Automotive Cockpit Module Market Size 2025-2029

The automotive cockpit module market size is forecast to increase by USD 28.3 billion at a CAGR of 6.5% between 2024 and 2029.

- The market is witnessing significant growth, driven by the adoption of advanced Human-Machine Interfaces (HMI) in mass-segment vehicles. This trend is expected to continue as consumers increasingly demand more intuitive and interactive in-car experiences. Another key driver is the maturing autonomous vehicles concept, which is leading to the development of more advanced and complex digital cockpits. However, the market also faces challenges, including the intricacies of designing and manufacturing these digital cockpits, which require a high degree of technical expertise and significant investment.

- Additionally, ensuring the safety and reliability of these systems, particularly as they become more integrated with autonomous driving technologies, is a significant challenge that must be addressed. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on developing innovative HMI solutions, investing in research and development, and collaborating with technology partners to address design complexities and ensure safety and reliability.

What will be the Size of the Automotive Cockpit Module Market during the forecast period?

- The market continues to evolve, with dynamic market activities unfolding across various sectors. Tier 1 suppliers are integrating advanced technologies such as automotive cybersecurity, natural language processing, and computer vision into cockpit systems. Luxury cars and premium vehicles are incorporating these innovations to enhance user experience and provide personalized cockpits. Mass market vehicles are also adopting multi-touch displays, gesture control, and voice recognition to offer connected services and improve functionality. Commercial vehicles and autonomous vehicles are leveraging connectivity solutions, fleet management, and real-time data analytics for enhanced safety and efficiency. Automotive design is focusing on integrating hardware design, sensor fusion, and machine learning to create digital cockpits that offer advanced features such as head-up displays, haptic feedback, and over-the-air updates.

- User research and user interface design are crucial in creating intuitive and user-friendly cockpit systems. The market is further witnessing the integration of artificial intelligence, deep learning, and 5G connectivity to enable advanced functional safety, autonomous driving, and vehicle security features. The ongoing development of embedded systems, hybrid vehicles, and electric vehicles is also driving the market forward. Vehicle safety and data privacy are key concerns, with ongoing efforts to ensure secure software development and system integration. The market is expected to continue its dynamic evolution, with ongoing advancements in automotive electronics, occupant monitoring systems, driver monitoring systems, and connected car technologies.

How is this Automotive Cockpit Module Industry segmented?

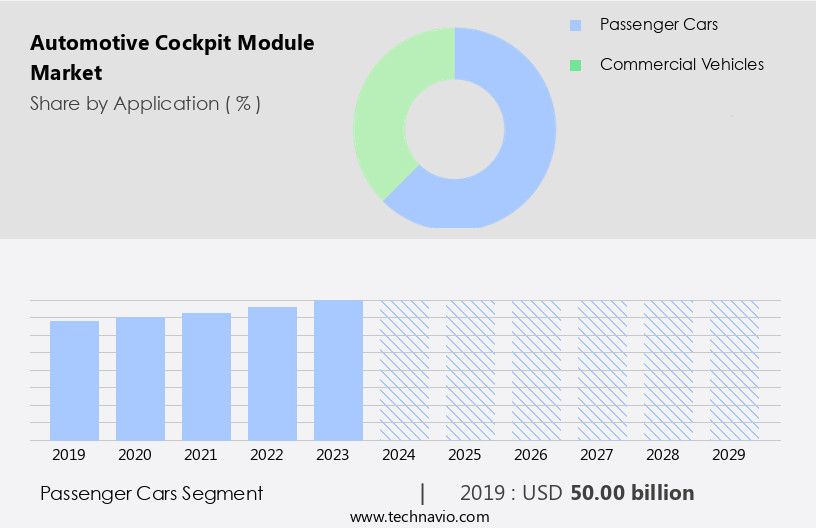

The automotive cockpit module industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- ICE

- Electric

- Hybrid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the passenger car segment due to its larger production and sales volume in the automotive industry. This market is driven by the increasing demand for safety and comfort features, as well as the focus of Original Equipment Manufacturers (OEMs) on product differentiation. Consumers' preference for cars equipped with the latest technologies, such as voice recognition, gesture control, and advanced driver assistance systems (ADAS), is further fueling market growth. Additionally, governments worldwide are mandating safety features like emergency call and stolen vehicle assistance systems, which are integrated into the cockpit module.

The market is also witnessing advancements in areas such as natural language processing, cloud-based services, computer vision, and machine learning, enhancing the user experience. Commercial vehicles and electric vehicles are also adopting these technologies, expanding the market's scope. The integration of 5G connectivity, haptic feedback, and personalized cockpit solutions is expected to further boost the market. Furthermore, the increasing focus on functional safety, data privacy, and system integration is shaping the future of the market.

