Instant Cameras And Accessories Market Size 2025-2029

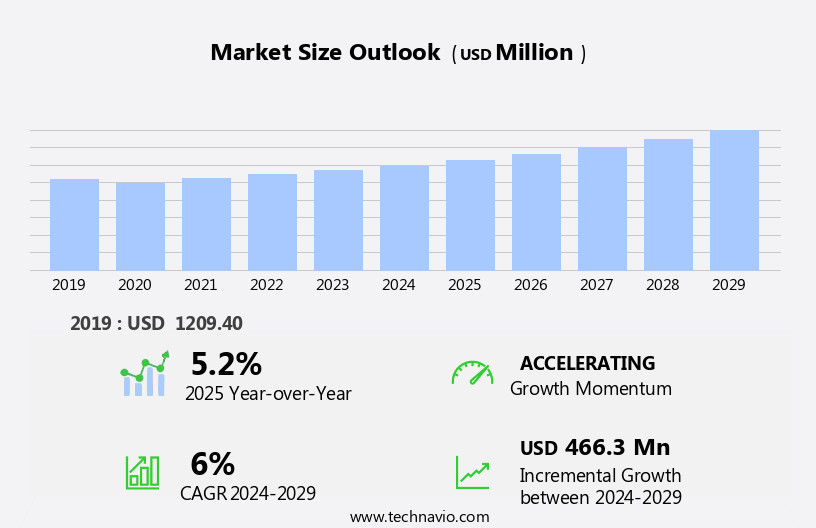

The instant cameras and accessories market size is forecast to increase by USD 466.3 million at a CAGR of 6% between 2024 and 2029.

- The Instant Camera and Accessories Market is experiencing significant growth, driven by several key factors. Firstly, the rise in gifting culture, particularly during special occasions and holidays, is fueling demand for instant cameras as they offer a unique and tangible way to capture and share memories. Secondly, the increasing popularity of online retail platforms has made instant cameras and accessories more accessible to consumers worldwide. Thirdly, the proliferation of smartphones and digital cameras has led to a resurgence in interest in instant photography, as consumers seek a break from the digital world and embrace the nostalgic appeal of instant prints.

- However, market growth is not without challenges. Intense competition from digital photography and increasing costs of raw materials pose significant threats to market players. To capitalize on opportunities and navigate challenges effectively, companies must focus on innovation, competitive pricing, and strategic partnerships to meet evolving consumer preferences and stay ahead of competitors.

What will be the Size of the Instant Cameras And Accessories Market during the forecast period?

- The market in the United States continues to experience significant activity, driven by the resurgence of interest in analog photography techniques and the desire for tangible, physical photos. This market encompasses a range of products, from instant cameras and film to accessories such as tripods, filters, and carrying cases. Key growth factors include the increasing popularity of experimental photography styles, the integration of advanced features like color balance and ISO sensitivity, and the adoption of modern technologies like Bluetooth connectivity and NFC. Additionally, the market is influenced by trends such as the rise of photography communities, the proliferation of mobile photo apps, and the increasing importance of photo preservation techniques like dye sublimation and inkjet printing.

- The market's size is substantial, with ongoing innovation in camera design, ergonomics, and reliability driving consumer demand. Furthermore, photography classes, workshops, and contests continue to attract enthusiasts, while photography influencers and bloggers shape public perception and fuel demand for new and innovative photography trends. Overall, the market for instant cameras and accessories is dynamic and diverse, reflecting the enduring appeal of photography and the ongoing evolution of technology.

How is the Instant Cameras and Accessories Industry segmented?

The instant cameras and accessories industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Online

