Automotive Camera Market Size 2024-2028

The automotive camera market size is forecast to increase by USD 4.25 billion at a CAGR of 10.03% between 2023 and 2028. The market is experiencing significant growth, driven by the priority of automotive safety among consumers. Imaging solutions, including wide-angle cameras, are becoming increasingly essential for advanced safety features such as lane departure warning, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance. These systems help ensure safety and improve the overall driving experience. However, the high replacement costs associated with camera modules pose a challenge for automakers and consumers alike. Furthermore, adverse weather conditions and temperature fluctuations can impact camera performance, necessitating advanced imaging technologies to overcome these challenges. Overall, the market for automotive cameras is expected to grow steadily, as automakers continue to invest in safety standards and advanced imaging solutions to enhance vehicle safety and convenience.

The autonomous driving technology market in the automotive industry is experiencing significant growth due to the integration of advanced imaging solutions. These imaging systems play a crucial role in enhancing vehicle safety through features like lane departure warning, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance. Autonomous vehicles, also known as self-driving cars, rely heavily on real-time images captured by onboard cameras to navigate roads and detect obstacles, blind spot areas, and adhere to safety regulations. Autonomous driving technology is essential in addressing carelessness and mistakes caused by human error, which lead to road and traffic accidents. Imaging systems help autonomous vehicles identify and respond to adverse weather conditions, temperature fluctuations, and vibrations, ensuring safe and reliable operation. Insurance companies are increasingly recognizing the importance of these safety features, making imaging solutions a must-have in both entry-level and high-end vehicles. The future of the automotive industry lies in the integration of advanced imaging systems and autonomous driving technology, paving the way for safer and more efficient transportation solutions.

Market Segmentation

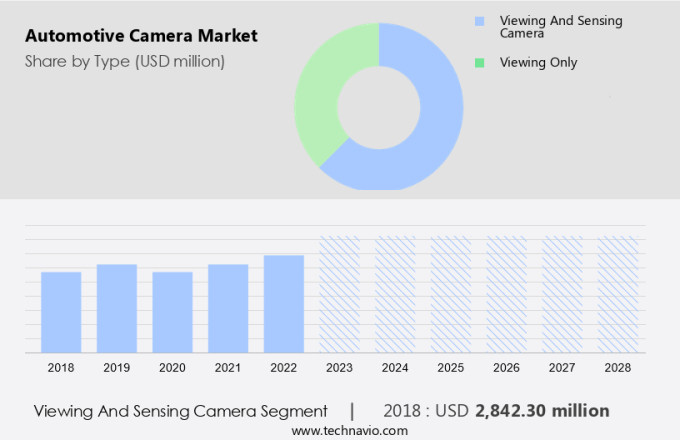

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Viewing and sensing camera

- Viewing only

- Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Type Insights

The viewing and sensing camera segment is estimated to witness significant growth during the forecast period. Autonomous vehicles and self-driving cars are revolutionizing the automotive industry with advanced safety features, including automotive cameras. These cameras provide a 360-degree view around the vehicle, enabling features such as blind spot detection, automatic emergency braking, and adaptive cruise control. Cameras work in conjunction with sensors, GPS, and artificial intelligence to enhance safety and improve the driving experience. Moreover, the integration of cameras in automotive systems is essential for autonomous vehicles to perceive their surroundings and navigate safely. The digital segment of the market is expected to grow significantly due to the increasing adoption of advanced driver-assistance systems (ADAS).

The reduction in the cost of sensors, cameras, and displays is also fueling the growth of this market. One of the critical safety applications of automotive cameras is the Front Collision Warning System (FCWS), which uses cameras and sensors to detect potential collisions and alert drivers to prevent accidents. The FCWS system is becoming increasingly popular due to its ability to enhance road safety and reduce the number of accidents caused by human error. The global market for automotive cameras is expected to grow steadily due to the increasing demand for advanced safety features in vehicles.

Get a glance at the market share of various segments Request Free Sample

The viewing and sensing camera segment accounted for USD 2.84 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

