift not only improved product differentiation but also contributed to waste minimization and cost optimization.

We can help! Our analysts can customize this flexible packaging market research report to meet your requirements.