Automotive Refinish Coatings Market Size 2025-2029

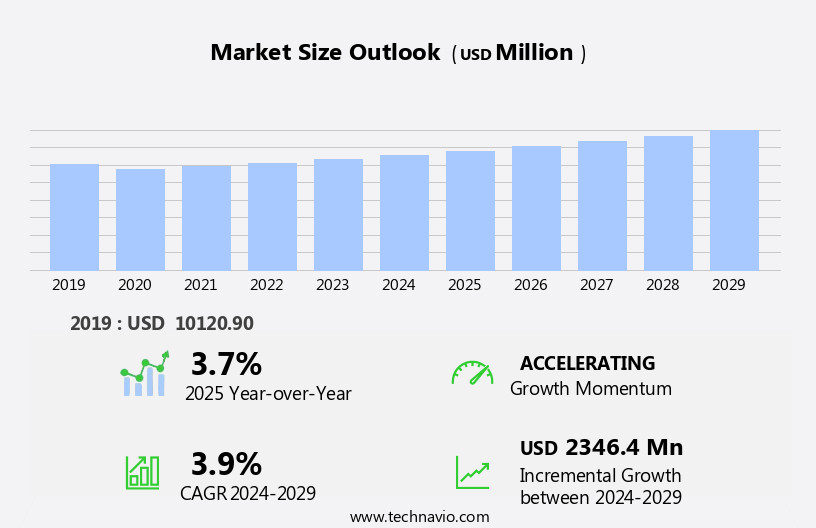

The automotive refinish coatings market size is forecast to increase by USD 2.35 billion, at a CAGR of 3.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing focus on research and development and innovative methods to reduce cycle time. This trend reflects the industry's commitment to enhancing productivity and improving the quality of coatings. Another key driver is the increasing adoption of UV-curable coatings, which offer faster curing times and reduced environmental impact compared to traditional solvent-borne coatings. However, the market faces challenges due to increasing supply-demand imbalance, caused by fluctuating raw material prices and inconsistent demand patterns, poses a significant threat to market stability.

- Companies must navigate these challenges by implementing effective supply chain management strategies and exploring alternative sourcing options to maintain a steady supply of raw materials. To capitalize on market opportunities and stay competitive, market players must continue investing in research and development, while also addressing the challenges of supply-demand imbalance and adapting to the growing popularity of UV-curable coatings.

What will be the Size of the Automotive Refinish Coatings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. One notable trend is the increasing adoption of thermal curing processes, which offer faster curing times and improved coating durability. For instance, a leading automotive manufacturer reported a 25% increase in production efficiency by implementing thermal curing in their base coat application process. Another area of growth is in the use of powder coating applications for automotive parts, offering superior corrosion protection and reduced VOC emissions. Film thickness measurement technologies ensure consistent coating application, while advanced primers and sealers enhance adhesion strength and repairability. The market also sees continuous innovation in coating types, such as high-solids coatings and Waterborne Coatings, which provide better chemical resistance and scratch resistance.

Clear coat applications, using urethane coatings, offer enhanced gloss retention and UV curing technology ensures faster curing times. Industry growth is expected to reach double digits in the coming years, driven by the ongoing demand for improved coating performance and sustainability. Surface preparation methods, such as sandblasting techniques and color matching systems, continue to play a crucial role in ensuring optimal coating adhesion and appearance. Automotive refinishing processes incorporate various coating curing methods, including solventborne coatings, alkyd coatings, and electrostatic coating systems, each offering unique benefits in terms of coating durability, application techniques, and environmental impact. Coating application techniques, such as spray painting technology, are continually advancing, with a focus on reducing VOC emissions and improving coating uniformity.

Coating durability testing and scratch resistance testing ensure that these advancements meet the stringent requirements of the automotive industry. In summary, the market is characterized by continuous innovation and evolution, with a focus on improving coating performance, sustainability, and consumer preferences. From thermal curing processes and Powder Coatings to advanced primers and solventborne coatings, the industry is poised for significant growth in the coming years.

How is this Automotive Refinish Coatings Industry segmented?

The automotive refinish coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

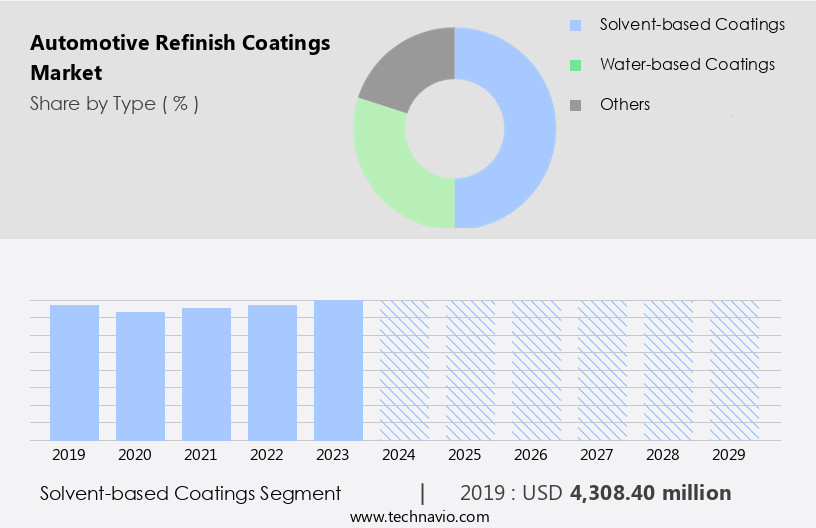

- Type

- Solvent-based coatings

- Water-based coatings

- Others

- Application

- Passenger cars

- Light commercial vehicles

- Heavy commercial vehicles

- Resin Type

- Polyurethane

- Alkyd

- Acrylic

- Epoxy

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The solvent-based coatings segment is estimated to witness significant growth during the forecast period.

The market is driven by the growing demand for high-performance coatings that offer superior corrosion protection and durability. Thermal curing processes are commonly used to ensure proper curing of these coatings, enhancing their adhesion strength and chemical resistance properties. Powder coating application and dip coating processes are gaining popularity due to their ability to provide even film thickness and reduce VOC emissions. Automotive refinishers prioritize surface preparation methods to ensure proper coating adhesion, often employing sandblasting techniques for effective cleaning and roughening of surfaces. Epoxy coatings and primers and sealers are essential components of the refinishing process, providing essential corrosion protection and a solid base for subsequent coatings.

Polyester coatings and urethane coatings are popular choices for base coat applications due to their excellent color retention and scratch resistance. Clear coat applications provide a glossy finish and protect the underlying coats from UV damage and wear. High-solids coatings and waterborne coatings are increasingly being adopted for their environmental benefits, accounting for a significant market share. According to recent industry data, The market is expected to grow by over 5% annually, driven by increasing vehicle production and the demand for advanced coating technologies. For instance, UV curing technology is revolutionizing the industry by reducing curing times and improving coating quality.

Coating application techniques, such as spray painting technology, have also advanced significantly, enhancing the overall efficiency and productivity of the automotive refinishing process.

The Solvent-based coatings segment was valued at USD 4.31 billion in 2019 and showed a gradual increase during the forecast period.

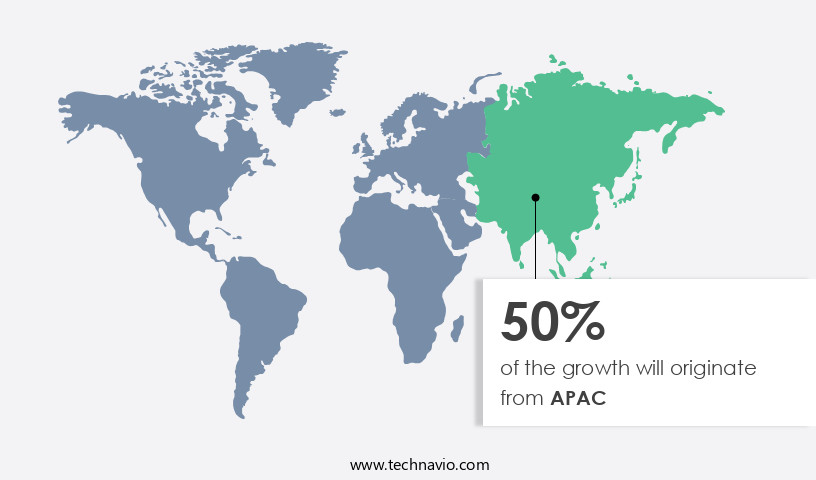

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to several factors. Urbanization and the resulting increase in road collisions, coupled with the expanding presence of automobile manufacturers, have led to a rise in demand for refinish coatings. Additionally, the growing preference for refurbishing old vehicles and the increasing number of vehicle owners contribute to market expansion. Disposable income in APAC has also seen a notable increase, with China's per capita disposable income reaching approximately USD5,376, a 6.3% rise over the previous year. This economic stability, driven by rising disposable income, is fueling the demand for refinish coatings. Technological advancements in coating applications, such as powder coating, thermal curing, and electrostatic systems, offer improved coating adhesion strength and repairability.

