Antihypertensive Drugs Market Size 2024-2028

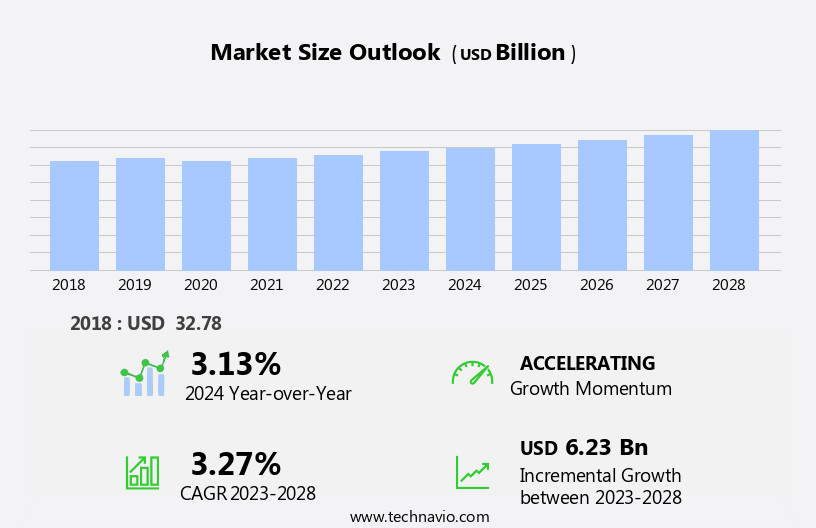

The antihypertensive drugs market size is forecast to increase by USD 6.23 billion at a CAGR of 3.27% between 2023 and 2028.

What will be the Size of the Antihypertensive Drugs Market During the Forecast Period?

How is this Antihypertensive Drugs Industry segmented and which is the largest segment?

The antihypertensive drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Systemic hypertension

- Pulmonary hypertension

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

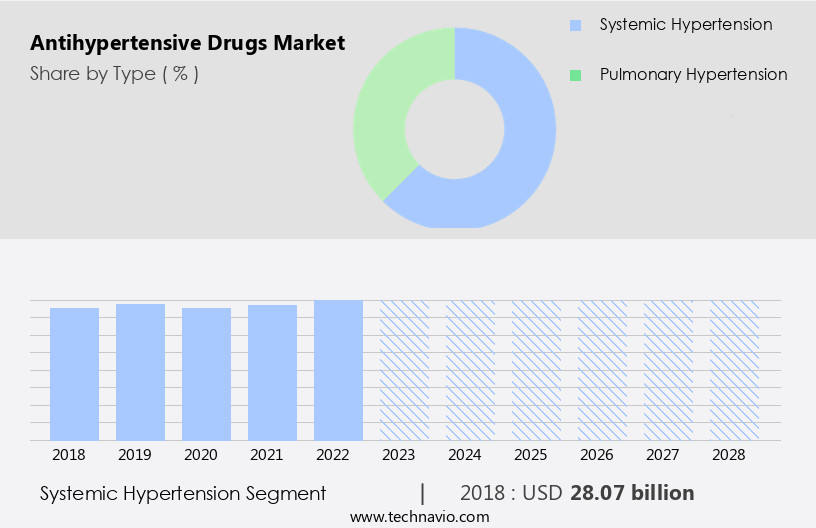

- The systemic hypertension segment is estimated to witness significant growth during the forecast period.

Antihypertenisve drugs, primarily diuretics and vasodilators, play a significant role in managing systemic hypertension. Diuretics, such as hydrochlorothiazide, furosemide, and spironolactone, are widely used due to their effectiveness in reducing blood volume, cardiac output, and systemic vascular resistance. Adrenergic blockers, including prazosin, terazosin, doxazosin, and trimazosin, are another therapeutic class used for producing vasodilation. Additionally, ACE inhibitors and ARBs are employed for treating systemic hypertension. The geriatric population, with a sedentary lifestyle, contributes to the increasing demand for these medications. Patent expirations of major brands have led to the emergence of generic alternatives in retail pharmacies, hospital pharmacies, e-commerce platforms, and online drug stores.

Calcium channel blockers and beta-adrenergic blockers are other antihypertensive drugs used in clinical practice.

Get a glance at the Antihypertensive Drugs Industry report of share of various segments Request Free Sample

The Systemic hypertension segment was valued at USD 28.07 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

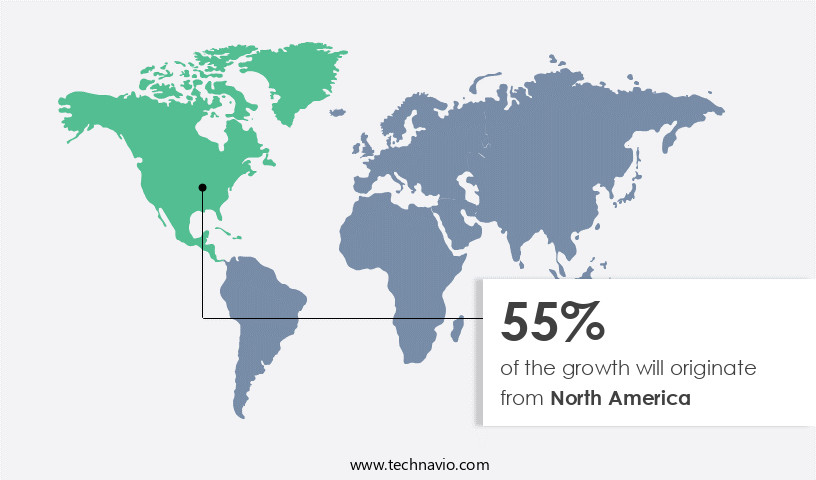

- North America is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to increased awareness of hypertension and the availability of various antihypertensive medications. The US and Canada have a significant focus on hypertension education and prevention, with organizations like the CDC and Hypertension Canada promoting awareness. The market's expansion is also driven by the presence of major pharmaceutical companies offering branded and generic antihypertensive drugs, including diuretics such as Thiazide diuretics (Hydrochlorothiazide, Chlorthalidone, Indapamide), ACE inhibitors, vasodilators, calcium channel blockers, and beta-adrenergic blockers. The market's growth is further supported by a well-established regulatory framework for drug approvals. Antihypertensive drugs are available through various channels, including retail pharmacies, hospital pharmacies, e-commerce websites, online drug stores, and hospitals.

Key therapeutic classes include Diuretics, ACE inhibitors, Calcium channel blockers, Beta-adrenergic blockers, and Vasodilators. The geriatric population, with a higher prevalence of hypertension, also contributes to market growth. Sedentary lifestyles and patent expirations are other factors influencing market dynamics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Antihypertensive Drugs Industry?

Availability of wide range of drugs is the key driver of the market.

What are the market trends shaping the Antihypertensive Drugs Industry?

Growing adoption of personalized medicine is the upcoming market trend.

What challenges does the Antihypertensive Drugs Industry face during its growth?

Advent of wearable defibrillators is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The antihypertensive drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the antihypertensive drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, antihypertensive drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The company's portfolio encompasses various antihypertensive medications, including Tenormin (atenolol), Tenoretic (atenolol and thiazide diuretic), Zestril (lisinopril), and Zestoretic (lisinopril and hydrochlorothiazide). These drugs are utilized for managing hypertension, a prevalent health condition characterized by persistently elevated blood pressure levels. Antihypertensive agents function by inhibiting the production of angiotensin II, dilating blood vessels, or enhancing the excretion of sodium and water from the body. The market for antihypertensive drugs continues to expand due to the rising prevalence of hypertension and the increasing awareness of its associated risks. Additionally, advancements in drug development and delivery systems contribute to the market's growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AstraZeneca Plc

- Aurobindo Pharma Ltd.

- Bausch Health Companies Inc.

- Bayer AG

- Cipla Inc.

- Daiichi Sankyo Co. Ltd.

- Dr Reddys Laboratories Ltd.

- GlaxoSmithKline Plc

- Hetero Healthcare Ltd.

- Johnson and Johnson Services Inc.

- Lupin Ltd.

- Merck and Co. Inc.

- Noden Pharma DAC

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zydus Lifesciences Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Antihypertensive drugs are a significant segment of the pharmaceutical market, catering to the growing population suffering from hypertension, or high blood pressure. Hypertension is a chronic condition characterized by persistent elevated blood pressure levels, which, if left untreated, can lead to severe health complications, including heart disease, stroke, and kidney damage. The antihypertensive drug market encompasses various therapeutic classes, each with distinct mechanisms of action. Diuretics, for instance, promote the excretion of water and sodium from the body, thereby reducing blood volume and lowering blood pressure. ACE inhibitors, on the other hand, hinder the production of angiotensin II, a potent vasoconstrictor, thereby relaxing blood vessels and decreasing peripheral resistance.

Vasodilators, another class of antihypertensive drugs, work by widening blood vessels, which in turn reduces the pressure on the walls of the arteries. Calcium channel blockers and beta-adrenergic blockers are other common classes of antihypertensive drugs that act by modulating the activity of calcium ions and adrenaline, respectively, to reduce blood pressure. The geriatric population represents a significant consumer base for antihypertensive drugs due to the increased prevalence of hypertension among older adults. Sedentary lifestyle, poor diet, and other age-related factors contribute to the development and progression of hypertension in this demographic. Market dynamics, including patent expirations, play a crucial role In the market.

The expiration of patents on several blockbuster drugs has led to increased competition and price erosion In the market. For instance, the expiration of the patent on Valsartan tablets has resulted in a surge in generic competition, leading to price decreases and increased availability. The market can be segmented based on distribution channels, including retail pharmacies, hospital pharmacies, and e-commerce. Retail pharmacies dominate the market due to their widespread availability and convenience. However, the e-commerce segment is gaining traction due to the increasing popularity of online shopping and the convenience it offers. Hospitals and hospital pharmacies represent another significant distribution channel for antihypertensive drugs.

These institutions are major consumers of antihypertensive drugs due to the high prevalence of hypertension among patients. E-commerce websites and online drug stores are also emerging as viable distribution channels, offering competitive pricing and convenience to consumers. In conclusion, the market is a dynamic and growing segment of the pharmaceutical industry. The market is driven by the increasing prevalence of hypertension, particularly among the geriatric population, and the availability of various therapeutic classes to address this condition. Market dynamics, including patent expirations, are also influencing the market landscape, leading to increased competition and price erosion. The distribution channels, including retail pharmacies, hospital pharmacies, and e-commerce, offer various advantages and challenges to market participants.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 6.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Antihypertensive Drugs Market Research and Growth Report?

- CAGR of the Antihypertensive Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the antihypertensive drugs market growth of industry companies

We can help! Our analysts can customize this antihypertensive drugs market research report to meet your requirements.