Anesthesia Breathing Circuits Market Forecast 2024-2028

The Anesthesia Breathing Circuits Market size is forecast to increase by USD 439 million, at a CAGR of 8.08% between 2023 and 2028. The market growth hinges on several factors, notably the rising frequency of surgeries and medical emergencies, coupled with the increasing prevalence of chronic diseases and their risk factors. Moreover, the improvement in healthcare infrastructure across developing economies is a significant contributor. These trends underscore the escalating demand for medical services and equipment, driving the expansion of the market. As healthcare facilities strive to address the growing healthcare needs of populations, the market is poised for continued advancement and innovation to meet the evolving healthcare landscape's challenges and requirements.

What will be the size of the During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

Anesthesia breathing circuits are essential medical devices used in the healthcare field for providing respiratory assistance to patients undergoing surgeries or recovering from respiratory conditions such as pulmonary embolism, sleep disorders, including obstructive sleep apnea, chronic bronchitis, and emphysema. These circuits connect patients to mechanical ventilators, ensuring the delivery of oxygen and the removal of carbon dioxide. Infection prevention and lung injury protection are critical aspects of anesthesia breathing circuits, making them an indispensable part of medical assistance. The market for anesthesia breathing circuits is driven by the increasing number of surgeries, the aging population, and the diverse uses of these circuits in telehealth operations. Medical professionals rely on these devices for ensuring medical device safety during procedures. Disposable circuits have gained popularity due to their ease of use and infection control benefits. The market is expected to grow significantly due to the increasing prevalence of respiratory conditions and the continuous advancements in technology to improve patient care. Our researchers analyzed the data with 2022 as the base year and the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing number of surgeries and medical emergency cases are notably driving market growth. The increasing incidence and prevalence of various chronic and lifestyle diseases, such as cancer, cardiovascular diseases (CVDs), chronic obstructive pulmonary disease (COPD), bone-related diseases, thrombosis, liver diseases, and renal diseases, is increasing the number of emergency visits to hospitals for various diagnostic and therapeutic purposes. In certain cases, surgeries are recommended by physicians as a part of the treatment and management regimen for various medical conditions, such as CVDs, malignant tumors, and cancer.

Moreover, general anesthesia is used while performing heart, joint, lung, brain, and major artery surgeries. It is an essential procedure that is followed by medical practitioners, especially surgeons, to facilitate surgical procedures. The increasing number of surgeries spurs the demand for anesthesia breathing circuits during anesthesia delivery to patients during surgery. Therefore, a growing number of surgeries and emergency cases requiring the delivery of anesthesia is expected to increase the demand for anesthesia breathing circuits, which will boost the growth of the market in focus during the forecast period.

Significant Market Trend

The adoption of latex-free and anti-microbial breathing circuits is an emerging trend in the market. Systematic disinfection of anesthesia breathing circuits is required to ensure that they do not become a vector for the cross-transmission of diseases. As a result, anesthesia breathing circuits that are made of an anti-microbial latex film could prevent pathogenic germs from growing on them. The addition of anti-microbial agents in anesthesia breathing circuits shows a comparable effect on the mechanical properties of natural rubber (NR) latex films. Inorganic metal oxides such as zinc oxide nanoparticles (ZnO NP) may act as both an activator and an anti-bacterial. Therefore, adding anti-microbial agents, especially ZnO NP, might be a superior option to NR latex films.

However, due to the above benefits that they provide, the usage of latex-free and anti-bacterial breathing circuits has gained attention. Products without latex reduce the possibility of allergic reactions, leading to enhanced patient care. Drager, for instance, provides latex-free breathing circuits for the care of adult and infant patients. Therefore, such factors are expected to boost market growth during the forecast period.

Major Market Challenge

The shortage of skilled anesthesiologists is a major challenge impeding market growth. Unlike other forms of anesthesia, including local anesthesia and nerve blocks, general anesthesia always needs to be delivered to patients under the supervision of a specialist anesthetist. This is because administering general anesthesia safely and reliably requires in-depth knowledge, technical skills, and awareness of the patient's vital parameters at the time of delivering anesthesia. In many countries, there is a severe shortage of anesthetists. Therefore, there is a need for adequately trained anesthetists to meet the demand in countries like Africa. For instance, African countries like Somalia and Central African Republic do not have trained anesthesiologists. These countries only have nurses with basic training to anesthetize patients.

Furthermore, access to trained anesthetists is further complicated by the uneven distribution of anesthesiologists in rural areas. The demand for anesthetists is increasing significantly due to the rising number of surgeries and the growing prevalence of chronic diseases and related risk factors. However, the lack of skilled and trained anesthetists is limiting the demand for anesthesia breathing circuits. These factors will hinder the growth of the market during the forecast period.

Key Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market research report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis and forecasting strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BioMed Devices - The company offers transport ventilators, blenders, breathing circuits, and accessories. The key offerings of the company include anesthesia breathing circuits.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market players, including:

- Airways surgical Pvt. Ltd.

- Ambu AS

- Becton Dickinson and Co.

- Dragerwerk AG and Co. KGaA

- Fisher and Paykel Healthcare Corp. Ltd.

- Flexicare Group Ltd.

- General Electric Co.

- Haier Smart Home Co. Ltd.

- Hamilton Bonaduz AG

- ICU Medical Inc.

- Intersurgical Ltd.

- Medtronic Plc

- Ningbo Boya Medical Equipment Co., Ltd.

- OSI Systems Inc.

- Sharn Inc.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, robust, tentative, and weak.

Market Segmentation

The market plays a crucial role in delivering anesthesia safely and effectively during medical procedures. These circuits encompass various components such as breathing tubes, bags, connectors, and filters. Recent advancements in circuit design and engineering have led to the development of innovative kits and improved quality and performance. Compliance with safety standards and regulations is paramount to ensure patient well-being. Additionally, the emphasis on reliability and maintenance of these circuits is increasing in healthcare settings. Anesthesia breathing circuits are integral to the anesthesia delivery system and are essential for maintaining proper ventilation and respiratory support during procedures.

The market share growth by the hospital segment will be significant during the forecast period. Hospitals accounted for the biggest and fastest-growing end-user segment in the global market as a result of the increasing prevalence of chronic diseases and medical conditions that need hospitalization and surgical intervention.

Get a glance at the market contribution of various segments Request a PDF Sample

The hospitals segment was valued at USD 368.4 million in 2018. In the US, hospitals witnessed a rise in the number of surgeries in 2021, including cataracts, transplants, and others. Similarly, The Lancet Commission for Global Surgery (LCoGS) estimated in 2021 that 5,000 surgeries needed to be performed to meet the surgical burden of disease among 100,000 people living in low and lower-middle-income countries globally. Therefore, the increase in the number of surgeries in hospitals is anticipated to increase the demand for anesthesia breathing circuits in these hospitals. Moreover, rising healthcare infrastructure and the growing number of hospitals in emerging economies like India, Malaysia, and others are propelling the demand for anesthesia breathing circuits. Therefore, such factors will foster the growth of the market through the hospital segment during the forecast period.

Key Region

For more insights on the market share of various regions Request PDF Sample now!

