Auto Parts Market Size 2025-2029

The auto parts market size is valued to increase USD 367.6 billion, at a CAGR of 3.2% from 2024 to 2029. Increased usage of technological advancement in global auto parts market will drive the auto parts market.

Major Market Trends & Insights

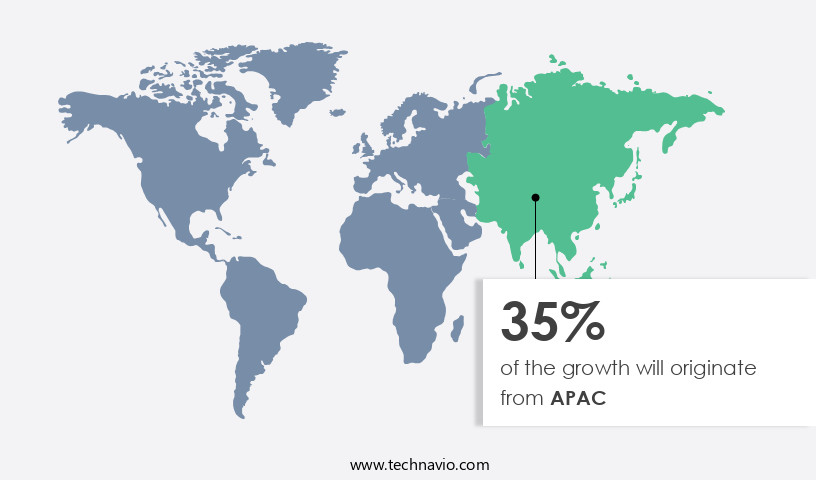

- APAC dominated the market and accounted for a 35% growth during the forecast period.

- By End-user - OEM segment was valued at USD 1530.70 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 26.46 billion

- Market Future Opportunities: USD 367.60 billion

- CAGR : 3.2%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and sale of various components used in the automotive industry. This dynamic market is currently experiencing significant shifts due to several key factors. Technological advancements, such as the increasing adoption of electric and autonomous vehicles, are driving innovation and growth. At the same time, consumer preferences are evolving towards more customized and personalized offerings.

- However, the decline in automobile production and sales due to economic downturns and supply chain disruptions poses challenges. According to a recent study, the global market share of aftermarket auto parts reached 70% in 2020, underscoring the industry's ongoing transformation. As the market continues to unfold, stakeholders must navigate these trends and adapt to the evolving landscape.

What will be the Size of the Auto Parts Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Auto Parts Market Segmented and what are the key trends of market segmentation?

The auto parts industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- OEM

- Aftermarket

- Distribution Channel

- Offline

- Online

- Type

- Driveline and Powertrain

- Interior and Exterior

- Electrical and Electronics

- Body and Chassis

- Wheel and Tires

- Others

- Propulsion

- Internal Combustion Engine

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The OEM segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of components, including automotive sensors, transmission parts, wiper systems, powertrain components, automotive electronics, interior trim, electronic control units, lane departure warning systems, vehicle safety systems, advanced driver assistance, lighting systems, tire pressure monitoring, airbag systems, exterior trim, collision avoidance, ignition systems, brake system parts, fuel injection systems, electrical systems, steering systems, seating systems, exhaust systems, engine management systems, suspension systems, automotive lighting, engine components, adaptive cruise control, drivetrain systems, body parts, anti-lock brakes, sensors and actuators, cooling systems, infotainment systems, and chassis components. Currently, the original equipment manufacturer (OEM) segment holds a substantial market share.

OEMs, such as those manufacturing brakes, steering, and other parts for newly constructed vehicles, are preferred by automobile manufacturers worldwide due to their precise fit and alignment with the vehicle's specifications. Buyers opt for OEM parts because they offer the assurance of identical performance and quality compared to the parts originally installed during manufacturing. Moreover, the automotive electronics segment is experiencing significant growth due to the increasing demand for advanced driver assistance systems (ADAS) and electric vehicle (EV) components. ADAS features, like lane departure warning, collision avoidance, and adaptive cruise control, are becoming increasingly common in modern vehicles, driving the demand for electronic control units and sensors.

Additionally, the tire pressure monitoring system (TPMS) market is projected to expand at a steady pace due to growing safety concerns and regulatory requirements. TPMS systems help maintain optimal tire pressure, ensuring improved fuel efficiency, extended tire lifespan, and enhanced vehicle safety. The infotainment systems segment is also expected to witness substantial growth as consumers increasingly demand advanced in-car technology and connectivity features. These systems provide entertainment, navigation, and communication capabilities, making them an essential component of modern vehicles. In terms of future industry growth, The market is anticipated to expand at a steady pace, driven by factors such as increasing vehicle production, rising demand for electric and autonomous vehicles, and the growing preference for aftermarket parts due to their cost-effectiveness.

