Automotive Seats Market Size 2024-2028

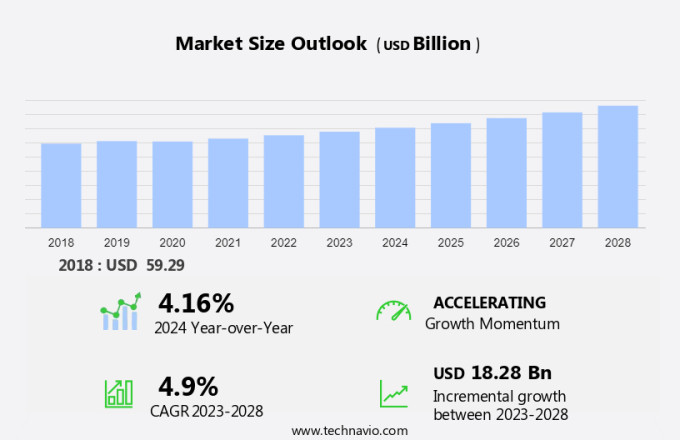

The automotive seats market size is forecast to increase by USD 18.28 billion at a CAGR of 4.9% between 2023 and 2028.

- The market is experiencing significant growth due to the rising demand for lightweight seats in electric vehicles (EVs). This trend is being driven by the increasing adoption of EVs and the need to reduce vehicle weight to improve battery life and overall efficiency. Additionally, technological advancements in automotive smart seats are also fueling market growth. These seats offer features such as heating, cooling, and massage functions, making them a desirable addition to modern vehicles. n. The ease of auto financing and the growth of e-commerce and construction sectors are further fueling the demand for commercial vehicles. However, raw material price volatility for automotive seat manufacturing poses a challenge to market growth. Producers must carefully manage costs to maintain profitability and competitiveness In the market.

What will be the Size of the Automotive Seats Market During the Forecast Period?

- The market is a significant segment in the global automotive industry, driven by safety regulations and industry standards that prioritize comfort and functionality. Advanced features, such as climate-controlled seat technology and powered seats, have become luxurious additions in both mass-market and luxurious vehicles. Customization options, including lightweight seat frames and leather seats, cater to the diverse preferences of consumers.

- The market for automotive seats is experiencing strong growth, particularly in the electric vehicle sector, as manufacturers integrate lightweight materials like polyethylene terephthalate and synthetic leather to reduce vehicle weight and enhance comfort. The y-o-y growth rate is expected to remain strong, driven by the increasing demand from middle-class families seeking advanced seating solutions. Motion sickness mitigation technologies, such as Auraloop and Carbon Impression, are also gaining traction, providing additional value to consumers. Overall, the market is a dynamic and evolving space, with a focus on innovation, safety, and customization.

How is this Automotive Seats Industry segmented and which is the largest segment?

The automotive seats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Bucket

- Bench

- Geography

- APAC

- China

- Japan

- Thailand

- Europe

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

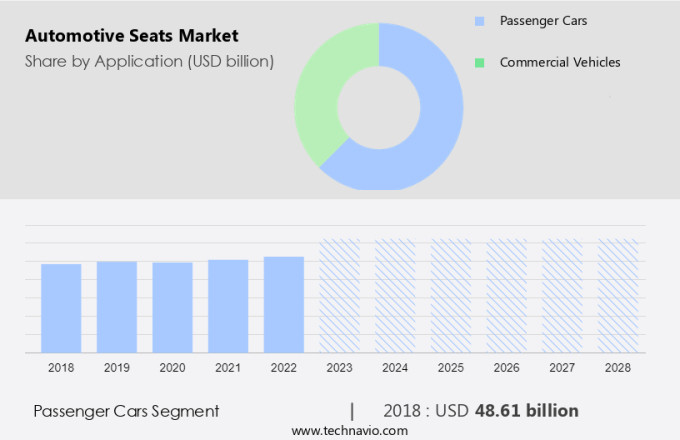

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is witnessing growth due to the increasing popularity of SUVs and electric vehicles (EVs). SUVs offer multipurpose applications, enhanced comfort, and greater in-vehicle space, making them a preferred choice for consumers. Additionally, the availability of affordable compact and mini-SUVs is boosting the market demand. Furthermore, the shift towards EVs is gaining momentum due to stringent emission norms, government incentives, and the decreasing cost of EVs. Advanced features such as climate-controlled seat technology, powered seats, and smart seating systems are enhancing the comfort and convenience of automotive seats. Safety regulations, including side curtain airbags and seat heating systems, ensure passenger safety.

Industry standards, such as lightweight seat frames and multizone climate control, are improving vehicle fuel efficiency and interior comfort. Customization options, including seat trim materials like synthetic leather, polyester fabrics, and cutting-edge trim materials, cater to various customer preferences. The market for automotive seats is expected to continue growing at a significant Y-o-Y rate, driven by the demand for luxury features and comfort solutions in both premium cars and mid-segment vehicles. Car-sharing companies and autonomous vehicles are also expected to contribute to the market growth. Modular seats, massage seats, memory seats, and ventilated seats are some of the advanced seating solutions gaining popularity among consumers.

Get a glance at the Automotive Seats Industry report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 48.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the expanding middle-class population and increasing per capita income. This demographic shift is driving the sales of passenger and commercial vehicles In the regio In the passenger vehicle segment, the focus on comfort and advanced features, such as climate-controlled seat technology, powered seats, and customization options, is leading to the adoption of premium seats in mid-segment cars and luxury vehicles. Electric vehicles are also gaining popularity, with the integration of smart seating systems, including memory seats, massage seats, and ventilated seats.

Furthermore, safety regulations and industry standards, including side curtain airbags and multizone climate control, are prioritized In the development of automotive seats. The use of lightweight materials, such as synthetic leather, polyester fabrics, and cutting-edge trim materials, is also increasing to improve vehicle fuel efficiency and reduce manufacturing costs. The integration of smart features, such as seat heating systems and smart seating systems, is enhancing the customer-perceived value of vehicles. The market for modular seats, including baby car seats and pet car seats, is also growing as car-sharing companies and autonomous vehicles gain traction. The durability of seats and the use of lightweight seat frames are crucial considerations to ensure safety and comfort for passengers.

Market Dynamics

Our automotive seats market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Automotive Seats Industry?

Rising demand for lightweight seats in EVs is the key driver of the market.

- The market is driven by several factors, including safety regulations and industry standards, advanced features, customization options, and the increasing popularity of electric vehicles. Automakers prioritize safety in vehicle design, leading to the integration of features such as side curtain airbags and advanced seat belt systems. Industry standards, such as those set by organizations like Faurecia, push for comfort and durability, leading to the development of climate-controlled seat technology, lightweight seat frames, and cutting-edge trim materials like Toray's synthetic leather and Indorama Ventures' polyethylene terephthalate. Advanced features, such as powered seats, massage seats, memory seats, and smart seating systems, have become luxury features in mid-segment cars and are popular in SUVs.

- These features enhance comfort and convenience, adding value to the vehicle interior. Comfort is a significant consideration for consumers, especially In the SUV market, where the seating segment is a crucial differentiator. Car-sharing companies also prioritize comfort and customization, leading to the adoption of modular seats and climate-controlled seats. Lightweight seats are increasingly important In the automotive industry, contributing to overall vehicle weight reduction. This is particularly significant for electric vehicles, as lighter seats help improve fuel efficiency and extend driving range. Regulatory compliance, such as stricter fuel efficiency and emission standards, further encourage the adoption of lightweight seats. The use of lightweight materials, such as polyurethane foam and lightweight interior parts, also adds to the customer perceived value and manufacturing cost savings. Comfort features, such as seat heating systems, ventilated seats, and heated seats, are popular among consumers, especially In the luxury vehicle segment.

What are the market trends shaping the Automotive Seats Industry?

Technological advancements in automotive smart seats is the upcoming market trend.

- The market is experiencing significant growth due to safety regulations and industry standards mandating advanced features in vehicle interiors. These advancements include powered seats, memory seats, massage seats, and modular seats, which have become luxury features in mid-segment cars and SUVs. Electric vehicles are also driving the demand for climate-controlled seat technology, lightweight seat frames, and smart seating systems. Comfort remains a top priority for consumers, leading to the integration of seat heating systems, ventilated seats, and multizone climate control. Manufacturers are using cutting-edge trim materials like synthetic leather, polyester fabrics, and Indorama Ventures' polyethylene terephthalate to enhance the durability and comfort of seats.

- Faurecia and Toray are leading the way in seat innovation, offering side curtain airbags and climate-controlled seat technology. As the SUV market continues to grow, so does the demand for spacious and customizable seating options. Car-sharing companies are also driving the need for modular automotive seats that can be easily adjusted and cleaned. Safety features, such as memory seats and massage seats, are becoming increasingly important as consumers prioritize comfort and wellness In their vehicles. The shift towards autonomous vehicles is also impacting the market, with a focus on lightweight materials and smart features that enhance the overall driving experience.

