Airport IT Spending Market Size 2025-2029

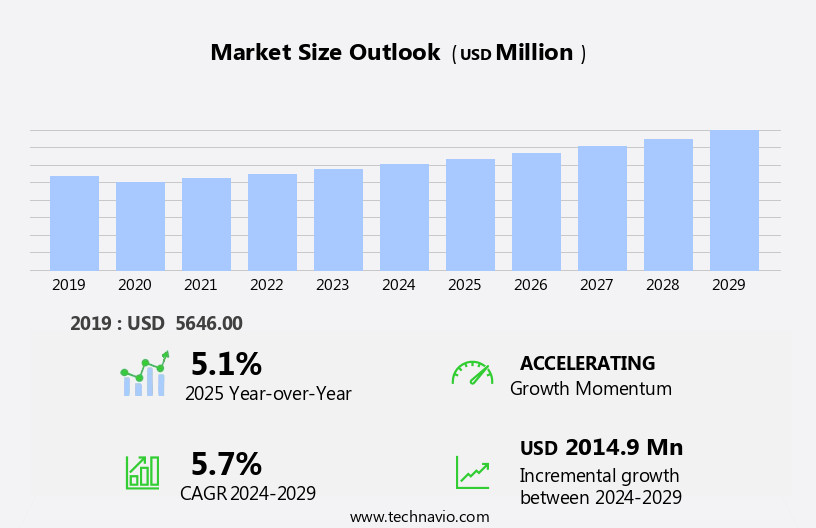

The airport it spending market size is forecast to increase by USD 2.01 billion, at a CAGR of 5.7% between 2024 and 2029.

- The market is driven by the growing emphasis on enhancing customer experience at airports. This includes implementing advanced technologies such as contactless check-in, automated baggage handling systems, and real-time flight information displays. Another key trend is the prioritization of high-end cybersecurity at airports to ensure the safety of sensitive passenger data and critical infrastructure. However, the market faces significant challenges. The high initial investment required for implementing these advanced technologies and the increasing complexity of IT systems at airports can pose significant financial and operational hurdles for airport authorities. Furthermore, ensuring compliance with evolving cybersecurity regulations adds an additional layer of complexity and cost.

- To capitalize on market opportunities and navigate these challenges effectively, airport authorities must carefully evaluate the cost-benefit analysis of each technology implementation and explore partnerships with technology providers to share the investment burden and expertise. Additionally, implementing robust cybersecurity measures and staying abreast of regulatory changes are essential to mitigate risks and maintain a strong competitive position in the market.

What will be the Size of the Airport IT Spending Market during the forecast period?

The market continues to evolve, with dynamic market activities unfolding across various sectors. Airport operations rely increasingly on wireless networking and advanced network infrastructure to support passenger self-service kiosks, mobile apps, IT consulting, airport management systems, runway management, and digital transformation. These technologies enhance operational efficiency, improve passenger experience, and optimize costs. Airport IT budgets allocate funds for project management, cloud services, and customer satisfaction initiatives. Check-in counters, environmental control systems, and baggage carousels are integrated with IT solutions for real-time data processing and analysis. Business intelligence, data privacy, and data visualization tools aid in decision-making and data governance.

Emerging technologies such as artificial intelligence, machine learning, and the Internet of Things are transforming airport infrastructure. Biometric authentication, access control, and IT infrastructure upgrades ensure security and privacy. Airport communications, air traffic management, IT service management, and airfield lighting systems are integrated for seamless operations. Airport sustainability initiatives incorporate IT solutions for energy management and weather monitoring. Software licenses, ground handling, and managed services enable operational efficiency and cost optimization. Passenger notifications, IT support, and system integration ensure service level agreements and technical support are met. Continuous innovation drives the adoption of new technologies and services, including airport wayfinding, data analytics, data centers, and software development.

The ongoing digital transformation of airports requires a focus on technology adoption, network security, and baggage handling. Airport wi-fi, return on investment, and maintenance agreements remain crucial components of airport IT strategies.

How is this Airport IT Spending Industry segmented?

The airport it spending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Operational system

- Administrative system

- Passenger processing system

- Component

- Hardware

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The operational system segment is estimated to witness significant growth during the forecast period.

Airport IT spending is primarily driven by operational systems, which are anticipated to dominate the market due to their ability to optimize costs, enhance operational efficiency, and improve passenger experience. Operational systems integrate data from various sources into a unified control panel, enabling real-time decision-making, forecasting, and billing. These systems streamline airport operations, facilitate collaborative decision-making, and optimize resource allocation, ultimately resulting in increased revenue. Network infrastructure, a crucial component of airport IT, is also a significant spending area. Modern airports rely on robust and secure network infrastructure to support the growing number of digital applications, including passenger apps, check-in counters, baggage handling, and airport information systems.

Network security is paramount to ensure data privacy and prevent potential cyber threats. Cloud services and IT outsourcing have gained popularity in the airport IT sector due to their cost-effective and flexible nature. Cloud computing enables airports to access software applications and store data remotely, reducing the need for expensive hardware and maintenance costs. IT outsourcing allows airports to focus on their core competencies while leveraging external expertise for IT management and support. Emerging technologies, such as artificial intelligence, machine learning, and biometric authentication, are transforming airport operations. These technologies enable advanced passenger processing, real-time data analytics, and improved security screening, enhancing the overall traveler experience.

Airport infrastructure, including airport communications, departure control systems, runway management, and airport sustainability, also contributes significantly to airport IT spending. Effective communication systems ensure seamless coordination between various airport departments, while departure control systems facilitate efficient passenger processing. Runway management systems optimize the use of airport resources, and airport sustainability initiatives reduce energy consumption and promote eco-friendly practices. In conclusion, airport IT spending is a dynamic and evolving market, driven by operational systems, network infrastructure, and emerging technologies. These investments aim to enhance operational efficiency, improve passenger experience, and optimize costs. The integration of cloud services, IT outsourcing, and advanced technologies is transforming airport operations, setting the stage for a more connected, efficient, and personalized travel experience.

The Operational system segment was valued at USD 2.68 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic the market, wireless networking and network infrastructure form the backbone of modern airports, enabling seamless connectivity for passengers and airport operations. Airport IT budgets continue to prioritize project management and operational efficiency, driving investments in emerging technologies such as artificial intelligence, machine learning, and biometric authentication. Cloud services and IT outsourcing are essential for cost optimization and scalability, while business intelligence and data analytics enhance passenger experience and airport operations. Environmental control systems and airport infrastructure are crucial for ensuring operational efficiency and sustainability. Passenger apps and digital signage offer real-time information and wayfinding, improving passenger satisfaction and reducing queries at check-in counters and departure control systems.

Security screening and access control systems ensure a secure and efficient passenger processing experience. Aircraft maintenance, baggage handling, and ground handling are critical airport functions that require robust IT infrastructure and software licenses for efficient management. Managed services and IT support ensure uninterrupted airport operations, while IT consulting and system integration enable digital transformation and the adoption of new technologies. Airport management systems, runway management, and air traffic management require advanced IT solutions for effective coordination and real-time data processing. Data privacy, data governance, and data visualization are essential for ensuring secure and efficient data management. Energy management and cost optimization are key priorities, with airport communications and airport sustainability initiatives driving the adoption of IoT and renewable energy solutions.

In the rapidly evolving airport IT landscape, airport operations, passenger experience, and airport infrastructure are the primary focus areas for investment. The market is expected to witness continued growth due to the increasing demand for technology adoption and the need for operational efficiency and passenger satisfaction. The Asia Pacific region, with its growing economies and increasing air travel demand, is a significant contributor to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Airport IT Spending Industry?

- Airports' initiatives to improve customer experience are the primary catalysts driving market growth.