The OEM segment was valued at USD 1530.70 billion in 2019 and showed a gradual increase during the forecast period.

The aftermarket segment is expected to gain significant traction as consumers seek to maintain their vehicles at a lower cost compared to purchasing OEM parts. Overall, the market is a dynamic and evolving industry, with various segments experiencing growth due to factors such as technological advancements, regulatory requirements, and consumer preferences.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Auto Parts Market Demand is Rising in APAC Request Free Sample

Commercial vehicles, accounting for approximately half of the total in-use vehicles in North America, dominate the market. Light commercial vehicles lead sales in this region. The expanding oil and gas, agricultural, mining, and industrial manufacturing sectors fuel the demand for commercial vehicles in North America. This growth is anticipated to boost the demand for auto parts during the forecast period. The North American Free Trade Agreement (NAFTA) mandates that over 62.5% of automobile components and parts in the region be sourced from North American countries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth, driven by the increasing adoption of advanced driver assistance features, electric vehicle powertrain technology, and hybrid vehicle battery management systems. Automotive sensor calibration techniques are becoming increasingly important to ensure the accuracy and reliability of these advanced features. Fuel efficiency improvement strategies and vehicle emission control systems are also key factors propelling market expansion. Autonomous driving systems and connected car communication protocols are revolutionizing the industry, necessitating the development of predictive maintenance algorithms and engine performance optimization techniques. Manufacturers are also focusing on advanced materials for automotive parts and lightweight vehicle design principles to enhance vehicle dynamics and control systems.

Moreover, electric motor design for vehicles is gaining traction, with adoption rates in this segment nearly doubling those of traditional internal combustion engine vehicles in some regions. The industrial application segment accounts for a significantly larger share of the market compared to the academic segment. Brake system component failure analysis is a critical area of focus for manufacturers, with quality control procedures and supply chain optimization for auto parts essential to minimize downtime and ensure customer satisfaction. Manufacturing processes for auto parts are also undergoing digital transformation, with a growing emphasis on automation and Industry 4.0 principles. Automotive cybersecurity vulnerabilities are an emerging concern, with a minority of players, less than 15%, investing in robust security measures to protect against potential threats.

As the market continues to evolve, stakeholders must stay abreast of these trends and adapt to remain competitive.

What are the key market drivers leading to the rise in the adoption of Auto Parts Industry?

- The market's growth is primarily driven by the increased adoption and advancements in technology. This technological revolution has significantly transformed the industry, leading to enhanced productivity, efficiency, and innovation.

- The market is characterized by its dynamic nature, with technological advancements significantly impacting various components such as brakes and headlamps. High-performance brake systems, for example, utilize modern technologies for optimal braking performance and enhanced vehicle handling. These systems incorporate electronic features, including regenerative braking, brake-by-wire, electronic brake force distribution, antilock braking, traction control, and electronic stability control systems.

- Moreover, 3D printing technology is revolutionizing the auto parts industry, enabling the fabrication of various components. Today's vehicles incorporate a substantial number of additive-manufactured parts, which contribute to their overall assembly. This continuous innovation underscores the market's evolving landscape and its applications across diverse sectors.

What are the market trends shaping the Auto Parts Industry?

- The upcoming market trend mandates an increasing focus on customization and personalization. Customization and personalization are key areas of growth in today's market.

- The market experiences a notable trend towards increasing customization, fueled by consumers' preferences for unique driving experiences and personalized vehicles. This tendency is most evident in the aftermarket sector, where buyers actively seek custom components and accessories to enhance both aesthetics and performance. Key areas of customization include body kits, alloy wheels, interior modifications, infotainment systems, and performance upgrades such as exhaust systems and turbochargers. The escalating popularity of luxury and premium vehicles has significantly boosted demand for bespoke parts and accessories.

- Technological advancements, including 3D printing and computer-aided design (CAD), have streamlined the manufacturing process, enabling producers to create personalized components more efficiently and cost-effectively. This continuous evolution in the market underscores the importance of staying informed about emerging trends and innovative technologies to cater to the evolving needs of consumers.

What challenges does the Auto Parts Industry face during its growth?

- The automobile industry is facing significant challenges due to the declining production and sales numbers, which is negatively impacting its growth trajectory.