The Passenger cars segment was valued at USD 50.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 29% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by the dominance of countries like China, Japan, and India as the world's largest automotive markets. APAC's appeal as a prime offshore location for automotive manufacturing is due to government incentives, low costs, and raw material advantages. Tier 1 suppliers in the region are intensely competing, utilizing advanced technologies and industry expertise to excel in the development of automotive cockpits, including instrument panels, instrument clusters, and electronic controls. Notable players in the region include Toyota Motor, Nissan Motor, Mazda Motor Corporation, Honda Motor Co., Ltd., and Hyundai Motor.

The market encompasses various innovations, such as natural language processing, cloud-based services, gesture control, multi-touch display, computer vision, and voice recognition, enhancing the user experience in mass market vehicles and luxury cars alike. Additionally, the integration of connectivity solutions, autonomous driving features, and vehicle safety systems is driving the market's evolution. The adoption of 5G connectivity, human-machine interface, and over-the-air updates is also transforming the automotive electronics landscape. Furthermore, machine learning, artificial intelligence, and sensor fusion are crucial elements in the development of advanced driver assistance systems (ADAS) and digital instrument clusters. The market's focus on functional safety, data privacy, and fleet management is ensuring the seamless integration of various systems, from infotainment systems to haptic feedback and head-up displays.

Electric vehicles and hybrid vehicles are also gaining traction, necessitating the development of charging solutions and software development for vehicle security and system integration. The market's emphasis on user research and personalized cockpit designs is further enhancing the overall driving experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Cockpit Module Industry?

- The integration of advanced Human-Machine Interfaces (HMI) in mass-segment vehicles is a significant market trend, serving as the primary driver for growth in this sector.

- The automotive cockpit market is experiencing significant growth due to the integration of advanced technologies, enhancing utility and comfort for vehicle drivers. Electrification is a key factor driving these technological advancements, with automotive component suppliers, such as Hyundai Mobis, introducing innovative cockpit displays. For instance, in 2024, Hyundai Mobis unveiled the M. VICS 5.0, an upgraded version of their original M. VICS display from 2021. This new display boasts a 27-inch, panoramic multi-screen setup that spans from pillar to pillar, offering drivers control over dashboard functions, navigation, and media content. Automotive cybersecurity, natural language processing, and cloud-based services are also transforming the cockpit experience.

- Luxury cars and mass market vehicles alike are incorporating connectivity solutions, such as gesture control and multi-touch displays, to create immersive and harmonious interiors. Additionally, commercial vehicles and autonomous vehicles are adopting these technologies to improve efficiency and safety. Computer vision and connectivity services are essential components of these advancements, enabling features like voice recognition and real-time traffic updates. In conclusion, the automotive cockpit market is witnessing substantial growth due to the integration of advanced technologies, including automation, cybersecurity, and connectivity solutions. These advancements are enhancing the driving experience for various vehicle segments, from luxury cars to commercial vehicles and autonomous vehicles.

- The integration of technologies like natural language processing, cloud-based services, gesture control, and multi-touch displays is creating immersive and harmonious interiors, making the future of automotive cockpits an exciting prospect.

What are the market trends shaping the Automotive Cockpit Module Industry?

- The maturation of the autonomous vehicles concept is an emerging market trend. This development signifies a significant shift towards advanced transportation solutions.

- The automotive industry is witnessing significant advancements in vehicle safety and user experience, driven by the integration of technology. Autonomous driving is a key focus area, with companies investing heavily in self-driving cars. Semi-autonomous features have gained acceptance in both passenger and commercial vehicles, and self-driving cars may become a reality within the forecast period. Automotive majors are at the forefront of achieving this goal, with a surge in the development and testing of Advanced Driver-Assistance Systems (ADAS) and telematics/connected vehicle applications and services.

- These advancements are facilitated by software updates, sensor fusion, big data analytics, voice recognition, and machine learning. Furthermore, 5G connectivity and user interface design enhancements are improving the connected car experience. Functional safety and user experience are prioritized, making the automotive cockpit module a crucial component of modern vehicles. These trends underscore the immense potential of the market.

What challenges does the Automotive Cockpit Module Industry face during its growth?

- The complexities inherent in designing digital cockpits pose a significant challenge to the growth of the industry. This intricate process involves integrating advanced technologies and ensuring user-friendly interfaces, which can be time-consuming and resource-intensive. Addressing these challenges requires a deep understanding of both avionics and human-computer interaction, as well as a commitment to continuous innovation and improvement.

- The automotive cockpit market is witnessing significant growth due to the increasing integration of advanced technologies in vehicles. Automotive cockpit modules have evolved from basic infotainment systems to digital displays, head-up displays, and virtual assistants. These advancements bring complexity to the design process, requiring suppliers to meet thermal and shape layouts, as well as various standards. Digital cockpit designs are a key trend in the automotive industry, offering features such as wireless charging, software development, and personalized user experiences. Deep learning technologies enable these systems to learn driver preferences and provide customized settings. Furthermore, system integration of vehicle security and automotive electronics is crucial for enhancing safety and convenience.

- Head-up displays project essential information directly onto the windshield, allowing drivers to keep their focus on the road. Virtual assistants, powered by artificial intelligence, can control various vehicle functions using voice commands. These innovations contribute to a more immersive and harmonious driving experience. Hardware design and user research play essential roles in creating effective automotive cockpit modules. The development of these systems requires a strong understanding of user needs and preferences, ensuring an intuitive and user-friendly interface. In conclusion, the automotive cockpit market is driven by the integration of advanced technologies, such as digital cockpits, head-up displays, and virtual assistants.

- The complexity of these systems necessitates stringent design requirements and a strong focus on user experience.

Exclusive Customer Landscape

The automotive cockpit module market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive cockpit module market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive cockpit module market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alps Alpine Co. Ltd. - This company specializes in advanced automotive cockpit modules, integrating cutting-edge technologies to enhance driving experiences. The system comprises driving environment recognition systems, vehicle dynamic control systems, collision safety systems, visibility support systems, cockpit information systems, and more. These components work synergistically to optimize vehicle performance, ensure safety, and provide drivers with real-time information. By leveraging innovative technologies, this solution elevates the driving experience and sets new industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alps Alpine Co. Ltd.

- DENSO Corp.

- Garmin Ltd.

- Grupo Antolin Irausa SA

- Hyundai Motor Co.

- Inteva Products LLC

- Lear Corp.

- LG Corp.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Samvardhana Motherson International Ltd.

- Schaeffler AG

- Stellantis NV

- TomTom NV

- Toyoda Gosei Co. Ltd.

- Visteon Corp.

- Yanfeng Automotive Interior Systems Co. Ltd.

- Yazaki Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Cockpit Module Market

- In February 2023, Magna International, a leading automotive supplier, announced the launch of its new advanced cockpit module, "iCockpit 3.0," featuring a 12.3-inch digital instrument cluster and a 15.6-inch infotainment touchscreen, aiming to enhance driver experience and connectivity (Magna International Press Release, 2023).

- In June 2024, Bosch and Continental, two major automotive technology companies, entered into a strategic partnership to jointly develop and produce advanced cockpit systems, combining Bosch's software expertise with Continental's hardware capabilities, aiming to offer integrated and customizable solutions for automakers (Bosch Press Release, 2024).

- In October 2024, Panasonic Corporation invested USD100 million in its new manufacturing facility in Gujarat, India, to produce automotive cockpit modules, aiming to cater to the growing demand for in-car technology and expand its market presence in Asia (Panasonic Corporation Press Release, 2024).

- In March 2025, the European Union announced new regulations requiring all new passenger cars to be equipped with advanced driver-assistance systems (ADAS) and digital cockpit modules by 2027, aiming to improve road safety and reduce carbon emissions (European Commission Press Release, 2025).

Research Analyst Overview

The market is witnessing significant advancements, driven by the integration of innovative technologies and functional safety standards. Virtual instrument panels are evolving into interactive displays, offering features such as cross traffic alerts, lane departure warning, and blind spot monitoring. Emergency braking and adaptive cruise control systems are becoming standard, ensuring vehicle safety. Infotainment services and connectivity protocols enable personalized settings, remote diagnostics, and real-time vehicle health monitoring. Data analytics and software architecture play a crucial role in predictive maintenance, augmented reality HUD, and driver fatigue detection. Functional safety standards, OTA updates, and cybersecurity protocols ensure secure and reliable vehicle operation.

The automotive industry is embracing autonomous driving features, integrating sensor technology and 3D graphics for enhanced user experience design. Navigation systems and human factors engineering optimize the driving experience, while cloud storage and vehicle personalization cater to individual preferences. Hardware integration and software validation are essential for seamless functionality, as intrusion detection and data encryption protect sensitive information. Rearview cameras and parking assistance systems provide convenience and enhance overall safety. The market continues to evolve, with ongoing advancements in sensor technology, connectivity, and data analytics shaping the future of the automotive industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Cockpit Module Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 28.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Cockpit Module Market Research and Growth Report?

- CAGR of the Automotive Cockpit Module industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive cockpit module market growth of industry companies

We can help! Our analysts can customize this automotive cockpit module market research report to meet your requirements.