Allergy Treatment Market Size 2025-2029

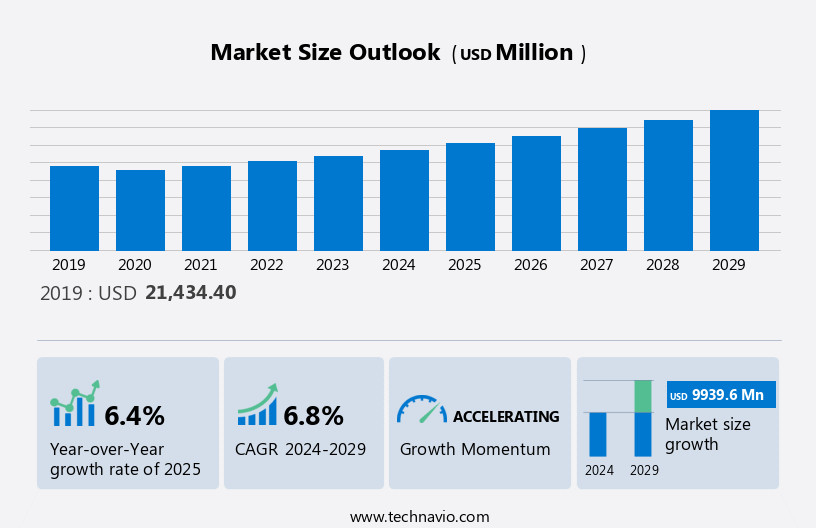

The allergy treatment market size is forecast to increase by USD9.94 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. One of the major drivers is the increasing focus on food-based allergy treatments, as food allergies continue to be a significant health concern in the US. Another trend is the strong pipeline of new treatments and therapies, which offers promising solutions for those suffering from allergies. Stringent regulations ensure the safety and efficacy of these treatments, providing reassurance to patients and healthcare providers. These factors, among others, are contributing to the growth and evolution of the market.

What will be the Size of the Allergy Treatment Market During the Forecast Period?

- The market in the United States is experiencing significant growth due to the increasing prevalence of allergic diseases, particularly food allergies and allergic rhinitis. According to the World Health Organization, approximately 300-450 million people worldwide suffer from allergic rhinitis, and up to 8% of children and 3% of adults have food allergies. Common allergens include peanuts, tree nuts, wheat, soy, milk, eggs, and shellfish, among others. Allergic reactions can manifest in various ways, such as face flushing, teary eyes, stuffy nose, and bronchoconstriction. Small molecule drugs and biologics are the primary treatment modalities for allergic diseases. These medications aim to reduce vascular permeability, inflammation, and allergic response.

Allergic conditions, such as atopic dermatitis, hay fever, and anaphylaxis, can lead to cardiovascular diseases, asthma, and even life-threatening reactions. Efficacy concerns and self-medication with over-the-counter medications are major challenges in the market. Additionally, aeroallergens like pollen and mold contribute to allergic diseases, particularly during seasons. Cancer patients undergoing chemotherapy and people living with HIV/AIDS are also at increased risk for allergic reactions. Overall, the market is expected to continue growing due to the high prevalence of allergic diseases and the unmet need for effective treatments.

How is this Allergy Treatment Industry segmented and which is the largest segment?

The allergy treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Therapeutic Area

- Pharmacological

- Non-pharmacological

- Type

- Rhinitis

- Asthma

- Skin allergy

- Eye

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Therapeutic Area Insights

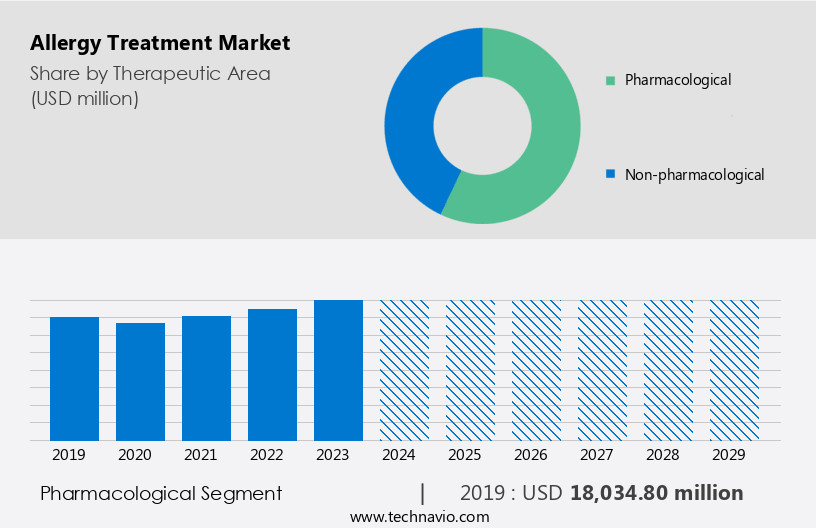

- The Pharmacological segment is estimated to witness significant growth during the forecast period.

The market encompasses various therapeutic areas, with pharmacological treatments being a significant segment for managing allergic conditions. These treatments include medications that alleviate symptoms, prevent allergic reactions, and provide emergency treatment for severe cases. Notably, the US Food and Drug Administration (FDA) approved neffy (epinephrine nasal spray) in August 2024 for the emergency treatment of Type I allergic reactions, including anaphylaxis, in adults and pediatric patients weighing at least 30 kilograms. This approval marks a pivotal advancement in the pharmacological management of severe allergic reactions, offering a new, non-injectable option for patients. This development underscores the ongoing efforts to improve allergy treatment and cater to the evolving needs of patients.

Get a glance at the allergy treatment industry share of various segments Request Free Sample

The Pharmacological segment accounted for USD 18034.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Insights

- North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth due to the high prevalence of allergic conditions and a strong focus on innovative treatments. Allergy specialists continue to provide relief for individuals suffering from various allergens, including weed pollen. The robust healthcare infrastructure in the region, coupled with substantial investment in research and development, facilitates the availability and accessibility of allergy treatments. Notably, in May 2022, Allergan, an AbbVie company, introduced LASTACAFT (alcaftadine ophthalmic solution 0.25%) without a prescription, catering to the estimated 40% of Americans affected by ocular allergies. Clinical studies demonstrate that a single drop of LASTACAFT can alleviate itchy, allergy-affected eyes within three minutes, providing up to 16 hours of relief.

This development underscores the industry's commitment to delivering effective allergy solutions for the North American population.

Market Dynamics

Our allergy treatment market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Allergy Treatment Industry?

Increasing focus on food based allergy treatment is the key driver of the market.

- The market in the US is experiencing notable growth, particularly in the area of food allergies. Food allergies pose serious health risks and significantly impact the quality of life for millions of individuals. In February 2024, a groundbreaking clinical trial, funded by the National Institutes of Health (NIH) and conducted in part at Arkansas Children's Hospital, introduced a novel approach to treating food allergies. This trial, which focused on severe food allergies to common allergens such as peanuts, milk, eggs, wheat, and tree nuts, has shown promising results. Allergy testing and diagnosis are essential steps in identifying food allergies and implementing effective allergy management strategies.

Allergy prevention measures, including allergy-friendly products and recipes, allergy support groups, and environmental controls, can help minimize allergy triggers. Seasonal allergies, caused by tree pollen, weed pollen, and other environmental allergens, can also be managed through allergy medication, allergy specialists, and an allergy-friendly lifestyle. Allergy symptoms, including watery eyes, can be debilitating, but proper diagnosis and treatment can significantly improve the quality of life for those affected. It is crucial for individuals with allergies to be aware of safety concerns and take appropriate measures to manage their condition effectively. Food allergies, including those to milk, soy, and eggs, can be particularly challenging, but ongoing research and clinical trials offer hope for new and innovative treatments.

Allergy-related diseases, such as asthma and eczema, can also be managed through a combination of medical interventions and lifestyle modifications. Allergy education and awareness are essential for individuals, healthcare infrastructure, and society as a whole to ensure that those with allergies receive the support and care they need.

What are the market trends shaping the Allergy Treatment Industry?

Strong pipeline is the upcoming trend in the market.

- The market in the US is experiencing significant growth due to the increasing prevalence of allergies and the availability of advanced allergy treatments. Allergy testing and diagnosis have become more accessible, enabling early identification and management of allergies. Seasonal allergies, caused by tree pollen, weed pollen, and other environmental allergens, as well as food allergies to wheat, milk, soy, egg, and other common triggers, affect millions of Americans. Allergy prevention and management are crucial, and allergy-friendly products, recipes, and lifestyles are gaining popularity. Allergy symptoms, including watery eyes, sneezing, and itching, can significantly impact quality of life. Allergy specialists and support groups provide valuable resources for allergy education, awareness, and safety concerns.

Allergy medications, including allergy shots, offer effective relief, while allergy immunotherapy provides long-term benefits. The healthcare infrastructure continues to evolve, with innovative treatments and therapies under development to address the diverse needs of allergy patients.

What challenges does Allergy Treatment Industry face during the growth?

Stringent regulations is a key challenge affecting the market growth.

- The market in the US is driven by the increasing prevalence of seasonal and environmental allergies, as well as food allergies such as wheat, milk, soy, egg, and others. Allergy testing and diagnosis play a crucial role in identifying allergy triggers and initiating appropriate treatment. Allergy immunotherapy, including allergy shots, is an effective long-term solution for managing allergies. Natural allergy treatments, such as allergy-friendly products, recipes, and lifestyle modifications, are also gaining popularity. Allergy symptoms, including watery eyes, sneezing, and itching, can significantly impact quality of life. Allergy awareness and education are essential for prevention and early intervention. Safety concerns regarding allergy medication, particularly for children and pregnant women, necessitate careful consideration and consultation with allergy specialists.

The regulatory environment, including legislation and healthcare infrastructure, can impact the availability and cost of allergy treatments. For instance, recent changes in Tennessee law allow consumers to purchase a larger supply of over-the-counter allergy medications, addressing access concerns while highlighting the complex regulatory landscape. Overall, the market requires ongoing attention to meet the evolving needs of patients and ensure safety and effectiveness.

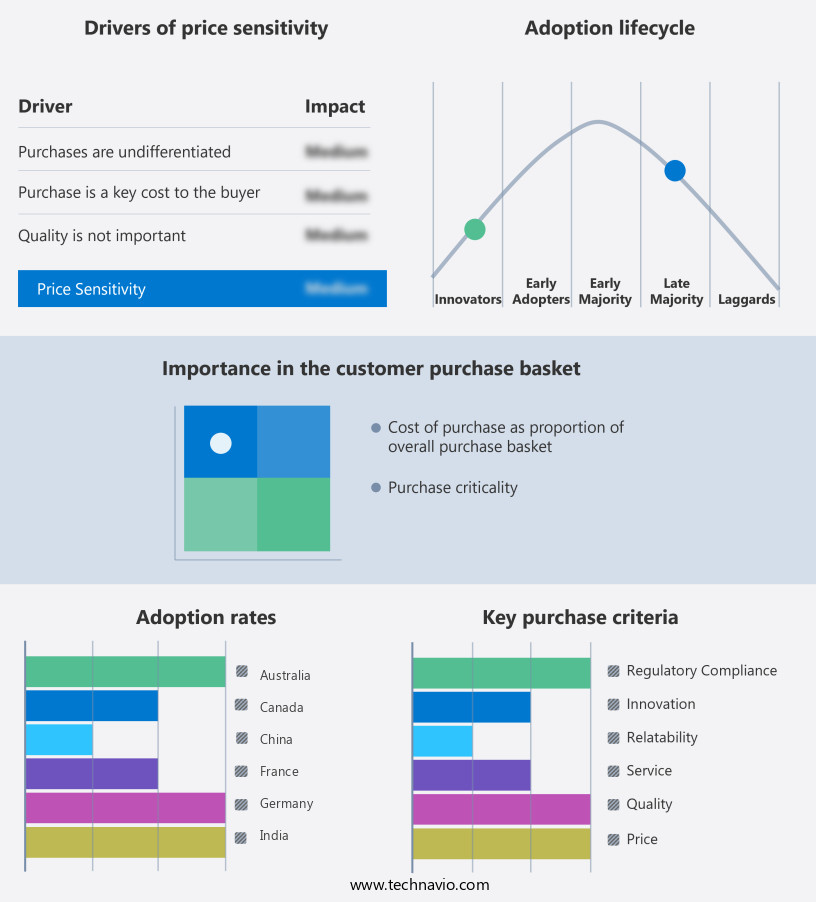

Exclusive Customer Landscape

The allergy treatment market market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbbVie Inc. - The company provides Xolair, a specialized allergy treatment, for children and adults in the US experiencing allergic reactions to one or more foods. Xolair is a proven solution designed to minimize allergic responses and improve quality of life for patients. This biotechnology-based treatment works by neutralizing the immune system's overreaction to allergens, providing long-lasting relief. With a focus on safety and efficacy, Xolair offers hope for those seeking effective management of their food allergies.

The market research and growth report includes detailed analyses of the competitive landscape of the allergy treatment market industry and information about key companies, including:

- AbbVie Inc.

- ALK Abello AS

- ALLERGOPHARMA GmbH and Co. KG

- Allergy Therapeutics PLCA

- Almirall SA

- AstraZeneca Plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- HAL Allergy BV

- LETI Pharma SLU

- Merck and Co. Inc.

- Nicox S.A.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Allergy treatment is a significant area of focus in healthcare, as the prevalence of allergies continues to rise globally. Allergies can manifest in various forms, including seasonal, food, environmental, and occupational. These conditions can cause a range of symptoms, from mild discomfort to life-threatening reactions. The market is characterized by continuous innovation and growth, driven by several factors. One of the primary factors is the increasing awareness and diagnosis of allergies. Advancements in allergy testing and diagnosis techniques have made it easier for individuals to identify their allergens and seek appropriate treatment.

Another factor contributing to the growth of the market is the development of new and effective therapies. Allergy immunotherapy, for instance, has emerged as a promising treatment option for various types of allergies. This therapy involves introducing gradually increasing doses of an allergen to the body to build immunity and reduce symptoms. Seasonal allergies, such as those caused by tree pollen or weed pollen, pose a significant challenge during specific periods. Allergy management during these seasons often involves a combination of medication and lifestyle modifications. Environmental allergens can also trigger allergic reactions in sensitive individuals, necessitating ongoing treatment and management.

Food allergies, including those to milk, soy, wheat, and eggs, can cause severe reactions and require strict avoidance of the allergen. Allergy-friendly products and recipes have gained popularity as a solution for individuals with food allergies. These products cater to specific dietary needs and help ensure safety and convenience. Allergy-related diseases, such as asthma and eczema, can co-occur with allergies and require specialized treatment. Allergy specialists play a crucial role in diagnosing and managing these conditions, providing essential support and guidance for patients. Safety concerns are a significant consideration in allergy treatment, particularly with regards to medication and allergy shots.

Proper administration and monitoring are essential to ensure safety and efficacy. Allergy awareness campaigns and educational resources are vital in promoting safe and effective allergy treatment. Allergy symptoms can significantly impact an individual's quality of life, particularly during allergy seasons or when exposed to allergens. Effective allergy treatment can help alleviate symptoms and improve overall well-being. Allergy prevention measures, such as avoiding known allergens and implementing lifestyle modifications, can also help reduce the severity and frequency of allergic reactions. The healthcare infrastructure plays a crucial role in providing accessible and affordable allergy treatment. Allergy support groups and community resources can offer valuable information, resources, and emotional support for individuals managing allergies.

In conclusion, the market is a dynamic and growing field, driven by increasing awareness, innovation, and a growing prevalence of allergies. Effective diagnosis, treatment, and management are essential to help individuals manage their allergies and improve their overall quality of life.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 9939.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Germany, UK, India, Japan, Canada, France, Australia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., ALK Abello AS, ALLERGOPHARMA GmbH and Co. KG, Allergy Therapeutics PLCA, Almirall SA, AstraZeneca Plc, Bayer AG, Boehringer Ingelheim International GmbH, Danaher Corp., F. Hoffmann La Roche Ltd., GlaxoSmithKline Plc, HAL Allergy BV, LETI Pharma SLU, Merck and Co. Inc., Nicox S.A., Novartis AG, Pfizer Inc., and Sanofi SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the allergy treatment market industry growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch