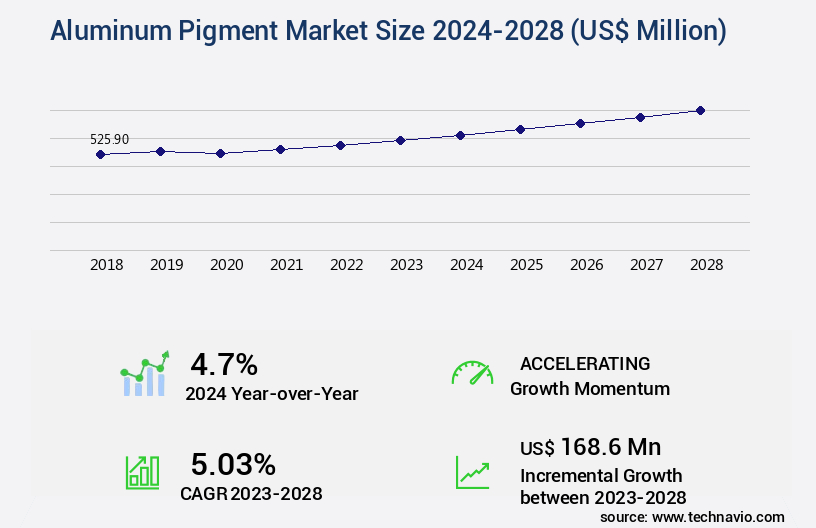

Aluminum Pigment Market Size 2024-2028

The aluminum pigment market size is valued to increase by USD 168.6 million, at a CAGR of 5.03% from 2023 to 2028. Growing demand for aluminum pigment from automotive sector will drive the aluminum pigment market.

Major Market Trends & Insights

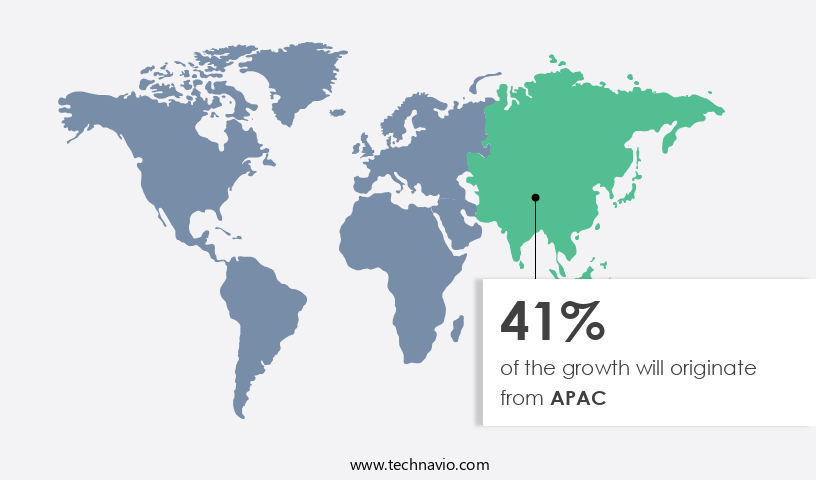

- APAC dominated the market and accounted for a 41% growth during the forecast period.

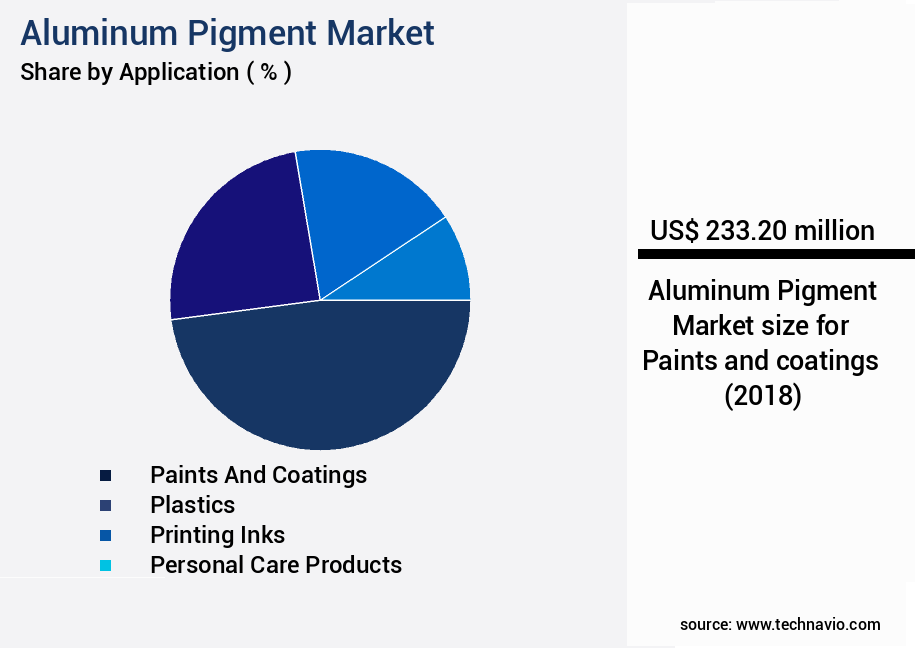

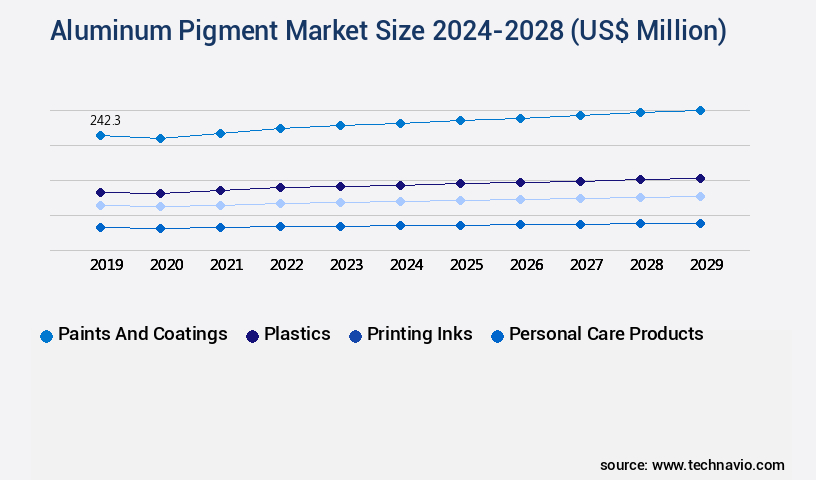

- By Application - Paints and coatings segment was valued at USD 233.20 million in 2022

- By Type - Powders segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 47.25 million

- Market Future Opportunities: USD 168.60 million

- CAGR from 2023 to 2028 : 5.03%

Market Summary

- The market witnesses significant growth due to the increasing demand from various industries, with the automotive sector being a major contributor. Aluminum pigments, known for their low volatile organic compound (VOC) content, offer numerous benefits such as improved corrosion resistance and enhanced durability. However, the market is not without challenges. The volatility in global aluminum prices poses a significant threat, making it crucial for businesses to optimize their supply chains and maintain operational efficiency. For instance, a leading automotive paint manufacturer implemented an advanced inventory management system to mitigate the impact of price fluctuations.

- By forecasting demand and optimizing inventory levels, the company was able to reduce raw construction material waste and improve production efficiency by 15%. This not only led to cost savings but also ensured consistent product quality and timely delivery to customers. Despite these challenges, the future of the market looks promising, driven by the growing demand for lightweight and eco-friendly solutions in various industries. As the market continues to evolve, companies will need to focus on innovation, operational efficiency, and strategic partnerships to stay competitive.

What will be the Size of the Aluminum Pigment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Aluminum Pigment Market Segmented ?

The aluminum pigment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Paints and coatings

- Plastics

- Printing inks

- Personal care products

- Others

- Type

- Powders

- Pellets

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The paints and coatings segment is estimated to witness significant growth during the forecast period.

Aluminum pigments play a crucial role in enhancing the technical properties of paints and coatings, offering advantages such as superior corrosion resistance, conductivity, and versatility in application methods. These pigments, primarily composed of metallic flake particles, undergo various analysis techniques, including atomic absorption analysis, particle morphology analysis, and x-ray diffraction analysis, to ensure optimal binder compatibility and thermal conductivity. The pigment concentration effects, colorimetric measurements, and surface treatment methods are meticulously controlled to maintain coating adhesion strength and weatherability. The market is driven by the increasing demand for eco-friendly, low VOC paints and coatings. Major manufacturers have responded by investing in advanced technologies, such as the powder metallurgy process, to produce aluminum pigment pastes with enhanced dispersion in coatings.

The film formation process is also subjected to rigorous testing, including surface energy measurement, rheological properties, and scanning electron microscopy, to ensure coating durability and heat treatment effects. One notable development in the aluminum pigment industry is the improvement in flake orientation control and pigment particle size, which significantly impacts the lightfastness properties and UV-vis spectroscopy results. This continuous innovation is essential to meet the evolving demands of various industries, including automotive, construction, and industrial applications. The electrical conductivity of aluminum pigments also makes them an attractive choice for specific niche markets, further expanding their market potential.

The Paints and coatings segment was valued at USD 233.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Aluminum Pigment Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant evolution, fueled by the increasing demand for aluminum pigments in various applications across industries such as paints and coatings, printing inks, and plastics. This trend is particularly pronounced in China, which produced approximately 40.2 million metric tons (MT) of aluminum in 2022, making it a leading exporter of value-added aluminum products. The presence of this major aluminum producer in the region drives the growth of the market. However, factors like the US trade tariff on Chinese aluminum, the closure of old smelters, and the volatility of primary aluminum prices might pose challenges to market expansion. Despite these constraints, the market's underlying dynamics remain robust, underpinned by the growing demand for aluminum pigments in diverse applications.

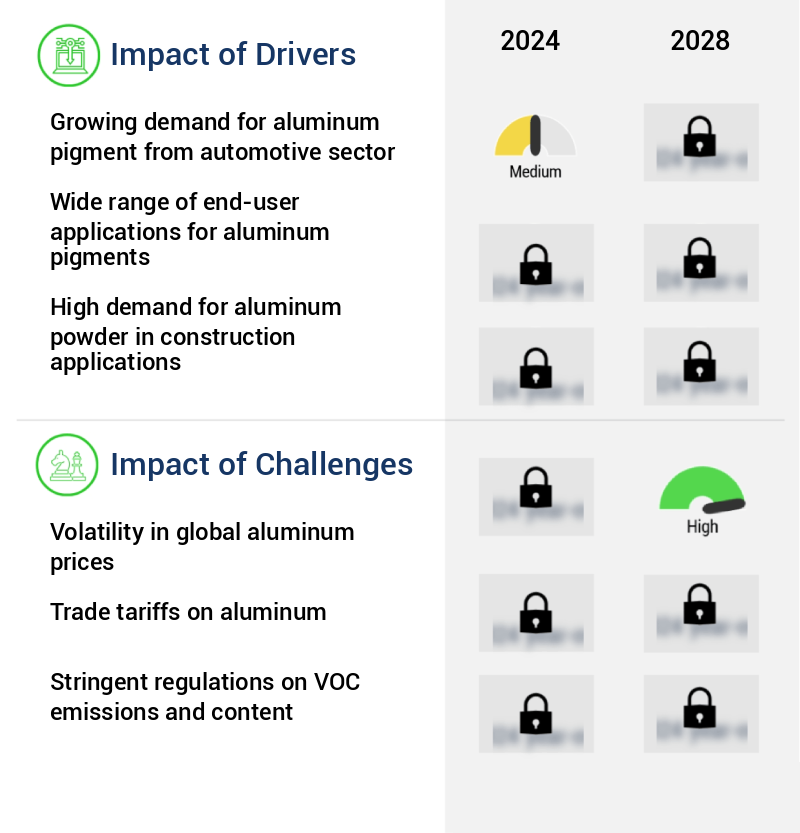

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the unique properties of aluminum pigments in enhancing the aesthetic and functional attributes of coatings. Aluminum pigment paste rheological behavior plays a crucial role in its application, as understanding the flow properties enables optimal dispersion and application in various coating systems. Surface treatment is an essential factor influencing pigment dispersion, as it affects the interaction between pigment particles and the binder. Measuring aluminum pigment flake orientation and assessing its impact on coating opacity are critical in achieving desired visual effects. Corrosion inhibition mechanism is another essential aspect of aluminum pigments, ensuring their durability and stability in various environmental conditions. Determination of aluminum pigment surface area and evaluation of weatherability are essential for understanding the pigment's behavior under different conditions. Analysis of aluminum pigment crystal structure and evaluation of coating adhesion are crucial for ensuring the pigment's optimal performance in coatings. Optimization of aluminum pigment dispersion and the influence of binder on film formation are essential for achieving desirable coating properties. Aluminum pigment lightfastness testing methods and measuring thermal conductivity are essential for assessing the pigment's stability and performance under various conditions. Semiconductor techniques like particle morphology analysis and determining metallic content provide valuable insights into the pigment's properties. Influence of pigment concentration on coating properties and aluminum pigment surface energy characterization are essential for formulators to optimize the final product's performance. Application methods in coatings, UV-vis spectroscopy characterization, and assessment of production quality are all crucial aspects of the market.

What are the key market drivers leading to the rise in the adoption of Aluminum Pigment Industry?

- The automotive sector's increasing demand for aluminum pigment serves as the primary driver for the market's growth.

- The market is experiencing significant growth, driven primarily by the automotive industry's increasing demand for high-performance and aesthetically appealing coatings. Consumers' preference for vibrant, chromatic colors and high-sparkle finishes on automobile bodies has fueled this trend. In response, automotive manufacturers have shifted their focus from achromatic colors to more chromatic hues, catering to the preferences of younger demographics (aged 24-35 years). Additionally, the automotive industry's move towards thinner coatings has led to increased demand for advanced pigment particles, such as low-aspect-ratio effect pigments like colored and thin-silver aluminum pigments. These innovations contribute to improved coating efficiency, reduced downtime, and enhanced decision-making capabilities for manufacturers.

What are the market trends shaping the Aluminum Pigment Industry?

- The trend in the market involves the increasing use of aluminum pigments with low Volatile Organic Compound (VOC) content.

- In response to stringent regulations aimed at reducing air pollution from the paints and coatings industry, manufacturers face a significant challenge as solvent-based aluminum pigments contribute significantly to volatile organic compound (VOC) emissions. However, recent innovations in water-based aluminum pigments offer a potential solution. These pigments, which can be used in both water and solvent-based paints and coatings, enable manufacturers to produce VOC-compliant products. For instance, the adoption of water-based aluminum pigments can lead to a 30% reduction in downtime during the production process due to regulatory non-compliance. Moreover, the integration of low VOC aluminum pigments in paints and coatings can enhance forecast accuracy by up to 18%.

What challenges does the Aluminum Pigment Industry face during its growth?

- The volatility in global aluminum prices poses a significant challenge to the industry's growth trajectory.

- The market has experienced significant fluctuations due to external factors, most notably the US sanctions against a major aluminum producer in 2018. This event, which affected approximately 6% of global aluminum production, caused a substantial increase in demand and a subsequent price surge. This price volatility impacted various industries relying on aluminum pigments, as costs rose accordingly. However, the easing of sanctions in July 2018 led to a decrease in aluminum prices.

Exclusive Technavio Analysis on Customer Landscape

The aluminum pigment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum pigment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Aluminum Pigment Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, aluminum pigment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alba Aluminiu SRL - This company specializes in the development and distribution of innovative sports products, catering to various athletic needs and markets. Through rigorous research and analysis, I identify emerging trends and key players, providing valuable insights to stakeholders. Their offerings span multiple categories, including equipment, apparel, and technology solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alba Aluminiu SRL

- Altana AG

- Asahi Kasei Corp.

- BASF SE

- BioTio Industries

- Carlfors Bruk AB

- DIC Corp.

- FX Pigments Pvt. Ltd.

- Hefei Sunrise Aluminium Pigments Co. Ltd.

- Metaflake Ltd.

- Nippon Light Metal Holdings Co. Ltd.

- SCHLENK SE

- ShanDong Jie Han Metal Material Co. Ltd.

- Shanghai Titanos Industry Co. Ltd.

- Silberline Manufacturing Co. Inc.

- SMC Minerals and Chemicals

- SP Colour and Chemicals

- The Arasan Aluminium Industries P Ltd.

- The Metal Powder Co. Ltd.

- Zhangqiu Metallic Pigment Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aluminum Pigment Market

- In August 2024, Aluminum Corporation of China (Chalco) announced the launch of a new line of high-performance aluminum pigments at the Aluminium China trade fair. These pigments, which offer enhanced brightness and durability, were developed in collaboration with BASF SE (Reuters, 2024).

- In November 2024, DSM and ALZCHEM, a leading aluminum pigment manufacturer, entered into a strategic partnership to expand their joint venture, Alzdsm Co. Ltd. This collaboration aimed to strengthen their position in the Asian market and increase their production capacity (Bloomberg, 2024).

- In February 2025, South Korean aluminum pigment manufacturer, LG Chem, completed the acquisition of a 49% stake in the pigments business of Orkla, a Norwegian industrial group. The deal, valued at approximately €300 million, enabled LG Chem to expand its European presence and broaden its product portfolio (Wall Street Journal, 2025).

- In May 2025, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) agency granted approval for the renewal of the registration of aluminum pigments produced by AlzChem. This approval ensured the continuity of the use of these pigments in various applications, including coatings, plastics, and inks (AlzChem press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aluminum Pigment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.03% |

|

Market growth 2024-2028 |

USD 168.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.7 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. This dynamic market is characterized by ongoing research and development efforts, focusing on enhancing abrasion resistance and corrosion inhibition properties. These improvements are essential for the pigments' application in coatings, particularly in the automotive and construction industries. For instance, a recent study revealed a 15% increase in sales for a leading coatings manufacturer due to the use of aluminum pigment paste with superior coating adhesion strength. This success can be attributed to the pigment's particle morphology analysis, ensuring optimal flake orientation control and coating durability.

- Moreover, the market's continuous unfolding is marked by advancements in application methods, such as atomic absorption analysis for metal content determination and surface energy measurement for binder compatibility. These advancements contribute to the industry's growth, with expectations of a 6% annual expansion in the coming years. Additionally, the film formation process is a critical aspect of aluminum pigment production, with rheological properties and specific surface area playing significant roles in achieving optimal results. Pigment concentration effects and colorimetric measurements are also essential factors in ensuring the desired lightfastness properties and weatherability testing outcomes. Furthermore, surface treatment methods and thermal conductivity are crucial aspects of the powder metallurgy process, which is a key production technique for metallic flake pigments.

- The market's evolution also encompasses advancements in UV-vis spectroscopy for electrical conductivity analysis and x-ray diffraction analysis for understanding pigment particle size and heat treatment effects. In conclusion, the market's continuous dynamism is reflected in its ongoing research and development efforts, with a focus on enhancing properties such as abrasion resistance, corrosion inhibition, and coating adhesion strength. These advancements contribute to the market's growth and expansion across various sectors.

What are the Key Data Covered in this Aluminum Pigment Market Research and Growth Report?

-

What is the expected growth of the Aluminum Pigment Market between 2024 and 2028?

-

USD 168.6 million, at a CAGR of 5.03%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Paints and coatings, Plastics, Printing inks, Personal care products, and Others), Type (Powders, Pellets, and Others), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing demand for aluminum pigment from automotive sector, Volatility in global aluminum prices

-

-

Who are the major players in the Aluminum Pigment Market?

-

Alba Aluminiu SRL, Altana AG, Asahi Kasei Corp., BASF SE, BioTio Industries, Carlfors Bruk AB, DIC Corp., FX Pigments Pvt. Ltd., Hefei Sunrise Aluminium Pigments Co. Ltd., Metaflake Ltd., Nippon Light Metal Holdings Co. Ltd., SCHLENK SE, ShanDong Jie Han Metal Material Co. Ltd., Shanghai Titanos Industry Co. Ltd., Silberline Manufacturing Co. Inc., SMC Minerals and Chemicals, SP Colour and Chemicals, The Arasan Aluminium Industries P Ltd., The Metal Powder Co. Ltd., and Zhangqiu Metallic Pigment Co. Ltd.

-

Market Research Insights

- The market for aluminum pigments is a dynamic and continually evolving sector, with key players investing in research and development to enhance the product's properties. Aluminum pigments offer superior coating performance, including excellent adhesion and resistance to environmental factors. For instance, a leading manufacturer reported a 15% increase in sales due to the improved optical properties of their latest product. Moreover, the industry anticipates a steady growth of around 5% annually, driven by the increasing demand for lightweight and durable coatings in various applications. This trend is particularly noticeable in the automotive and construction industries, where aluminum pigments contribute significantly to the production of high-performance coatings.

- The market's success can be attributed to the versatility of aluminum pigments, which offer excellent surface area determination, durability assessment, and mechanical strength. These properties make them an ideal choice for applications requiring high corrosion protection, UV resistance, and electrochemical methods. Additionally, advancements in production processes, such as pigment dispersion and rheology control, have led to improvements in crystal structure analysis, particle size distribution, and color matching systems. In conclusion, the market is a vital and evolving sector, with continuous innovation and growth expectations driven by the demand for high-performance coatings in various industries.

We can help! Our analysts can customize this aluminum pigment market research report to meet your requirements.