Alginates Derivatives Market Size 2024-2028

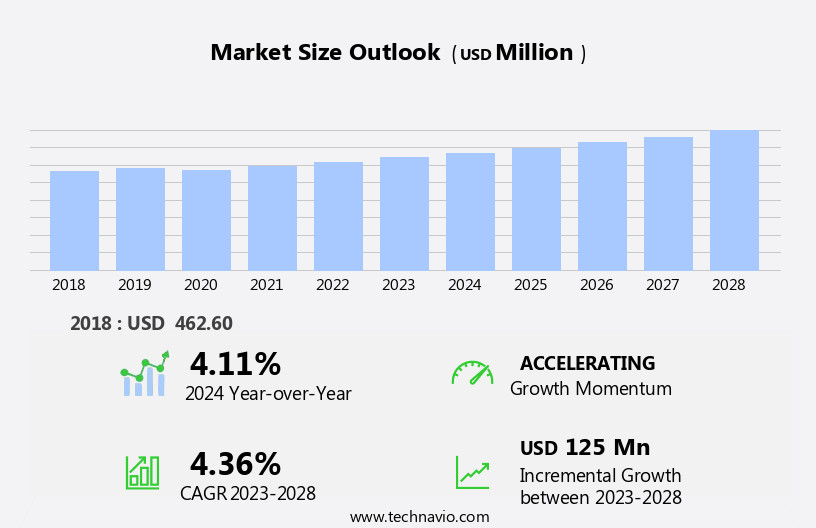

The alginates derivatives market size is forecast to increase by USD 125 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expanding applications in various industries. One of the primary sectors fueling this demand is the biomedical industry, where alginates are utilized in wound dressings, dental applications, and drug delivery systems due to their biocompatibility and gelling properties. Additionally, the consumption of processed and convenience food is on the rise, leading to increased demand for alginates as a food additive and stabilizer. However, challenges persist in the market, particularly in the supply of raw materials. Alginates are derived primarily from brown seaweed, making the industry reliant on sustainable harvesting and processing methods.

- Companies seeking to capitalize on market opportunities must navigate these challenges by implementing strategic sourcing and supply chain management initiatives. Furthermore, investments in research and development to expand the application scope of alginates and improve production methods will be crucial for market growth. Overall, the market presents a compelling opportunity for businesses to innovate and address the evolving needs of various industries while navigating the complexities of raw material supply.

What will be the Size of the Alginates Derivatives Market during the forecast period?

- The alginate derivatives market in the US exhibits growth, driven by the increasing demand for these versatile polymers in various industries. Sodium alginate, derived from brown seaweed, is a key player in this market due to its gelling properties and ability to act as a thickening agent, emulsifier, and stabilizing agent in food and beverage manufacturing. In addition, biotechnological applications, such as controlled release and encapsulation in pharmaceuticals, contribute significantly to market expansion. Agriculture also utilizes alginate derivatives as soil conditioners and for the production of divalent cations. The market is further by the growing trend towards low-calorie foods and the use of alginate derivatives as texturizing agents and disintegrants.

- The extraction process and production costs remain key challenges, while environmental regulations drive innovation in the development of sustainable and eco-friendly production methods. Overall, the alginate derivatives market is poised for continued growth, with applications extending beyond traditional industries to include water treatment and biotechnological applications.

How is this Alginates Derivatives Industry segmented?

The alginates derivatives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Sodium alginate

- Calcium alginate

- Potassium alginate

- PGA

- Others

- Application

- Food and beverages

- Industrial

- Pharmaceutical

- Others

- Geography

- North America

- US

- APAC

- China

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

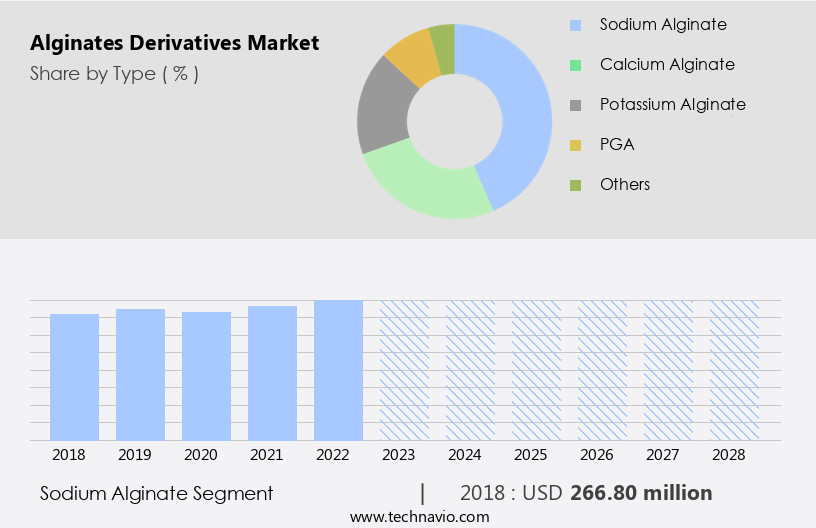

The sodium alginate segment is estimated to witness significant growth during the forecast period.

Sodium alginate, a naturally derived polysaccharide from brown algae, is composed of beta-d-mannuronic acid and beta-l-gluluronic acid residues. When dissolved in calcium ions, it forms a gel, making it a valuable ingredient in various industries. Applications of sodium alginate extend beyond paper sizing agents and welding rod binders, reaching textiles, food, and beverages. This market expansion is anticipated to fuel the growth of the market. Sodium alginate's versatility is evident in its use as an emulsifier, thickener, stabilizer, and binding agent. In the textile industry, it enhances textile quality and facilitates processes like roller printing and screen printing.

In the food and beverage sector, it improves mouthfeel, acts as a disintegrant, and contributes to the production of low-calorie foods. Additionally, sodium alginate's environmental applications include use in water treatment processes and sustainable harvesting practices. The increasing consumer awareness and regulations regarding environmental impact further boost the market's growth. Global demand for alginates derivatives is driven by their biocompatibility, gelling properties, and use in controlled release formulations for drug applications and wound care products. Sodium alginate's potential in biotechnological applications, such as cell encapsulation and thickeners, also contribute to the market's expansion. The market's growth is influenced by factors like seasonal variations, consumer incomes, and climate conditions.

Sodium alginate's applications in agriculture as soil conditioners and its use in the production of thickeners, binders, and stabilizing agents for F&B manufacturers further expand its market reach. Sodium alginate's versatility and sustainability initiatives are expected to continue driving the market's growth during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The Sodium alginate segment was valued at USD 266.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

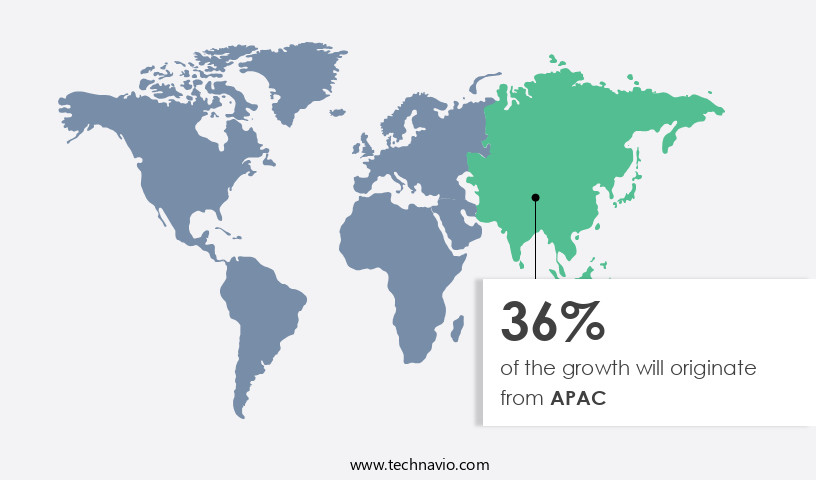

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds a significant share in The market, primarily due to the thriving food and beverage industry in the region. The convenience food sector, which includes ready-to-eat (RTE) and instant foods, has experienced notable growth in recent years. This trend is driven by changing consumer lifestyles and the increasing demand for time-saving meal options in the US and Canada. Alginates derivatives, such as sodium alginate, are extensively used as thickening and stabilizing agents in various food applications, including ice cream, bakery products, and beverages. Beyond food applications, alginates derivatives also find extensive use in various environmental applications, including water treatment processes and soil conditioners.

In addition, they are used in biotechnological applications, such as drug formulation, cell encapsulation, and controlled release. The environmental impact of harvesting seaweed, a primary source of alginate, is a concern, and sustainable harvesting practices are being adopted to mitigate this issue. The extraction process of alginate from brown seaweed is an essential factor influencing production costs. Biotechnological applications, such as biocompatibility and reactive dyes, offer significant growth opportunities for the market. Consumer income levels and climate conditions also impact the demand for alginates derivatives. Environmental regulations continue to play a crucial role in shaping the market dynamics. Alginates derivatives are used as binders and texturizing agents in various industries, including textiles, where they enhance the quality of wool, cotton, silk, and nylon.

They are also used as thickeners and stabilizing agents in various industries, such as agriculture and cosmetics. The global demand for alginates derivatives is expected to continue growing due to their versatile applications and sustainability initiatives. Female participation in the workforce and the increasing awareness of low-calorie foods are also driving market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Alginates Derivatives Industry?

- Growing usage of alginates in biomedical applications is the key driver of the market.

- Alginates are naturally derived anionic polymers obtained primarily from brown algae, which is a significant source of natural products with therapeutic properties. These biomaterials are gaining popularity in biomedical science and engineering due to their favorable characteristics, such as biocompatibility, ease of gelation, low toxicity, and cost-effectiveness compared to synthetic polymers. Alginate hydrogels, a type of alginate, are extensively utilized in various applications, including wound healing, tissue engineering, and drug delivery.

- The structural similarities of alginate hydrogels to the extracellular matrices in living tissues make them crucial in tissue engineering, enabling the production of man-made tissue and organ replacements for patients who have experienced organ or tissue loss or failure.

What are the market trends shaping the Alginates Derivatives Industry?

- Growing consumption of processed and convenience food is the upcoming market trend.

- Packaged food and beverages, including RTE meals, instant mixes, and canned food, have gained significant popularity among consumers in developed countries, such as the US, Canada, and the UK. This trend can be attributed to the increasing consumer awareness regarding the benefits of consuming packaged foods, which are perceived as safer and less susceptible to contamination compared to unpackaged alternatives. The convenience and ease of use offered by RTE food products have also contributed to their rising demand worldwide. Factors such as rapid urbanization, increasing disposable income, and a growing number of women in the workforce have further boosted the market for convenience and RTE food products.

- These trends are expected to continue driving the growth of the market in the coming years. Consumers' preference for packaged foods is a significant market dynamic, underpinned by the benefits of safety, convenience, and ease of use.

What challenges does the Alginates Derivatives Industry face during its growth?

- Challenges related to supply of raw materials is a key challenge affecting the industry growth.

- The market faces challenges in ensuring a consistent supply of raw materials due to the natural sourcing of alginates from brown algae. These algae, including Laminaria hyperborea, Laminaria digitata, Laminaria japonica, Ascophyllum nodosum, and Macrocystis pyrifera, are the primary sources of alginates. However, the availability of these marine organisms varies, making it difficult for companies to secure a steady supply of raw materials.

- Additionally, extracting alginates from their natural environment in a pure form poses another challenge. The lack of efficient technology for the extraction of brown algae, which are typically found in deep waters, further complicates matters. These factors hinder the regular supply of raw materials necessary for the production of alginates and derivatives.

Exclusive Customer Landscape

The alginates derivatives market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the alginates derivatives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, alginates derivatives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashland Inc. - The company specializes in providing alginate, a versatile raw material utilized in various product formulations. Alginate's unique properties make it an essential component in numerous industries, including food, pharmaceuticals, and industrial applications. This eco-friendly substance, derived from algae, offers advantages such as thickening, gelling, and stabilizing properties. By incorporating alginate into their offerings, businesses can enhance product functionality and consumer experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashland Inc.

- BRENNTAG SE

- Cargill Inc.

- DuPont de Nemours Inc.

- FMC Corp.

- IRO Alginate Industry Co. Ltd.

- J RETTENMAIER and SOHNE GmbH and Co KG

- JRS PHARMA GmbH and Co. KG

- KIMICA Corp.

- Marinalg International

- Marine Biopolymers Ltd.

- Mytech Inc.

- Qingdao Allforlong Bio-Tech Co., Ltd.Â

- Qingdao Bright Moon Seaweed Group Co. Ltd.

- Qingdao Fengrun Seaweed Co. Ltd.

- QINGDAO GFURI SEAWEED INDUSTRIAL Co. Ltd.

- Shandong Jiejing Group Corp.

- SNAP Natural and Alginate Products Pvt. Ltd.

- SNP Inc.

- Syngenta Crop Protection AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Alginates, a family of naturally derived anionic polysaccharides, have gained significant attention in various industries due to their unique properties. These polymers, primarily extracted from brown seaweed, exhibit remarkable gelling and emulsifying abilities, making them indispensable in numerous applications. The global market for alginate derivatives is driven by the increasing demand for sustainable and eco-friendly alternatives in various sectors. The emulsification property of alginate derivatives is extensively utilized in the food and beverage industry for the production of convenience foods, ice cream, and low-calorie beverages. In the textile industry, alginate derivatives are employed as binders and thickeners, enhancing the quality and durability of textiles made from cotton, wool, silk, and synthetic fibers like nylon.

In the realm of biotechnology, alginate derivatives find extensive applications in drug formulation and cell encapsulation. The biocompatibility and controlled release properties of alginate make it an ideal material for the development of advanced pharmaceutical products. Furthermore, alginate derivatives are used in the production of wound care products, providing an effective and sustainable solution for healing and tissue regeneration. The extraction process of alginate from brown seaweed is a critical factor influencing the market dynamics. Harvesting seaweed sustainably and implementing environmentally friendly practices are essential to ensure a consistent supply of high-quality alginate. The environmental impact of alginate production is a topic of ongoing research, with initiatives focusing on reducing production costs and minimizing the carbon footprint.

The texturizing and gelling properties of alginate derivatives make them suitable for various applications in the field of art and design. Alginates are used in the production of pastes and adhesives, enabling artists to create intricate sculptures and installations. In addition, alginate derivatives are used as stabilizing agents in various water treatment processes, ensuring the removal of impurities and maintaining water quality. The global demand for alginate derivatives is influenced by several factors, including consumer incomes, seasonal variations, and environmental regulations. As consumer awareness of sustainability and eco-friendly products continues to grow, the demand for alginate derivatives is expected to increase.

However, climate conditions and production costs remain significant challenges that need to be addressed to ensure a steady supply of alginate derivatives. In , alginate derivatives offer a versatile and sustainable solution for various industries, from food and textiles to biotechnology and art. The market for alginate derivatives is driven by the increasing demand for eco-friendly alternatives, the unique properties of alginate, and the ongoing research and development in the field. The sustainability of alginate production and the implementation of environmentally friendly practices are essential to ensure a consistent and sustainable supply of alginate derivatives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 125 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Alginates Derivatives Market Research and Growth Report?

- CAGR of the Alginates Derivatives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the alginates derivatives market growth of industry companies

We can help! Our analysts can customize this alginates derivatives market research report to meet your requirements.