Air Cargo Market Size 2025-2029

The air cargo market size is forecast to increase by USD 20.6 billion, at a CAGR of 5.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the surge in e-commerce sales and the increasing demand for temperature-sensitive goods. The e-commerce sector's rapid expansion has led to a substantial increase in the volume of small consignments, necessitating the use of air freight for quick and reliable delivery. Moreover, the rise in demand for temperature-sensitive products, such as pharmaceuticals and perishables, is a crucial trend shaping the market. However, this market growth is not without challenges. The increasing jet fuel prices pose a significant obstacle, as fuel accounts for a substantial portion of the total operating costs for air cargo carriers.

- This trend puts pressure on companies to find ways to optimize their fuel consumption and explore alternative fuel sources to maintain profitability. In conclusion, the market is witnessing robust growth due to the e-commerce boom and the increasing demand for temperature-sensitive goods. However, the rising jet fuel prices present a significant challenge that companies must address to remain competitive and profitable. To capitalize on the market opportunities and navigate these challenges effectively, companies need to focus on optimizing their operations, exploring alternative fuel sources, and implementing cost-saving measures.

What will be the Size of the Air Cargo Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by a multitude of dynamic factors. Freight consolidation and trade agreements reshape the industry landscape, with freight forwarders playing a pivotal role in optimizing shipping costs and route planning. Fuel efficiency and cargo automation are driving environmental sustainability, with the Internet of Things and big data analytics transforming distribution centers. Temperature-controlled shipping and import regulations necessitate stringent cargo security measures, from biometric security to advanced cargo handling technologies. Logistics providers integrate pallet handling, conveyor systems, and inventory management to streamline operations, while cargo security technologies ensure the safe transportation of goods. Ground handling and customs clearance processes are undergoing digitalization, with supply chain optimization a top priority for businesses.

Airline networks and e-commerce logistics necessitate real-time cargo tracking and delivery time guarantees. Export compliance and cargo inspection are crucial components of international trade, with carbon emissions and eco-friendly packaging becoming increasingly important considerations. Fleet management and aircraft maintenance are essential for maintaining cargo capacity and ensuring flight schedules run smoothly. Artificial intelligence and advanced technologies like RFID tracking and demand forecasting are revolutionizing air cargo operations, enabling more efficient and effective supply chain management. The industry's continuous adaptation to these evolving market dynamics underscores its vital role in the global economy.

How is this Air Cargo Industry segmented?

The air cargo industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Manufacturing

- FMCG and retail

- Pharmaceuticals and chemicals

- Others

- Type

- Belly cargo

- Freighter

- Service Type

- Express Cargo

- General Cargo

- Special Cargo

- Destination

- Domestic

- International

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

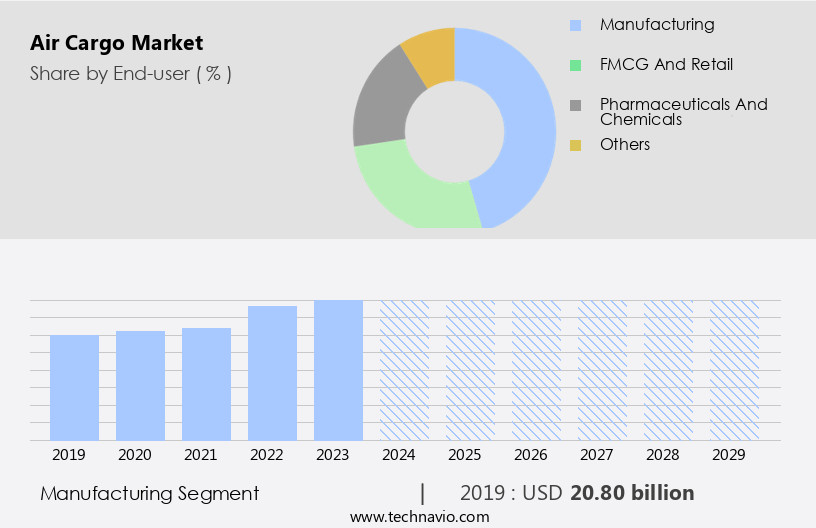

The manufacturing segment is estimated to witness significant growth during the forecast period.

Air cargo plays a crucial role in the global supply chain, particularly in the transportation of time-sensitive and high-value goods such as automobiles and their components. The air freight industry is characterized by various entities that facilitate seamless cargo operations. Lead times are critical in this market, with freight forwarders optimizing routes and logistics providers ensuring efficient cargo handling through pallet handling, conveyor systems, and inventory management. Fuel efficiency is a significant concern for air cargo companies, leading to the adoption of sustainable aviation fuel and cargo automation to reduce carbon emissions. Environmental sustainability is also a priority, with eco-friendly packaging and cargo security technologies being employed to minimize the carbon footprint and safeguard cargo.

