Automotive Brake Hoses and Lines Market 2024-2028

The automotive brake hoses and lines market size is estimated to grow by USD 2.99 billion, at a CAGR of 2.56% between 2023 and 2028. Automotive brake hoses and lines are essential components of a vehicle's braking system, ensuring safe and efficient stopping power. Affordability is a key offering in this market, with manufacturers prioritizing minimal recurring costs for consumers. The global automotive industry is witnessing an increase in production of both passenger and commercial vehicles, fueled by growing demand and advancements in technology. Government standards on automotive braking systems are stringent, requiring manufacturers to adhere to rigorous safety regulations. These standards ensure the reliability and durability of brake hoses and lines, providing peace of mind for drivers. The market for automotive brake hoses and lines is expected to grow, driven by these factors and the ongoing demand for vehicle safety and performance.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Download Free Sample in a Minute

Market Dynamics

Automotive brake hoses and lines are essential components of a vehicle's braking system. They transport hydraulic fluid from the master cylinder to the braking calipers or brake shoes, enabling the vehicle to stop effectively. Automotive brake systems consist of disc brakes, drums, brake pads, rotors, brake calipers, and brake shoes. Brake hoses, specifically automotive brake hoses, are multilayer hoses designed to withstand the high-pressure hydraulic fluid and resist corrosion. Modern vehicles use metal hardlines for high-performance applications. Brake lines, another crucial part, are responsible for transferring hydraulic fluid from the master cylinder to the braking system. They come in various forms, including metal hardlines and rubber hoses. The production of automotive brake hoses and lines involves the use of raw materials and advanced fabrication techniques, followed by assembly into the vehicle's braking system. Anti-Lock Braking Systems (ABS) and brake-by-wire systems have become increasingly popular, requiring specialized brake hoses and lines to function correctly. The market for automotive brake hoses and lines is expected to grow due to the increasing demand for advanced safety features and the continuous production of new vehicles.

Key Market Driver

One of the key factors driving the market growth is the affordability of automotive brake hoses and lines at minimal recurring cost. Automotive brake hoses or lines form an essential part of the conventional automotive braking system. In addition, a brake hose is affordable and readily available in the commercial market at minimal replacement cost thereby fuelling the growth of the global automotive brake hose and lines market.

Moreover, hydraulically operated brake systems use brake hoses also known as brake lines, which use fluid pressure to stop the vehicle. In addition, as hydraulic brake fluid flows through the brake hose whenever the brake is applied, it deteriorates over time. Therefore such factors, coupled with the low cost of purchase of brake hoses and lines, act as a market enabler for the concerned market. Hence, it is driving the market growth during the forecast period.

Key Market Trends

A key factor shaping the market growth is the improving reliability of automotive braking systems. The automotive system developers and automakers have started working on enhancing the system reliability and durability of such systems/technologies. In addition, the spending and investments in making them fool-proof have considerably increased over the last few years.

Moreover, the technical issues, glitches, and malfunctions associated with such electronic braking systems have periodically led to vehicle recalls. As a result, this has pushed both automakers and advanced braking system developers to work collectively in making them fail-proof. Furthermore, the work on developing advanced algorithms has been gaining momentum, which forms the basis or brain in designing such systems. Hence, such factors are driving the market growth during the forecast period.

Key Market Challenge

The emergence of an all-electronic braking system is one of the key challenges hindering the market growth. There has been significant development and innovations in the global automotive industry that it transformed the way people travel. In addition, automotive electronics is making inroads in automotive design, development, and manufacturing, thereby redefining the complete value chain. Furthermore, the rise in applications of automotive electronics is making modern automobiles lightweight and energy-efficient with improved performance.

Moreover, it is expected that the brake hoses or lines will be replaced by electronic components or actuators in the future, which may limit the growth of the market. In addition, the electronic braking system is still undergoing developments and improvements by Tier I suppliers and automakers, where R&D activities are increasing the reliability and functioning of the complete braking system. Therefore, as the system by design replaces conventional mechanical parts and linkages, it hinders the market growth during the forecast period.

Customer Landscape

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Customer Landscape

Who are the Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AGS Automotive Solutions: The company offers automotive brake hoses and lines through its subsidiary BrakeQuip LLC.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Codan Rubber AS

- Continental AG

- Cooper Standard Holdings Inc.

- Dana Inc.

- Dayco IP Holdings LLC

- EDELBROCK LLC

- Hitachi Ltd.

- JAGWIRE

- KST Technology Inc.

- Meritor Inc.

- Mitsubishi Corp.

- NICHIRIN Co. Ltd.

- Parker Hannifin Corp.

- Polyhose India Pvt. Ltd.

- Robert Bosch GmbH

- Rothe Packtech Pvt. Ltd.

- TI Fluid Systems Plc

- TOSY AUTO PRODUCTS

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Largest-Growing Segments in the Market?

The passenger vehicles segment is estimated to witness significant growth during the forecast period. The increasing production volume of automobiles in developing economies including China and India are acting as market enablers for the market. In addition, there is an increase in purchasing purchase power parity in these nations, which is further stimulating the demand for automobiles.

Get a glance at the market contribution of various segments Download the PDF Sample

The passenger vehicles segment was the largest segment and was valued at USD 17.38 billion in 2018. Moreover, the growth in the market share of premium and luxury segments such as sedans and sports utility vehicles (SUVs) in APAC is fueling the growth of the passenger vehicles segment of the market. This is due to the better-quality brake lines and assemblies used in addition to multiple brake hoses per wheel in most vehicles. In addition, passenger vehicles can be segmented as entry-level, mid-level, and premium or luxury-level vehicles. Hence, such factors are fuelling the growth of this segment which in turn drives the market growth during the forecast period.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

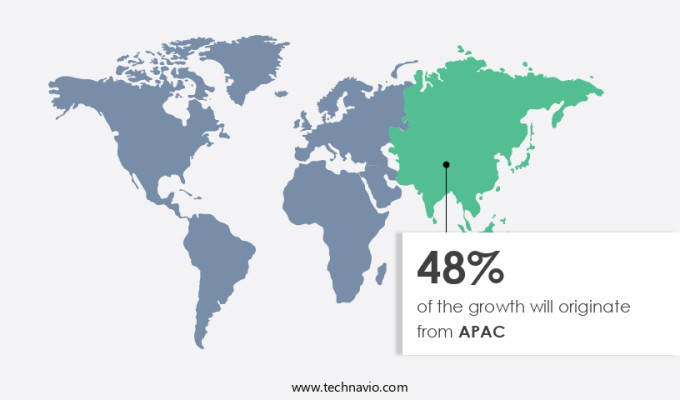

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The increase in the volume of automobile sales in countries including China, Japan, South Korea, India, and Southeast Asian nations is acting as a major market enabler for the market. This is because, in these countries, there is a significant demand for both passenger and commercial vehicles due to the improving socio-economic conditions and purchasing power parity.

Thus, these economies dominate the brake hoses and lines market in APAC. In addition, APAC has some of the fastest-growing automotive economies in the world, such as China, India, and the Association of Southeast Asian Nations (ASEAN). Furthermore, the region also has developed automotive markets such as Japan, South Korea, and Australia when compared with other countries in APAC. Hence, such factors are driving the market growth in APAC during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Passenger vehicles

- Commercial vehicles

- Type Outlook

- Rubber

- Stainless steel

- Others

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Market Analyst Overview

Automotive brake hoses and lines are an integral part of the automotive brake system. They transport hydraulic fluid or pneumatic pressure from the master cylinder to the braking calipers or drums in a vehicle. Brake hoses are available in various types, including multilayer hoses, rubber hoses, and hydraulic fluid-filled hoses. The automotive brake system comprises various components, such as disc brakes, brake calipers, brake shoes, and drums. Hydraulic brake hoses and pneumatic braking systems are commonly used in automobiles. The advent of advanced technologies, such as Anti-Lock Braking Systems (ABS), brake-by-wire systems, smart braking systems, and electronic braking systems, has led to the evolution of brake hoses and lines. The market for automotive brake hoses and lines is driven by factors such as urbanization, increasing automotive safety norms, and the production of electric vehicles (EVs).

In addition, the tire manufacturing industry also plays a significant role in the market's growth. The demand for automotive brake hoses and lines is high in various vehicle segments, including two-wheelers, light commercial vehicles, heavy trucks, buses, and coaches. Brake manufacturers and OEMs are continually innovating to improve the performance and durability of brake hoses and lines. Materials such as Polytetrafluoroethylene (PTFE) are used in the fabrication of these components to ensure high resistance to heat, pressure, and chemicals. The automobile industry's production process relies on the availability of raw materials and advanced fabrication techniques to meet the growing demand for automotive brake systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.56% |

|

Market growth 2024-2028 |

USD 2.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

1.94 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

China, US, Japan, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGS Automotive Solutions, Codan Rubber AS, Continental AG, Cooper Standard Holdings Inc., Cummins Inc., Dana Inc., Dayco IP Holdings LLC, EDELBROCK LLC, Hitachi Ltd., JAGWIRE, KST Technology Inc., Mitsubishi Corp., NICHIRIN Co. Ltd., Parker Hannifin Corp., Polyhose India Pvt. Ltd., Robert Bosch GmbH, Rothe Packtech Pvt. Ltd., TI Fluid Systems Plc, TOSY AUTO PRODUCTS, and Valeo SA |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.