Electric Vehicle Motor Market Size 2024-2028

The electric vehicle (EV) motor market size is forecast to increase by USD 80.27 billion at a CAGR of 50.22% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing sales of electric vehicles due to their fuel efficiency and environmental benefits. Rules and regulations, such as emissions norms, are pushing the adoption of EVs in urbanized areas. Subsidy programs and tax benefits offered by governments in various countries are further boosting the market. The market is segmented based on motor type, including AC induction motor and DC permanent magnet motor, and vehicle type, including passenger cars and commercial vehicles. Challenges include the lack of operational charging infrastructure in emerging markets and the dependence on rare earth metals for battery production.

- Additionally, the need for battery recycling and the development of cost-effective and efficient battery technologies are key trends in the market. The charging infrastructure and battery recycling are crucial for the widespread adoption of EVs and the growth of the market.

Electric Vehicle Motor Market Analysis

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Power Rating

- MPR

- HPR

- LPR

- Type

- AC motor

- DC motor

- Geography

- APAC

- China

- Europe

- Germany

- France

- Norway

- North America

- US

- South America

- Middle East and Africa

- APAC

By Power Rating Insights

The MPR segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to rules and regulations promoting the adoption of fuel-efficient vehicles and subsidy programs encouraging the shift towards EVs. Mid-power rating motors, such as MPR motors, remain popular choices for full or plug-in hybrid powertrains and low-range pure EVs, as demonstrated by their use in vehicles like the Nissan Leaf, Hyundai Sonata, Hyundai Ioniq Electric, Toyota Prius, and Chevrolet Volt. However, the market share of mid-power rating motors is expected to decline as demand for All Wheel Drive EVs (AWD EVs) increases. This trend is attributed to the growing preference for dual hybrid powertrains, which utilize low-power rating motors as secondary motors.

Additionally, concerns regarding the sourcing and recycling of rare earth metals used in EV motors and the development of charging infrastructure are key factors influencing market dynamics.

Get a glance at the market share of various segments Request Free Sample

The MPR segment accounted for USD 1.41 billion in 2018 and showed a gradual increase during the forecast period.

Will APAC become the largest contributor to the Electric Vehicle (Ev) Motor Market?

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the increasing popularity of EVs in countries such as China, Japan, India, Singapore, Thailand, and South Korea. Rules and regulations promoting the adoption of fuel-efficient vehicles, subsidy programs, and tax benefits for EV owners are key drivers for this market. China and Japan are currently leading the market, with China accounting for a substantial share due to its large EV sales volume. South Korea, India, and Hong Kong are also expected to be significant contributors to the market's growth during the forecast period. The increasing production and sales of EVs will result in higher demand for EV related parts, including batteries, power inverters, and motors.

Moreover, the development of charging infrastructure and initiatives for battery recycling and the use of rare earth metals in EV motors will further boost market growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Dynamics

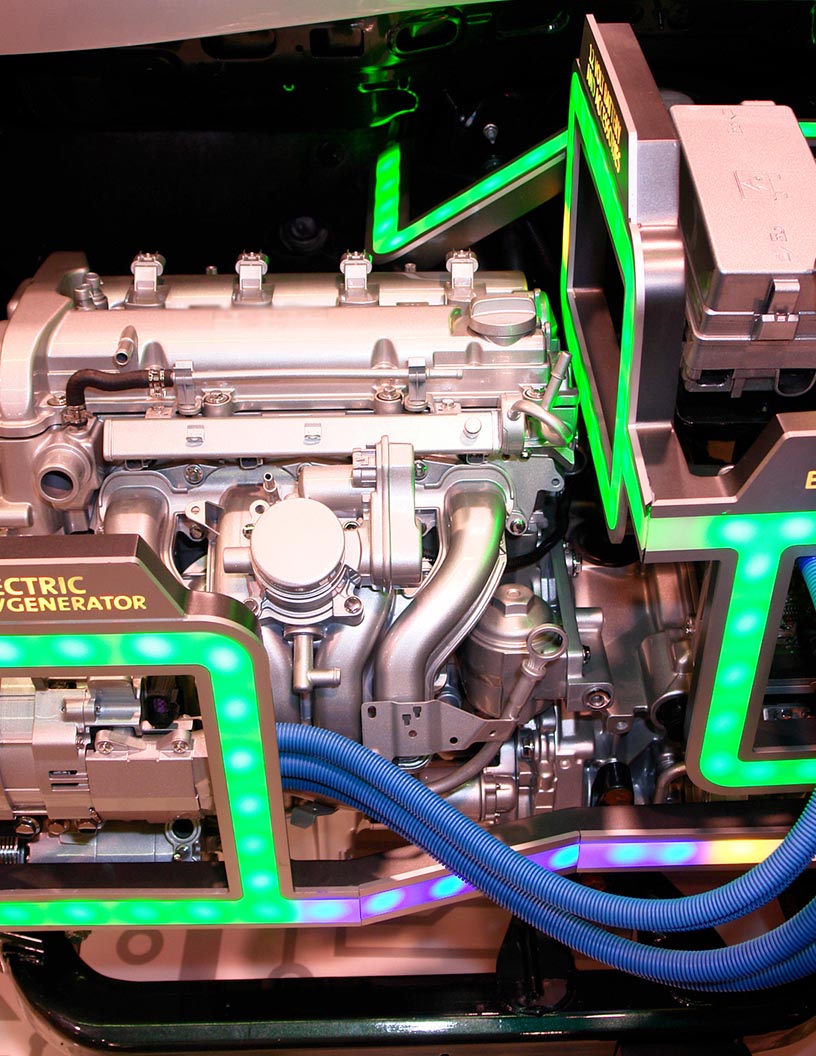

- The market is experiencing significant growth due to the increasing adoption of electric vehicles (EVs) by automakers as an alternative to traditional internal combustion engine vehicles. The shift towards clean mobility is driven by stringent emission regulations and fuel economy norms. The propulsion systems of EVs primarily use AC synchronous motors, which offer high torque and efficiency. Battery technologies play a crucial role in the EV motor industry, with ongoing advancements aimed at reducing battery costs and increasing charging speed. Automotive companies are investing massively in R&D to improve battery technologies and expand their EV offerings.

- Professional opinions and independent perspectives suggest that the EV market will continue to grow, with battery electric vehicles and plug-in hybrids leading the charge. Industry statements indicate that the EV motor industry will witness numerous strategies and expansions to cater to the growing demand for EVs. The tax exemptions and incentives offered by governments worldwide further boost the market's growth. The future of the EV motor industry looks promising, with the potential to revolutionize the automotive sector and reduce carbon emissions significantly.

What are the key market drivers leading to the rise in adoption of Electric Vehicle (Ev) Motor Market ?

Increasing sales of EVs is the key driver of the market.

- The market is experiencing significant growth due to various industry statements and strategies. Governments worldwide are taking initiatives to promote EV sales, recognizing their potential to reduce air pollution and greenhouse gas emissions. EVs offer numerous benefits, including the absence of harmful pollutants such as particulates, carbon monoxide, hydrocarbons, and volatile organic compounds. Factors driving demand for EVs include incentives and perks offered by governments, increased awareness to combat emissions, stringent carbon emission norms, and growing participation from domestic and international players. Additionally, the increasing popularity of hybrid vehicles and the rise in fuel prices further boost the market's expansion.

- Public fleets are also transitioning to EVs to meet regulatory requirements and reduce operational costs. Battery pack advancements and the integration of regenerative braking systems further enhance the appeal of EVs.

What are the trends shaping the Electric Vehicle (Ev) Motor Market?

Battery performance overview from logs is the upcoming trend in the market.

- The market is experiencing significant growth and industry statements indicate continued expansion. Strategies such as the integration of advanced torque vectoring systems and regenerative braking technology are driving innovation in EV designs. Battery packs are becoming more efficient, with longer ranges and faster charging capabilities. The public fleet sector is increasingly adopting EVs due to their environmental benefits and cost savings, particularly as fuel prices continue to rise.

- Shared EV mobility is also gaining traction, with taxi-sharing services and corporate fleet operators purchasing EVs in bulk to offer eco-friendly transportation options. For instance, Taxi Electric in Amsterdam offers this service, exempting companies from annual profit tax for the first year upon bulk purchase.These trends are shaping the future of the EV industry.

What challenges does Electric Vehicle (Ev) Motor Market face during the growth?

Lack of operational infrastructure in emerging markets is a key challenge affecting the market growth.

- The market is experiencing significant growth, driven by industry statements advocating for the reduction of carbon emissions and the increasing popularity of sustainable transportation solutions. Strategies for expanding the EV market include advancements in battery pack technology, which enhance torque and vehicle range, as well as the integration of regenerative braking systems.

- However, the lack of efficient charging infrastructure, particularly in emerging markets such as Africa, India, and Southeast Asian countries, poses a challenge to the industry's expansion. The absence of proper road infrastructure in these regions further complicates the wide-scale implementation of EV charging stations. Consequently, individuals and public fleet operators who utilize EVs for commercial purposes primarily confine their operations to major cities due to the limited availability of charging infrastructure in smaller urban areas.

- To mitigate this issue, governing bodies are implementing initiatives to establish charging stations in their respective regions, promoting the adoption of electric commercial vehicles (CVs). The fluctuating fuel prices also contribute to the growing interest in EVs, making them a cost-effective alternative to traditional internal combustion engine vehicles. In summary, the EV motor market is poised for growth, with advancements in battery technology and government initiatives driving expansion, despite the challenges posed by insufficient charging infrastructure in emerging markets.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Allied Motion Technologies Inc. - The company offers electric vehicle (EV) motors that includes the DDA and GTx series offering load-carrying capacity up to 907 kg (2000 lb).

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd

- AMETEK Inc.

- Continental AG

- DENSO Corp.

- e Gle Co. Ltd.

- ECOmove GmbH

- Ford Motor Co.

- GEM motors d.o.o

- Hitachi Ltd.

- Magna International Inc.

- Metric Mind Engineering

- Mitsubishi Electric Corp.

- Nidec Corp.

- Nissan Motor Co. Ltd.

- Robert Bosch GmbH

- Siemens AG

- Toshiba Corp.

- Valeo SA

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing adoption of electric vehicles (EVs) by automakers as an alternative to traditional internal combustion engine vehicles. Propulsion systems in EVs are primarily driven by AC synchronous motors, which convert electrical energy into mechanical torque. Battery technologies, such as lithium-ion, are a critical component of EVs, with charging speed and battery costs being key factors influencing market growth. Emission regulations have been a major driver for the EV market, with stringent emission norms and fuel economy regulations leading to massive investments in clean mobility. The automotive industry is responding with new product launches, capacity expansions, and joint ventures.

Battery packs, charging infrastructure, and regenerative braking are other key areas of focus. Urbanization and the need for fuel-efficient vehicles are also contributing to the growth of the market. Subsidies, incentives, tax benefits, and rules and regulations are playing a crucial role in the adoption of EVs by consumers and public fleets. The role of artificial intelligence (AI) in optimizing charging speed, battery management, and connected vehicle technology is also a significant trend. Battery recycling, rare earth metals, and the use of permanent magnets in motors are other important areas of research and development. Investors are closely watching the EV market for opportunities, with some countries implementing sanctions on countries producing rare earth metals, potentially impacting the supply chain.

The market is expected to continue growing, with EV sales projected to increase significantly in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 50.22% |

|

Market Growth 2024-2028 |

USD 80.27 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

36.1 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 52% |

|

Key countries |

China, US, Norway, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., Allied Motion Technologies Inc., AMETEK Inc., Continental AG, DENSO Corp., e Gle Co. Ltd., ECOmove GmbH, Ford Motor Co., GEM motors d.o.o, Hitachi Ltd., Magna International Inc., Metric Mind Engineering, Mitsubishi Electric Corp., Nidec Corp., Nissan Motor Co. Ltd., Robert Bosch GmbH, Siemens AG, Toshiba Corp., Valeo SA, and Volkswagen AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.

_motor_market_size_abstract_2024_v1.jpg)

_motor_market_segments_abstract_2024_v2.jpg)

_motor_market_regions_abstract_2023_geo_v2.jpg)

_motor_market_customer_landscape_abstract_2023_geo_v1.jpg)