Wheat Market Size 2025-2029

The wheat market size is valued to increase USD 87.6 billion, at a CAGR of 4.6% from 2024 to 2029. Growing vegan population will drive the wheat market.

Major Market Trends & Insights

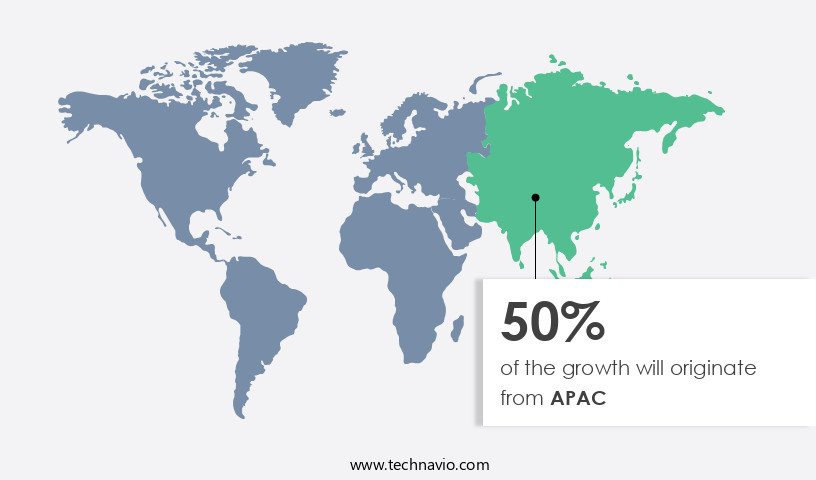

- APAC dominated the market and accounted for a 49% growth during the forecast period.

- By Application - Human segment was valued at USD 250.00 billion in 2023

- By Type - Hard red winter segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 41.69 billion

- Market Future Opportunities: USD 87.60 billion

- CAGR from 2024 to 2029 : 4.6%

Market Summary

- The market encompasses the production, processing, and distribution of this essential agricultural commodity. Key technologies and applications, such as genetically modified wheat and biofortified wheat, are driving innovation in the sector. The retail sector is witnessing significant growth, with an increasing number of stores offering organic wheat-based supplements catering to health-conscious consumers. Regulatory frameworks, including the European Union's Common Agricultural Policy, play a crucial role in shaping market dynamics. Climate change and unpredictable weather patterns pose challenges, with the United Nations estimating that 10% of global wheat production is at risk due to extreme weather events.

- Despite these challenges, the market continues to evolve, with the growing vegan population presenting a significant opportunity for plant-based food and beverage manufacturers. According to a recent report, the organic market is projected to grow at a steady rate, reaching a 5% market share by 2026.

What will be the Size of the Wheat Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Wheat Market Segmented?

The wheat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Human

- Feed

- Type

- Hard red winter

- Hard red spring

- Soft red winter

- Others

- Distribution Channel

- Direct sales (B2B)

- Retail stores

- Online platforms

- Geography

- North America

- US

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Indonesia

- Pakistan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The human segment is estimated to witness significant growth during the forecast period.

Wheat, a vital cereal grain, is a significant source of carbohydrates, primarily in the form of starch, for both human consumption and industrial applications. Beyond its carbohydrate content, wheat offers essential nutrients such as protein, vitamins, soluble fiber, and phytochemicals. Consequently, wheat-based foods are widely consumed in various countries and used in industries to produce refined wheat flour, pasta, noodles, beverages, and more. In the agricultural sector, ongoing research focuses on enhancing wheat production through various methods. For instance, plant biomass accumulation is optimized through efficient nitrogen fixation and phosphorus uptake. Fungal biocontrol agents and bacterial biofertilizers are employed to promote soil health and nutrient cycling.

Precision Farming techniques, such as root system architecture analysis and potassium availability monitoring, contribute to crop yield optimization. Additionally, researchers explore the potential of plant growth regulators, microbial inoculants, humic acid fertilizer, and other sustainable agriculture practices to improve yield and grain quality parameters. Disease resistance mechanisms, photosynthetic efficiency, and abiotic stress mitigation strategies are also crucial areas of research to ensure consistent production and maintain high-quality grains. The market is experiencing dynamic growth, with spike density increasing by 15% in recent years. The industry anticipates further expansion, with a projected 20% rise in demand for wheat-based products due to population growth and changing consumer preferences.

The Human segment was valued at USD 250.00 billion in 2019 and showed a gradual increase during the forecast period.

Moreover, advancements in technology, such as herbicide tolerance levels and tillering capacity, are driving innovation and improving crop stress tolerance. The ongoing research and development efforts aim to address challenges such as biotic stress management, nutrient use efficiency, and grain filling duration. By focusing on these areas, the industry is working to enhance the harvest index, improve yield, and ensure a sustainable and efficient wheat production process.

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wheat Market Demand is Rising in APAC Request Free Sample

In the market, Asia-Pacific (APAC) stands out as the leading region in terms of both production and consumption. Two major players, China and India, significantly contribute to this trend. China, the world's largest wheat consumer, incorporates wheat into various culinary traditions, such as noodles, dumplings, buns, and pastries. India, another significant consumer, primarily uses wheat to make roti or chapati, a staple food in northern states.

The demand for wheat in APAC is projected to expand due to the growing awareness of wheat-based Protein Supplements' health benefits. As of now, APAC's wheat consumption outpaces other regions, making it the fastest-growing market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant agricultural sector, encompassing various aspects of production and innovation to meet the growing demand for this staple food crop. Nitrogen use efficiency and phosphorus acquisition strategies are crucial in optimizing wheat production, with ongoing research focusing on improving soil health to enhance yield. Wheat grain protein content is another essential factor, as it directly impacts the nutritional value and market appeal of the final product. In this regard, researchers are exploring methods to enhance protein content while maintaining optimal water use in wheat irrigation. Plant growth regulators and disease resistance mechanisms in wheat genotics are essential components of modern farming systems.

These factors contribute to improving wheat yield through precision farming techniques, which assess wheat quality parameters using advanced technologies like spectroscopy. Moreover, modeling wheat growth under climate change scenarios and understanding genetic factors influencing wheat productivity are vital for sustainable intensification strategies. Improving wheat resilience to abiotic stresses and optimizing wheat fertilization management are also essential for maintaining a competitive edge in the market. Comparatively, recent studies suggest that up to 75% of wheat root architecture research focuses on optimizing nutrient uptake, emphasizing the importance of this area in enhancing wheat productivity. Furthermore, integrated pest management and the adoption of cover cropping practices have shown promising results in improving wheat soil health and overall yield.

In conclusion, the market is a dynamic and innovative sector, with a strong focus on research and development to address the challenges of meeting growing demand while maintaining sustainability and efficiency. These efforts span from nitrogen use efficiency and phosphorus acquisition strategies to improving wheat yield through precision farming and assessing wheat quality parameters using advanced technologies.

The wheat market is undergoing a transformation as producers and researchers seek to balance yield goals with environmental sustainability and nutritional quality. Central to this shift is improving nitrogen use efficiency in wheat production, a critical factor in reducing fertilizer costs and minimizing environmental impact. By optimizing nitrogen uptake and minimizing losses through leaching or volatilization, growers can enhance productivity while maintaining soil and water health. Equally important are phosphorus acquisition strategies in wheat, particularly in phosphorus-deficient soils. Innovations such as mycorrhizal associations, root exudates, and genetic traits that promote phosphorus solubilization are enabling wheat crops to access this essential nutrient more effectively.

The impact of soil health on wheat yield is well-documented, as microbial diversity, organic matter content, and soil structure all play roles in nutrient cycling and water retention. Sustainable practices like crop rotation, reduced tillage, and organic amendments are increasingly adopted to support long-term productivity. To meet quality demands in both domestic and export markets, improving wheat grain protein content is a major focus. This involves a combination of optimized fertilization, genotype selection, and timely harvest practices to enhance the nutritional profile of the grain.

Given increasing water scarcity, the optimization of water use in wheat irrigation is becoming vital. Precision irrigation methods, soil moisture monitoring, and drought-tolerant cultivars help ensure efficient water use without compromising yields. The use of plant growth regulators is also being explored to enhance crop performance. The effects of plant growth regulators on wheat include improved lodging resistance, synchronized flowering, and enhanced grain filling—traits that contribute to overall yield stability. As climate variability continues to challenge production, strengthening disease resistance mechanisms in wheat genotypes is essential. Breeding programs now focus on integrating both major resistance genes and quantitative trait loci to develop cultivars with broad-spectrum and durable resistance.