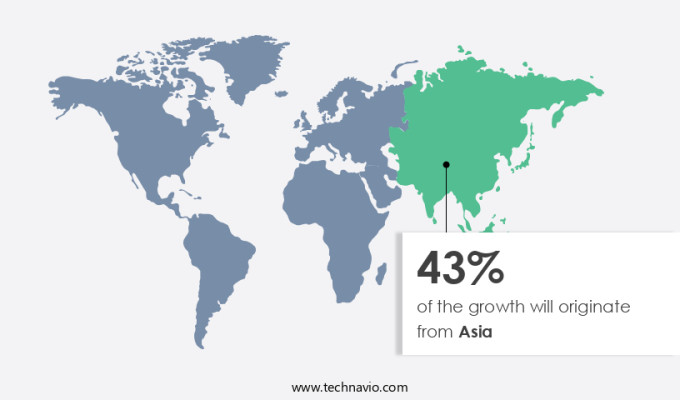

Asia is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional market trends and drivers that shape the market during the forecast period. In North America, the US and Canada are the major revenue contributors to the market in North America. The market in the region is driven by the well-established healthcare infrastructure, an increasing number of surgeries being performed under general anesthesia, and the growing prevalence of chronic diseases and related risk factors. In addition, the growing number of ASCs has led to a rise in the number of surgeries performed in developed countries in the region, such as the US. For instance, in December 2021, Trillium Health Partners, a hospital network based in Western Toronto, Canada, announced plans to invest USD 27 million to establish a new multispecialty hospital in Mississauga. Thus, the growing number of hospitals in developed countries adds to the number of surgical procedures performed, which, in turn, will boost the demand for anesthesia breathing circuits in the region during the forecast period.

In addition, the prevalence and incidence of chronic diseases in North America have increased significantly. For instance, according to the National Cancer Institute, in 2020, 1,806,590 new cases of cancer were diagnosed in the US, while 606,520 people lost their lives due to the disease. The increasing prevalence of such chronic diseases increases the demand for surgical procedures as a part of the overall treatment regimen, which drives the demand for anesthesia breathing circuits for airway maintenance during surgery. This, in turn, will boost the growth of the market in North America during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Hospitals

- Ambulatory surgical centers

- Clinics

- Product Type Outlook

- Closed circuits

- Semi-closed circuits

- Semi-open circuits

- Open circuits

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- Asia

- China

- India

- Vietnam

- Others

- Rest of World

- Saudi Arabia

- South Africa

- Brazil

- Others

- North America

You may also be interested in:

- Anesthesia Devices Market Analysis North America, Europe, Asia, Rest of World (ROW) - US, Germany, UK, China, Japan - Size and Forecast

- Anesthesia Laryngeal Masks Market Analysis North America, Europe, Asia, Rest of World (ROW) - US, Germany, UK, Japan, China - Size and Forecast

- Airway Management Tubes Market Analysis North America, Europe, Asia, Rest of World (ROW) - US, Germany, France, China, Canada - Size and Forecast

Market Analyst Overview

Anesthesia breathing circuits play a crucial role in the healthcare field, particularly during surgical procedures and respiratory assistance for various conditions. These circuits facilitate the delivery of oxygen and removal of carbon dioxide, ensuring proper respiratory function for patients with respiratory dysfunction due to pulmonary embolism, sleep disorders like obstructive sleep apnea, or chronic conditions such as chronic bronchitis and emphysema. Two main types of anesthesia breathing circuits are open and closed. Open circuits allow unfiltered room air to enter, while closed circuits provide a more controlled environment with the use of mechanical ventilators. Anesthesia equipment, including these circuits, is essential for hospitals, ambulatory surgical centers, and clinics. Disposable circuits ensure infection prevention and minimize the risk of lung injuries. With the increasing number of surgical procedures, surgical therapies, prosthetic surgeries, and transplants, the demand for anesthesia equipment is on the rise. The aging population and the prevalence of chronic respiratory diseases, such as tuberculosis, bronchitis, and chronic disorders, further contribute to the market growth. Medical professionals rely on these circuits to monitor vital parameters during surgical operations and ensure medical assistance in case of accidents or respiratory care. Telehealth operations and remote patient monitoring also increase the diverse uses of anesthesia breathing circuits. Medical device safety remains a priority, with continuous efforts to improve anesthesia equipment efficiency and minimize risks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market growth 2024-2028 |

USD 439 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

Asia at 43% |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airways surgical Pvt. Ltd., Ambu AS, Becton Dickinson and Co., BioMed Devices, Dragerwerk AG and Co. KGaA, Fisher and Paykel Healthcare Corp. Ltd., Flexicare Group Ltd., General Electric Co., Haier Smart Home Co. Ltd., Hamilton Co., ICU Medical Inc., Intersurgical Ltd., Medtronic Plc, Ningbo Boya Medical Equipment Co., Ltd., OSI Systems Inc., Sharn Inc., Teleflex Inc., TG Eakin Ltd., Vincent Medical Holdings Ltd., and Vyaire Medical Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the industry across North America, Europe, Asia, and Rest of World (ROW)

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch