Automotive Brake-By-Wire Systems Market Size 2025-2029

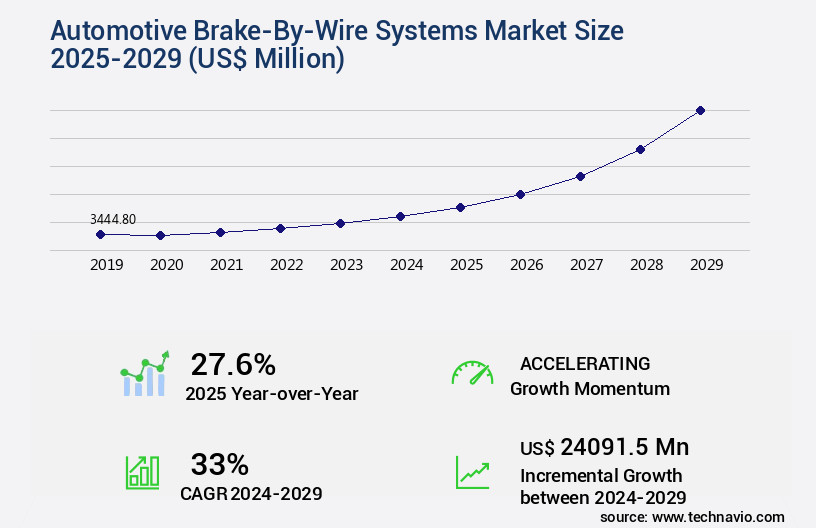

The automotive brake-by-wire systems market size is forecast to increase by USD 24.09 billion, at a CAGR of 33% between 2024 and 2029.

Major Market Trends & Insights

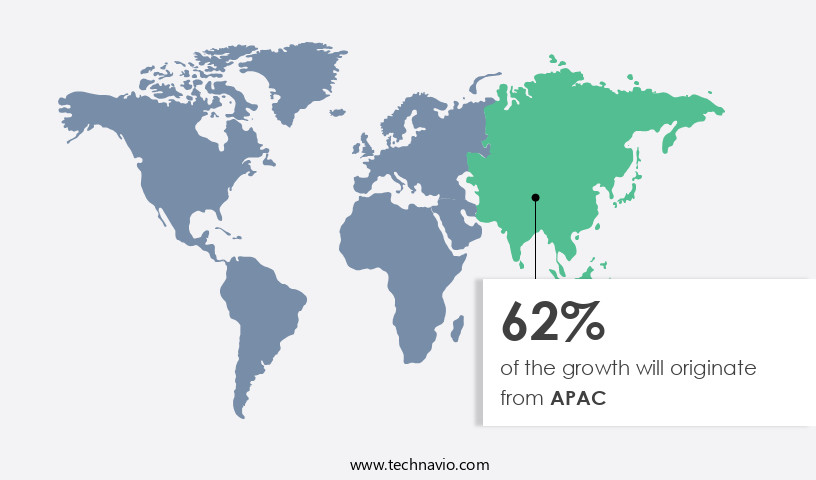

- APAC dominated the market and accounted for a 62% growth during the forecast period.

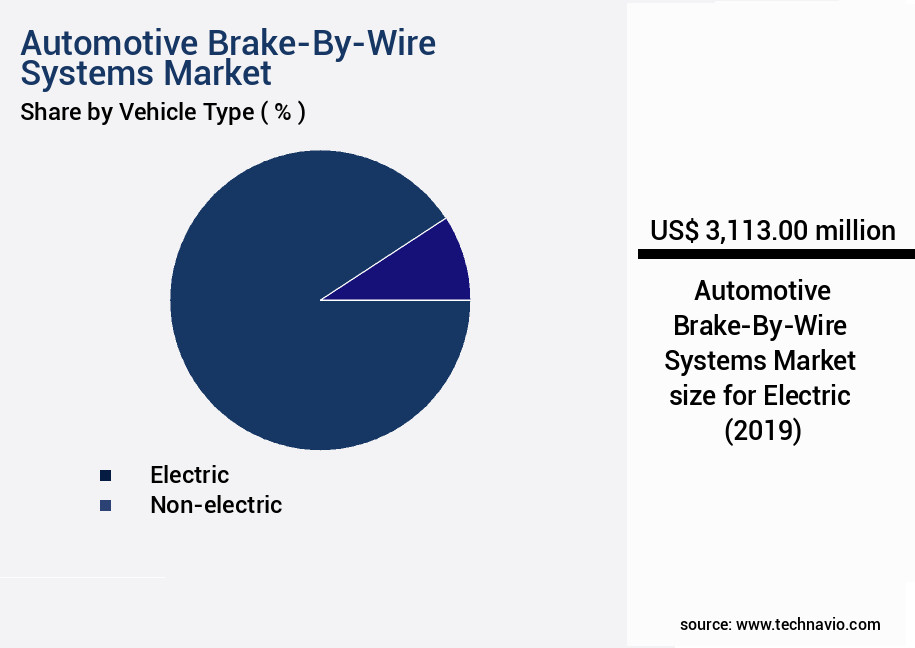

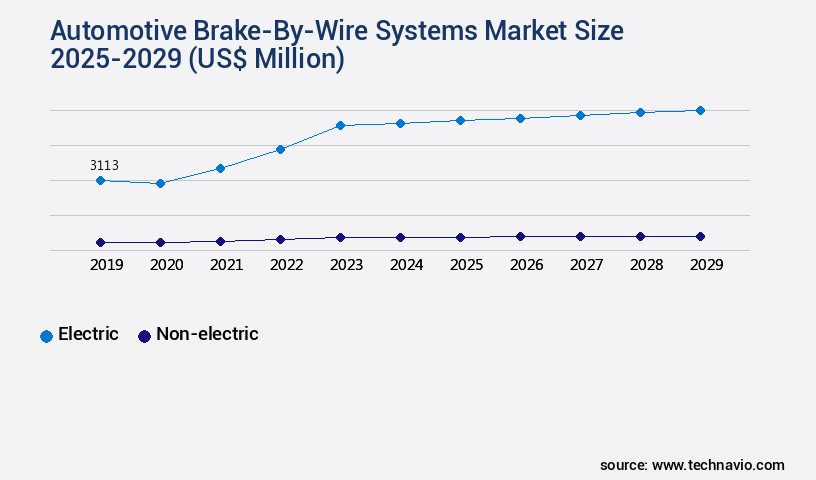

- By the Vehicle Type - Electric segment was valued at USD 3.11 billion in 2023

- By the Application - Passenger vehicles segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 820.14 billion

- Market Future Opportunities: USD USD 24.09 billion

- CAGR : 33%

- APAC: Largest market in 2023

Market Summary

- The market is witnessing significant advancements, driven by the increasing demand for advanced safety features in vehicles. According to industry reports, the market is projected to experience substantial growth in the coming years, with a focus on reducing vehicle weight and improving fuel efficiency. Electronically assisted braking systems are becoming increasingly popular, with some estimates suggesting that they could account for over 50% of new vehicle sales by 2030.

- However, the high cost of development and maintenance of these systems remains a challenge, with some manufacturers exploring cost-effective alternatives such as hybrid hydraulic-electric systems. Despite this, the benefits of brake-by-wire systems, including improved safety, reduced emissions, and enhanced driving dynamics, continue to drive adoption across various vehicle segments.

What will be the Size of the Automotive Brake-By-Wire Systems Market during the forecast period?

Explore market size, adoption trends, and growth potential for automotive brake-by-wire systems market Request Free Sample

- The market encompasses advanced technologies that replace conventional hydraulic brake systems with electronic interfaces, actuator performance, and pressure sensors. These systems employ control strategies, real-time control, and diagnostic codes for functional safety. Performance testing and durability are crucial factors, with system architecture incorporating communication protocols, redundancy mechanisms, and software validation. Actuator performance is a key consideration, with electronic brake systems offering improved pedal feedback and reduced brake response time. However, system latency and sensor accuracy remain challenges. Hydraulic lines are eliminated, replaced by power distribution and pressure modulation. The market's growth is driven by the increasing demand for lighter, more efficient vehicles, as well as the integration of safety certification and thermal management systems.

- Two notable developments include the implementation of control algorithms for pressure modulation and the integration of safety certification mechanisms. These advancements have led to a significant reduction in system failure modes, enhancing overall vehicle safety. Despite these advancements, challenges persist, including the need for hardware component reliability and the development of robust communication protocols. The market continues to evolve, with ongoing research focusing on improving system integration, system latency, and pedal feedback.

How is this Automotive Brake-By-Wire Systems Industry segmented?

The automotive brake-by-wire systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Vehicle Type

- Electric

- Non-electric

- Application

- Passenger vehicles

- Commercial vehicles

- Component

- Sensors

- Actuators

- Control Units

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Vehicle Type Insights

The electric segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the increasing penetration of advanced electronic systems in hybrid, all-electric, and plug-in hybrid vehicles. These vehicles' sales are driven by environmental advantages and government incentives, as well as the functional benefits of reduced cost of ownership, noise reduction, and the scarcity of fossil fuels. Prominent automakers in the hybrid/all-electric vehicle sector are integrating regenerative braking systems to harvest kinetic energy during braking, which can be stored and utilized for other functions. This market trend is further fueled by the evolving infrastructure to support electric vehicles and the growing focus on reducing the automotive industry's carbon footprint.

Software algorithms, electro-hydraulic actuation, wheel speed sensors, brake bias adjustment, brake line pressure, electronic stability control, electronic throttle control, brake assist technology, hydraulic actuators, electronic control unit, sensor fusion techniques, hydraulic pressure regulation, tire pressure monitoring, stopping distance metrics, anti-lock braking system, actuator response time, brake system redundancy, brake torque distribution, driver input processing, fault detection diagnostics, fail-operational mechanisms, traction control integration, hydraulic control system, and vehicle dynamics control are essential components of these advanced brake systems. The market for brake-by-wire systems is expected to expand further as technology continues to advance and electric vehicles gain broader market acceptance.

According to recent industry reports, the market for brake-by-wire systems in electric vehicles is projected to reach a penetration rate of 50% by 2025. Furthermore, the market for hydraulic control systems in conventional vehicles is anticipated to decline by 10% during the same period. These trends underscore the ongoing transformation of the automotive industry and the increasing importance of advanced electronic systems in modern vehicles. As the market continues to evolve, businesses must stay informed about the latest developments and adapt to meet the changing demands of consumers and regulatory requirements.

The Electric segment was valued at USD 3.11 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 62% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Brake-By-Wire Systems Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant expansion in the Asia Pacific (APAC) region. Key contributors to this growth include developing economies like India and China, as well as established automotive markets such as Japan and South Korea. This trend is driven by the high-volume sales of hybrid passenger vehicles from major automakers like INFINITI, Toyota Motor, and Lexus, which incorporate these advanced brake systems. The market is poised for continued growth as more automakers introduce sophisticated brake technologies. In APAC, China is a leading market, accounting for a substantial market share. India, too, is witnessing a surge in demand for these systems due to increasing vehicle production and sales.

Meanwhile, countries in the Association of Southeast Asian Nations (ASEAN) are also experiencing significant growth. Japan and South Korea, as developed markets, contribute to the region's market expansion through their high production and sales of hybrid and electric vehicles. The market is expected to witness a steady increase in demand during the forecast period. This growth is attributed to the increasing adoption of electric and hybrid vehicles, stringent safety regulations, and advancements in technology. Moreover, the market is expected to benefit from the rising demand for fuel efficiency and reduced emissions. According to recent reports, the market for automotive brake-by-wire systems is projected to grow at a steady pace, with a compound annual growth rate (CAGR) of approximately 10%.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the evolving automotive industry, electro-hydraulic brake system architecture is giving way to advanced brake-by-wire systems. These systems offer numerous benefits, including real-time control algorithms for braking, sensor fusion for improved performance, and hydraulic pressure regulation strategies for enhanced safety. However, reliability testing is crucial to ensure the dependability of these complex systems. Brake-by-wire systems employ fail-operational modes to maintain safety in case of component failures. Redundancy and safety mechanisms are integral to their design, enabling vehicle dynamics control and seamless interaction with systems like anti-lock braking and electronic stability control. Performance testing is essential to optimize actuator response time and electronic control unit software validation. Brake torque distribution control strategies and wheel speed sensor accuracy are critical factors in ensuring optimal brake performance. Compared to traditional hydraulic systems, brake-by-wire systems offer faster response times and improved precision. For instance, in emergency situations, an emergency brake assist system functionality can reduce stopping distances by up to 20%. Moreover, brake pedal feel calibration techniques enable a more natural driving experience for consumers. Brake pressure modulator control algorithms and electronic stability control system interaction are essential components of these systems, ensuring optimal vehicle handling and stability. As the industry shifts towards electrification, brake-by-wire systems will play a pivotal role in delivering safer, more efficient, and more responsive vehicles.

What are the key market drivers leading to the rise in the adoption of Automotive Brake-By-Wire Systems Industry?

- The significant expansion of electrification in the automotive sector serves as the primary market catalyst.

- Modern vehicles incorporate numerous electronic components to boost functional efficiency and minimize weight. The automotive industry's technological evolution, driven by electrification, has led to advancements in fuel delivery systems, braking systems, steering systems, and safety systems. Electrification plays a pivotal role in enhancing vehicle performance, restricting emissions, and improving overall system efficiency. Automotive electronics have gained significant importance in modern vehicles, necessitating the adoption of sophisticated systems like automotive brake-by-wire systems. These systems enable the control of a vehicle's body electronics, ensuring precise and efficient operation. The automotive brake-by-wire market is a dynamic and evolving landscape, with continuous advancements and innovations shaping its future.

- The integration of electronic components into braking systems offers several benefits. For instance, it allows for the implementation of advanced safety features, such as regenerative braking and adaptive cruise control. Additionally, it enables the optimization of brake pedal force and brake booster efficiency, contributing to improved fuel economy and reduced emissions. The market for automotive brake-by-wire systems is expected to witness substantial growth, with increasing demand from the automotive industry for advanced safety features and improved vehicle efficiency. As vehicle manufacturers continue to prioritize the integration of electronic components into their offerings, the adoption of automotive brake-by-wire systems is poised to expand.

- In contrast to conventional hydraulic braking systems, automotive brake-by-wire systems offer several advantages. They provide real-time vehicle data, enabling the implementation of advanced safety features and optimizing brake performance. Moreover, they offer flexibility in vehicle design and layout, allowing for the integration of other electronic systems and components. In summary, the automotive brake-by-wire market represents a significant growth opportunity, driven by the increasing demand for advanced safety features and improved vehicle efficiency. As the automotive industry continues to prioritize the integration of electronic components into their offerings, the adoption of automotive brake-by-wire systems is set to expand, shaping the future of the automotive industry.

What are the market trends shaping the Automotive Brake-By-Wire Systems Industry?

- The growing adoption of electronically assisted braking functionalities is becoming a notable trend in the market. This technology is increasingly being integrated into vehicles to enhance safety and improve overall performance.

- The automotive industry has witnessed significant advancements in braking technology, leading to the emergence of brake-by-wire systems. Traditional braking systems have been augmented with assisted technologies, enhancing vehicle safety and control. These systems include regenerative braking, electronic stability control, and traction control. Brake-by-wire systems replace the conventional mechanical linkages between the brake pedal and the brakes with electrical signals. This innovation offers several advantages, such as improved pedal feel, reduced weight, and enhanced safety features. For instance, brake-by-wire systems can provide real-time information on tire pressure, road conditions, and vehicle speed to the braking system, enabling optimized braking performance.

- Moreover, the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies has further accelerated the adoption of brake-by-wire systems. These systems require precise and instantaneous control of the brakes, making electric braking systems an ideal solution. Comparatively, the market for hydraulic brake systems is expected to experience a decline in demand due to the growing popularity of electric braking systems. However, the transition towards electric vehicles and the need for cost-effective solutions may result in a continued presence of hydraulic brake systems in the market. In conclusion, the market is a dynamic and evolving landscape, driven by technological advancements and changing consumer preferences.

- The integration of electric braking systems with ADAS and autonomous driving technologies is expected to significantly impact the market's growth trajectory.

What challenges does the Automotive Brake-By-Wire Systems Industry face during its growth?

- The escalating costs of developing and maintaining electronic braking systems pose a significant challenge to the industry's growth trajectory.

- The automotive brake-by-wire market is undergoing significant evolution, transitioning from mechanical to electromechanical or all-electronic systems. This shift brings about increased complexity and costs, particularly in the development, maintenance, and repair of these advanced electronic braking systems. The integration of electronic components and subsystems in brake-by-wire systems raises the cost of development, leading to a higher overall vehicle cost. Moreover, the expenses related to software development, testing, and updates throughout the product lifecycle can be substantial, especially for ensuring compatibility with evolving vehicle architectures and technologies. The cost of component integration, including engineering efforts and modifications, further adds to the development expenses.

- Despite these challenges, the benefits of brake-by-wire systems, such as improved safety, reduced vehicle weight, and enhanced driving dynamics, continue to drive market growth. Comparatively, traditional hydraulic brake systems have a lower development cost due to their simpler design and fewer components. However, they require regular maintenance and have a higher weight, which can negatively impact vehicle fuel efficiency. In conclusion, the automotive brake-by-wire market is experiencing continuous growth and transformation, offering numerous advantages while presenting challenges related to development, maintenance, and repair costs. This dynamic market landscape necessitates ongoing research and innovation to address these challenges and maximize the benefits of electronic brake systems.

Exclusive Customer Landscape

The automotive brake-by-wire systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive brake-by-wire systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Brake-By-Wire Systems Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive brake-by-wire systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akebono Brake Industry Co. Ltd. - The company specializes in advanced automotive brake systems, including Electric Brakes, delivering enhanced stopping power to the industry. Their innovative by wire technology sets new standards in automotive safety.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akebono Brake Industry Co. Ltd.

- Brembo Spa

- Continental AG

- Haldex AB

- Hitachi Ltd.

- HL Mando Co. Ltd.

- Hyundai Motor Group

- Knorr Bremse AG

- KSR International Inc.

- Robert Bosch GmbH

- SFS Group AG

- Stellantis NV

- Toyota Motor Corp.

- Veoneer Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Brake-By-Wire Systems Market

- In January 2024, Bosch, a leading automotive technology company, announced the launch of its latest generation of brake-by-wire systems, named "Bosch BrakeByWire 3.0," at the Consumer Electronics Show (CES) in Las Vegas (Bosch press release, 2024). This innovative system combines hydraulic and electronic braking functions, ensuring improved safety and efficiency in vehicles.

- In March 2024, Continental AG, another major automotive supplier, formed a strategic partnership with Magna International to jointly develop and commercialize advanced brake-by-wire systems (Continental AG press release, 2024). This collaboration aimed to combine Continental's expertise in brake systems and Magna's experience in mechatronics and engineering services, targeting the growing demand for electric and autonomous vehicles.

- In May 2024, ZF Friedrichshafen AG, a global technology company, received regulatory approval from the European Union for its Electronic Brake System (EBS), marking a significant milestone in the commercialization of brake-by-wire technology (ZF Friedrichshafen AG press release, 2024). The EBS system, which uses electric signals instead of hydraulic pressure to apply the brakes, is expected to improve vehicle safety, reduce weight, and enhance fuel efficiency.

- In April 2025, Aptiv, a global technology company specializing in automotive and mobility services, completed the acquisition of AutonomouStuff, a leading autonomous vehicle technology provider, for approximately USD400 million (Aptiv press release, 2025). This strategic move enabled Aptiv to expand its portfolio of advanced driver-assistance systems (ADAS) and autonomous driving technologies, including brake-by-wire systems, which are crucial components for self-driving vehicles.

Research Analyst Overview

- The market represents a significant evolution in vehicle safety and control systems. This market encompasses advanced technologies such as electronic stability control (ESC), electronic throttle control (ETC), and brake assist technology, which rely on hydraulic actuators, electronic control units (ECUs), and sensor fusion techniques for optimal performance. Brake pedal travel, a critical aspect of traditional hydraulic braking systems, is minimized in brake-by-wire systems. This reduction in travel enhances driver feedback and control, contributing to improved vehicle handling and safety. ESC, for instance, utilizes sensor fusion techniques to analyze vehicle dynamics and apply individual wheel braking to maintain stability. Brake assist technology, another essential component, employs hydraulic pressure regulation and sensor data to determine the driver's intent and apply additional braking force when necessary.

- For example, in emergency situations, brake assist systems can reduce stopping distance by up to 25% compared to manual braking. The market is expected to grow at a steady pace, with industry analysts projecting a 10% annual increase in market size over the next five years. This growth is driven by the increasing demand for advanced safety features and the ongoing development of more efficient and responsive brake systems. Brake-by-wire systems integrate various components, including hydraulic actuators, wheel speed sensors, and tire pressure monitoring systems, to optimize vehicle performance and safety. Additionally, these systems offer redundancy and fail-operational mechanisms, ensuring reliable braking even in the event of component failures.

- In summary, the market represents a dynamic and evolving sector, driven by the integration of advanced technologies and the pursuit of improved vehicle safety and control. From electronic stability control and brake assist technology to hydraulic actuators and electronic control units, the market's continuous innovation is shaping the future of automotive engineering.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Brake-By-Wire Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 33% |

|

Market growth 2025-2029 |

USD 24091.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.6 |

|

Key countries |

China, US, Japan, India, South Korea, Germany, France, Canada, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Brake-By-Wire Systems Market Research and Growth Report?

- CAGR of the Automotive Brake-By-Wire Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive brake-by-wire systems market growth of industry companies

We can help! Our analysts can customize this automotive brake-by-wire systems market research report to meet your requirements.