Aircraft Auxiliary Power Unit Gearbox Market Size 2024-2028

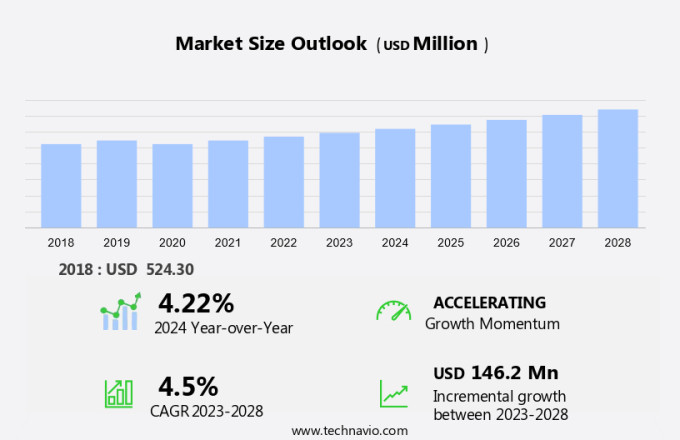

The aircraft auxiliary power unit gearbox market size is forecast to increase by USD 146.2 million and is estimated to grow at a CAGR of 4.5% between 2023 and 2028. The global aerospace industry is experiencing significant growth, driven primarily by the increasing demand for commercial aircraft. This trend is expected to continue, with numerous investors pouring resources into the market. In response, major players are ramping up production and launching new and innovative aircraft models to meet this demand. Boeing, for instance, recently unveiled its new 737 Max 10, while Airbus introduced the A321XLR. These advancements not only cater to the growing need for more efficient and eco-friendly commercial aircraft but also position companies at the forefront of technological innovation in the aerospace sector.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is a significant segment of the aircraft industry that caters to the electrical power and other auxiliary requirements of commercial and military aircraft. The gearbox is a crucial component of APUs, which includes the main shaft, oil-cooled generator, fuel control unit, lubrication module, cooling fan, and others. These gearboxes provide electricity, compressed air, and shaft power during aircraft ground operations and in-flight situations when the main engine is not running. The market for APU gearboxes is driven by the growing commercial aircraft fleet and military aircraft fleet, which necessitates the need for reliable and efficient power sources. The increasing flight hours and the focus on lightweight gearboxes are also key factors driving the market growth. The market is expected to witness significant growth in the coming years due to the increasing demand for civil aircraft and military aircraft and the ongoing development of geared turbofan engines. The aviation industry's MRO spending and the adoption of advanced technologies like 3D printing technology are also expected to impact the market positively. Despite the challenges posed by air traffic and the ongoing lockdown situation, the market is expected to recover and grow steadily. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Growing demand for commercial aircraft is notably driving market growth. The global market is witnessing significant growth due to the increasing demand for new aircraft to cater to the rising air traffic. Major Original Equipment Manufacturers (OEMs) are expanding their production capabilities to meet the scheduled deliveries, as evidenced by Airbus' delivery of 611 commercial aircraft in 2021, a 10% increase from the previous year.

Moreover, the production of aircraft is not limited to traditional fixed-wing and rotary-wing platforms but also includes Unmanned Aerial Vehicles (UAVs). Developing countries such as India and China are significant contributors to the global aircraft production. In addition, there is a growing trend towards battery-powered and electric ground power for APUs to reduce carbon emissions and operating costs. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Advancement in aircraft auxiliary power unit is the key trend in the market. Aircraft Auxiliary Power Units (APUs) play a vital role in the aviation industry by supplying electrical power and air conditioning to fixed-wing, rotary-wing, and unmanned aerial vehicles (UAVs) while on the ground. This equipment enhances passenger comfort and ensures the air source for engine start-up.

Moreover, the competitive landscape in the APUs market is witnessing significant advancements, with key players focusing on cost savings and operational efficiency. For instance, Honeywell International Inc. announced in March 2021 the development of a power source for hybrid-electric aircraft, which will be integrated with their HGT1700 auxiliary power unit, forming a turbogenerator. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Impact of COVID-19 on aviation industry is the major challenge that affects the growth of the market. The global market for Aircraft Auxiliary Power Units (APUs) Gearboxes has experienced significant challenges due to the COVID-19 pandemic's impact on the aviation industry. Fixed-wing and rotary-wing aircraft, including those used for military applications and unmanned aerial vehicles (UAVs), have seen a decline in demand.

Moreover, the financial strain on airlines has led to a reassessment of fleet strategies and capital expenditures, resulting in cancellations, deferrals, or renegotiations of aircraft orders. This situation is unlikely to change in the near future, as the aviation industry recovers at a slow pace. However, the trend towards battery-powered electric ground power and the competitive landscape analysis of key players, such as Honeywell, Rolls-Royce, and Pratt & Whitney, continue to shape the market dynamics. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB SKF: The company offers aircraft auxiliary power unit gearboxes such as Engine and gearbox which has tight tolerance limits.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atec Inc.

- General Electric Co.

- Honeywell International Inc.

- Krasny Octiabr

- Liebherr International AG

- Northstar Aerospace

- PBS Aerospace Inc.

- PBS India Pvt. Ltd.

- Precipart

- RTX Corp.

- Regal Rexnord Corp.

- Safran SA

- The Timken Co.

- TransDigm Group Inc.

- Triumph Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

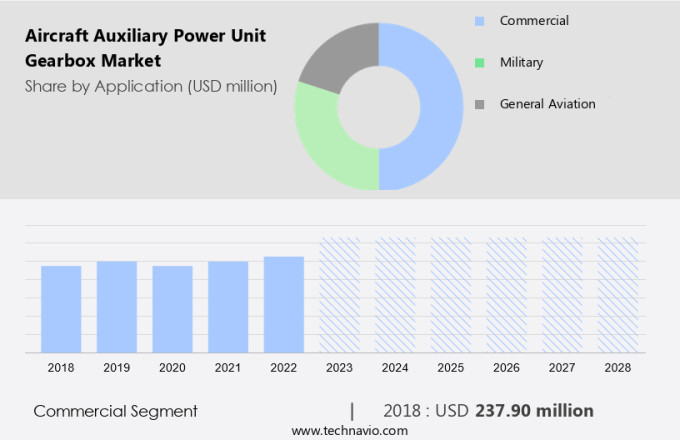

The commercial segment is estimated to witness significant growth during the forecast period. This segment caters to the power requirements of passengers, freighter, and business aircraft. The expansion of this market can be linked to the burgeoning commercial aviation industry, driven by the increasing number of air travelers and escalating cargo shipments.

Get a glance at the market share of various regions Download the PDF Sample

The commercial segment was the largest segment and valued at USD 237.90 million in 2018. The aviation industry's growth is fueled by technological advancements and the growing consumer preference for air travel, making it a more economical mode of transportation. The demand for new aircraft by operators to meet the tourism industry's demands is on the rise. In military aviation, upgrades to existing aircraft fleets are driving the demand for APUs. The APUs provide electricity, compressed air, and shaft power for various aircraft systems, including air conditioning, main engine starting, and ground power supply. Hence, such factors are fuelling the growth of this segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

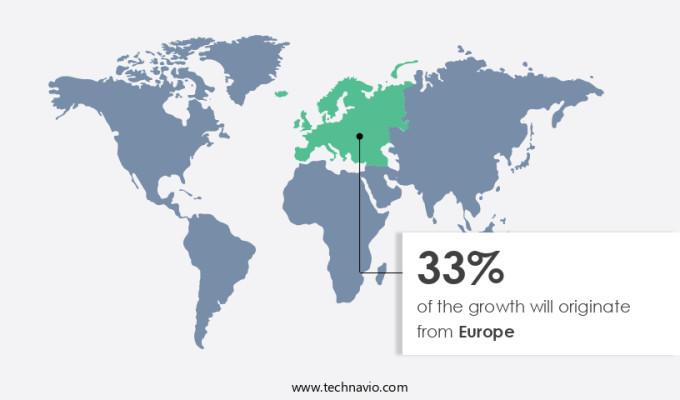

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Aircraft Auxiliary Power Unit (APU) Gearbox market caters to the demand for electrical power and shaft power from commercial and military aircraft during ground operations and in flight situations where the main engine is not in use. The gearbox is a crucial component of APUs, which include oil-cooled generators, fuel control units, and lubrication modules. These systems provide electricity for air conditioning, lighting, and other aircraft systems, as well as compressed air for pneumatic systems. The global aircraft industry, including both civil and military fleets, is experiencing a surge in demand due to increasing air traffic and the need for fuel-efficient, environment-friendly vehicles. Hence, such factors are driving the market growth in Europe during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Application Outlook

- Commercial

- Military

- General aviation

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Commercial Aircraft Auxiliary Power Unit (APU) Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, Canada, China, Germany, UK - Size and Forecast

Aircraft Auxiliary Power Unit Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, Germany, UK, Canada - Size and Forecast

Automotive Steering Gearbox Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, Japan, Germany, France - Size and Forecast

Market Analyst Overview

Aircraft Auxiliary Power Units (APUs) are essential components in both commercial and military aircraft fleets. The gearbox is a crucial part of APUs, responsible for transmitting power from the main shaft to the oil-cooled generator, fuel control unit, lubrication module, cooling fan, and other systems. These systems provide electrical power and compressed air for aircraft ground operations, air conditioning during taxiing, and starting the main engine in flight. The Market is driven by the increasing flight hours of passenger and freighter aircraft, military aircraft upgrades, and the need for fuel-efficient and environment-friendly vehicles. Lightweight gearboxes and the integration of 3D printing technology are trends in the market. The market's growth is influenced by the aviation industry's continuous expansion, despite the air traffic disruptions caused by the lockdown situation. The market landscape depends on the Military aircraft fleet, Surge in aircraft production, Geared turbofan, Fuel efficient, Platform, Environment-friendly vehicles, Advanced military aircraft platforms, Civil aircraft, Gas turbine engines, Electric power. The high initial investment in APUs and engine limitations are challenges for component manufacturers. The use of open rotor engines in commercial aircraft and the increasing popularity of geared turbofans are expected to provide opportunities for market growth. APUs are essential for aircraft industry operations, providing electricity and compressed air during ground operations and in-flight engine starting. The market for APUs is expected to grow significantly, driven by the increasing demand for commercial and military aircraft and the need for fuel-efficient and environment-friendly vehicles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 146.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.22 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB SKF, Atec Inc., General Electric Co., Honeywell International Inc., Krasny Octiabr, Liebherr International AG, Northstar Aerospace, PBS Aerospace Inc., PBS India Pvt. Ltd., Precipart, RTX Corp., Regal Rexnord Corp., Safran SA, The Timken Co., TransDigm Group Inc., and Triumph Group Inc. |

|

Market dynamics |

Parent market analysis, market forecast , market report , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies