Automotive Cockpit Module Market Size 2026-2030

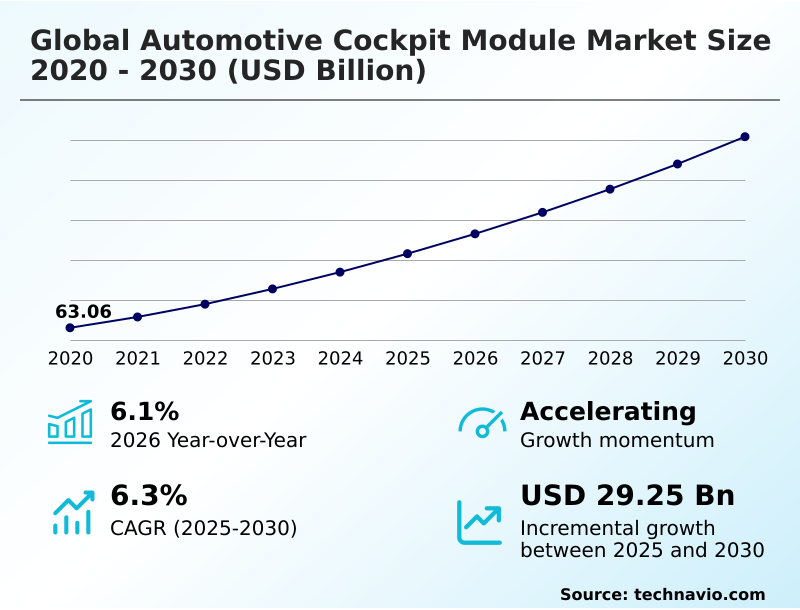

The automotive cockpit module market size is valued to increase by USD 29.25 billion, at a CAGR of 6.3% from 2025 to 2030. Imperative of integrating advanced driver assistance systems and autonomous driving capabilities will drive the automotive cockpit module market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 39.7% growth during the forecast period.

- By Application - Passenger cars segment was valued at USD 61.58 billion in 2024

- By Type - ICE segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 47.77 billion

- Market Future Opportunities: USD 29.25 billion

- CAGR from 2025 to 2030 : 6.3%

Market Summary

- The automotive cockpit module market is undergoing a profound transformation, moving from analog instruments to a sophisticated, integrated digital environment. This evolution redefines the driver-vehicle relationship, with the cockpit module now serving as the central nervous system of the automobile and a key brand differentiator.

- Growth is propelled by the integration of functionalities such as augmented reality head-up displays, large-format display panels, and intuitive voice assistants. The rise of electric and autonomous vehicles is a major catalyst, requiring the human-machine interface to adapt as the driver's role shifts from active operator to passive supervisor.

- This necessitates a more immersive and personalized cabin environment enabled by a powerful cockpit domain controller. For instance, a Tier-1 supplier must now master software integration and user experience design, a pivot from traditional hardware manufacturing, requiring strategic investments in talent and technology to manage the complexities of a real-time operating system alongside feature-rich infotainment platforms.

- This shift toward holistic, user-centric design, where hardware and software are developed in tandem, is fostering a new wave of innovation in more powerful and scalable cockpit solutions.

What will be the Size of the Automotive Cockpit Module Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Cockpit Module Market Segmented?

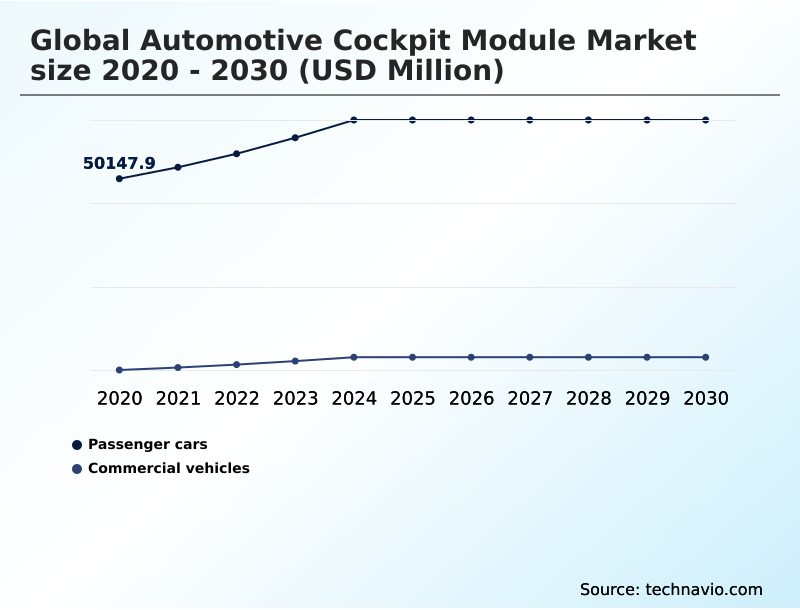

The automotive cockpit module industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- ICE

- Electric

- Hybrid

- Technology

- Digital cockpit

- Integrated cockpit

- Geography

- APAC

- China

- Japan

- India

- Europe

- UK

- Germany

- France

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of World (ROW)

- APAC

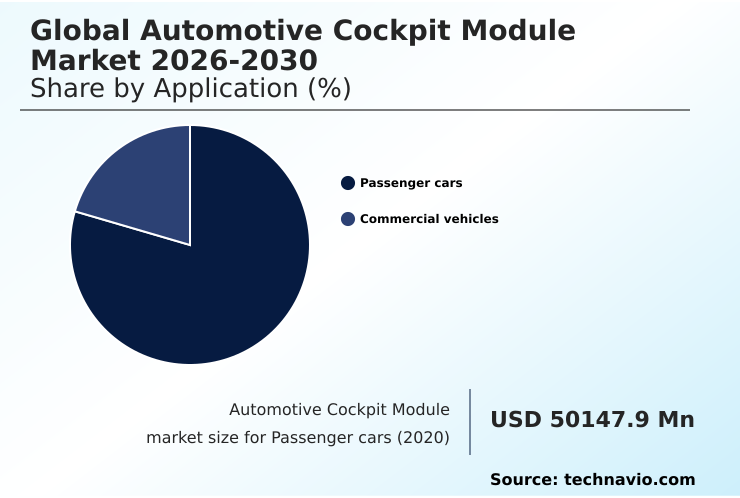

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The passenger cars segment is the principal arena for innovation, where the cockpit module has become a primary brand differentiator.

Design philosophy centers on a seamless human-machine interface, manifested through the integration of large, high-resolution display panels that combine the instrument cluster and central infotainment systems.

The push toward higher levels of vehicle autonomy directly influences design, requiring modules to effectively communicate critical data from advanced driver assistance systems. For example, augmented reality head-up displays can decrease driver cognitive load by over 15% in complex scenarios.

The transition to electric vehicles further reshapes requirements, with the cockpit domain controller now managing unique information such as battery state-of-charge, energy consumption, and proximity to charging infrastructure, demanding advanced system-on-a-chip solutions.

The Passenger cars segment was valued at USD 61.58 billion in 2024 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39.7% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Cockpit Module Market Demand is Rising in APAC Request Free Sample

The Asia-Pacific (APAC) automotive cockpit module market is the largest and most dynamic globally, accounting for 39.7% of the incremental growth.

This region is a complex tapestry of mature markets at the forefront of innovation and rapidly expanding markets where demand for technology-rich vehicles is surging, driving the adoption of digital cockpit systems.

A primary trend is the swift adoption of technologies driven by a tech-savvy consumer base expecting seamless connectivity and advanced human-machine interface (HMI) features.

Intense competition, particularly from agile domestic suppliers in China, accelerates the innovation cycle, making features like large passenger displays more accessible.

Automakers are integrating technologies such as natural language processing and advanced driver monitoring systems 30% faster than in other regions, strategically positioning themselves to lead in the new era of software-defined vehicles.

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The strategic direction of the market is heavily influenced by specific use cases and architectural choices. The evolution of the digital cockpit for electric vehicles, for instance, requires unique hvac controls in center stack designs and sophisticated cockpit module thermal management solutions to preserve battery life.

- Concurrently, the integrated cockpit domain controller architecture is becoming standard, relying on a real-time operating system with low latency to ensure functional safety in cockpit electronics. This centralization is essential for managing the over the air update architecture that defines the software defined vehicle user experience.

- Key technical hurdles include mastering the driver monitoring system implementation and ensuring robust in vehicle infotainment system security to counter threats. On the hardware front, large format oled display integration and the design of pillar to pillar screens are key differentiators.

- These trends are not isolated; achieving a seamless multi display cockpit system virtualization demands a deep understanding of automotive hmi design principles.

- For suppliers, aligning their adas integration in instrument cluster capabilities with robust cybersecurity for connected car cockpit protocols is now a baseline requirement, as planning cycles for these integrated systems are 20% more complex than for legacy distributed architectures.

- Even the digital cockpit platform for commercial vehicles is benefiting from smart vehicle architecture benefits, creating a more cohesive approach to user experience design for autonomy across all vehicle segments.

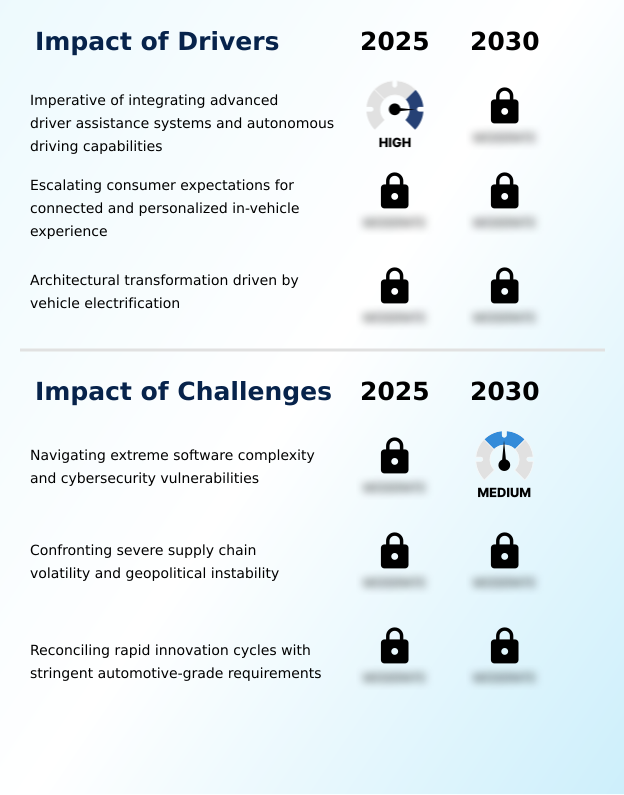

What are the key market drivers leading to the rise in the adoption of Automotive Cockpit Module Industry?

- The imperative to integrate advanced driver assistance systems and autonomous driving capabilities is a key driver for the market's growth.

- A dominant force is the escalation of consumer expectations for a deeply integrated, connected, and personalized in-vehicle experience. Conditioned by seamless smartphone interfaces, consumers now demand similar sophistication from their vehicles, viewing the automobile as a connected digital platform.

- The cockpit module is the central hub for this, managing ubiquitous connectivity through platforms like Apple CarPlay and Android Auto, which now have an adoption rate exceeding 80% in new vehicles.

- The demand for a rich multimedia environment with high-definition video and downloadable third-party apps necessitates cockpit modules with high-performance processors. Personalization is another critical facet, with modules managing multiple user profiles for a bespoke environment.

- Furthermore, the ability to deliver over-the-air (OTA) updates has become crucial, with some brands reporting a 50% increase in customer satisfaction for vehicles with this feature, transforming the car into an evolving platform.

What are the market trends shaping the Automotive Cockpit Module Industry?

- The ascendancy of immersive, large-format, and freeform displays is reshaping vehicle interiors. This trend moves beyond traditional dashboards toward expansive, digitally-centric glass cockpit aesthetics.

- A defining trend is the rapid adoption of large, high-resolution, and unconventional display formats, creating an expansive, seamless, and digitally-centric 'glass cockpit.' This design philosophy is heavily influenced by consumer electronics, compelling automakers to prioritize the visual and interactive quality of the cockpit HMI.

- The functional necessity is driven by the vast data from ADAS and infotainment systems, requiring a larger digital canvas. This is fueling a migration toward advanced solutions like OLED and MicroLED displays, which offer superior contrast and enable curved, freeform designs such as pillar-to-pillar screens.

- These advanced display technologies have been shown to improve information legibility by up to 25% in varied lighting conditions. The underlying cockpit module must possess formidable graphics processing capabilities and a sophisticated software architecture to manage multiple content streams securely, a challenge that is increasing development complexity by nearly 40%.

What challenges does the Automotive Cockpit Module Industry face during its growth?

- Navigating extreme software complexity and escalating cybersecurity vulnerabilities presents a key challenge affecting industry growth.

- The market faces a persistent challenge rooted in the fragility and volatility of its global supply chain, particularly for advanced semiconductors. Modern cockpit modules are semiconductor-intensive, relying on high-performance system-on-a-chip processors, memory, and display drivers. The manufacturing of these components is geographically concentrated, creating a systemic vulnerability.

- The recent global chip shortage highlighted this, with lead times for some critical components extending by over 50% and causing widespread production stoppages. This is exacerbated by competition from consumer electronics, which often operate on faster cycles. Compounding this are geopolitical instability and trade policy uncertainty, which introduce unpredictable costs and logistical hurdles.

- Efforts to regionalize supply chains are underway but are capital-intensive and long-term, with initial analyses suggesting a potential 15-25% increase in component costs in the short term, presenting a major impediment to stable growth.

Exclusive Technavio Analysis on Customer Landscape

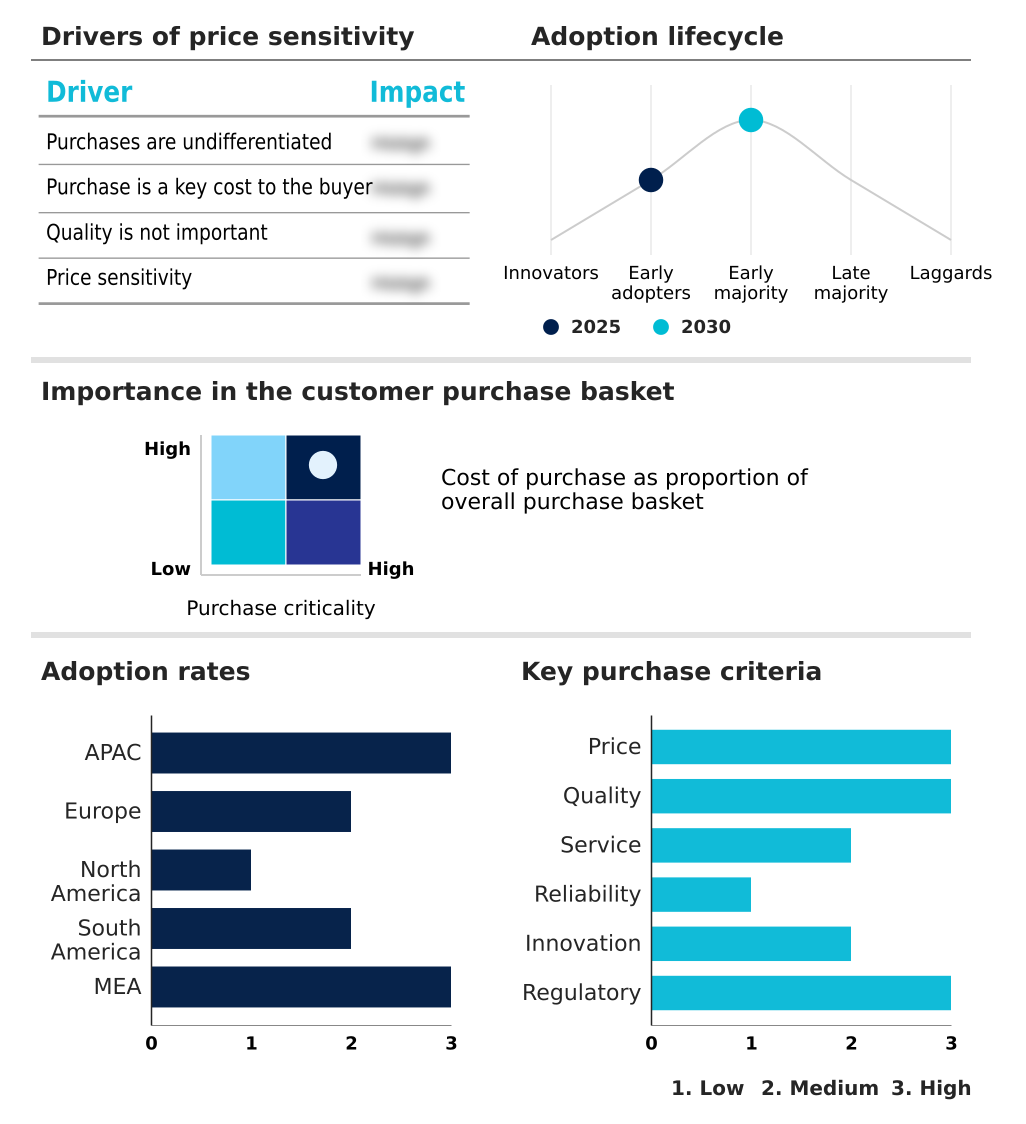

The automotive cockpit module market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive cockpit module market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Cockpit Module Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive cockpit module market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alps Alpine Co. Ltd. - Offerings include integrated human-machine interface systems and advanced electronic components, enabling sophisticated infotainment, display, and connectivity solutions for modern vehicle interiors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alps Alpine Co. Ltd.

- Aptiv Plc

- Continental AG

- DENSO Corp.

- Forvia SE

- Garmin Ltd.

- Grupo Antolin Irausa SA

- Inteva Products LLC

- Lear Corp.

- LG Electronics Inc.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

- Motherson Group

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Toyoda Gosei Co. Ltd.

- Visteon Corp.

- Yanfeng

- Yazaki Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive cockpit module market

- In March 2025, Geely initiated a major consolidation of its in-house R&D teams to accelerate the development of next-generation digital cockpit systems with a focus on large, unified screen architectures.

- In March 2025, ECARX announced a strategic plan to provide advanced digital cockpit solutions, including voice recognition and navigation services, for vehicles produced by Volkswagen Brazil.

- In January 2025, Suzuki announced its selection of the Qt software platform to design and power the digital cockpits for its upcoming portfolio of mainstream electric vehicles.

- In January 2025, BlackBerry QNX unveiled a fully virtualized digital cockpit system, providing a framework for consolidating multiple in-vehicle systems with different operating systems onto a single hardware platform.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Cockpit Module Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 300 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 6.3% |

| Market growth 2026-2030 | USD 29248.5 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 6.1% |

| Key countries | China, Japan, India, South Korea, Australia, Indonesia, UK, Germany, France, Italy, The Netherlands, Spain, US, Canada, Mexico, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa, Israel and Turkey |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is defined by a fundamental transformation away from simple interfaces toward a sophisticated human-machine interface that serves as the epicenter of vehicle intelligence. This evolution mandates significant advancements in processing power and sensor fusion capabilities, driving demand for larger, higher-resolution, and fully configurable digital instrument clusters and central information displays.

- The architectural shift to a centralized cockpit domain controller, integrating the instrument cluster, infotainment systems, and heads-up display onto a single, powerful system-on-a-chip, has become a foundational pillar of growth.

- This consolidation, which can reduce the number of electronic control units by over 60% in some premium vehicles, enables a more holistic user experience essential for managing advanced driver assistance systems. Consequently, the graphical processing capabilities and software architectures, often managed by a real-time operating system, are becoming substantially more complex.

- Boardroom decisions now center on securing the supply of advanced display panels and managing the cybersecurity risks associated with over-the-air updates. The integration of driver monitoring systems, telematics control units, and augmented reality head-up displays within the instrument panel carrier is no longer optional but a critical component for achieving higher levels of driving automation and ensuring functional safety.

What are the Key Data Covered in this Automotive Cockpit Module Market Research and Growth Report?

-

What is the expected growth of the Automotive Cockpit Module Market between 2026 and 2030?

-

USD 29.25 billion, at a CAGR of 6.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Passenger cars, and Commercial vehicles), Type (ICE, Electric, and Hybrid), Technology (Digital cockpit, and Integrated cockpit) and Geography (APAC, Europe, North America, South America, Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Imperative of integrating advanced driver assistance systems and autonomous driving capabilities, Navigating extreme software complexity and cybersecurity vulnerabilities

-

-

Who are the major players in the Automotive Cockpit Module Market?

-

Alps Alpine Co. Ltd., Aptiv Plc, Continental AG, DENSO Corp., Forvia SE, Garmin Ltd., Grupo Antolin Irausa SA, Inteva Products LLC, Lear Corp., LG Electronics Inc., Magna International Inc., Marelli Holdings Co. Ltd., Motherson Group, Panasonic Holdings Corp., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Toyoda Gosei Co. Ltd., Visteon Corp., Yanfeng and Yazaki Corp.

-

Market Research Insights

- The market is shaped by the architectural transition to a software-defined vehicle, where smart vehicle architecture and advanced cockpit software platforms are paramount. The adoption of multi-display cockpit systems, enabled by virtualization technology and a secure hypervisor, allows automakers to reduce development cycles for new features by up to 40%.

- This shift toward integrated interior systems and electronic control modules is driven by the need for superior user experience design and adherence to functional safety standards like ISO 26262. Digital cockpit platforms facilitate deep integration of sensor fusion and computer vision, while effective thermal management addresses the challenges of high-performance processors.

- As a result, in-vehicle display solutions are becoming more sophisticated, with some seating integrated cockpit systems now offering personalization features that improve user retention by over 25%, demonstrating the critical role of cockpit components in modern automotive strategy.

We can help! Our analysts can customize this automotive cockpit module market research report to meet your requirements.