- Offline

- Type

- Camera

- Accessories

- Product Type

- Retractable lenses

- Non-retractable lenses

- End-user

- Commercial

- Individual

- Geography

- North America

- US

- Canada

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

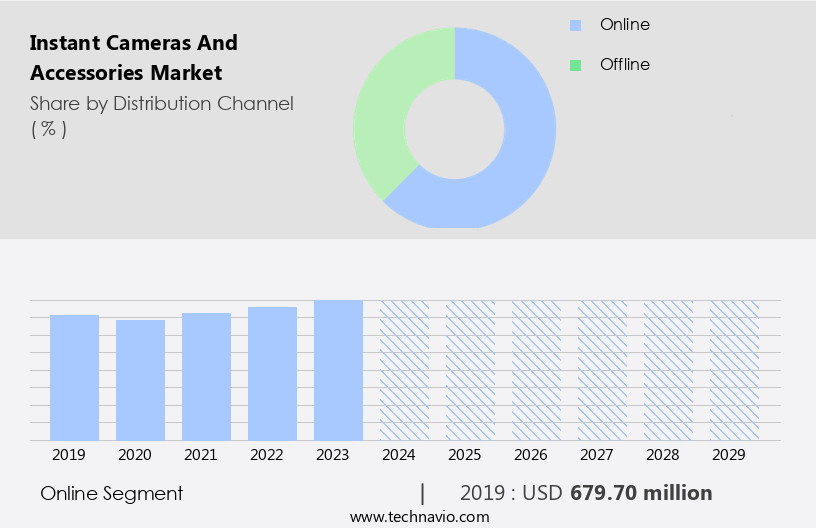

The online segment is estimated to witness significant growth during the forecast period. The market has witnessed significant growth in recent years, driven by the revival of analog photography and the appeal of instant gratification. This niche market caters to photography enthusiasts, casual photographers, and collectors, offering a range of specialty cameras, film formats, and accessories. Photo albums, art prints, and photo gifting continue to be popular applications for instant pictures. Online photography forums, photography blogs, and camera comparisons provide valuable insights for consumers seeking to make informed purchasing decisions. Event photography, portrait photography, and creative photography are key areas where instant cameras and accessories offer value for money and unique image quality.

Diverse offerings, including Polaroid cameras, Lomo cameras, hybrid instant cameras, and portable photo printers characterize the market. Camera accessories such as camera straps, film cartridges, and flash attachments cater to the customization needs of photography enthusiasts. Smartphone photo printers and selfie cameras have gained popularity, blurring the lines between instant cameras and mobile photography. Instant photo apps and mobile printing services enable users to enjoy instant prints from their smartphones. The market also offers limited edition cameras and film packs, appealing to collectors and those seeking retro technology. Nostalgia plays a significant role in the market, with many consumers drawn to the unique aesthetic and creative possibilities of instant photography.

Despite the convenience of online sales, concerns over counterfeit products and credibility have hindered their impact on the market. Consumers continue to value the tactile experience of purchasing and using instant cameras and accessories in physical stores. Camera features, printing speed, battery life, and image quality remain key considerations for consumers, with each brand offering unique value propositions. Overall, the market offers a rich and diverse ecosystem for photography enthusiasts and casual photographers alike.

Get a glance at the market report of share of various segments Request Free Sample

The Online segment was valued at USD 679.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

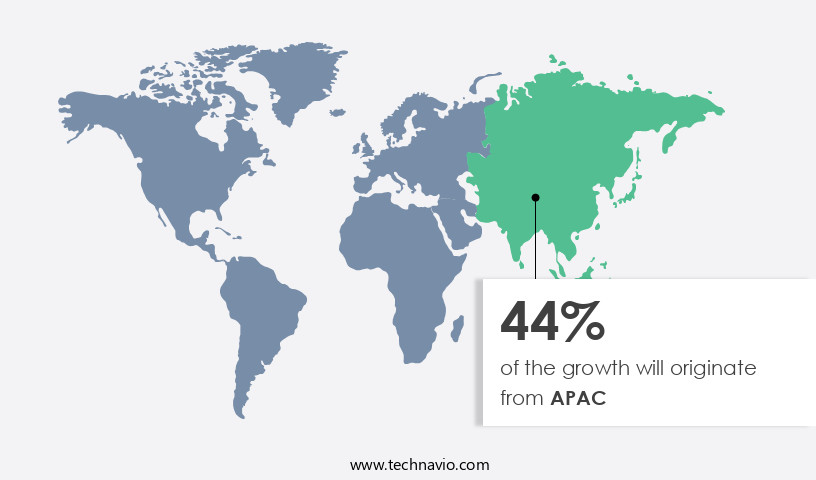

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America, with the US being the major contributor, is experiencing growth due to the increasing preference for instant gratification in photography. This market is driven by the photography community, including photography blogs and forums, fueling the analog revival. Photo gifting and event photography are key applications, with printing speed and smartphone photo printers being significant factors. Specialty cameras, such as Polaroid, Lomo, and hybrid models, cater to casual photographers and photography enthusiasts. Camera comparisons and customization, including film cartridges, camera straps, and flash attachments, offer value for money and creative expression. Niche markets, such as vintage photography and portrait photography, also contribute to the market's growth.

Despite the high price point and battery life concerns, the nostalgia factor and social media integration make instant cameras and accessories an attractive option for many. Instant photo frames, printing services, and film formats further expand the market's offerings. Travel photography and photography accessories, including camera lenses and instant camera apps, also contribute to the market's growth. Overall, the market in North America continues to thrive, offering a wide range of products for various photography applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Instant Cameras And Accessories Industry?

- Rise in gifting culture is the key driver of the market. Instant cameras and accessories have experienced a notable rise in demand due to the cultural significance of gifting, particularly during special occasions. Millennials, in particular, have shown a preference for personalized gifts, leading to an increase in the sales of instant cameras and related items. The custom of exchanging photographs as tokens of love, appreciation, and joy has persisted across various countries, including the US and Japan. The evolution of this tradition has contributed to the growth of this market.

- Instant cameras and accessories offer a unique and tangible way to capture and share memories, making them an ideal choice for gifting purposes. The trend is expected to continue, as people seek meaningful and personal ways to express their feelings to loved ones.

What are the market trends shaping the Instant Cameras and Accessories Industry?

- The rising popularity of online retail is the upcoming market trend. Instant cameras and accessories have seen significant growth in sales through online retail and e-commerce platforms. Leading manufacturers worldwide now sell their products via these channels, including Amazon, due to their profitability and the ability to reach consumers without geographical limitations.

- Online retail provides added convenience for consumers, allowing them to purchase products from the comfort of their homes. Additionally, e-commerce channels offer better promotion capabilities for manufacturers through effective strategies and advertising analytics. The shift towards online sales is a major market trend, enabling instant camera and accessory companies to expand their customer base and increase revenue.

What challenges does the Instant Cameras And Accessories Industry face during its growth?

- Proliferation of smartphones and digital cameras is a key challenge affecting the industry growth. Instant cameras face competition from the increasing popularity of smartphones and digital cameras, which offer advanced features such as high-definition resolution, optical zoom capabilities, and superior performance in various lighting conditions. Apple iPhone and Samsung Galaxy S7 are prime examples of smartphones known for their exceptional picture and video quality. With the widespread availability of Internet connectivity, users can easily share their images on social media platforms. In emerging markets, the proliferation of high-end smartphones and digital cameras is expected to decrease the demand for instant cameras, thereby hindering the growth of the market during the forecast period.

- Despite the convenience and advanced features of smartphones and digital cameras, instant cameras continue to hold a niche market due to their unique appeal and the ability to provide instant physical prints. However, the market growth may be restrained by the declining demand for instant cameras in the face of the rising popularity of smartphones and digital cameras.

Exclusive Customer Landscape

The instant cameras and accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the instant cameras and accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, instant cameras and accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

C and A Marketing Inc. - The company offers instant photography solutions, providing the Next Generation 2 Starter Set and Gift Set, along with a range of frames. tographic experience while maintaining a sleek and modern aesthetic.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- C and A Marketing Inc

- Canon Inc.

- Eastman Kodak Co.

- Elite Brands Inc.

- FUJIFILM Corp.

- HassyPB

- HP Inc.

- Instant Box Camera

- Leica Camera AG

- Lomographische GmbH

- MiNT Camera

- Olympus Corp.

- RCP Handels GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Instant cameras and their accompanying accessories have experienced a resurgence in popularity in recent years, fueled by the analog revival and the desire for instant gratification in an increasingly digital world. This niche market caters to photography enthusiasts and casual photographers alike, offering a unique experience that sets it apart from traditional digital photography. The instant photography community is thriving, with numerous photography blogs and online forums dedicated to the art form. These platforms provide a space for users to share their experiences, offer camera comparisons, and discuss the latest trends in the market. Specialty cameras, such as Polaroid and Lomo models, continue to dominate the scene, with their distinctive designs and features appealing to both collectors and creatives.

Instant picture accessories play a crucial role in enhancing the overall experience of using an instant camera. Camera straps, flash attachments, and customizable cameras are popular choices, allowing users to personalize their devices and make them more functional. Film packs, available in various formats and colors, add to the creative possibilities, enabling AI photographers to experiment with different looks and styles. The instant prints market is also growing, with a variety of portable photo printers and printing services available to cater to the needs of both individuals and businesses. Smartphone photo printers have emerged as a convenient solution for those who want to print their mobile photography instantly.

Selfie cameras, with their built-in instant print capabilities, have also gained popularity, offering a fun and unique way to capture and share memories. The market for instant cameras and accessories is driven by several factors. The nostalgia factor, with its connection to vintage technology, is a significant draw for many consumers. Value for money, as instant photography offers a tangible, collectible product, is another key consideration. Image quality, customization options, and battery life are essential features that influence purchasing decisions. In the realm of event photography, instant cameras and prints have become a popular choice for capturing special moments and creating lasting memories.

Their ability to provide instant gratification and a unique aesthetic makes them an attractive alternative to digital photography. Instant photo frames, photo sharing platforms, and social media integration further enhance the overall experience, making instant photography a desirable choice for both personal and professional use. The market is a thriving niche that caters to a diverse range of photography enthusiasts. Its unique value proposition, driven by factors such as instant gratification, nostalgia, and customization, continues to fuel its growth. With a wide range of products and accessories available, this market offers endless possibilities for creative expression and memory-making.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 466.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, China, Japan, Canada, India, UK, Germany, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Instant Cameras And Accessories Market Research and Growth Report?

- CAGR of the Instant Cameras And Accessories industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the instant cameras and accessories market growth and forecasting

We can help! Our analysts can customize this instant cameras and accessories market research report to meet your requirements.