- The market experiences ongoing challenges due to decreased automobile production and sales. Economic downturns, geopolitical instability, and supply chain disruptions are major contributors to the reduction in vehicle manufacturing in regions like North America, Europe, and parts of Asia. For example, the ongoing semiconductor shortage significantly impacts new vehicle production, forcing automakers to postpone launches or decrease production volumes, subsequently affecting the demand for original equipment (OE) auto parts.

- Furthermore, changing consumer preferences, such as a rising preference for shared mobility and ride-hailing services, contribute to declining vehicle sales in specific markets. These trends underscore the evolving nature of the market and its applications across various sectors.

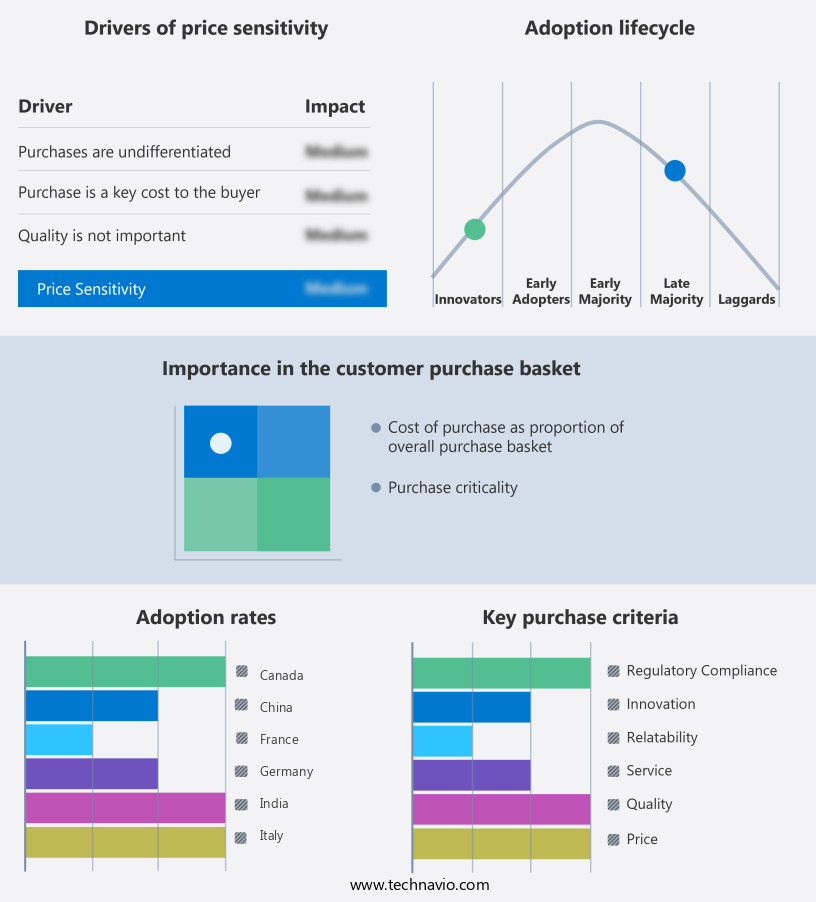

Exclusive Technavio Analysis on Customer Landscape

The auto parts market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the auto parts market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Auto Parts Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, auto parts market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing a range of automotive components, including Pin 14 with 3M Acrylic Foam Tape 5392, 3M Wheel Weight TN6020, and Rain Sensor Brackets with 3M Die Cuttable Tape DC2008.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AISIN Corp.

- Akebono Brake Industry Co. Ltd.

- Autoliv Inc.

- BorgWarner Inc.

- Brembo Spa

- Forvia SE

- General Motors Co.

- HELLA GmbH and Co. KGaA

- Hyundai Motor Co.

- Lear Corp.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

- Robert Bosch GmbH

- Schaeffler AG

- Tenneco Inc.

- The Goodyear Tire and Rubber Co.

- Toyota Motor Corp.

- Valeo SA

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Auto Parts Market

- In January 2024, global automotive component manufacturer, Magna International, announced the launch of its new eMobility Innovation Center in Europe, focusing on electric vehicle (EV) components and technologies (Magna International Press Release, 2024). This strategic investment underscores Magna's commitment to the growing EV market.

- In March 2024, leading auto parts supplier, Bosch, and technology company, Siemens, formed a strategic partnership to develop and produce electric vehicle batteries in Europe, aiming to secure a competitive position in the EV battery market (Bosch Press Release, 2024). This collaboration combines Bosch's automotive expertise with Siemens' industrial know-how.

- In May 2024, American auto parts giant, Caterpillar Inc., completed the acquisition of Twin Disc Inc., a leading manufacturer of heavy-duty transmission equipment, for approximately USD 3.3 billion (Caterpillar Inc. SEC Filing, 2024). This acquisition strengthens Caterpillar's position in the off-highway vehicle market.

