Automotive Grille Market Size 2024-2028

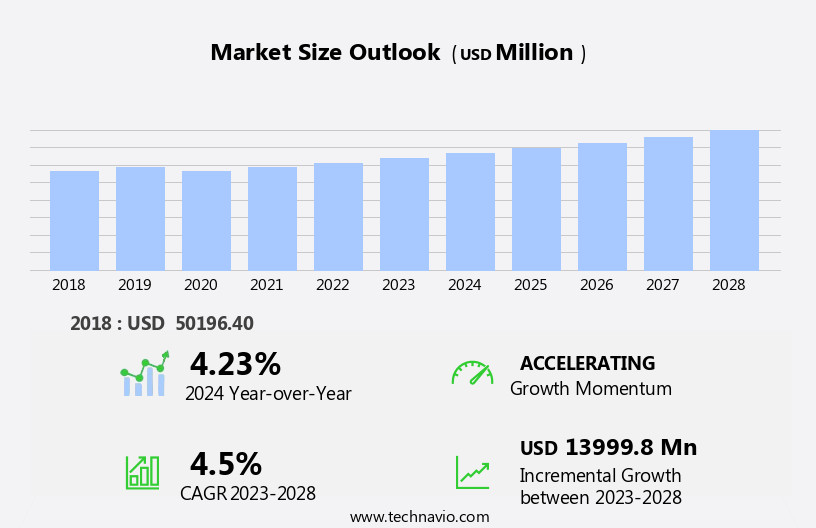

The automotive grille market size is forecast to increase by USD 14 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing sales of automobiles and the continuing trend towards electric vehicles. With the rise in automotive sales, the demand for grilles, as a crucial component of vehicle design and functionality, is also on the upswing. However, the market faces an emerging trend that challenges its growth: the availability of cars without grilles, particularly in the electric vehicle segment. This shift in consumer preference is influenced by the desire for aerodynamic designs and reduced drag, which can improve vehicle performance and efficiency. Companies in the market must adapt to this trend by focusing on innovative grille designs that balance aesthetics with functionality and efficiency.

- Moreover, they should explore opportunities in the electric vehicle market by offering grille solutions that cater to the unique design requirements of these vehicles. By staying abreast of these market dynamics and proactively addressing challenges, market players can capitalize on the growth opportunities in the market.

What will be the Size of the Automotive Grille Market during the forecast period?

- The market in the US is experiencing significant growth, driven by the increasing demand for thermal performance and protection in both light and heavy commercial vehicles and passenger cars. High-performance grilles made of materials such as stainless steel, aluminum, and plastics, including billet and mesh designs, are gaining popularity due to their ability to enhance cooling, fuel efficiency, and aerodynamic efficiency. Advanced technological features, such as semiconductor integration and the incorporation of headlights, are also driving market expansion. The market's size is substantial, with continued growth expected due to urbanization, the shift towards electric vehicles, and the need for cost-effective and easy-machine grille options.

- Vehicle production remains a key factor, with grilles essential for engine airflow and radiator protection, as well as enhancing vehicle aesthetics and incorporating advanced driver assistance systems. The market's direction is towards lighter, more efficient, and technologically advanced grille designs, with a focus on materials such as aluminum and CNC manufacturing techniques.

How is this Automotive Grille Industry segmented?

The automotive grille industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

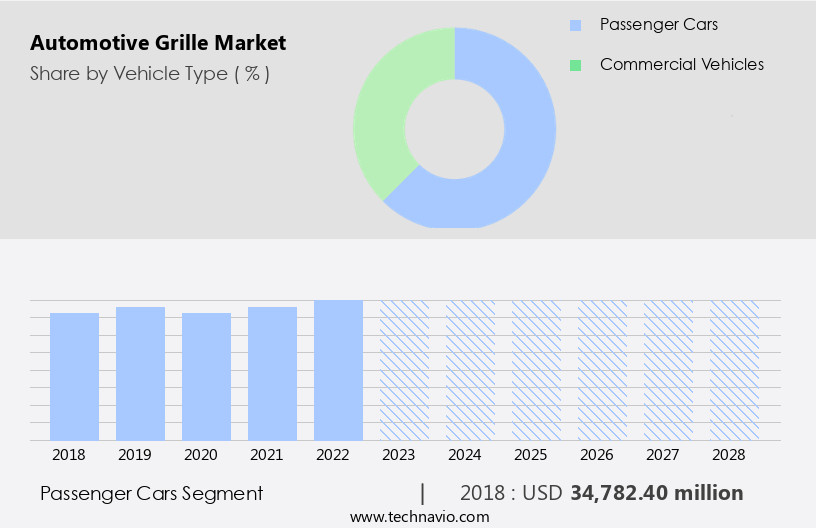

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable expansion, primarily driven by the increasing production of passenger cars. Both metallic and plastic grilles are currently in the growth phase, with plastic grilles gaining popularity due to their cost-effectiveness. However, high-end vehicles often feature metallic grilles, such as aluminum or stainless steel, to enhance their premium value. Advanced technological features, like active grille shutters, are also driving market growth. These components improve cooling and fuel efficiency by regulating airflow to the engine. Furthermore, the semiconductor shortage has led to increased focus on the manufacturing process, with lightweight materials like ABS plastics and CNC machining becoming more common.

Urbanization and the rise of electric vehicles have also influenced market trends. Plastic and mesh grilles are popular choices for electric vehicles due to their aerodynamic efficiency and ease of machining. Debris protection is a significant concern for heavy-duty vehicles and light commercial vehicles, leading to the adoption of raised steel mesh and other protective grille designs. Consumer preferences for customization and advanced driver assistance systems (ADAS) have opened up aftermarket opportunities. Companies like Zunsport offer custom grille designs, while grilles with thermal performance and carbon footprint considerations are gaining popularity. In , the market is expected to continue growing due to the increasing production of passenger cars, advancements in technology, and evolving consumer preferences.

Get a glance at the market report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 34.78 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

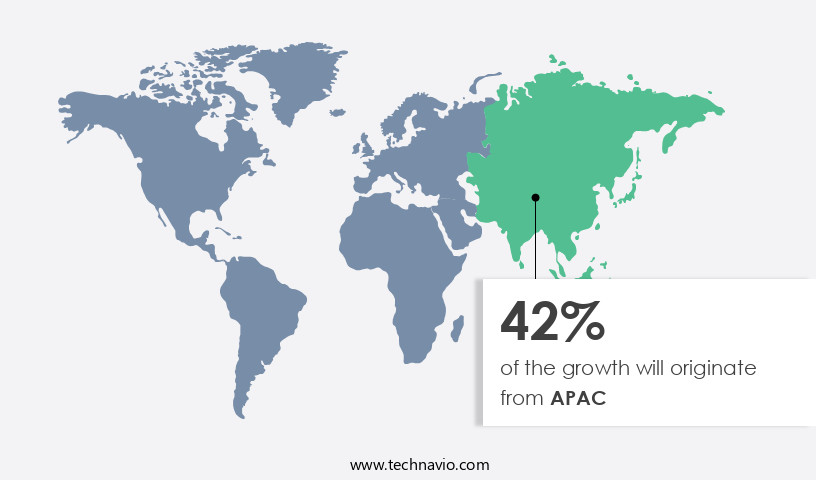

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. With increasing economic development and urbanization, there is a rising demand for vehicles in countries like China, Japan, and India. Major automotive original equipment manufacturers (OEMs) and suppliers are investing in the region, setting up research and development (R&D) and manufacturing facilities to meet this demand. While emissions norms in APAC are less stringent than in Europe, governments are implementing measures to reduce emissions. Automotive grilles play a crucial role in cooling the engine and ensuring fuel efficiency. They also offer debris protection and contribute to aerodynamic efficiency.

Advanced technological features, such as thermal performance, advanced driver assistance systems, and customization options, are driving consumer preferences. Lightweight materials, such as aluminum and stainless steel, are being used to reduce vehicle weight and improve fuel efficiency. Semiconductor shortages have affected the manufacturing process, but the market is expected to recover as supply chain issues are resolved. Electric vehicles (EVs) are gaining popularity due to their environmental sustainability and cost-effectiveness. Grilles for EVs have unique design requirements, such as mesh or billet automotive grilles for airflow and cooling. Light commercial vehicles and heavy-duty vehicles also require grilles for debris protection and engine compartment cooling.

The market for automotive grilles is expected to continue growing due to these factors and the increasing demand for vehicles in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Grille Industry?

- Increasing automotive sales is the key driver of the market.

- The market is driven by the increasing sales of automobiles, as automotive grilles are essential components used in nearly every vehicle. The demand for automobiles is growing in emerging economies such as Brazil, China, and India due to rising consumer purchasing power and significant economic growth. The industrialization and global trade activity in these countries, particularly in the BRIC region, have been .

- China, in particular, has maintained its position as the world's largest automotive market due to its massive fiscal stimulus packages in recent years. This trend is expected to continue, driving the growth of the market during the forecast period.

What are the market trends shaping the Automotive Grille Industry?

- Growing popularity of electric vehicles is the upcoming market trend.

- Electric vehicles, introduced in the 1990s, experienced limited popularity among consumers due to insufficient marketing and awareness. However, the situation has significantly changed in recent years. companies' increased marketing efforts and growing public consciousness about environmental benefits have fueled the demand for electric vehicles. Key advantages, such as reduced air and noise pollution, have played a pivotal role in their market penetration. For instance, Ford Motor Company provides comprehensive information on various electric vehicle models and technologies on its website.

- Government support, both for manufacturers and consumers, has further the adoption of electric vehicles. One of the most successful economic electric vehicles, Nissan LEAF, is equipped with a 24kWh battery, priced approximately at USD12,000. This cost is equivalent to a mid-segment internal combustion engine car. Overall, the electric vehicle market has witnessed substantial growth, offering a viable alternative to traditional gasoline-powered vehicles.

What challenges does the Automotive Grille Industry face during its growth?

- Availability of cars without grilles is a key challenge affecting the industry growth.

- The market faces challenges from the increasing production of vehicles without grilles. Electric vehicles, such as Tesla Model S and Tesla Model 3, do not require grilles since their cooling systems do not rely on traditional grille designs. Additionally, some internal combustion engine cars, like Porsche models with rear engines and rear-wheel-drive, only have air vents for engine cooling instead of grilles.

- These vehicles pose a significant obstacle to the market's growth, as the grille is a crucial component contributing to a vehicle's exterior aesthetics.

Exclusive Customer Landscape

The automotive grille market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive grille market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive grille market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aeroworks Performance - The company introduces an advanced front-end module for automotive applications, integrating numerous components and functions in a compact, aerodynamic design. This innovative solution enhances vehicle efficiency and performance, aligning with our commitment to technological innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeroworks Performance

- Batz Group

- Brainerd Industries Inc.

- COMPAGNIE PLASTIC OMNIUM SE

- Dorman Products Inc.

- DV8 Offroad

- FALTEC Co. Ltd.

- FF INDIA

- Hangzhou Yiyang Auto Parts Co. Ltd.

- HBPO GmbH

- Hyundai Mobis Co. Ltd.

- LACKS ENTERPRISES INC.

- Magna International Inc.

- Putco Inc.

- ROUSH ENTERPRISES INC.

- Sakae Riken Kogyo Co. Ltd.

- Samshin Chemical Co. Ltd.

- SRG Global Inc.

- Tata Sons Pvt. Ltd.

- Toyoda Gosei Co. Ltd.

- T-Rex Truck Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant component of the automobile manufacturing industry, playing a crucial role in the vehicle's cooling system and aesthetic appeal. The market is subject to various dynamics, including advancements in technology, consumer preferences, and industrialization. Cooling is a primary function of automotive grilles. They facilitate the intake of air for the engine and radiator, ensuring thermal performance and longevity. With the increasing popularity of electric vehicles, the grille's role in cooling the battery pack becomes essential. Fuel efficiency is another critical factor influencing grille design. The semiconductor shortage has led to a focus on lightweight materials, such as plastic and aluminum, for grille manufacturing.

These materials offer easy machining, making the manufacturing process more cost-effective and efficient. The market caters to various vehicle segments, including passenger cars, light commercial vehicles, and heavy-duty vehicles. Debris protection is a significant concern for heavy-duty vehicles, leading to the development of , raised steel mesh grilles. Advanced driver assistance systems (ADAS) and technological features are increasingly integrated into automotive grilles. These features enhance vehicle safety and improve aerodynamic efficiency. Urbanization and rising disposable incomes have led to a in customization trends, with consumers seeking unique grille designs. Customization options range from chrome plating and raised steel mesh to CNC-machined and mesh automotive grilles.

Sustainability is a growing concern in the automotive industry, with manufacturers focusing on reducing their carbon footprint. Lightweight materials and efficient manufacturing processes are essential in achieving this goal. The aftermarket opportunities in the market are substantial, with consumers seeking cost-effective alternatives to original equipment manufacturer (OEM) grilles. Abs plastics and stainless steel are popular materials for aftermarket grilles due to their durability and cost-effectiveness. The market is subject to various challenges, including the semiconductor shortage, supply chain disruptions, and increasing competition. Manufacturers must adapt to these challenges by focusing on innovation, cost reduction, and sustainability to remain competitive.

In , the market is a dynamic and evolving industry, influenced by various factors, including technology, consumer preferences, and industrialization. Manufacturers must focus on innovation, cost reduction, and sustainability to remain competitive and cater to the diverse needs of the automobile manufacturing industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 13999.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, Japan, India, US, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Grille Market Research and Growth Report?

- CAGR of the Automotive Grille industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive grille market growth of industry companies

We can help! Our analysts can customize this automotive grille market research report to meet your requirements.