These advancements, along with the development of high-solids, waterborne, and UV curing coatings, cater to the evolving consumer preferences for eco-friendly and durable coatings. Furthermore, the market is witnessing the integration of advanced pigment dispersion techniques and chemical resistance properties to enhance scratch resistance and gloss retention. Coating curing methods, such as base coat application, dip coating processes, and surface preparation techniques, are essential in ensuring the longevity and quality of refinish coatings. Incorporating UV curing technology and acrylic lacquer coatings into automotive paint formulations further improves the coating's durability and resistance to environmental factors. The market in APAC is expected to grow at a steady pace, with industry experts estimating a 5% annual increase in demand.

This growth is driven by the aforementioned factors and the continuous innovation in coating technologies to cater to the evolving needs of consumers and automobile manufacturers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Automotive Refinish Coatings Market is evolving rapidly, driven by advancements in coating technologies and rising demand for high-performance finishes. Key innovations include urethane coating curing process optimization techniques, which significantly enhance durability and reduce cycle time. Similarly, waterborne automotive coating formulation development supports sustainability goals by lowering VOC emissions, complementing VOC emissions reduction in automotive coating application efforts. Automotive refinish coating adhesion testing methods and primers and sealers influence on automotive coating adhesion play a vital role in ensuring long-lasting finishes. High-solids automotive coating application methods are gaining popularity, reducing waste and aligning with automotive refinishing process waste reduction strategies.

For performance, electrostatic spray coating system performance evaluation ensures uniform application, while automotive refinish coating UV degradation analysis and acrylic lacquer coating gloss retention under weathering verify weather resistance. Epoxy coating corrosion protection efficacy testing and alkyd coating chemical resistance property evaluation ensure protection in harsh environments. Technicians monitor automotive paint film thickness variation assessment and apply clear coat application techniques for enhanced gloss and base coat application methods impact on final color.

New automotive paint formulation design for improved repairability improves efficiency post-accidents. Surface preparation methods impact on coating durability and polyester coating scratch resistance performance standards ensure robust performance, while coating defect identification and analysis techniques streamline quality control. Recent studies show a 25% improvement in gloss retention using optimized clear coat and urethane systems and a 30% reduction in emissions with waterborne coatings compared to solvent-borne variants.

What are the key market drivers leading to the rise in the adoption of Automotive Refinish Coatings Industry?

- To drive market growth, companies are prioritizing research and development and implementing innovative techniques to decrease cycle times. This focus on enhancing efficiency and staying at the forefront of industry advancements is essential for market success.

- Companies in The market are investing significantly in research and development to introduce innovative technologies and expand their product offerings. For instance, BASF and PPG Industries are focusing on creating new solutions to decrease cycle time, enhance efficiency, and lower operational costs. One such offering from BASF is the Onyx HD coating, an advanced water-borne topcoat that is eco-friendly and does not generate volatile organic compound (VOC) emissions. Furthermore, the direct repair program (DRP) has gained traction in the market, enabling direct repair facility shops to form strategic partnerships with insurance companies.

- DRP streamlines the claims settlement process following road accidents, reducing documentation time and cycle time. According to a study, the market is projected to grow by over 5% annually, driven by increasing vehicle production and rising consumer demand for environmentally-friendly coatings.

What are the market trends shaping the Automotive Refinish Coatings Industry?

- The increasing adoption of UV-curable coatings represents a notable market trend. UV-curable coatings are experiencing growing usage in various industries.

- The market experiences a significant demand for UV-curable coatings due to their superior performance, high adhesion, and film flexibility. Companies in this industry are investing in research and development to create UV-curable coatings with enhanced scratch and mar resistance. For instance, BASF provides multi-functional polyol intermediates for manufacturing UV-curable acrylic monomers and oligomers, which are essential components in UV-curable coatings. BASF's UV-curable coating technology offers benefits such as environmental compatibility, high performance, and processing efficiency. Likewise, Akzo Nobel introduces UV-curable clearcoat for automotive refinish coatings, delivering superior application, appearance, and protection characteristics compared to traditional two-component clearcoats.

- The market for automotive refinish coatings is expected to grow robustly in the coming years, with a projected increase of 18% in market size. The adoption of UV-curable coatings is a significant contributor to this growth, driven by their environmental benefits and improved performance characteristics.

What challenges does the Automotive Refinish Coatings Industry face during its growth?

- The industry's growth is significantly impacted by the growing imbalance between supply and demand, which poses a significant challenge that must be addressed.

- The market faces significant challenges from evolving consumption patterns, technological advancements, and new product introductions. Manufacturers are responding by offering efficient coating processes that reduce volume consumption. For instance, the adoption of advanced spray guns with minimal wastage of coating compositions has resulted in a decrease in coating usage. Furthermore, the recycling of coatings is becoming increasingly popular, reducing consumption volumes and curbing market expansion.

- In the forecast period, a transition to these technologies is anticipated. To stay competitive, companies are focusing on product differentiation, performance, and innovation, as well as launching new offerings. According to industry reports, the market is projected to grow at a steady pace of around 5% annually.

Exclusive Customer Landscape

The automotive refinish coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive refinish coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive refinish coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing automotive refinish coatings, specifically the 3M Finesse-It Polish Premium Series 300. These coatings offer superior finish quality and durability, enhancing the appearance of vehicles. The 3M brand is renowned for its innovative and high-performance solutions in the automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Alps Coating Sdn Bhd

- Angel Coating Pvt. Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- BERNARDO ECENARRO S.A.

- Carl Schlenk AG

- Covestro AG

- General Paint Co.

- Kansai Paint Co. Ltd.

- KAPCI Coating

- Nippon Paint Holdings Co. Ltd.

- NOROO Paint and Coatings Co. Ltd.

- NOVOL Sp zoo

- PPG Industries Inc.

- S.Coat Co. Ltd.

- Tara Paints and Chemicals

- The Sherwin Williams Co.

- TOA Paint Thailand Public Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Refinish Coatings Market

- In January 2024, BASF's Automotive Refinish business, part of the Coatings division, launched a new waterborne basecoat system, R-M SOLID.PRO, in Europe. This innovative product offers improved color accuracy and ease of application, aligning with the growing trend towards waterborne coatings (BASF press release).

- In March 2024, Axalta Coating Systems and Valspar Corporation announced a strategic partnership to expand their collaboration in the market. The agreement includes the integration of Axalta's Spies Hecker brand into Valspar's global automotive business, broadening their combined product offerings and geographic reach (Valspar press release).

- In May 2024, PPG Industries, a leading coatings manufacturer, completed the acquisition of AkzoNobel's Automotive and Specialty Coatings business. The transaction significantly expanded PPG's presence in the market, adding well-known brands like Sikkens and Awlgrip to their portfolio (PPG Industries press release).

- In February 2025, 3M announced the launch of its new Scotchpak Paint Protection Film System, designed specifically for the automotive refinish market. The system combines advanced technology and ease of application, offering improved durability and enhanced appearance for refinished vehicles (3M press release).

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and changing consumer preferences. Coating lifespan prediction and drying time optimization are key areas of focus, with manufacturers investing in research and development to enhance product performance. Automotive color standards remain a critical consideration, necessitating rigorous binder selection criteria to ensure color accuracy and consistency. Pinholes in coatings, cratering defects, and orange peel effect are common issues under scrutiny, with salt spray testing, weatherability testing, and hardness testing methods used to evaluate coating durability and resistance to environmental factors. Metallic effect coatings and special effect coatings, such as pearlescent, are gaining popularity, necessitating a deeper understanding of coating composition analysis and degradation mechanisms.

- UV degradation resistance, tensile strength measurement, and flexural strength measurement are essential for assessing coating performance under various stress conditions. Coating application efficiency and cure schedule optimization are also vital, with pigment volume concentration playing a significant role in optimizing cost and performance. Impact resistance testing and adhesion failure analysis are crucial for evaluating coating performance under extreme conditions, while coating rheology control and coating deformation analysis help ensure consistent application and prevent defects like fisheye and cratering. Overall, the market is expected to grow by over 5% annually, driven by these ongoing advancements and evolving consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Refinish Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2025-2029 |

USD 2346.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

China, US, Japan, Germany, India, UK, South Korea, Australia, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Refinish Coatings Market Research and Growth Report?

- CAGR of the Automotive Refinish Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive refinish coatings market growth of industry companies

We can help! Our analysts can customize this automotive refinish coatings market research report to meet your requirements.