What challenges does the Automotive Seats Industry face during its growth?

Raw material price volatility for automotive seat manufacturing is a key challenge affecting the industry's growth.

- The market is subject to various market dynamics that influence the industry's growth and profitability. Seat manufacturers face challenges in managing production costs due to price volatility in raw materials, such as metals, plastics, and textiles. Long-term contracts with suppliers help mitigate some of these risks, but external factors like the COVID-19 pandemic and geopolitical conflicts can disrupt global supply chains, making it difficult to secure necessary materials. Safety regulations and industry standards continue to evolve, driving the demand for advanced features in automotive seats. Customization options, such as powered seats, massage seats, memory seats, and climate-controlled seat technology, are becoming increasingly popular, particularly in luxury and premium vehicles.

- Electric vehicles and SUVs are also contributing to the growth of the market, with the latter segment experiencing significant demand for modular seats and smart seating systems. Comfort remains a key consideration for consumers, with seat heating systems, ventilated seats, and multizone climate control becoming standard features in many vehicles. Lightweight seat frames and interior parts are also gaining popularity due to their contribution to fuel efficiency and vehicle weight reduction. The use of cutting-edge trim materials, such as Toray's advanced synthetic leather and Indorama Ventures' polyethylene terephthalate, is on the rise. These materials offer durability, comfort, and a luxurious feel, while also being eco-friendly and vegan-friendly alternatives to traditional leather seats.

Exclusive Customer Landscape

The automotive seats market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive seats market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive seats market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adient Plc

- Bharat Seats Ltd.

- Chongqing Huixinyi Technology Co. Ltd.

- COBRA SEATS

- FP Seating Systems Pvt. Ltd.

- Gentherm Inc.

- Glide Engineering INC

- Lazzerini S.r.l. S.B.

- Lear Corp.

- Magna International Inc.

- NHK Spring Co. Ltd.

- RCO Engineering Inc.

- RECARO Automotive GmbH

- SAIC Motor Corp. Ltd.

- SAL Automotives Ltd.

- Stellantis NV

- TACHI S Co. Ltd.

- Toyota Motor Corp.

- TS TECH Co. Ltd.

- Victora Auto Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a significant segment of the global automotive industry, catering to the evolving demands of consumers for comfort, safety, and customization In their vehicles. This market is characterized by continuous innovation, driven by advancements in technology and changing consumer preferences. Advanced features have become a key differentiator In the market. Comfort, once a luxury, is now an essential requirement for both premium and mid-segment cars. Seats with heating, ventilation, and massage functions have gained popularity, especially in regions with extreme climates. Seating customization is another trend, with consumers seeking modular seats that offer adjustability and flexibility to suit individual preferences.

Moreover, safety remains a primary concern In the market. Seats with side curtain airbags and advanced safety features are increasingly being adopted to protect passengers during traffic accidents. Lightweight seat frames and climate-controlled seat technology are other innovations that enhance safety while reducing vehicle weight and improving fuel efficiency. The market is also influenced by the rise of electric vehicles (EVs) and autonomous vehicles. Seats in EVs require lightweight interior parts to optimize battery life, while those in autonomous vehicles may offer more space due to the absence of a steering wheel. Customization and smart features are becoming increasingly important In the market.

Furthermore, seats with memory functions, multizone climate control, and smart seating systems are gaining popularity. Car-sharing companies are also driving demand for modular automotive seats that can be easily installed and removed. The use of cutting-edge trim materials, such as Toray's advanced fibers, Indorama Ventures' polyethylene terephthalate, and Auraloop's carbon impression, adds a premium touch to vehicle interiors. However, the cost of these materials and the manufacturing cost of advanced seat features can impact the customer's perceived value. The market is diverse, catering to various vehicle types, including SUVs and luxury vehicles. Middle-class families and vegan consumers are also influencing the market with their preferences for affordable, comfortable, and eco-friendly seating solutions.

|

Automotive Seats Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market Growth 2024-2028 |

USD 18.28 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.16 |

|

Key countries |

US, Canada, China, Japan, and Thailand |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Seats Market Research and Growth Report?

- CAGR of the Automotive Seats industry during the forecast period

- Detailed information on factors that will drive the Automotive Seats market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive seats market growth of industry companies

We can help! Our analysts can customize this automotive seats market research report to meet your requirements.