Automotive NVH Materials Market Size 2024-2028

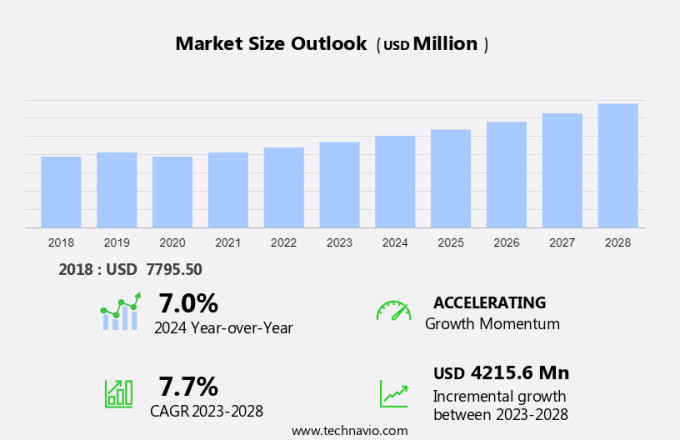

The automotive NVH materials market size is forecast to increase by USD 4.22 billion and is estimated to grow at a CAGR of 7.7% between 2023 and 2028. The automotive industry is experiencing significant growth, particularly in the passenger vehicle segment. This trend is driven by increasing disposable income and urbanization, leading to a rising demand for personal mobility solutions. In tandem with this growth, there is a heightened focus on reducing vehicle noise levels to meet stringent government regulations. One material that is gaining popularity for its noise reduction properties is polyurethane. As a versatile insulating material, polyurethane effectively absorbs sound waves, making it an ideal solution for noise reduction in automobiles. Furthermore, its use in various automotive applications, such as seating, roof linings, and engine compartment insulation, adds to its demand. Overall, the growing demand for passenger vehicles, increasing stringency of noise reduction regulations, and rising demand for polyurethanes are key trends shaping the automotive industry landscape.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is witnessing significant growth due to the increasing demand for fuel-efficient vehicles and lightweight vehicles. With a focus on reducing cabin sounds and enhancing comfort, automakers are using various materials for acoustic management, such as rubber, thermoplastic polymers, engineering resins, polypropylene, textile materials, fiberglass, and mixed textile fibers. These materials help in reducing NVH levels, ensuring passenger comfort, and improving vehicle durability. Battery-powered and hybrid vehicles are also driving the demand for NVH materials as they require specific materials for their unique powertrains. Safety measures are another crucial factor influencing the market, as automakers are using these materials to ensure passenger safety and comfort. Aftermarket services, replacement parts, repairs, and maintenance, and accessorization are other areas where NVH materials are in high demand. International trade plays a vital role in the market, with key players focusing on expanding their footprint in emerging markets. Overall, the market is expected to grow significantly in the coming years, driven by the increasing demand for fuel economy, comfort, and safety in vehicles. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Growing demand for passenger vehicles is notably driving market growth. The automotive industry is witnessing significant growth due to the increasing sales of passenger and light commercial vehicles (LCVs) globally. Consumers' preference for comfort is on the rise, leading to an increased demand for vehicles that offer superior ride quality and noise insulation.

Moreover, this trend is driving the market for NVH (Noise, Vibration, Harshness) materials in both passenger vehicles and LCVs. These play a crucial role in enhancing vehicle comfort and reducing cabin sounds, which are essential factors for consumers in their vehicle purchasing decisions. Fuel efficiency and environmental concerns are major influencers in the automotive industry, leading to the production of fuel-efficient vehicles, including battery-powered cars and hybrids. Traditional IC engines are also being optimized through the use of advanced fuel injection systems and turbochargers to improve fuel economy. Hence, such factors are driving the market during the forecast period.

Significant Market Trends

Growing emphasis on reduction of NVH levels is the key trend in the market. Modern automotive designs prioritize consumer preferences for vehicle comfort and reduced noise levels, in addition to powertrain efficiency and safety. NVH (Noise, Vibration, Harshness) materials have become increasingly significant in vehicle development, as consumers demand smoother, quieter rides. In the past, powertrain noise was of minimal concern.

However, today's consumers seek vehicles with minimal cabin sounds, especially in fuel-efficient, lightweight vehicles like battery-powered cars and hybrids, as well as luxury models. NVH control materials are essential for managing noise insulation, ride quality, and passenger comfort in various vehicle types, including sedans, passenger cars, and heavy commercial vehicles. These materials must possess chemical resistance, electrical resistance, high temperature resistance, and robust mechanical properties to meet the demands of the automotive industries. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Fluctuations in raw material prices is the major challenge that affects the growth of the market. The automotive industry's relentless pursuit of fuel efficiency and reduced CO2 emissions has led to the production of lightweight vehicles, including battery-powered cars and hybrids. NVH levels, or noise, vibration, and harshness, are critical factors in ensuring passenger comfort and safety measures in these vehicles. NVH materials, primarily made from polyurethane, PVC, polypropylene, and other compounds, play a crucial role in controlling these levels.

However, the volatile prices of crude oil, a primary raw material, pose a significant challenge to the market. This instability impacts the final cost of NVH materials, affecting both manufacturers' profit margins and the affordability of these materials for automakers. Additionally, crude oil price fluctuations impact the cost of raw materials like toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), essential for manufacturing polyurethane. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co: The company offers 3M Thinsulate Acoustic Insulation, that is a non-woven BMF material that fits naturally into early trends.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avon Group Manufacturing Ltd.

- BASF SE

- Borealis AG

- Borgers SE and Co. KGaA

- Celanese Corp.

- Covestro AG

- Dow Inc.

- Eagle Industries Inc.

- Eastman Chemical Co.

- Evonik Industries AG

- Exxon Mobil Corp.

- Henkel AG and Co. KGaA

- Huntsman Corp

- ITT Inc.

- Lanxess AG

- Material Sciences Corp.

- Mitsui Chemicals Inc.

- Nitto Denko Corp.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

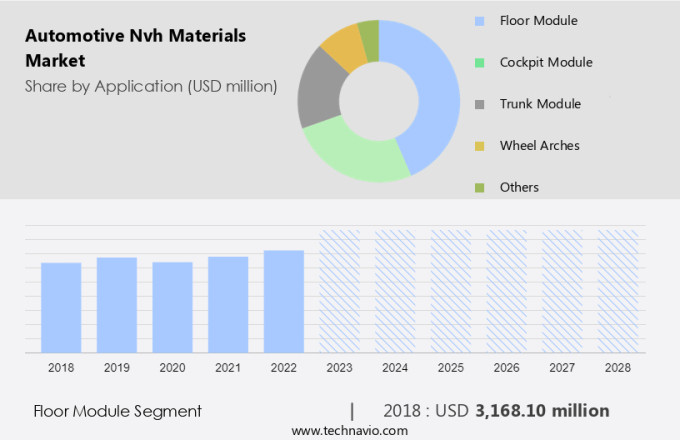

By Application

The floor module segment is estimated to witness significant growth during the forecast period. The automotive industry's focus on fuel efficiency and reduced CO2 emissions has led to the development and implementation of lightweight vehicles, including battery-powered cars and hybrids.

Get a glance at the market share of various regions Download the PDF Sample

The floor module segment was the largest segment and valued at USD 3.17 billion in 2018. NVH levels, or noise, vibration, and harshness, are crucial factors in ensuring passenger comfort and vehicle durability. NVH materials play a significant role in managing these factors, particularly in floor modules. These materials minimize the noise generated by IC engines and tire-road interaction, enhancing ride quality and passenger comfort. Hence, such factors are fuelling the growth of the market during the forecast period.

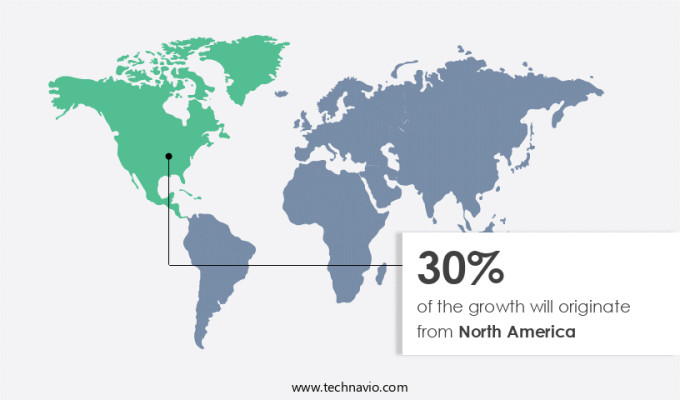

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Automotive NVH (Noise, Vibration, and Harshness) materials market caters to the demands of automobile manufacturers for customized solutions to enhance comfort, safety, and performance in passenger vehicles and light commercial vehicles. The market incorporates various materials such as foam laminates, molded rubber components, film laminates, engineering plastics, thermoplastic polymers, engineering resins, and synthetic rubber products. These materials play a crucial role in absorbing friction and providing damping to reduce noise and vibration. Foam laminates and molded rubber components are widely used for sound absorption and insulation. Hence, such factors are driving the market in North America during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application Outlook

- Floor module

- Cockpit module

- Trunk module

- Wheel arches

- Others

- Material Outlook

- Polyurethane

- Mixed textile fibers

- Fiberglass

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Automotive Cockpit Module Market: Automotive Cockpit Module Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, Germany, Japan, India - Size and Forecast

Automotive Floor Carpet Market: Automotive Floor Carpet Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Mexico, Japan, Germany - Size and Forecast

Timing Gear Market: Timing Gear Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, Canada, China, UK, Germany - Size and Forecast

Market Analyst Overview

The market is witnessing significant growth due to the increasing demand for fuel efficient vehicles and lightweight vehicles. With the rise of battery powered vehicles and hybrid vehicles, there is a growing need for effective NVH control materials to ensure ride quality and passenger comfort. These materials play a crucial role in reducing cabin sounds and improving overall vehicle durability. IC engines, traditional in automobiles, continue to face pressure to reduce CO2 emissions, leading to the development of advanced fuel injection systems and turbochargers. In response, automotive industries are turning to thermoplastic polymer materials for NVH control due to their chemical resistance, electrical resistance, and high temperature resistance. The market landscape depends on the Active noise control system, Battery powered light vehicles, Active noise reduction systems, International trade, Textile materials, and Mixed textile fiber. Safety measures and comfort measures are also key considerations in the automotive industry. NVH materials are essential for ensuring passenger comfort and reducing passenger discomfort caused by noise and vibration. In addition, aftermarket services, replacement parts, repairs, and maintenance, and accessorization are significant opportunities for growth in the NVH materials market. The market for NVH materials is diverse, encompassing passenger cars, luxury vehicles, and heavy commercial vehicles. The demand for these materials is driven by the need to improve ride quality, reduce cabin sounds, and enhance overall vehicle performance. As the automotive industry continues to evolve, the role of NVH materials in ensuring fuel economy, vehicle durability, and acoustic management will only become more critical.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2024-2028 |

USD 4.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.0 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 30% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Avon Group Manufacturing Ltd., BASF SE, Borealis AG, Borgers SE and Co. KGaA, Celanese Corp., Covestro AG, Dow Inc., Eagle Industries Inc., Eastman Chemical Co., Evonik Industries AG, Exxon Mobil Corp., Henkel AG and Co. KGaA, Huntsman Corp, ITT Inc., Lanxess AG, Material Sciences Corp., Mitsui Chemicals Inc., Nitto Denko Corp., and TotalEnergies SE |

|

Market dynamics |

Parent market analysis, market report, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies