Alcoholic Beverage Packaging Market Size 2024-2028

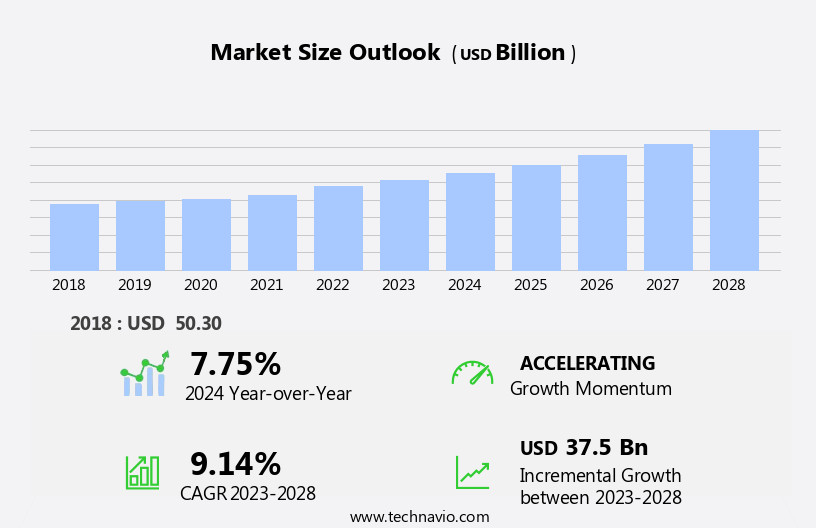

The alcoholic beverage packaging market size is forecast to increase by USD 37.5 billion, at a CAGR of 9.14% between 2023 and 2028.

- The market is experiencing significant growth due to the rising consumption of alcoholic beverages worldwide. This trend is driving the demand for innovative and attractive packaging solutions to cater to the increasing consumer base. Another key trend in the market is the growing popularity of metal packaging for alcoholic beverages, particularly for spirits and wine, as consumers seek premium and sustainable options. However, the market faces challenges as well. The increasing cost of raw materials and energy is significantly raising the production cost of packaging, putting pressure on manufacturers to find cost-effective solutions.

- Additionally, the complex regulatory landscape and stringent safety standards for alcoholic beverage packaging add to the challenges for market players. Companies seeking to capitalize on market opportunities must focus on offering sustainable, cost-effective, and innovative packaging solutions while navigating the regulatory landscape and ensuring product safety.

What will be the Size of the Alcoholic Beverage Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Supply chain visibility plays a crucial role in ensuring brand protection and consumer safety as packaging lines adapt to e-commerce packaging requirements. Labeling machines and filling machines integrate advanced technologies such as barcodes, RFID tags, and QR codes for efficient tracking and traceability. Pet bottles made of HDPE material, plastic closures, and packaging design innovations continue to gain popularity due to their oxygen barrier properties and tamper-evident seals. UV protection and logistics optimization are essential for maintaining product quality and reducing wastage. In the spirits packaging segment, glass jars, cork stoppers, and metal closures add a premium touch to the product, while spirits in glass bottles offer a traditional and elegant appeal.

Aluminum cans, beer packaging, and wine packaging each have unique requirements, such as temperature control and shelf life, that necessitate specialized packaging solutions. The use of biodegradable materials, paperboard packaging, and recycled materials is gaining traction as sustainability becomes a priority. Product protection, through shrink wrap and pallet wrapping, is essential for ensuring the safe transportation of alcoholic beverages. Inventory management, moisture barriers, and temperature control are critical considerations for ready-to-drink packaging, while digital printing and offset printing offer cost-effective solutions for small and large production runs, respectively. The ongoing evolution of the market reflects the industry's commitment to innovation, sustainability, and consumer safety.

How is this Alcoholic Beverage Packaging Industry segmented?

The alcoholic beverage packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Glass

- Metal

- Others

- Application

- Beer

- Wine

- Spirits

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Material Insights

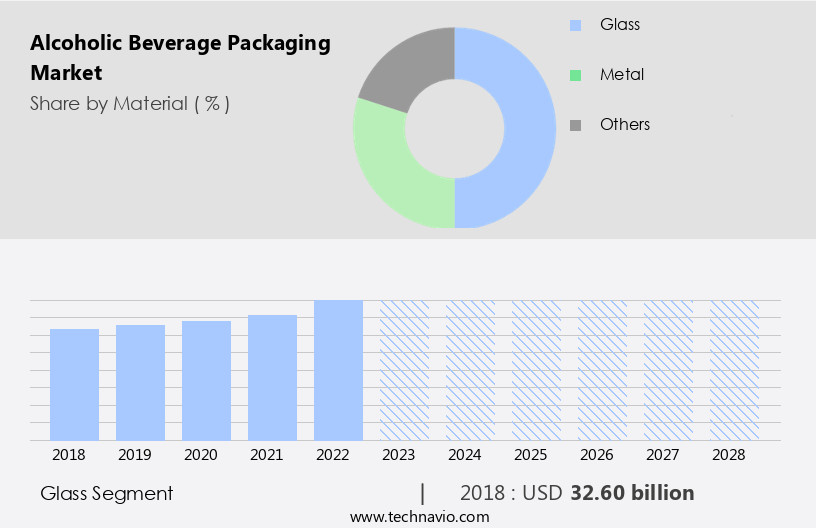

The glass segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, glass remains a preferred choice for various reasons. With a significant market share, glass packaging caters to numerous beverage types, including beers, wines, rum, vodka, and whiskey. The advantages of glass are noteworthy: it is impermeable to oxygen and carbon dioxide, ensuring longer product shelf life. Glass bottles' resistance to leaching is another key factor, as they undergo de-alkalization during manufacturing, reducing the risk of contamination. Furthermore, glass bottles maintain their shape during pasteurization, a crucial process for ensuring product safety. In the evolving market landscape, glass packaging also accommodates various design elements, such as screen printing, labeling, and even digital printing.

Additionally, glass packaging can be combined with other materials, such as metal closures, cork stoppers, and plastic or aluminum caps, to enhance product protection and consumer convenience. As e-commerce sales increase and logistics optimization becomes essential, glass packaging's durability and stackability make it an ideal choice for shipping. Moreover, the recyclability of glass bottles aligns with consumers' growing preference for sustainable packaging solutions. In the realm of spirits packaging, glass jars and bottles continue to be popular, while wine packaging incorporates temperature control and UV protection features. Overall, glass packaging's versatility, durability, and safety make it an enduring choice in the alcoholic beverage industry.

The Glass segment was valued at USD 32.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

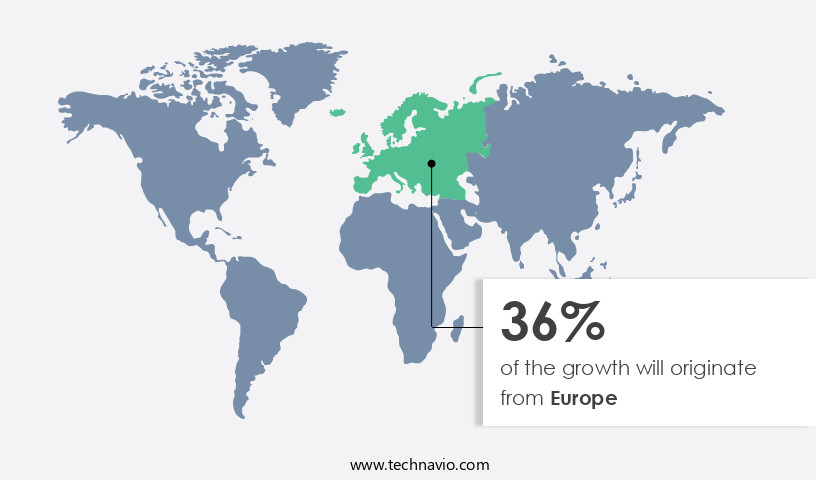

Europe is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by the increasing disposable income of consumers in Europe. In 2021, the median household disposable income in the UK was â¬31,400, representing a 2% annual increase, according to the Office for National Statistics (ONS). Europeans are among the world's highest consumers of alcohol, with over 60% of adults consuming alcohol in 2020. Per capita consumption of pure alcohol in Europe exceeded 9 liters. Brand protection and consumer safety are key concerns in the alcoholic beverage packaging industry. Packaging lines incorporate various technologies, such as labeling machines, filling machines, and bar codes, to ensure product authenticity and traceability.

RFID tags and tamper-evident seals provide additional security measures. Packaging materials like plastic bottles, HDPE bottles, and glass jars are used for different types of alcoholic beverages. Plastic closures, such as screw caps and crown caps, are commonly used to seal containers. Biodegradable materials and paperboard packaging are gaining popularity due to environmental concerns. E-commerce packaging and logistics optimization are essential for efficient supply chain management. Oxygen barriers, UV protection, and moisture barriers are crucial to maintain product quality and shelf life. Recycling programs and the use of recycled materials are also important trends in the market. Innovative packaging designs, such as temperature control, shrink wrap, and digital printing, enhance the consumer experience.

Beverage cans, glass bottles, and aluminum cans are popular packaging formats for various alcoholic beverages. Flexographic printing and offset printing are common techniques used for labeling and branding. Inventory management and supply chain visibility are crucial for businesses to maintain optimal stock levels and meet consumer demand. The market for alcoholic beverage packaging is expected to continue growing due to these trends and the increasing demand for convenient, safe, and sustainable packaging solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Alcoholic Beverage Packaging Industry?

- The significant increase in alcohol consumption serves as the primary growth factor for the market.

- The market is experiencing significant growth due to the increasing consumption of alcoholic beverages in emerging economies. This trend is driven by the expanding urban population and rising disposable incomes, leading people to explore new forms of leisure and entertainment. In the US, over 70% of adults consumed alcoholic beverages in 2020, representing a growth of over 5% compared to 2005. To meet the rising demand, alcoholic beverage manufacturers are focusing on enhancing their supply chain visibility and improving brand protection and consumer safety. This includes investing in advanced packaging lines, labeling machines, and filling machines.

- Plastic bottles, particularly HDPE bottles, are gaining popularity due to their lightweight and cost-effective nature. Moreover, the advent of e-commerce has led to an increase in demand for specialized e-commerce packaging solutions. These solutions include the use of bar codes and RFID tags for efficient tracking and traceability. Screen printing and other advanced labeling techniques are also being used to enhance branding and product differentiation. In conclusion, the market is witnessing significant growth due to the increasing consumption of alcoholic beverages and the need for advanced packaging solutions to meet the evolving demands of consumers and manufacturers.

- The focus on supply chain visibility, brand protection, and consumer safety is driving innovation in the market, with an emphasis on sustainable and cost-effective packaging solutions.

What are the market trends shaping the Alcoholic Beverage Packaging Industry?

- The increasing preference for metal packaging in the alcoholic beverages industry, beyond beer, represents a notable market trend. This shift towards metal containers is driven by various factors, including sustainability, durability, and the desire for premium branding.

- The market is witnessing significant growth due to various factors. One of the key trends is the increasing usage of metal cans for alcoholic beverages, including spirits and wine. Metal packaging offers advantages such as oxygen barriers, tamper-evident seals, and UV protection. These features ensure the preservation of the product's quality and enhance its shelf life. Moreover, the logistics optimization and supply chain management benefits of metal cans are driving their adoption. Cans are lighter and more compact than glass bottles, making them easier and more cost-effective to transport. Additionally, the use of plastic closures, such as pet bottles, and metal closures, like cork stoppers, also provides convenience and functionality.

- Despite the dominance of glass jars and bottles in the spirits packaging market, metal cans are gaining popularity due to their advantages. For instance, the sales of canned wine in the US have seen a significant surge, with an increase of over 100% during 2019-2020. This trend is expected to continue as consumers seek more convenient and portable packaging options. In summary, the market is evolving, with metal cans emerging as a popular choice due to their numerous benefits, including preservation, convenience, and logistics optimization. The trend towards canned spirits and wine is expected to continue, offering opportunities for businesses to innovate and meet evolving consumer preferences.

What challenges does the Alcoholic Beverage Packaging Industry face during its growth?

- The escalating costs of raw materials and energy significantly impact the packaging industry's production costs, posing a substantial challenge to its growth.

- The market is influenced by several factors, including the cost of raw materials and energy. The price of aluminum, a primary material for manufacturing aluminum cans, significantly impacts the cost of end-products. Similarly, the use of fuels such as coal in the production of shrink wrap and corrugated boxes adds to the overall cost. In the case of wine packaging, the price of glass, a key component in wine bottles, is a significant factor. The increasing cost of raw materials like sand and energy used in glass manufacturing further exacerbates the issue. These rising costs pose a significant challenge for companies in the market.

- Product protection, achieved through the use of materials like biodegradable ones and screw caps, is essential to maintain the quality of the beverages. Packaging waste reduction through pallet wrapping is also a growing trend. Flexographic printing and paperboard packaging are other areas of focus for companies to offer innovative and sustainable solutions.

Exclusive Customer Landscape

The alcoholic beverage packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the alcoholic beverage packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, alcoholic beverage packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The Stelvin closure system is a innovative alcoholic beverage packaging solution, gaining industry recognition for its effectiveness in preserving wine's quality and freshness. This technology ensures airtight seals, preventing oxidation and contamination, thereby extending the product's shelf life. The company's commitment to advanced packaging solutions enhances consumer experience and market competitiveness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Ardagh Group SA

- Ball Corp.

- Beatson Clark

- Berry Global Inc.

- Brick Packaging

- Compagnie de Saint Gobain

- Crown Holdings Inc.

- Diageo Plc

- DS Smith Plc

- Gerresheimer AG

- Krones AG

- Mondi Plc

- O I Glass Inc.

- Orora Ltd.

- Smurfit Kappa Group

- Tetra Laval SA

- Vetreria Etrusca Spa

- Vidrala SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Alcoholic Beverage Packaging Market

- In January 2024, Ball Corporation, a leading provider of aluminum beverage packaging, announced the expansion of its beverage can manufacturing facility in Thailand. This expansion aimed to increase production capacity by 12 billion cans per year, catering to the growing demand in the Asia Pacific region (Ball Corporation Press Release).

- In March 2024, Amorim Cork and Glass, a Portuguese packaging company, entered into a strategic partnership with Diageo, the world's largest spirits company. The collaboration focused on the development and implementation of sustainable, lightweight glass bottles for Diageo's Smirnoff vodka brand (Amorim Cork and Glass Press Release).

- In May 2024, Constellation Brands, an international producer and marketer of beer, wine, and spirits, completed the acquisition of a majority stake in Canopy Growth Corporation, a leading cannabis company. This strategic move aimed to expand Constellation's product offerings into the cannabis beverage market (Constellation Brands Press Release).

- In February 2025, Crown Holdings, a global packaging company, received regulatory approval from the European Commission for its acquisition of Alcan Packaging, a leading European aluminum beverage can manufacturer. The acquisition significantly expanded Crown's market presence and capacity in Europe (Crown Holdings Press Release).

Research Analyst Overview

- The market is witnessing significant advancements, driven by consumer experience and regulatory requirements. Active packaging, such as UV-Vis spectroscopy and sensory analysis, ensures product integrity and food safety. Circular economy strategies, including waste reduction through recycling and reuse, are gaining traction. Connected packaging and intelligent systems enable real-time monitoring of shelf life and product condition. Packaging regulation, including migration testing and toxicity assessments, ensures compliance. Digital printing technologies, like gravure and offset lithography, offer customization and cost savings. High-barrier films and modified atmosphere packaging extend shelf life and maintain product quality. Innovation in packaging material testing, including impact resistance, compression strength, and barrier property testing, enhances product protection.

- Sustainability initiatives, like circular economy strategies and waste management, reduce environmental impact. Smart packaging, such as augmented reality and aseptic designs, engage consumers and ensure product authenticity. Regulatory compliance, sensory evaluation, and shelf life testing remain critical aspects of the market. Shelf life testing, using techniques like near-infrared spectroscopy and Raman spectroscopy, ensures product quality and consumer satisfaction. Regulations on packaging material testing, including drop testing and stacking strength, ensure product safety and durability. Market trends include the adoption of UV-Vis spectroscopy for product authentication and shelf life monitoring, as well as the integration of digital printing technologies for customization and cost savings.

- The use of high-barrier films and modified atmosphere packaging extends shelf life and maintains product quality. Packaging innovation continues to drive market growth, with a focus on consumer experience, sustainability, and regulatory compliance. Intelligent packaging and connected systems offer real-time monitoring and product authentication, while waste reduction strategies and circular economy initiatives promote sustainability. Regulations on packaging material testing ensure product safety and durability, while innovation in digital printing technologies offers cost savings and customization.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Alcoholic Beverage Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.14% |

|

Market growth 2024-2028 |

USD 37.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.75 |

|

Key countries |

US, Germany, China, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Alcoholic Beverage Packaging Market Research and Growth Report?

- CAGR of the Alcoholic Beverage Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the alcoholic beverage packaging market growth of industry companies

We can help! Our analysts can customize this alcoholic beverage packaging market research report to meet your requirements.