Automotive Brake Wear Sensors Market Size 2025-2029

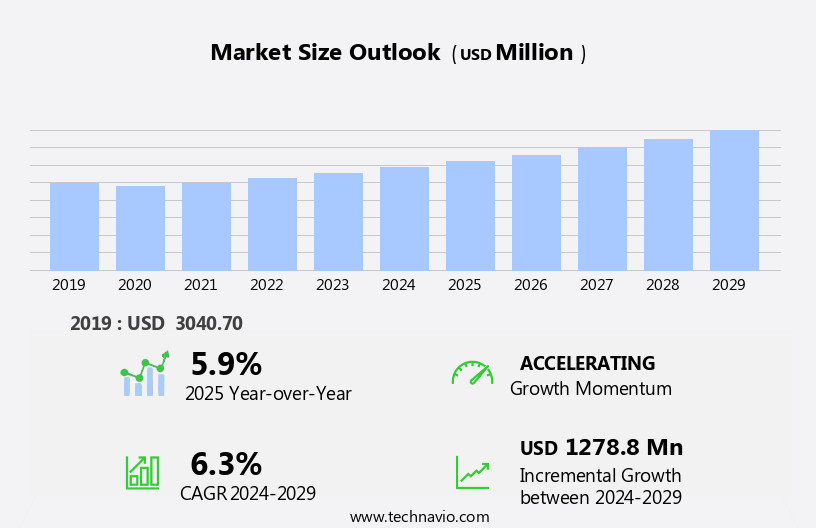

The automotive brake wear sensors market size is forecast to increase by USD 1.28 billion, at a CAGR of 6.3% between 2024 and 2029.

- The market is driven by the increasing demand to minimize damage to braking systems. These sensors play a crucial role in estimating the remaining life of brake pads, thereby preventing unnecessary replacements and reducing maintenance costs. Furthermore, OEMs are under pressure to reduce costs, making the adoption of cost-effective brake wear sensors an attractive proposition. However, challenges persist in the form of technical complexities in sensor design and integration, as well as the need for continuous calibration to ensure accurate readings.

- To capitalize on market opportunities, companies must focus on developing advanced sensor technologies that offer high accuracy, durability, and cost-effectiveness. Navigating these challenges requires a deep understanding of the evolving automotive industry landscape and a commitment to innovation and continuous improvement.

What will be the Size of the Automotive Brake Wear Sensors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and dynamic market activities. These sensors play a crucial role in ensuring the safety and efficiency of brake systems by detecting wear and triggering replacement before significant damage occurs. The market encompasses various entities, including analog sensors, Electronic Control Systems (ECS), distribution channels, fault detection, vibration testing, and warranty claims. Analog sensors, a traditional technology, are being gradually replaced by digital sensors due to their superior performance and reliability. ECS, an integral part of Advanced Driver Assistance Systems (ADAS), are increasingly being integrated into brake systems for enhanced safety and real-time monitoring. The supply chain of automotive brake wear sensors involves various stakeholders, from sensor design and manufacturing to power management, signal processing, and sensor packaging.

Sensor performance is influenced by factors such as sensor accuracy, environmental testing, and compliance with automotive standards. Brake system design, vehicle diagnostics, and repair procedures are key applications of automotive brake wear sensors. Fault detection and vibration testing are essential for identifying potential issues and ensuring sensor reliability. Sensor cost, sensor lifespan, and sensor fusion are critical considerations for manufacturers, influencing the overall design and implementation of these sensors. Brake pad wear, durability testing, temperature testing, and humidity testing are crucial aspects of sensor manufacturing processes. Compliance with safety regulations and installation methods are essential for ensuring the safety and efficiency of brake systems.

Brake fluid, friction materials, and electronic components are essential raw materials in the production of automotive brake wear sensors. Materials science plays a significant role in the development of high-performance sensors. Wireless sensors and wired sensors are two primary types of sensors used in the automotive industry, each with its unique advantages and applications. The aftermarket sales channel is a significant growth area for automotive brake wear sensors, driven by the increasing popularity of DIY repairs and maintenance. Sensor replacement and sensor maintenance are critical aspects of the market. OEM sales and warranty claims are significant revenue streams for manufacturers and distributors.

In conclusion, the market is a dynamic and evolving landscape, influenced by various factors such as sensor design, performance, supply chain, and applications. The market is characterized by continuous innovation and the integration of advanced technologies to enhance safety, efficiency, and reliability.

How is this Automotive Brake Wear Sensors Industry segmented?

The automotive brake wear sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Product

- Electronic brake wear sensors

- Disc brake wear sensors

- Channel

- OEM

- Aftermarket

- Type

- On-road

- Off-road

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

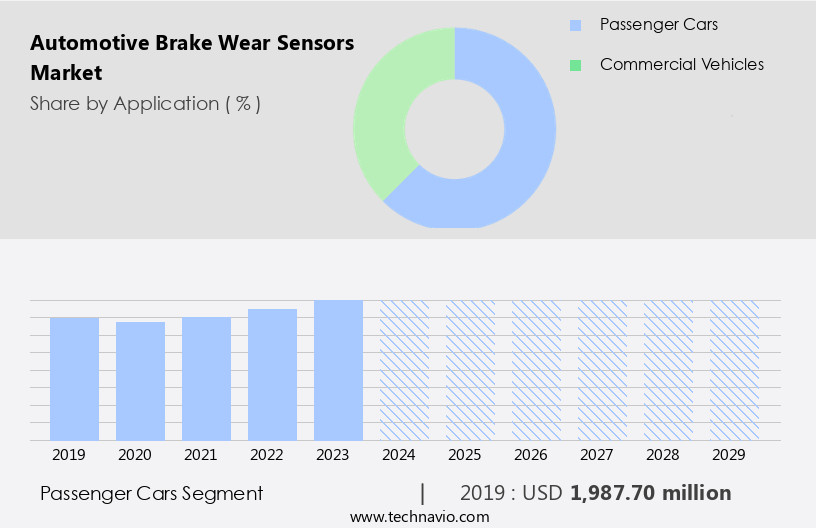

The passenger cars segment is estimated to witness significant growth during the forecast period.

The automotive brake wear sensor market is experiencing significant growth due to increasing demand for safety features in vehicles, particularly in developing economies with a high number of passenger car sales. These sensors play a crucial role in automotive safety by monitoring brake system performance and alerting drivers when brake pads or discs need replacement. Automakers are integrating advanced driver-assistance systems (ADAS) into their vehicles, which rely on these sensors for accurate data acquisition and real-time monitoring. Sensor design and performance are key considerations for automotive brake wear sensors, with manufacturers focusing on miniaturization, power management, and sensor accuracy to improve overall system efficiency and reliability.

The supply chain for these sensors involves various stakeholders, including friction materials suppliers, electronic component manufacturers, and materials science researchers. Environmental testing, durability testing, and compliance testing are essential aspects of sensor manufacturing processes to ensure sensor reliability and safety regulations. Hydraulic and ABS systems in vehicles utilize both wired and wireless sensors for brake system diagnostics and repair procedures. Sensor lifespan and cost are important factors in the aftermarket sales channel, where wear indicators and wheel speed sensors are commonly used for sensor replacement. Sensor fusion technology is a recent trend in the market, combining data from multiple sensors to enhance overall system performance and accuracy.

Digital sensors, such as Hall effect and magnetic sensors, offer advantages in terms of signal processing and durability compared to traditional analog sensors. The distribution channels for automotive brake wear sensors include OEM sales, aftermarket sales, and repair procedures, with CAN bus communication systems facilitating seamless data transfer and fault detection. In summary, the automotive brake wear sensor market is driven by safety regulations, increasing demand for safety features, and the integration of advanced driver-assistance systems in vehicles. Manufacturers focus on sensor design, performance, and reliability to meet the evolving needs of the automotive industry.

The Passenger cars segment was valued at USD 1.99 billion in 2019 and showed a gradual increase during the forecast period.

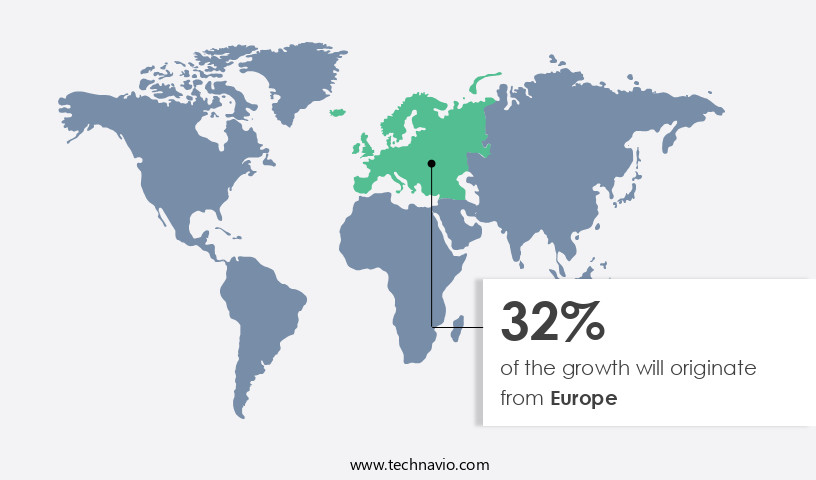

Regional Analysis

Europe is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the automotive industry, North America, as a developed economy, leads the way in adopting advanced technologies. With mature markets and technologically advanced nations like the US, Canada, and Mexico, this region hosts a significant concentration of passenger and commercial vehicle manufacturers. Major automotive OEMs, including General Motors, Ford Motor, and Fiat Chrysler Automobiles, are based here. In 2024, over 15.8 million units of automobiles were sold in the US, making it the world's second-largest automotive market. The US market demonstrates a high demand for SUVs and light trucks. Automotive brake wear sensors play a crucial role in ensuring safety and optimizing vehicle performance.

These sensors are integrated into advanced driver-assistance systems (ADAS) and electronic stability control (ESC) systems to monitor brake system health. Sensor design and performance are essential factors, as they impact supply chain efficiency and data acquisition. Sensor packaging and power management also play a role in extending sensor lifespan and reliability. Brake system design and vehicle diagnostics are critical applications for brake wear sensors. Digital sensors, such as Hall effect and magnetic sensors, offer advantages like high accuracy and real-time monitoring. Friction materials and electronic components are essential materials in sensor manufacturing, while materials science and environmental testing ensure sensor durability.

Brake fluid and sensor replacement are essential aspects of maintenance, with OEM sales and aftermarket sales catering to different customer segments. Wireless sensors and wear indicators enable remote monitoring and reduce the need for periodic inspections. Signal processing and wired sensors ensure accurate data acquisition and transmission. Rotor wear, calibration, and compliance testing are essential considerations in sensor design and manufacturing. Safety regulations mandate regular sensor maintenance, hydraulic system checks, and temperature testing. Installation methods, such as CAN bus and wired connections, impact sensor integration and repair procedures. Sensor fusion and durability testing are essential aspects of sensor design and manufacturing, ensuring sensor reliability and longevity.

Sensor cost and sensor fusion are critical factors in the automotive industry's competitiveness.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant segment in the global automotive electronics industry. These sensors play a crucial role in ensuring road safety by monitoring brake pad wear and providing real-time alerts to drivers. Advanced technologies like ultrasonic, hydraulic, and magnetic sensors are driving innovation in the market. Manufacturers are focusing on developing sensors with high accuracy, durability, and low power consumption to meet the evolving demands of consumers. Integration of these sensors with vehicle diagnostic systems and telematics is also gaining popularity, enabling predictive maintenance and remote monitoring. The market is expected to grow steadily due to increasing vehicle production, rising demand for safety features, and stringent regulations on vehicle safety. Additionally, the market is witnessing significant investments from key players to expand their product portfolios and strengthen their market position.

What are the key market drivers leading to the rise in the adoption of Automotive Brake Wear Sensors Industry?

- The increasing demand for minimizing damage to braking systems serves as the primary market driver.

- The automotive industry prioritizes safety regulations and compliance testing to ensure the optimal performance of vehicles. With the increasing use of advanced safety systems, such as ABS and hydraulic systems, sensors play a crucial role in maintaining their functionality. Automotive brake wear sensors are essential safety devices that alert drivers when the efficiency of their brake pads is decreasing. These sensors, which can be installed using various methods, undergo rigorous testing, including humidity testing, to ensure their durability and reliability.

- Real-time monitoring of sensor data is vital for maintaining proper vehicle maintenance and repair procedures. Sensor applications extend beyond brake systems, with CAN bus systems enabling seamless communication between sensors for enhanced vehicle performance. The sensor's lifespan is a critical factor in ensuring continued safety and reliability, making ongoing maintenance and replacement essential.

What are the market trends shaping the Automotive Brake Wear Sensors Industry?

- The ability of automotive brake wear sensors to estimate mileage is an emerging trend in the market. These sensors provide valuable information on brake condition and can help drivers anticipate replacement needs, enhancing vehicle safety and maintenance efficiency.

- Automotive brake wear sensors are essential safety components that alert drivers when brake pad performance begins to deteriorate due to corrosion or physical damage to connectors. These sensors estimate the remaining mileage before brake pad replacement, providing drivers with advanced warning. However, the reliability of these sensors is crucial to prevent unnecessary warranty claims and ensure the durability of the braking system. Manufacturing processes play a significant role in sensor reliability. Vibration testing, temperature testing, and fault detection techniques are employed to ensure sensor accuracy and longevity. Analog sensors, a common type of brake wear sensor, are prone to interference and require precise calibration.

- Sensor fusion, which combines data from multiple sensors, can improve overall system performance and accuracy. The cost of brake wear sensors is a critical consideration for both manufacturers and consumers. Ensuring sensor reliability while minimizing costs is essential for maintaining a competitive edge in the market. Distribution channels, including aftermarket and OEM, must also provide reliable and timely sensor replacement to maintain customer satisfaction. In conclusion, the automotive brake wear sensor market is driven by the need for enhanced safety and improved vehicle performance. Ensuring sensor reliability through rigorous testing and manufacturing processes, while minimizing costs, is essential for success in this market.

What challenges does the Automotive Brake Wear Sensors Industry face during its growth?

- The pressure to decrease costs for Original Equipment Manufacturers (OEMs) represents a significant challenge that can impede industry growth.

- The automotive industry is experiencing significant technological advancements, with automotive Original Equipment Manufacturers (OEMs) integrating Advanced Driver-Assistance Systems (ADAS) and digital sensors into brake systems to enhance safety and performance. Sensor design plays a crucial role in achieving optimal sensor performance, with a focus on power management, sensor packaging, and data acquisition. Friction materials, electronic components, and sensor accuracy are essential considerations in brake system design. In the face of increasing regulatory requirements and consumer demands, OEMs are under pressure to reduce costs while ensuring compliance. Digital sensors and electronic components are driving up manufacturing costs.

- To address this challenge, OEMs are focusing on improving sensor design, optimizing power management, and implementing efficient supply chain management strategies. Vehicle diagnostics and digital sensors are enabling real-time data acquisition, providing valuable insights into brake system performance and potential issues. In summary, the market is evolving, with a focus on improving sensor design, sensor performance, and power management to meet the demands of the dynamic regulatory environment and consumer preferences. Digital sensors and electronic components are driving up costs, necessitating the need for efficient supply chain management strategies.

Exclusive Customer Landscape

The automotive brake wear sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive brake wear sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive brake wear sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akebono Brake Industry Co. Ltd. - The company specializes in providing advanced automotive brake wear sensor solutions, including the innovative Akebono EURO technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akebono Brake Industry Co. Ltd.

- Beck Arnley Holdings LLC

- BorgWarner Inc.

- Brembo Spa

- Carlisle Co. Inc.

- Continental AG

- DENSO Corp.

- FMP Group Australia Pty Ltd.

- Herth Buss Fahrzeugteile GmbH and Co. KG

- Holstein Automotive Group

- Mitsubishi Electric Corp.

- Otto Zimmermann Maschinen und Apparatebau GmbH

- PEX German O.E. Parts LLC

- Robert Bosch GmbH

- SADECA SYSTEMS SLU

- Sensata Technologies Inc.

- Shandong Frontech Auto Parts Co. Ltd.

- Standard Motor Products Inc.

- Visteon Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Brake Wear Sensors Market

- In January 2024, Continental AG, a leading automotive technology company, announced the launch of its new generation of brake wear sensors, which feature improved accuracy and longer service life. These sensors utilize ultrasonic technology to monitor brake pad wear and provide real-time data to drivers (Continental AG press release).

- In March 2024, Bosch and Autoliv, two major players in the automotive safety systems market, signed a strategic collaboration agreement to jointly develop and produce brake wear sensors. This partnership aims to leverage Bosch's expertise in sensor technology and Autoliv's strengths in automotive safety systems (Bosch press release).

- In April 2025, Aptiv, a global technology company, completed the acquisition of Autoness, a leading provider of advanced driver assistance systems (ADAS) and sensor technology. This acquisition will significantly strengthen Aptiv's position in the automotive sensor market, particularly in the area of brake wear sensors (Aptiv press release).

- In May 2025, the European Union announced the approval of new regulations for advanced driver assistance systems, including mandatory brake wear sensors in all new passenger cars from 2027. This regulatory development is expected to drive the growth of the market in Europe (European Commission press release).

Research Analyst Overview

- The market is witnessing significant advancements, driven by the integration of technology trends such as big data, IoT applications, and machine learning. Sensor placement and orientation are crucial factors in ensuring sensor accuracy and reliability, leading to the development of sensor networks and root cause analysis. Noise reduction and signal filtering are essential for effective data interpretation and decision support systems. Supply chain optimization and cost reduction strategies are key areas of focus for OEMs and aftermarket players. Sensor integration and cloud connectivity enable remote diagnostics and over-the-air updates, improving preventative maintenance and system architecture.

- Firmware updates and data analysis tools facilitate software development and algorithm development for predictive analytics and failure analysis. Data normalization and data visualization are essential for effective warranty analysis and service life prediction. Machine learning and sensor calibration techniques enhance sensor reliability and manufacturing efficiency. OEM partnerships and distribution network optimization are critical for ensuring a seamless customer experience and competitive advantage. Software updates and data analytics enable real-time sensor monitoring and real-time decision making, improving overall vehicle performance and safety. Sensor calibration techniques and algorithm development are crucial for ensuring sensor accuracy and reducing false positives.

- In the automotive industry, the integration of advanced technologies into brake wear sensors is transforming the market landscape. From sensor placement and noise reduction to predictive analytics and cost reduction strategies, the future of automotive brake wear sensors is one of innovation and efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Brake Wear Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 1278.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Germany, Canada, UK, China, France, Japan, Italy, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Brake Wear Sensors Market Research and Growth Report?

- CAGR of the Automotive Brake Wear Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive brake wear sensors market growth of industry companies

We can help! Our analysts can customize this automotive brake wear sensors market research report to meet your requirements.