- Airports worldwide prioritize the implementation of advanced technologies to enhance customer experience and cater to the rising demand for travel services. The growing trend of mobility and frequent air travel has resulted in a surge in passenger traffic, making it essential for airports to focus on operational efficiency and service delivery. To achieve these objectives, airports are adopting various technologies such as data privacy-focused software licenses for departure control systems, managed services for airport communications, and artificial intelligence for baggage handling and airport energy management. These solutions not only improve operational efficiency but also ensure cost optimization and network security.

- Moreover, the adoption of data visualization tools and access control systems enables airports to monitor and manage their facilities effectively, ensuring a harmonious passenger experience. Service level agreements with ground handling companies and airport wi-fi providers ensure that passengers have a seamless experience during their transit. Airports are also exploring the use of chatbots, smart help, and social media to engage with passengers and offer personalized services. For instance, KLM Royal Dutch Airlines has successfully implemented a chatbot on Facebook Messenger, enabling customers to book and check-in, receive boarding passes, and receive flight status updates. In conclusion, the market is expected to witness significant growth as airports continue to invest in advanced technologies to meet the evolving needs of passengers and ensure a positive return on investment.

- The focus on data privacy, operational efficiency, and customer experience will remain key drivers of market growth.

What are the market trends shaping the Airport IT Spending Industry?

- Focusing on advanced cybersecurity is an essential trend in the aviation industry, particularly at airports. To maintain the security of sensitive passenger information and critical infrastructure, it is crucial to prioritize high-end cybersecurity solutions.

- In the dynamic world of technology, airport IT spending continues to grow as businesses and organizations seek to optimize passenger self-service through innovative solutions such as passenger kiosks and mobile apps. IT consulting plays a crucial role in implementing these systems, which also include airport management systems, runway management, and digital transformation initiatives. Interactive displays, data governance, and passenger notifications enhance the travel experience, while IT support ensures the smooth operation of air traffic management, IT service management, airfield lighting, and airport sustainability systems. The integration of technologies like the Internet of Things (IoT), facial recognition, and weather monitoring further streamlines airport operations.

- However, these advanced systems require robust cybersecurity measures to mitigate potential threats, including cyber-attacks and data breaches. The aviation industry, identified as a critical sector by the US Homeland Security Presidential Directive 7 (HSPD-7) and the National Infrastructure Protection Plan (NIPP), is at the forefront of implementing cybersecurity standards. The ongoing digital transformation in the aviation sector underscores the importance of investing in IT infrastructure while maintaining a focus on air traffic management, airfield lighting, airport sustainability, and passenger experience.

What challenges does the Airport IT Spending Industry face during its growth?

- The high initial investment required for advanced IT systems and the subsequent complexity in managing and updating these technologies pose a significant challenge to industry growth.

- The airport IT market is experiencing significant growth as the aviation industry embraces advanced technologies to enhance operational efficiency and reduce costs. IT infrastructure plays a pivotal role in modern airport operations, from passenger processing to real-time data management. Biometric authentication, data analytics, and system integration are key areas of investment, with cloud computing and machine learning enabling the development of immersive and harmonious passenger experiences. Airport wayfinding, digital signage, and security systems are essential components of IT infrastructure, requiring robust technical support and maintenance agreements. The increasing complexity of these systems necessitates a skilled workforce, driving demand for IT professionals.

- However, the high initial investment required for IT infrastructure and connectivity presents a significant challenge for airport IT market companies. The adoption of multiple technologies has resulted in intricate systems, increasing the importance of sharing resources and collaboration among stakeholders. In conclusion, the airport IT market is evolving rapidly, with a focus on data centers, software development, and system integration to meet the demands of modern air travel.

Exclusive Customer Landscape

The airport it spending market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the airport it spending market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, airport it spending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amadeus IT Group SA - This company specializes in providing IT solutions for airports, focusing on passenger servicing, ground handling, and airport operations. Our offerings aim to enhance efficiency and optimize resources in these areas. By implementing advanced technologies and innovative strategies, we help airports improve customer experience, streamline processes, and boost productivity. Our expertise lies in leveraging data analytics, automation, and cloud computing to address the unique challenges faced by airport IT environments. Our goal is to deliver customized, scalable, and secure solutions that meet the evolving needs of the aviation industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amadeus IT Group SA

- Atos SE

- Capgemini Services SAS

- China Civil Aviation Information Network Co. Ltd.

- Cobham Ltd.

- Damarel Systems International Ltd.

- INFORM GmbH

- International Business Machines Corp.

- Intersystems

- Lockheed Martin Corp.

- NEC Corp.

- Northrop Grumman Corp.

- Passur Aerospace Inc.

- RTX Corp.

- RESA SAS

- Saab AB

- Siemens AG

- SITA

- Thales Group

- VELATIA S.L

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Airport IT Spending Market

- In February 2023, SITA, a leading technology provider for the air transport industry, announced the launch of its new biometric boarding gate solution, which enables contactless travel and improves passenger experience [1]. This innovation is expected to significantly contribute to the growth of the market, as airports worldwide invest in advanced technologies to enhance passenger processing and safety.

- In May 2024, Amadeus, a leading IT solutions provider for the travel industry, entered into a strategic partnership with Helsinki Airport to implement its cloud-based IT solutions [2]. This collaboration aims to streamline airport operations, improve efficiency, and provide a more personalized travel experience for passengers.

- In October 2024, Rockwell Collins, a leading provider of aviation and high-technology solutions, was acquired by Collins Aerospace, a unit of United Technologies Corporation [3]. This merger is expected to create a global leader in the aviation industry, with significant implications for airport IT spending as the combined entity will offer a broader range of technology solutions to airports.

- In January 2025, the European Union Aviation Safety Agency (EASA) approved the use of drones for airport surveillance and security purposes [4]. This regulatory approval marks a significant development in the market, as airports invest in advanced surveillance technologies to improve safety and security.

- [1] SITA. (2023, February 2). SITA launches new biometric boarding gate solution to enable contactless travel. Retrieved from https://www.Sita.Aero/press-releases/sita-launches-new-biometric-boarding-gate-solution-to-enable-contactless-travel

- [2] Amadeus. (2024, May 5). Amadeus and Helsinki Airport partner to enhance passenger experience with cloud-based IT solutions. Retrieved from https://www.Amadeus.Com/en/media/press-releases/2024/amadeus-and-helsinki-airport-partner-to-enhance-passenger-experience-with-cloud-based-it-solutions

- [3] United Technologies Corporation. (2024, October 3). United Technologies Completes Acquisition of Rockwell Collins. Retrieved from https://www.Utc.Com/news/press-releases/2024/10/utc-completes-acquisition-of-rockwell-collins

- [4] European Union Aviation Safety Agency. (2025, January 15). EASA approves use of drones for airport surveillance and security. Retrieved from https://easa.Europa.Eu/news/easa-approves-use-drones-airport-surveillance-and-security.

Research Analyst Overview

- In the dynamic airport market, various technologies are shaping the future of airport operations. Airport robotics, such as automated guided vehicles and AI-powered solutions, are streamlining processes and enhancing efficiency in airport infrastructure modernization. Distributed ledger technology, including airport security blockchain and airport analytics, is revolutionizing data management and security. Sustainability initiatives, like carbon emission reduction and green airports, are gaining traction, with advanced security technologies and cybersecurity solutions ensuring airport security enhancements. Queue management and passenger flow optimization are key areas of focus for airport business intelligence, while big data analytics and virtual reality are driving airport capacity management and design & development.

- Augmented reality and queue management systems are also optimizing airport operations and improving the passenger experience. Airport IT upgrades, including airport automation and airport data security, are essential for smart airports to stay competitive and adapt to evolving market trends.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Airport IT Spending Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 2014.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Airport IT Spending Market Research and Growth Report?

- CAGR of the Airport IT Spending industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the airport it spending market growth of industry companies

We can help! Our analysts can customize this airport it spending market research report to meet your requirements.