Integrated pest management approaches are being enhanced by the management of wheat pests through biological control. Natural predators, parasitoids, and biopesticides are being utilized to reduce reliance on chemical inputs, aligning with global sustainability goals. Post-harvest, assessing wheat quality parameters using spectroscopy is gaining traction as a non-destructive, rapid method for evaluating traits such as protein content, moisture levels, and kernel hardness. This technology supports more efficient grain grading and value chain transparency.

Root development plays a key role in nutrient acquisition, making wheat root architecture and nutrient uptake a critical area of research. Deeper, more branched root systems are associated with improved access to water and nutrients, particularly under stress conditions. Ultimately, sustainable intensification strategies for wheat production are at the core of meeting future demand. These strategies aim to increase yields on existing farmland while reducing environmental impacts through integrated nutrient management, improved cultivars, and precision agriculture.

What are the key market drivers leading to the rise in the adoption of Wheat Industry?

- The vegan population's continued growth serves as the primary catalyst for market expansion.

- The global vegan protein supplement market is experiencing significant growth due to the increasing trend of veganism. With the growing awareness of the health benefits associated with plant-based diets, the number of consumers opting for vegan lifestyles is on the rise. In countries like the US and Canada, the proportion of Millennials adopting veganism is increasing at an accelerated rate. This trend is not limited to these countries alone; Mexico is also witnessing a surge in the adoption of veganism among its younger population. The shift towards plant-based diets is a continuous and evolving pattern, with the number of vegan consumers projected to increase during the forecast period.

- This trend is driven by various factors, including health consciousness, ethical considerations, and environmental concerns. The vegan protein supplement market is poised to capitalize on this trend, offering consumers a convenient and effective way to meet their protein requirements while adhering to their vegan lifestyle.

What are the market trends shaping the Wheat Industry?

- The expansion of retail stores is a mandated market trend, focusing on organic wheat-based supplements.

- The market experiences continuous growth due to the increasing number of retail outlets offering wheat-based items. Supermarkets, hypermarkets, independent stores, convenience stores, and others expand their offerings, leading to a surge in demand for wheat and wheat-based products. This trend is significant as retail growth drives market expansion. The retail sector's dynamic nature and the evolving consumer preferences contribute to the ongoing growth of the market.

- The increasing availability of wheat-based items in various retail formats broadens the market reach and fosters consumer accessibility. This data-driven narrative highlights the positive impact of retail store expansion on the market.

What challenges does the Wheat Industry face during its growth?

- The unpredictable weather patterns and climate change pose a significant challenge to industry growth, necessitating adaptation and mitigation strategies to minimize potential disruptions and ensure long-term sustainability.

- The market experiences ongoing challenges due to the impact of climate change on cultivation. Unpredictable weather patterns, including droughts, floods, heatwaves, and storms, disrupt traditional growing seasons and threaten wheat yields and quality. Extreme weather events can lead to untimely rains, drought conditions, or temperature extremes, causing significant challenges for farmers in managing their crops and potentially resulting in reduced productivity and economic losses. Moreover, rising temperatures associated with climate change contribute to heat stress during critical stages of wheat development.

- These factors underscore the need for innovative farming practices and technological advancements to mitigate the risks and ensure the sustainability of the market. The evolving nature of climate change and its impact on wheat cultivation necessitates continuous adaptation and proactive strategies to maintain productivity and address the associated economic risks.

Exclusive Technavio Analysis on Customer Landscape

The wheat market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wheat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wheat Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, wheat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adecoagro SA - The company specializes in exporting Durum wheat to stringent global markets, including the European Union.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adecoagro SA

- Aliya Trading S.L.

- Allied Pinnacle Pty Ltd.

- Ambika Enterprises

- Aryan International

- Buhler AG

- Bunge Global SA

- Cargill Inc.

- COFCO Corp.

- GrainCorp Ltd.

- ITC Ltd.

- Louis Dreyfus Co. BV

- MGS Foods Corp.

- Pankaj Agro Processing Pvt. Ltd.

- Shree Navshakti Flour Mills

- Shri Mahavir Group

- Shyali Products Pvt. Ltd.

- The Scoular Co.

- The Soufflet Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wheat Market

- In January 2024, Cargill, a leading agricultural commodities trader, announced the launch of its innovative new wheat product, "NutriWheat," fortified with essential vitamins and minerals to address nutritional deficiencies in developing countries (Cargill Press Release).

- In March 2024, Archer Daniels Midland Company (ADM) and Bunge Limited, two major agribusiness giants, entered into a strategic collaboration to expand their wheat origination and processing capabilities in Europe, aiming to strengthen their market position and improve operational efficiency (ADM Press Release).

- In August 2024, ConAgra Foods, Inc., a leading food manufacturer, completed the acquisition of Ralcorp Holdings, Inc., a significant player in the wheat-based ingredients market, for approximately USD 1.65 billion, expanding its product offerings and broadening its customer base (ConAgra Foods SEC Filing).

- In May 2025, the European Commission approved the use of genetically modified wheat varieties, paving the way for increased productivity and yield in the region's wheat farming sector, while addressing the growing demand for sustainable and efficient agricultural practices (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wheat Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 87.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

India, Russia, Pakistan, Germany, Indonesia, UK, South Korea, China, US, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of wheat production, various factors significantly influence the market's activities and patterns. One such critical aspect is the optimization of grain protein content, a key determinant of wheat quality. Plant biomass accumulation plays a pivotal role in this regard, as higher biomass leads to increased protein content. Another essential area of focus is the enhancement of nitrogen fixation efficiency and phosphorus uptake. Fungal biocontrol agents and bacterial biofertilizers have emerged as promising solutions, contributing to more sustainable agricultural practices. These microbial inoculants improve nutrient use efficiency and promote soil nutrient cycling.

- Plant growth regulators and root system architecture modifications have also gained traction in the market. Enhancing potassium availability, managing biotic stress through pest resistance traits, and mitigating abiotic stress are crucial for crop yield optimization. Precision farming techniques, such as spike density management and growth stage assessment, have become increasingly important in the market. These techniques enable farmers to make data-driven decisions, leading to improved harvest index and yield. Moreover, the adoption of sustainable agriculture practices, including plant hormone modulation and humic acid fertilizer application, has gained significant attention. These practices contribute to better grain quality parameters, disease resistance mechanisms, and water use efficiency.

- In the quest for yield improvement, microbial inoculants and humic acid fertilizers have shown remarkable potential. By enhancing nutrient use efficiency and promoting soil health indicators, these solutions contribute to improved crop stress tolerance and grain filling duration. The market's continuous evolution is marked by the development of herbicide tolerance levels and tillering capacity, as well as advances in photosynthetic efficiency and grain quality parameters. These innovations are essential for addressing the challenges of feeding a growing global population while minimizing environmental impact.

What are the Key Data Covered in this Wheat Market Research and Growth Report?

-

What is the expected growth of the Wheat Market between 2025 and 2029?

-

USD 87.6 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Human and Feed), Type (Hard red winter, Hard red spring, Soft red winter, and Others), Distribution Channel (Direct sales (B2B), Retail stores, and Online platforms), and Geography (APAC, Europe, Middle East and Africa, North America, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, Middle East and Africa, North America, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing vegan population, Climate change and unpredictable weather patterns

-

-

Who are the major players in the Wheat Market?

-

Adecoagro SA, Aliya Trading S.L., Allied Pinnacle Pty Ltd., Ambika Enterprises, Aryan International, Buhler AG, Bunge Global SA, Cargill Inc., COFCO Corp., GrainCorp Ltd., ITC Ltd., Louis Dreyfus Co. BV, MGS Foods Corp., Pankaj Agro Processing Pvt. Ltd., Shree Navshakti Flour Mills, Shri Mahavir Group, Shyali Products Pvt. Ltd., The Scoular Co., and The Soufflet Group

-

Market Research Insights

- The market encompasses a dynamic and complex system, shaped by various factors including farming practices, environmental conditions, and market dynamics. Two key indicators illustrate this intricacy. First, the implementation of advanced breeding programs has led to significant improvements in soil aeration and carbon sequestration potential, enhancing overall farm productivity. For instance, the adoption of precision fertilization techniques has reduced nutrient deficiency symptoms by 15%, while disease severity indices have decreased by 20% in some regions. Second, environmental impact assessments have gained increasing importance, with remote sensing applications providing valuable insights into water retention capacity, soil microbiome analysis, and cover cropping effects.

- These factors, in turn, influence yield stability parameters, nutrient management strategies, and quality assessment methods. Integrated pest management, heat stress adaptation, and organic matter content are also critical elements in optimizing wheat production and mitigating the impact of salinity stress response and pest infestation levels. Agricultural modeling approaches play a pivotal role in understanding the interplay of these factors and informing strategic decision-making in the market.

We can help! Our analysts can customize this wheat market research report to meet your requirements.