The Internet of Things (IoT) and big data analytics are transforming the industry, enabling real-time cargo tracking and demand forecasting. Temperature-controlled shipping is another crucial aspect, with distribution centers and air cargo terminals utilizing advanced cooling systems to maintain optimal conditions for perishable goods. Import regulations, trade agreements, and export compliance are essential considerations for cargo operations. Trade finance and cargo insurance are also vital components of the market, ensuring secure and timely transactions. Cargo theft prevention and cargo consolidation are other critical areas of focus for logistics providers. The airline network is a significant factor in determining shipping costs and delivery times.

Route planning and flight schedules are optimized to minimize transit times and reduce shipping costs. Third-party logistics providers offer comprehensive solutions, integrating ground handling, customs clearance, and supply chain optimization. Air cargo terminals utilize advanced cargo security technologies, including biometric security and cargo inspection, to ensure the safe and secure transportation of goods. Cargo capacity and aircraft maintenance are also essential aspects of the market, with artificial intelligence and fleet management playing a role in optimizing operations. In the automotive industry, which is a significant contributor to the market, European countries account for a significant share of car exports and auto parts exports.

The global sales of automobiles and their components through exports are increasing, with European countries leading the way. The air cargo industry continues to evolve, adapting to changing market dynamics and customer demands while prioritizing efficiency, sustainability, and security.

The Manufacturing segment was valued at USD 20.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

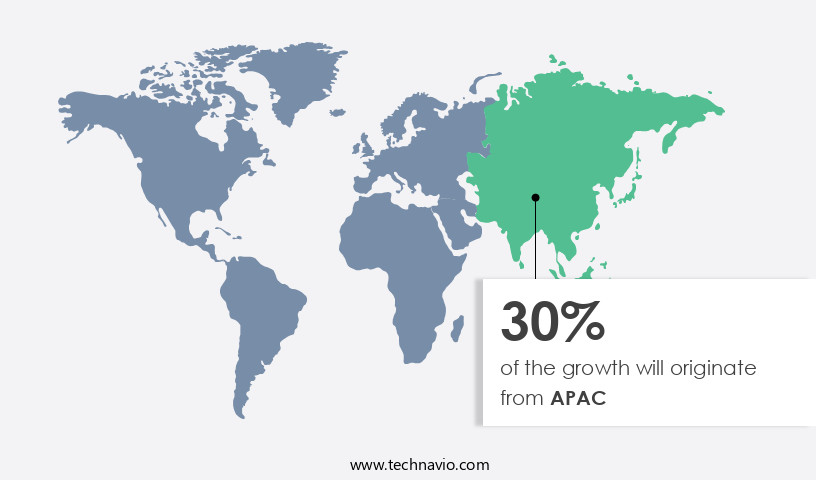

APAC is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market, a crucial component of international trade, is witnessing significant growth as raw materials are transported from Asia Pacific (APAC) countries to North America. This trend is driven by the cost advantages of manufacturing and labor in APAC nations, including China, India, Vietnam, and Thailand. In 2024, China held a substantial share of the Trans-Pacific the market from APAC. Consumer goods, such as apparel and telecommunication equipment, are among the major commodities traded from APAC to North America by air. Other goods, including plastic goods, vegetables, animal products, and textiles, are also exported via airfreight to European and North American destinations.

The air cargo industry is embracing automation and technology to enhance efficiency and sustainability. The Internet of Things (IoT) is revolutionizing cargo handling through real-time monitoring and predictive maintenance. Cargo terminals are implementing conveyor systems, pallet handling equipment, and inventory management systems to streamline operations. Fuel efficiency is a top priority, with the adoption of sustainable aviation fuel and fleet management strategies. Environmental sustainability is also a concern, leading to the use of eco-friendly packaging and carbon emissions reduction initiatives. Import regulations, customs clearance, and cargo security are essential aspects of the market. Third-party logistics providers offer cargo consolidation, trade finance, and route planning services to optimize supply chains.

Airline networks and cargo operations are leveraging big data analytics to improve demand forecasting and cargo capacity utilization. Cargo theft prevention, cargo inspection, and cargo insurance are crucial for maintaining the integrity and security of air cargo. Biometric security and advanced cargo handling technologies are being employed to enhance security measures. The market is interconnected with global supply chain optimization, export compliance, and international trade agreements. Shipping containers, shipping costs, and flight schedules are integral components of the air cargo ecosystem. E-commerce logistics and delivery time are also significant factors driving market growth. In conclusion, the market is a dynamic and evolving industry, shaped by various factors, including trade patterns, technology, and regulatory requirements.

It plays a vital role in connecting global markets and facilitating international trade.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Air Cargo Industry?

- E-commerce sales represent the primary growth factor in the market, with continuous expansion in this sector significantly driving market development.

- The market is experiencing significant growth due to the surge in e-commerce sales and the increasing preference for rapid delivery of goods. Online sellers rely on air cargo services to meet customer demands for timely delivery, driving the expansion of cargo airlines and investments in advanced logistics technologies. These advancements include freight forwarders utilizing cargo automation and the Internet of Things to streamline processes, improve fuel efficiency, and enhance environmental sustainability. Additionally, distribution centers are integrating temperature-controlled shipping and big data analytics to optimize inventory management and supply chain operations.

- Import regulations continue to shape the market, with airlines adapting to evolving requirements and third-party logistics providers offering trade finance and cargo theft prevention services to mitigate risks. Overall, the market is undergoing transformative changes to meet the demands of e-commerce and the evolving logistics landscape.

What are the market trends shaping the Air Cargo Industry?

- The increasing demand for temperature-sensitive products represents a significant market trend. This trend is driven by various factors, including advancements in technology and growing consumer preferences for fresh and high-quality goods.

- The market presents significant opportunities for businesses requiring swift transportation of high-value, time-sensitive, and temperature-controlled goods. Pharmaceutical companies, in particular, rely heavily on air transport for their products' timely delivery. However, the industry encounters challenges such as insufficient expertise, inadequate infrastructure, and ill-equipped facilities. Moreover, increasing regulations add to the complexities. To address these issues, the International Air Transport Association (IATA) has taken steps to establish certified pharmaceutical trade lanes, ensuring consistent standards and product integrity. This initiative aims to strengthen the air cargo industry's compliance with pharmaceutical manufacturers' requirements. Effective cargo consolidation, optimized route planning, and the use of advanced cargo security technologies, such as conveyor systems, pallet handling equipment, and inventory management systems, are essential for enhancing the efficiency and security of air cargo operations.

- Ground handling and customs clearance processes also play a crucial role in ensuring seamless transportation. Logistics providers employ advanced cargo handling equipment and ground handling techniques to streamline processes and minimize potential damages. The integration of technology, such as cargo handling equipment and conveyor systems, further improves the efficiency and accuracy of cargo handling. In conclusion, the market faces challenges in meeting the unique requirements of temperature-sensitive goods transportation. However, the industry's ongoing efforts to address these challenges through initiatives like IATA's certified pharmaceutical trade lanes, technology integration, and logistics optimization demonstrate its commitment to providing reliable and efficient air cargo services.

What challenges does the Air Cargo Industry face during its growth?

- The jet fuel price increase poses a significant challenge to the industry's growth trajectory.

- The market is significantly influenced by the cost of fuel, which represents a substantial operating expense for market participants. The recent decline in crude oil prices, attributed to increased production by countries such as Russia, Canada, and the easing of sanctions on Iran, has provided relief to market players. However, this surplus is projected to diminish, and the cost of crude oil is anticipated to rise during the forecast period. Cargo security, including biometric security, remains a top priority in the air freight industry. E-commerce logistics and delivery time are crucial factors driving market growth. Cargo operations are subject to export compliance and rigorous cargo inspection.

- The integration of sustainable aviation fuel is a developing trend in the industry. Freight rates and flight schedules are essential elements of cargo operations. Cargo insurance is a necessary risk management tool for market participants. Air cargo terminals play a vital role in facilitating the smooth transfer of goods between modes of transportation.

Exclusive Customer Landscape

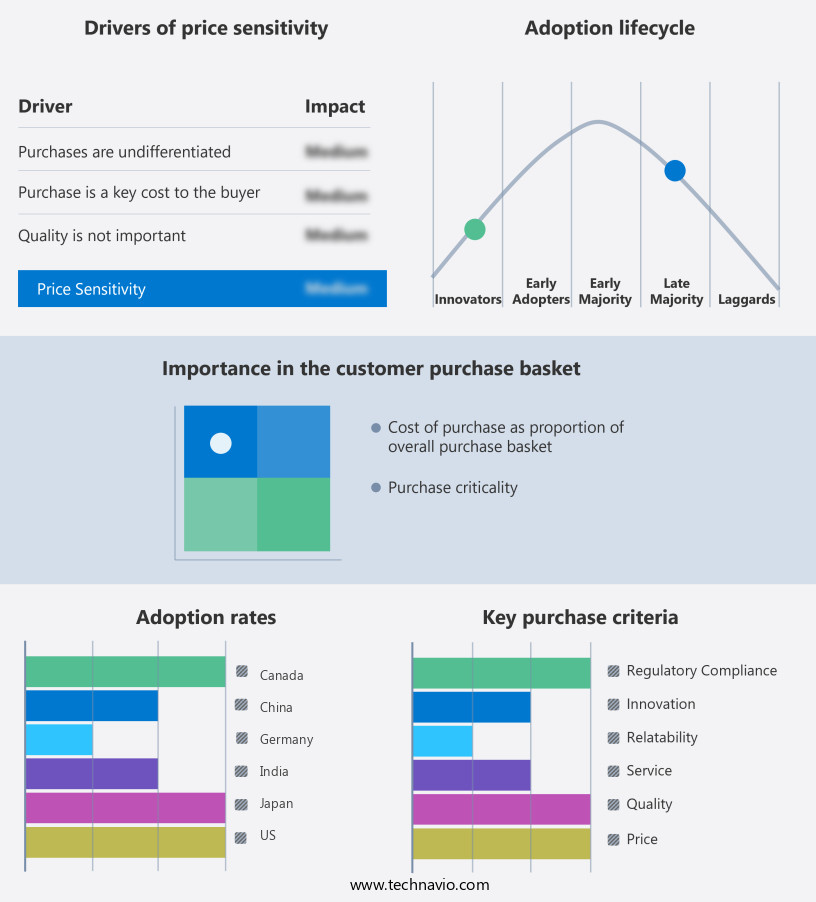

The air cargo market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air cargo market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air cargo market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.P. Møller â Mærsk A/S

- Atlas Air

- Bollore Logistics

- Cargolux

- Cathay Pacific Airways Limited

- CEVA Logistics

- C.H. Robinson

- China Airlines Cargo

- DB Schenker

- DHL Aviation

- Emirates SkyCargo

- Expeditors International

- FedEx Corporation

- Geodis

- Hellmann Worldwide Logistics

- Korean Air Cargo

- Kuehne+Nagel

- Lufthansa Cargo

- Nippon Express

- Qatar Airways Cargo

- Singapore Airlines Cargo

- United Parcel Service (UPS)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Cargo Market

- In February 2023, Boeing and DHL Supply Chain announced a strategic partnership to develop and implement a new generation of 737-800 Freighters, aiming to reduce fuel consumption and emissions by up to 16% compared to current freighters (Boeing, 2023).

- In May 2024, Amazon Prime Air secured regulatory approval from the Federal Aviation Administration (FAA) for its drone delivery service, Prime Air, to operate beyond the visual line of sight, marking a significant step towards the integration of drones into the air cargo industry (Amazon, 2024).

- In July 2024, Emirates SkyCargo and DB Schenker signed a Memorandum of Understanding (MoU) to enhance their collaboration in air freight services, focusing on expanding their network and optimizing the supply chain (Emirates SkyCargo, 2024).

- In October 2024, Cargolux and Volga-Dnepr Group announced a merger, creating the world's largest all-cargo airline, with a combined fleet of over 140 aircraft and an annual revenue of â¬5 billion (Cargolux, 2024).

Research Analyst Overview

- Air cargo plays a crucial role in global trade, enabling the swift transportation of goods across vast distances. The market is characterized by the continuous evolution of cargo handling procedures and technology. Wide-body and freighter aircraft facilitate the movement of high cargo volume, while narrow-body aircraft cater to belly cargo. Cargo sorting and manifest management are essential components of air cargo networks, ensuring efficient and accurate delivery. Air cargo innovation is a driving force in the industry, with advancements in cargo storage technology enhancing cargo density and reducing damage and loss. However, cargo claims due to damage or loss remain a concern for air cargo carriers, necessitating stringent cargo handling procedures and regulations.

- Cargo liability and insurance are critical aspects of the market, with carriers and shippers sharing responsibilities for cargo protection. Air cargo hubs serve as strategic locations for cargo consolidation and distribution, enabling efficient and cost-effective transportation. Regulations, such as those related to cargo weight and cargo density, impact the market dynamics, requiring carriers to adapt to changing requirements. Specialized cargo aircraft cater to unique cargo needs, ensuring safe and secure transportation. Cargo unloading and loading processes are continually optimized to minimize cargo handling time and improve overall efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Cargo Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 20.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, Japan, Germany, India, Canada, UK, France, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Cargo Market Research and Growth Report?

- CAGR of the Air Cargo industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air cargo market growth of industry companies

We can help! Our analysts can customize this air cargo market research report to meet your requirements.