- In February 2025, the European Union approved the new Regulation (EU) 2025/XXX on CO2 emissions from heavy-duty vehicles, setting ambitious targets for reducing emissions from trucks and buses (European Commission Press Release, 2025). This regulation will drive demand for advanced technologies and alternative fuels in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Auto Parts Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2025-2029 |

USD 367.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Germany, China, UK, Japan, India, Canada, South Korea, France, Italy, UAE, Brazil, and rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The automotive industry continues to evolve, with various components and systems shaping its dynamic landscape. Among the key areas experiencing significant activity are automotive sensors, transmission parts, wiper systems, powertrain components, and automotive electronics. These elements are integral to vehicle functionality and safety. Automotive sensors, including those for lane departure warning, collision avoidance, and tire pressure monitoring, are increasingly being integrated into advanced driver assistance systems. Transmission parts, such as clutches and gears, undergo continuous improvements to enhance fuel efficiency and performance. Wiper systems, essential for ensuring optimal visibility, are being developed with advanced materials for improved durability and efficiency.

- Powertrain components, including electronic control units, ignition systems, and fuel injection systems, are being optimized for better engine performance and reduced emissions. Automotive electronics, including infotainment systems and lighting systems, are becoming more sophisticated, offering enhanced user experiences and safety features. Interior trim and exterior trim components are also undergoing transformations, with a focus on sustainability and aesthetics. Seating systems are being engineered for improved comfort and support, while exhaust systems are being optimized for reduced emissions and improved fuel efficiency. Engine management systems and suspension systems are being developed with advanced technologies to improve vehicle handling and performance.

- Drivetrain systems are being engineered for increased durability and efficiency, while body parts are being designed for improved safety and aerodynamics. Cooling systems and steering systems are being optimized for better performance and longevity, while brake system parts and suspension systems are being developed for improved safety and handling. Exhaust systems are being engineered for reduced emissions and improved fuel efficiency, while engine components are being optimized for better performance and durability. Adaptive cruise control and drivetrain systems are gaining popularity, offering enhanced safety and convenience features. Sensors and actuators are being integrated into various systems to improve vehicle functionality and performance.

- Overall, the automotive industry continues to evolve, with a focus on advanced technologies and improved safety features.

What are the Key Data Covered in this Auto Parts Market Research and Growth Report?

-

What is the expected growth of the Auto Parts Market between 2025 and 2029?

-

USD 367.6 billion, at a CAGR of 3.2%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (OEM and Aftermarket), Distribution Channel (Offline and Online), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Type (Driveline and Powertrain, Interior and Exterior, Electrical and Electronics, Body and Chassis, Wheel and Tires, and Others), and Propulsion (Internal Combustion Engine, Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Internal Combustion Engine, Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, and Fuel Cell Electric Vehicles)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased usage of technological advancement in global auto parts market, Decline in automobile production and sales

-

-

Who are the major players in the Auto Parts Market?

-

Key Companies 3M Co., AISIN Corp., Akebono Brake Industry Co. Ltd., Autoliv Inc., BorgWarner Inc., Brembo Spa, Forvia SE, General Motors Co., HELLA GmbH and Co. KGaA, Hyundai Motor Co., Lear Corp., Magna International Inc., Marelli Holdings Co. Ltd., Robert Bosch GmbH, Schaeffler AG, Tenneco Inc., The Goodyear Tire and Rubber Co., Toyota Motor Corp., Valeo SA, and ZF Friedrichshafen AG

-

Market Research Insights

- The market encompasses a diverse range of products and processes, including supply chain management for classic car parts, parts manufacturing for automotive hardware and heavy duty components, as well as the production of materials science-driven solutions such as fluids and lubricants, gaskets and seals, and filters and belts. The market for repair parts, including wiring harnesses, diagnostic tools, and replacement components, is a significant segment, with an estimated annual revenue of USD 350 billion in 2020. In contrast, the market for performance parts, tooling and equipment, and custom parts catering to the automotive enthusiast community, is projected to grow at a faster rate, reaching USD 120 billion by 2025.

- Effective inventory management, quality control, and parts distribution are crucial for success in this dynamic industry, which also includes the production of original equipment and aftermarket parts for vehicles, as well as the development of repair manuals, body repair kits, and truck parts. The market for automotive hardware, fasteners and clips, and electrical connectors is expected to continue evolving, driven by advancements in technology and consumer demand.

We can help! Our analysts can customize this auto parts market research report to meet your requirements.