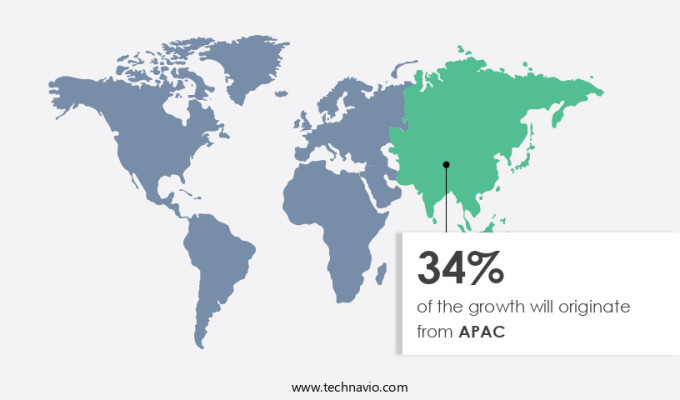

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the North American region, the United States is a significant contributor to The market. The increasing emphasis on road safety and passenger security is driving the demand for automotive cameras in this country. Regulations mandating the use of rearview cameras to prevent accidents, particularly those involving pedestrians, are a major factor. Blind spots are a significant concern in automotive safety, and automotive cameras provide a 360-degree view, enabling blind spot detection and automatic emergency braking. Autonomous vehicles and self-driving cars are the future of transportation, and sensors, including cameras, are essential components. Artificial intelligence and GPS technology are integrated into these systems to enhance functionality. The digital segment of the automotive industry is rapidly growing, and the adoption of advanced safety features, such as adaptive cruise control, is increasing. In North America, the market is poised for significant growth due to these trends and regulatory requirements.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The priority of automotive safety among customers is the key driver of the market. The automotive industry in major countries is heavily invested in advancing road safety through the integration of autonomous driving technology and imaging solutions. Autonomous vehicles are designed to mitigate human errors, which are the leading cause of traffic accidents. Active safety systems, including lane departure warning, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance, are essential components of these vehicles. These systems utilize imaging technology to identify potential hazards and alert drivers to take corrective actions. However, adverse weather conditions and temperature fluctuations can challenge the effectiveness of these systems, necessitating continuous advancements. Autonomous driving technology is revolutionizing the automotive industry by prioritizing safety and reducing the risk of accidents caused by human error.

Market Trends

Increased use of wide-angle camera technology is the upcoming trend in the market. The market is experiencing significant growth due to the increasing emphasis on autonomous driving technology and safety standards. Imaging solutions in automobiles are becoming increasingly essential to ensure the safety of passengers and pedestrians. Wide-angle lenses in automotive camera modules are gaining popularity for their extensive field coverage and superior image quality. Autonomous driving technology relies heavily on camera systems for lane departure warning, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance. These features are crucial for ensuring the safety of passengers and vulnerable road users, such as pedestrians, in adverse weather conditions and temperature fluctuations. Automakers are investing heavily in the development of advanced camera systems to meet the growing demand for safer and more technologically advanced vehicles.

The importance of camera systems in the automotive industry is reflected in the increasing number of organizations dedicated to safety standards and regulations. In conclusion, the market is poised for significant growth due to the increasing focus on safety and the integration of advanced imaging solutions in vehicles. Wide-angle lenses are a key component of these systems, providing enhanced coverage and image quality to support features such as lane departure warning, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance.

Market Challenge

High replacement costs associated with camera modules is a key challenge affecting the market growth. Autonomous driving technology is revolutionizing the automotive industry, and imaging solutions through cameras are a vital component of this transformation. These cameras enhance safety by providing real-time information on lane departure, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance. Initially, these features were exclusive to premium and luxury vehicles, but regulatory requirements and consumer demand have led to their widespread adoption. Automakers, such as Honda, Chevrolet, and Ford, now offer rearview cameras as standard features in their base models. While the cost of individual cameras is relatively low, the overall expense is significant due to the intricacy and labor-intensive nature of installation. In adverse weather conditions and temperature fluctuations, these cameras ensure optimal performance, making them indispensable for modern vehicles.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ASMPT Ltd. - The company offers automotive camera such as PCT optical camera.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Continental AG

- HELLA GmbH and Co. KGaA

- Hitachi Ltd.

- Hyundai Motor Group

- Kyocera Corp.

- Magna International Inc.

- Mcnex Co. Ltd.

- Mobileye Technologies Ltd.

- Murata Manufacturing Co. Ltd.

- OmniVision Technologies Inc.

- Panasonic Holdings Corp.

- Robert Bosch Stiftung GmbH

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Stellantis NV

- Stonkam Co. Ltd.

- Teledyne Technologies Inc.

- Valeo SA

- Veoneer Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The autonomous driving technology market in the automotive industry is witnessing significant growth due to the integration of advanced imaging solutions in vehicles. These imaging systems play a crucial role in enhancing safety standards by providing features like lane departure warning, collision avoidance, pedestrian detection, traffic sign recognition, and parking assistance. Autonomous vehicles, also known as self-driving cars, are equipped with sensors, GPS, artificial intelligence, and onboard cameras to detect obstacles, blind spot areas, and adverse weather conditions. Autonomous vehicles are designed to mitigate road accidents and traffic accidents caused by carelessness and mistakes. Safety regulations are stringent, and insurance companies are increasingly encouraging the adoption of safety features like automatic emergency braking, adaptive cruise control, and driver monitoring systems.

Additionally, the digital segment, including SUVs, LCVs, and HCVs, is witnessing a swell in demand for these advanced safety technologies. Rear-view cameras, 360-degree cameras, top-view cameras, bird's-eye cameras, surround view cameras, and stereo cameras are some of the imaging systems used in vehicles to provide real-time images for improved visibility in congested areas and parking spaces. Thermal cameras, infrared cameras, and digital cameras are also used for specific applications. The market is expected to grow further as automakers continue to innovate and integrate advanced imaging solutions to ensure vehicle safety.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market Growth 2024-2028 |

USD 4.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 34% |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ASMPT Ltd., Continental AG, HELLA GmbH and Co. KGaA, Hitachi Ltd., Hyundai Motor Group, Kyocera Corp., Magna International Inc., Mcnex Co. Ltd., Mobileye Technologies Ltd., Murata Manufacturing Co. Ltd., OmniVision Technologies Inc., Panasonic Holdings Corp., Robert Bosch Stiftung GmbH, Samsung Electronics Co. Ltd., Sony Group Corp., Stellantis NV, Stonkam Co. Ltd., Teledyne Technologies Inc., Valeo SA, and Veoneer Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch