Airway Management Tubes Market Size 2024-2028

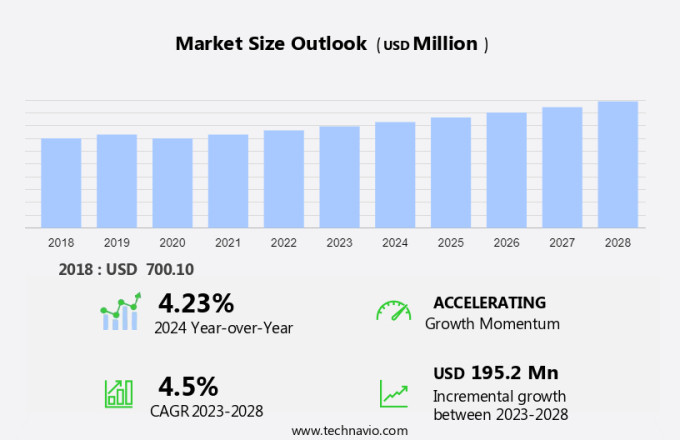

The airway management tubes market size is forecast to increase by USD 195.2 million at a CAGR of 4.5% between 2023 and 2028. Airway management tubes are essential medical equipment used during intubation procedures in various fields, including anesthesia and emergency medicine. The market for these tubes is driven by several factors, including the growing number of cardiovascular diseases and lung cancer cases, which necessitate intubation for treatment. Additionally, the need for effective suctioning during intubation and the increasing emphasis on pediatric airway management are key trends in the market. However, challenges such as risks and complications associated with airway management products, including potential damage to the trachea and bronchus, remain a concern. Video laryngoscopes have gained popularity in recent years due to their ability to provide clear visualization of the glottis during intubation, reducing the risk of complications.

What will the size of the market be during the forecast period?

The market plays a crucial role in the healthcare industry by providing essential solutions for oxygenation and ventilation during various medical procedures and emergency situations. These tubes are utilized in hospitals, clinics, and ambulatory surgical centers to manage respiratory diseases, such as asthma, chronic obstructive pulmonary disease (COPD), and other medical conditions. Airway management tubes are indispensable tools in anesthesia and emergency medicine. They facilitate open pathways for oxygen intake and carbon dioxide expulsion during surgeries, ensuring optimal patient safety and comfort. In addition, these tubes are vital for cardiopulmonary resuscitation in critical situations, making them an essential component in emergency care departments. Neonatology and the care of premature infants also benefit significantly from the use of airway management tubes. These devices contribute to improved survival rates for preterm births and the geriatric population, ensuring better healthcare outcomes.

Additionally, the demand for cost-efficient airway management devices continues to grow, driven by the increasing number of hospitals, clinics, and healthcare centers focusing on enhancing patient care while minimizing expenses. Supraglottic devices and infraglottic devices, including laryngeal mask airways and endotracheal tubes, respectively, cater to this need. Respiratory diseases, such as COPD and asthma, affect millions of people in the US, necessitating the use of airway management tubes for effective oxygenation and ventilation. These devices play a vital role in the treatment of these conditions, ensuring that patients receive adequate respiratory support during their recovery.

Further, laryngoscopes, essential for intubation procedures, are often used in conjunction with airway management tubes. The advanced technology and ergonomic designs of modern laryngoscopes enable healthcare professionals to perform intubations more efficiently and accurately, reducing the risk of complications. In conclusion, the market is a vital segment of the medical equipment industry, providing essential solutions for oxygenation, ventilation, and airway management in various healthcare settings. The increasing prevalence of respiratory diseases and the growing need for cost-efficient devices continue to drive market growth. By focusing on innovation and patient safety, manufacturers can contribute significantly to enhancing the overall quality of care in hospitals, clinics, and ambulatory surgical centers.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Device

- Supraglottic devices

- Infraglottic devices

- Resuscitators

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Device Insights

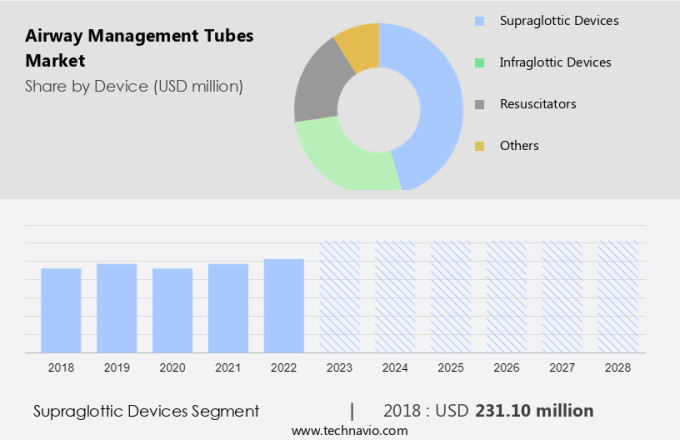

The supraglottic devices segment is estimated to witness significant growth during the forecast period. Airway management tubes, specifically supraglottic devices, have gained significant attention in the medical field for their use in intubation and airway management. These devices, such as laryngeal mask airways (LMAs), are inserted into the pharynx to facilitate ventilation, oxygenation, and anesthetic gas administration without the need for endotracheal intubation. Initially limited to operating rooms, technological advancements have expanded their application in emergency settings. Organizations like the European Resuscitation Council and the American Heart Association advocate for the use of supraglottic devices in emergency airway management. Companies such as Ambu AS and Intersurgical Ltd. Manufacture these devices, contributing to the growing market for medical equipment in this category.

Further, video laryngoscopes have also emerged as a valuable tool in intubation procedures, offering improved visualization of the glottis and facilitating easier intubation. Infraglottic devices, on the other hand, are used for the administration of medications and fluids directly into the trachea or bronchi. In conclusion, the market for airway management tubes, including supraglottic and infraglottic devices, continues to grow as medical professionals seek less invasive alternatives for intubation and airway management in various clinical settings. Companies manufacturing these devices are investing in research and development to improve their functionality and expand their applications.

Get a glance at the market share of various segments Request Free Sample

The supraglottic devices segment accounted for USD 231.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is projected to expand at a steady pace over the coming years. The United States and Canada are the major contributors to the market's revenue. The trend towards minimally invasive procedures and robotic surgeries has led to a decrease in the demand for airway management tubes, as they are primarily used during surgeries where general anesthesia is administered. However, certain surgical procedures such as trauma, maxillofacial surgeries, and cardiac surgeries still necessitate the use of these tubes. Moreover, government initiatives to reduce hospital stays and enhance the quality of healthcare have boosted the adoption of airway management tubes in emergency care departments, ICUs, and healthcare centers. Tracheostomy tubes, including both conventional and video laryngoscopes, continue to be essential respiratory devices for managing airway obstruction in the geriatric population and preterm births. Cost-efficient devices are gaining popularity in the market due to their affordability and effectiveness.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for single-use devices is the key driver of the market. Airway management tubes, including endotracheal tubes, have become increasingly popular among medical professionals due to their single-use disposable nature. Reusable airway management equipment poses risks of cross-contamination, leading to healthcare-associated infections (HAIs) or nosocomial infections. The Centers for Disease Control and Prevention (CDC) reports that approximately 1.7 million cases of nosocomial infections occur annually in the US, resulting in the death of around 99,000 individuals. By utilizing disposable airway management tubes, the risk of cross-contamination is significantly reduced. These devices offer several advantages, such as lower maintenance costs, shorter sterilization duration, and affordable materials and components compared to reusable tubes.

The demand for single-use airway management devices is on the rise globally, particularly in developed countries. This trend is driven by the need for enhanced patient safety and infection control in various settings, including operating rooms and during surgeries for conditions such as COPD, bronchitis, emphysema, and neoplasms. The adoption of these devices is expected to continue due to their convenience, cost-effectiveness, and improved patient outcomes.

Market Trends

Growing emphasis on pediatric airway management is the upcoming trend in the market. Airway management in pediatric patients poses unique challenges for healthcare professionals due to their anatomical and physiological differences from adults. These differences can complicate the usage of airway management devices, increasing the risk of gastric aspiration. In response to this need, companies have developed specialized product categories for pediatric patients. The demand for these products is on the rise due to the increasing hospitalization rates of pediatric patients. Supraglottic devices and infraglottic devices are commonly used airway management tools in pediatric patients. Resuscitators and laryngoscopes are also essential components of airway management systems. Hospitals, clinics, and ambulatory surgical centers are the primary markets for these products.

Respiratory diseases such as asthma and surgical procedures necessitate the use of airway management devices in pediatric patients. Companies have responded by introducing various product designs tailored to the unique needs of pediatric patients. In conclusion, the airway management market for pediatric patients is witnessing significant growth due to the increasing hospitalization rates and the need for specialized airway management products. companies are responding to this demand by introducing new products and making design modifications to cater to the unique needs of pediatric patients.

Market Challenge

Risks and complications associated with airway management products are key challenges affecting the market growth. Airway management tubes play a crucial role in ensuring the proper delivery of oxygen to patients during surgeries and intensive care. However, the use of these tubes comes with potential risks and complications, which can hinder their adoption and limit their application among healthcare providers. Some complications can stem from design or manufacturing issues, while others may result from incorrect usage by medical professionals. For instance, misplacing a Laryngeal Mask Airway (LMA) above the airway opening can lead to gastric distension and aspiration, as well as nerve injuries from direct compression. Air pollution, smoking habits, stress, tuberculosis, and other health conditions can further complicate airway management procedures, necessitating the use of airway stenting and clearance systems.

In the operating room and intensive care units, the immune system's response to the presence of foreign objects in the airway can also pose challenges. Healthcare providers must exercise caution and adhere to best practices to minimize these risks and ensure optimal patient outcomes.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ambu AS - The company offers airway management tubes that includes bronchoscopes, video laryngoscopes, double lumen tubes, single lumen tubes, endobronchial blocker, laryngeal masks, face masks, breathing bags, resuscitators.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ConvaTec Group Plc

- Cook Group Inc.

- Fisher and Paykel Healthcare Corp. Ltd.

- Flexicare Group Ltd.

- Fuji Systems Co. Ltd.

- Intersurgical Ltd.

- KARL STORZ SE and Co. KG

- Medis Medical (UK) Ltd

- Medtronic Plc

- Mercury Medical

- Pulmodyne Inc.

- Roper Technologies Inc.

- Smiths Group Plc

- SourceMark

- SunMed

- Teleflex Inc.

- Trudell Healthcare Solutions Inc.

- Vyaire Medical Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Airway management tubes are essential medical equipment used for securing and maintaining open pathways for oxygenation and ventilation in patients with respiratory diseases or undergoing surgical procedures. These devices include supraglottic devices, such as laryngeal mask airways, oropharyngeal airways, and nasopharyngeal airways, and infraglottic devices, including endotracheal tubes and tracheostomy tubes. Hospitals, clinics, and ambulatory surgical centers are primary users of airway management tubes due to the high prevalence of respiratory diseases, including asthma, COPD, bronchitis, emphysema, and lung cancer, which require intubation and ventilation support. Cardiovascular diseases, such as heart failure and cardiopulmonary resuscitation, also necessitate the use of airway management equipment.

Further, anesthesia and emergency medicine departments are significant consumers of airway management tubes, with laryngoscopes, both conventional and video, being crucial tools for intubation. The geriatric population and preterm births also require cost-efficient devices for airway management. Airway management tubes play a vital role in critical care settings, including intensive care units, emergency care departments, and ICS, for patients with chronic respiratory diseases, neoplasms, and tuberculosis. Lifestyle-related factors, such as air pollution, smoking habits, stress, and immune system compromise, further increase the demand for airway management equipment. Airway stenting and airway clearance systems are additional applications for airway management tubes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 195.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, Germany, France, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ambu AS, ConvaTec Group Plc, Cook Group Inc., Fisher and Paykel Healthcare Corp. Ltd., Flexicare Group Ltd., Fuji Systems Co. Ltd., Intersurgical Ltd., KARL STORZ SE and Co. KG, Medis Medical (UK) Ltd, Medtronic Plc, Mercury Medical, Pulmodyne Inc., Roper Technologies Inc., Smiths Group Plc, SourceMark, SunMed, Teleflex Inc., Trudell Healthcare Solutions Inc., and Vyaire Medical Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch