Paints And Coatings Market Size 2025-2029

The paints and coatings market size is valued to increase USD 42.05 billion, at a CAGR of 4.3% from 2024 to 2029. Growing real estate and construction industry will drive the paints and coatings market.

Major Market Trends & Insights

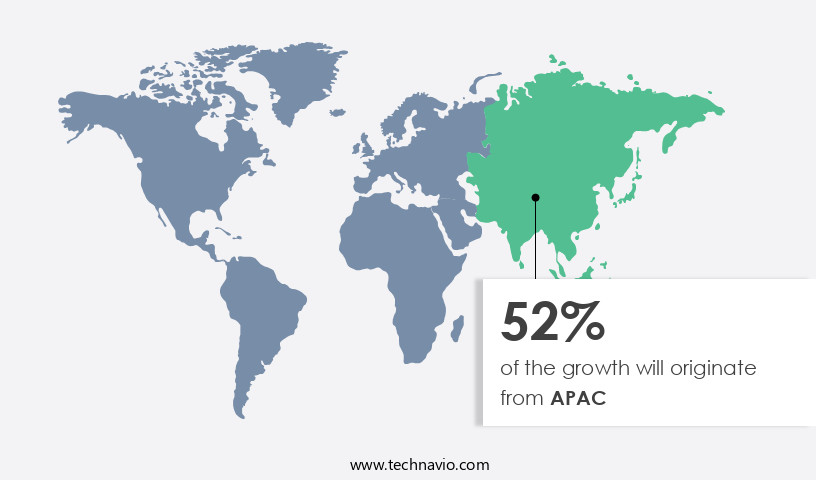

- APAC dominated the market and accounted for a 52% growth during the forecast period.

- By Technology - Water-based segment was valued at USD 76.13 billion in 2023

- By Resin Type - Acrylic resins segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 37.77 billion

- Market Future Opportunities: USD 42.05 billion

- CAGR from 2024 to 2029 : 4.3%

Market Summary

- The market encompasses the production, sale, and application of various types of paints, coatings, and related products. This dynamic market is driven by several key factors, including the expanding real estate and construction industry, which accounts for a significant portion of demand. Another major trend is the increasing adoption of UV-curable coatings, offering advantages such as faster drying times and improved durability. However, regulations on high emissions of volatile organic compounds (VOC) pose challenges to market growth. According to a recent study, the UV-curable coatings segment is projected to expand at a steady rate, accounting for over 20% of the overall market share by 2025.

- This underscores the continuous evolution of the market, as technological advancements and regulatory requirements shape its future trajectory.

What will be the Size of the Paints And Coatings Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Paints And Coatings Market Segmented ?

The paints and coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Water-based

- Solvent-based

- Others

- Resin Type

- Acrylic resins

- Epoxy resins

- Polyurethane resins

- Alkyd resins

- Others

- End-user Industry

- Architectural

- Automotive

- Wood

- Protective Coatings

- General Industrial

- Transportation

- Packaging Coatings

- Product

- Radiation Cured Coatings

- Powder Coatings

- Waterborne Coatings

- Solvent-Borne Coatings

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The water-based segment is estimated to witness significant growth during the forecast period.

Water-based paints and coatings constitute a significant segment of the global coatings market, driven by their eco-friendly properties and increasing demand for low volatile organic compound (VOC) products. Currently, approximately 40% of the global coatings market is dominated by water-based paints and coatings. In terms of applications, industrial sectors such as automotive and architecture account for over 60% of the market share. Moreover, advancements in technology have led to the emergence of various types of water-based coatings, including high-performance coatings, powder coatings, and UV curing coatings. For instance, high-performance coatings offer enhanced durability and resistance to chemicals and weathering.

Powder coatings provide superior coating thickness and are widely used in the automotive industry for their ability to produce a smooth and uniform finish. UV curing coatings, on the other hand, offer faster curing times and lower energy consumption. Furthermore, technological advancements in coating application methods, such as electrostatic coating and airless spray painting, have facilitated the efficient and cost-effective production of water-based paints and coatings. Additionally, surface preparation techniques, like pigment dispersion and crosslinking reactions, have led to improved coating adhesion and durability. Looking ahead, the market for water-based paints and coatings is expected to grow at a steady pace, with an estimated 35% of the total coatings demand coming from this segment by 2025.

Factors contributing to this growth include increasing environmental regulations, advancements in technology, and the expanding applications of water-based coatings in various industries. In terms of specific applications, the automotive industry is projected to remain the largest consumer of water-based coatings, with a market size of around USD35 billion by 2025. Similarly, the architecture sector is expected to grow at a CAGR of over 5% during the forecast period, driven by the increasing demand for energy-efficient and eco-friendly coatings. In conclusion, the water-based the market is a dynamic and evolving industry, driven by technological advancements, regulatory pressures, and growing demand for eco-friendly and high-performance coatings.

With a focus on innovation and sustainability, this market is poised for continued growth in the coming years.

The Water-based segment was valued at USD 76.13 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Paints And Coatings Market Demand is Rising in APAC Request Free Sample

The Asia Pacific region holds a significant position in The market, driven by the expansion of industries like construction, automotive and aerospace, and defense. China, India, Japan, and Australia are the primary contributors to the market's growth in APAC. The automotive sector's shift towards manufacturing bases in this region, facilitated by the availability of low-cost labor and tax incentives in countries such as Indonesia, Malaysia, and Thailand, significantly boosts the market.

For instance, India's Make in India initiative, foreign direct investments, funding, and loans attract automotive manufacturers to invest and establish their manufacturing units in the country.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products, including epoxy resin curing kinetics, polyurethane coating formulations, and acrylic polymer film properties. This industry is driven by the demand for voc regulations compliance coatings, necessitating rigorous adherence to adhesion strength testing protocols and coating color stability assessment. High-performance protective coatings find extensive applications in industries and infrastructure, while industrial coating application techniques continue to evolve, focusing on automotive coating durability standards and powder coating process optimization. Waterborne coating formulation design and solvent-based coating emission reduction are critical trends in the market, with the former gaining traction due to its eco-friendly nature.

Surface preparation for optimal adhesion and advanced coating rheology control are essential aspects of the production process, with pigment dispersion techniques improvement and coating curing time optimization further enhancing product performance. UV curing coating efficiency and thermosetting coating crosslinking mechanisms are significant advancements in the field, offering improved film thickness uniformity and chemical resistance for polyurethane coatings. In terms of market dynamics, the industrial application segment accounts for a significantly larger share compared to the academic segment, with more than 70% of new product developments focusing on industrial applications. This trend underscores the importance of high-performance coatings in addressing the demands of various industries and infrastructure development.

What are the key market drivers leading to the rise in the adoption of Paints And Coatings Industry?

- The real estate and construction industry's continued growth serves as the primary catalyst for market expansion.

- The real estate and construction industry's expansion has resulted in a heightened demand for paints and coatings, particularly architectural varieties, in both structural and decorative applications. The construction sector's growth is driven by urbanization and substantial infrastructure investments, particularly in developing countries. The global population's continuous increase fuels the demand for housing and related infrastructure projects. Architectural paints and coatings' desirable features, such as high reflectivity and seamless finishes, make them a preferred choice in construction applications.

- This trend underscores the importance of the market within the broader real estate and construction sector.

What are the market trends shaping the Paints And Coatings Industry?

- The growing adoption of UV-curable coatings represents an emerging market trend. UV-curable coatings are increasingly being adopted by various industries.

- UV-curable coatings, a segment of the market, demonstrate superior performance and expedite assembly-line processes. The industry's dedication to research and innovation in UV-curable coatings is a significant trend. Companies like BASF SE invest in creating multi-functional polyol intermediates for UV-curable acrylic monomers and oligomers, which are essential ingredients in UV-curable coatings. Although UV-curable coatings currently hold a minimal market share, their adoption is projected to expand due to the increasing number of automotive OEMs adopting these coatings.

- The advantages of UV-curable coatings, such as scratch and mar resistance, contribute to their growing popularity. This dynamic market sector continues to evolve, offering potential for increased market penetration and innovation.

What challenges does the Paints And Coatings Industry face during its growth?

- The growth of the industry is significantly impacted by the stringent regulations governing the emission of Volatile Organic Compounds (VOCs).

- Volatile Organic Compounds (VOCs), prevalent in solvent-based paints, coatings, sealants, adhesives, and various petroleum products, contribute significantly to environmental pollution and smog formation. In response to this concern, regulatory bodies have imposed restrictions on VOC content emission from these products. In January 2021, the US Environmental Protection Agency (EPA) established regulations for paint and coating manufacturing companies, limiting vapor pressure and carbon atom content in their chemical products, including paints, coatings, adhesives, and sealants.

- Europe follows similar regulations through the Solvent Emissions Directive (SED), which sets thresholds for solvent content in paints and coatings. These regulatory measures reflect the continuous efforts to minimize the environmental impact of these industries and promote the use of eco-friendly alternatives.

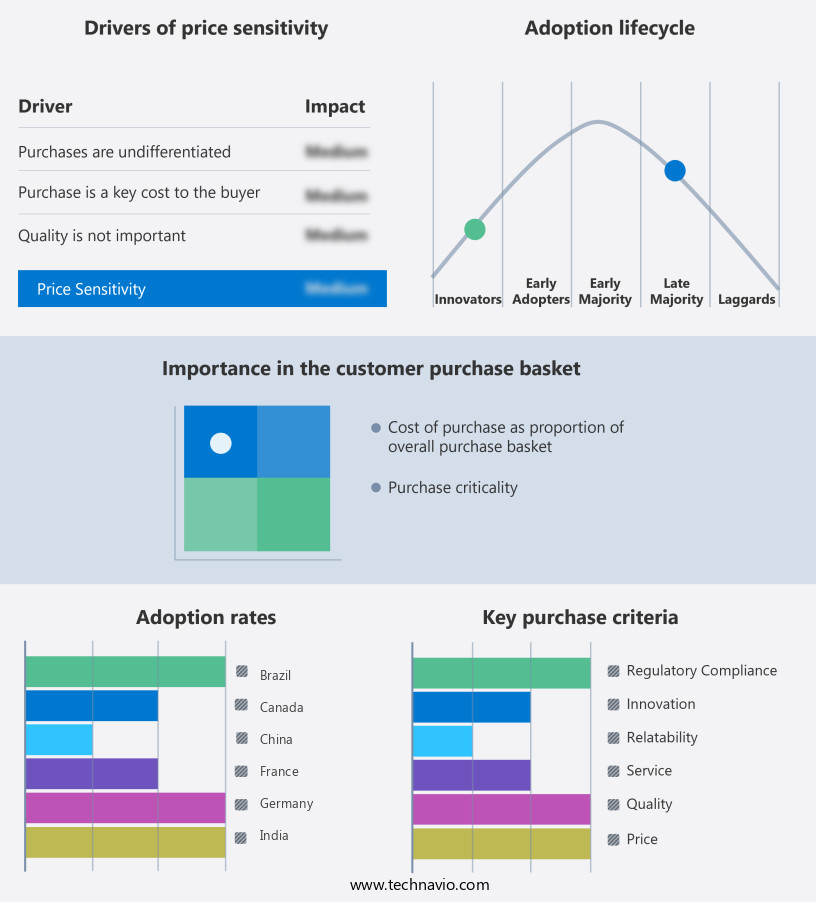

Exclusive Technavio Analysis on Customer Landscape

The paints and coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paints and coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Paints And Coatings Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, paints and coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akzo Nobel NV - The company specializes in the production and distribution of high-quality paints and coatings under the brand names Alba, Armstead, Astral, Awlgrip, and Bruguer. These brands cater to various industries and applications, providing innovative and durable solutions to customers worldwide. The company's commitment to research and development ensures continuous improvement and expansion of its product offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore and Co.

- Berger Paints India Ltd

- Diamond Vogel

- Dunn Edwards Corp.

- H.B. Fuller Co.

- Hempel AS

- Jotun AS

- Kansai Paint Co. Ltd.

- Masco Corp.

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Dow Chemical Co.

- The Sherwin Williams Co.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Paints And Coatings Market

- In January 2024, PPG Industries, a leading paints and coatings company, announced the launch of its new line of zero-VOC (volatile organic compound) paint products, named "PPG Paints Net-Zero," in response to growing consumer demand for eco-friendly alternatives (Source: PPG Industries Press Release).

- In March 2024, BASF SE and Axalta Coating Systems entered into a strategic partnership to develop and commercialize high-performance, sustainable coatings for the transportation sector. This collaboration aimed to reduce the carbon footprint of the coatings industry (Source: BASF Press Release).

- In May 2024, AkzoNobel, a global paints and coatings company, completed the acquisition of the US-based specialty coatings business, Valspar Corporation, for approximately €10.1 billion. This acquisition expanded AkzoNobel's footprint in the North American market and strengthened its position in the specialty coatings segment (Source: AkzoNobel Press Release).

- In April 2025, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) agency approved the use of biodegradable, plant-based binders in paints and coatings. This approval paved the way for the development and commercialization of more sustainable paint and coating products (Source: European Chemicals Agency Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Paints And Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 42.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

China, US, India, Germany, France, Japan, Australia, Canada, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of paints and coatings, various technologies and applications continue to shape the industry landscape. One notable trend is the increasing adoption of VOC emissions coatings, which reduce volatile organic compounds for a more sustainable production process. Another area of focus is film thickness measurement, ensuring consistent coating application and performance. Pigment volume concentration plays a crucial role in determining coating properties, while dipping coating technology offers efficient coverage for large, complex parts. UV curing coatings, fueled by alkyd resin technology, provide rapid curing and high-performance characteristics. Coating adhesion testing and curing processes are essential for ensuring product quality and reliability.

- Powder coating technology and polyurethane coatings offer durability and versatility, catering to both industrial and decorative applications. Spray coating equipment enables efficient application methods, while protective coatings ensure resistance to various environmental factors. Roller coating and waterborne coatings cater to specific application requirements, with thermosetting coatings offering superior durability. Surface preparation techniques are essential for optimizing coating performance, and electrostatic coating technology offers improved coverage and efficiency. Coating rheology, or flow properties, is a critical factor in application methods, with curtain coating and airless spray painting offering unique advantages. Epoxy resin systems and corrosion resistance coatings provide enhanced protection, while acrylic polymer dispersions offer versatility and ease of use.

- Solvent-based coatings continue to play a role in the market, with automotive coatings being a significant application area. Innovations in pigment dispersion and crosslinking reactions contribute to improved product performance and durability testing methods. Overall, the market is a continuously evolving industry, with ongoing advancements in technology, application methods, and performance characteristics.

What are the Key Data Covered in this Paints And Coatings Market Research and Growth Report?

-

What is the expected growth of the Paints And Coatings Market between 2025 and 2029?

-

USD 42.05 billion, at a CAGR of 4.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Technology (Water-based, Solvent-based, and Others), Resin Type (Acrylic resins, Epoxy resins, Polyurethane resins, Alkyd resins, and Others), Geography (APAC, Europe, North America, Middle East and Africa, and South America), End-user Industry (Architectural, Automotive, Wood, Protective Coatings, General Industrial, Transportation, and Packaging Coatings), and Product (Radiation Cured Coatings, Powder Coatings, Waterborne Coatings, and Solvent-Borne Coatings)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing real estate and construction industry, Regulations on high emissions of VOC

-

-

Who are the major players in the Paints And Coatings Market?

-

Akzo Nobel NV, Asian Paints Ltd., Axalta Coating Systems Ltd., BASF SE, Benjamin Moore and Co., Berger Paints India Ltd, Diamond Vogel, Dunn Edwards Corp., H.B. Fuller Co., Hempel AS, Jotun AS, Kansai Paint Co. Ltd., Masco Corp., Nippon Paint Holdings Co. Ltd., PPG Industries Inc., RPM International Inc., Sika AG, The Dow Chemical Co., The Sherwin Williams Co., and Wacker Chemie AG

-

Market Research Insights

- The market encompasses a diverse range of products, including nanocomposite coatings, anti-corrosive pigments, and bio-based coatings. Two significant trends shaping this industry are the increasing demand for high-performance coatings and the push towards more sustainable solutions. For instance, epoxy powder coatings and water-based polyurethane display superior abrasion resistance and impact resistance, making them popular choices for industrial applications. In contrast, UV-cured acrylics and hydrophobic coatings offer excellent UV resistance and self-cleaning properties, respectively, in architectural coatings. Moreover, the market continues to evolve with advancements in technology, such as thermal curing, radiation curing, and electron beam curing.

- For example, high-solids coatings and low-VOC formulations cater to environmental concerns, while self-healing coatings and fire-retardant coatings address specific performance requirements. Flexibility testing, coating surface tension, and weatherability testing are essential evaluation methods to ensure the optimal performance and durability of these coatings. The market for paints and coatings is expected to grow steadily, with the global market size projected to reach USD150 billion by 2025, reflecting a compound annual growth rate of 4%. This growth is driven by the increasing demand for advanced coatings and the ongoing shift towards more sustainable solutions.

We can help! Our analysts can customize this paints and coatings market research report to meet your requirements.