Aviation Actuator System Market Size 2025-2029

The aviation actuator system market size is forecast to increase by USD 4.01 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by rising defense spending and the increasing demand for compact actuators in modern aircraft designs. These trends are fueled by the ongoing modernization of military fleets and the continuous push for fuel efficiency and lighter-weight components in commercial aviation. However, market expansion is not without challenges. Regulatory hurdles impact adoption, as stringent certification requirements and lengthy approval processes can delay new product launches. Furthermore, supply chain inconsistencies temper growth potential, as the reliance on a limited number of key component suppliers can create vulnerabilities and price volatility.

- Brushless DC motors and linear motion systems are increasingly popular due to their high performance and low power consumption. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on developing innovative solutions that address regulatory compliance and supply chain reliability while maintaining high-performance standards. By doing so, they can position themselves as strategic partners to aircraft manufacturers and maintain a competitive edge in this dynamic market. Market research from reputable highlights the increasing demand for aviation actuator systems due to the growing commercial aircraft fleet and the integration of avionics and advanced technologies like machine learning and data analytics.

What will be the Size of the Aviation Actuator System Market during the forecast period?

- This dynamic sector encompasses various components, including servo actuators, electric actuators, and electromechanical actuators. These actuators play a pivotal role in flight control surfaces, aileron control, and environmental resistance in commercial aircraft and aerospace manufacturing. Design for reliability and advanced manufacturing techniques, such as 3D printing, are essential for actuator installation and system integration. Actuator control units, position sensors, temperature sensors, and pressure sensors are integral to performance monitoring and predictive analytics.

- Actuator selection, sizing, and maintenance are crucial for life cycle cost and fault tolerance. Environmental impact and actuator design are significant considerations, with lightweight materials, composite materials, and artificial intelligence driving innovation. Actuator maintenance and remote diagnostics enable efficient aircraft maintenance. Actuator manufacturers focus on design for maintainability, system integration, and environmental resistance to meet the evolving needs of the aerospace industry.

- Actuator design and maintenance are essential for ensuring optimal performance and safety. In summary, the market is a critical component of the aerospace industry, with ongoing trends and innovations driving growth and efficiency. Actuator technology, system integration, and data analytics are key areas of focus for aerospace manufacturers and aircraft maintenance providers.

How is this Aviation Actuator System Industry segmented?

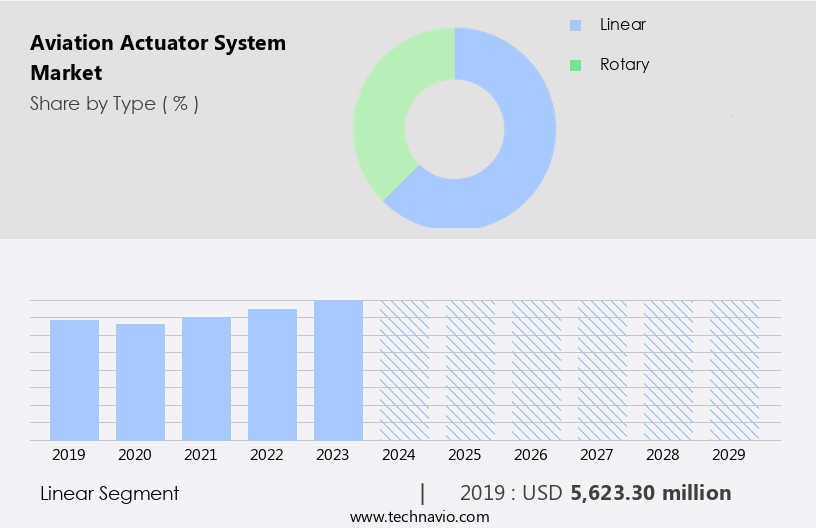

The aviation actuator system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Linear

- Rotary

- Technology

- Hydraulic

- Electromechanical

- Electric

- Pneumatic

- Electrohydrostatic

- Installation Sites

- OEM

- Aftermarket

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The linear segment is estimated to witness significant growth during the forecast period. Linear actuators play a pivotal role in aviation systems, providing straight-line motion essential for the operation of critical aircraft components, including landing gear, flaps, slats, cargo doors, air brakes, and thrust reversers. These actuators convert energy, often electrical, hydraulic, or pneumatic, into linear displacement, ensuring the precise control required for both commercial and military aircraft. Their reliability in handling heavy loads makes them indispensable for applications where exact positioning is crucial. As the aviation industry shifts towards electrification, electric linear actuators are gaining popularity due to their benefits in weight reduction, energy efficiency, simplified design, and reduced maintenance.

Flight control systems, such as aileron control and rudder control, rely on actuators to provide the necessary force and motion. Predictive maintenance and fault detection systems integrate position feedback sensors to monitor actuator performance and prevent potential issues. Certification requirements mandate rigorous testing and validation processes to ensure the safety and reliability of actuator systems. Aerospace manufacturers prioritize the development of smart actuators and servo actuators, which offer enhanced environmental resistance and improved response time. Actuator control units and actuator systems enable remote control and performance monitoring, contributing to fuel efficiency and overall aircraft performance.

Military aircraft and commercial aircraft types, including general aviation, require actuators with varying load capacities and stroke lengths to meet their unique specifications. Engine control systems rely on actuators to optimize fuel consumption and ensure efficient power management. The integration of sensors and advanced technologies, such as motorized and pneumatic actuators, enhances flight safety and reduces maintenance costs.

The Linear segment was valued at USD 5.62 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market experiences significant growth due to defense spending, increasing airline traffic, and fleet modernization initiatives. Defense budgets, such as the USD 1.27 trillion US budget for Fiscal Year 2024, with USD 874.5 billion allocated to the military, significantly influence the market. Advanced military aircraft, which rely on sophisticated actuator systems for functions like flight control, landing gear, and engine control, are a primary focus of this investment. Parallel to defense, the civil aviation sector also contributes to the market's expansion, as airlines accommodate growing passenger traffic and upgrade their fleets. Actuator systems are integral to various aircraft functions, including rudder control, flap actuation, aileron control, and flight control surfaces.

These systems must meet rigorous certification requirements, ensuring high performance, reliability, and safety standards. Operating temperatures, stroke lengths, load capacity, response time, and power consumption are critical factors in the design and testing of actuator systems. Position feedback sensors, predictive maintenance, and fault detection technologies enable continuous monitoring and optimization of actuator performance. Aerospace manufacturers integrate sensors and advanced technologies, such as smart actuators and servo actuators, to enhance efficiency, reduce weight, and improve flight safety. The market encompasses various actuator types, including hydraulic, electric, and pneumatic actuators, catering to diverse aircraft requirements. Actuator systems are also employed in commercial aircraft for fuel efficiency and performance monitoring, while remote control and actuator control units facilitate easier maintenance.

Despite the high costs associated with maintenance and replacement, the benefits of advanced actuator systems, including improved safety and operational efficiency, justify the investment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Aviation Actuator System market drivers leading to the rise in the adoption of Industry?

- Rising defense spending serves as the primary catalyst for market growth. In today's global economic climate, defense budgets continue to increase, fueling significant expansion within the industry. This trend underscores the importance of defense spending as a key market driver. The market is experiencing significant growth due to increasing defense spending worldwide. According to recent research, European defense spending reached an all-time high of USD 300 billion in 2023, marking a 10% increase from the previous year and the ninth consecutive year of growth. This substantial increase in defense budgets signifies the commitment of European nations to strengthen their military capabilities by investing in advanced aviation technologies and actuator systems. North America also demonstrated a substantial military expenditure of USD 943 billion in 2023, reflecting a 2.4% increase from 2022. This robust defense budget supports extensive research and development activities, leading to the procurement of sophisticated actuator systems for various military aircraft.

- Moreover, the integration of fault detection systems and smart actuators in aviation actuator systems is driving market growth. These technologies enable quick response time and weight reduction, making them essential for both military and general aviation applications. Rotary actuators and flap actuation systems are among the key applications of aviation actuator systems, and they are crucial for engine control and aircraft maneuverability. The adoption of these advanced technologies is expected to continue, as they offer improved performance, reliability, and cost savings in terms of maintenance.

What are the Aviation Actuator System market trends shaping the Industry?

- The increasing need for compact actuators represents a significant market trend. This demand stems from the growing preference for smaller, more efficient technologies in various industries. The market is witnessing a notable trend towards the adoption of compact actuators in modern aircraft designs. This trend is primarily driven by the need for lightweight and space-efficient components to enhance performance and fuel efficiency. Servo actuators, a type of compact actuator, are gaining popularity due to their ability to provide precise control over flight control surfaces such as ailerons. Environmental resistance is another crucial factor influencing the market's growth. Aviation actuator systems are exposed to harsh operating conditions, including extreme temperatures and vibrations. Electric actuators, which are increasingly being used in the aviation industry due to their low power consumption and ease of control, are designed to withstand such conditions.

- Actuator control units play a vital role in ensuring the proper functioning of these systems. They monitor and regulate the actuator's performance, ensuring optimal efficiency and reliability. Performance monitoring is essential in aircraft maintenance, as it helps identify potential issues before they become critical. Compact actuator systems offer several advantages, including reduced weight, improved fuel efficiency, and enhanced performance. For instance, UAVOS's SDLM-04B Linear Servo Actuator is a high-performance and reliable actuator system designed for applications requiring high forces and long-term reliability. Its side-by-side motor and gearbox design provides increased power density and versatility, making it suitable for various industries, including aerospace manufacturing and aircraft maintenance.

How does Aviation Actuator System market faces challenges face during its growth?

- The actuator malfunction issue poses a significant challenge to the industry's growth, necessitating continuous attention and innovation from professionals to mitigate potential risks and ensure optimal system performance. The market faces significant challenges due to concerns over actuator malfunctions and their impact on flight safety. These concerns have gained prominence following recent incidents and regulatory warnings. In September 2024, the US National Transportation Safety Board (NTSB) issued urgent safety recommendations for certain Boeing 737 models, including the 737 Max line. The NTSB warned that critical flight controls could jam due to potential actuator failures. This warning came after an investigation into a February incident where pilots of a United Airlines Max 8 reported that their rudder pedals were stuck in the neutral position during landing at Newark airport.

- These incidents underscore the importance of reliable actuator systems in aviation, with motorized and pneumatic actuators playing crucial roles in various aircraft functions, such as landing gear deployment and remote control of flight surfaces. Ensuring flight safety and fuel efficiency through sensor integration and adherence to aerospace standards remains a top priority for market participants.

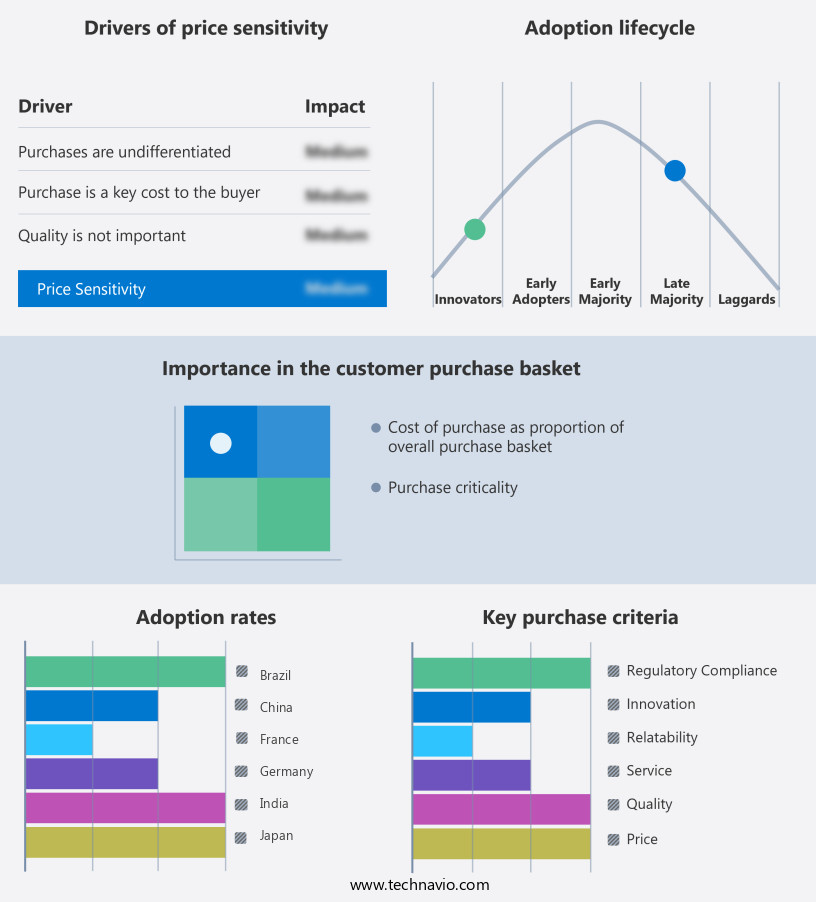

Exclusive Customer Landscape

The aviation actuator system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aviation actuator system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aviation actuator system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMETEK Inc. - The company offers aviation actuator system, such as linear, rotary, and electro-hydrostatic (hybrid) actuators.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- BAE Systems Plc

- Collins Aerospace

- Crane Aerospace and Electronics

- Curtiss Wright Corp.

- Eaton Corp. plc

- General Electric Co.

- Hanwha Corp.

- Honeywell International Inc.

- Howmet Aerospace Inc.

- L3Harris Technologies Inc.

- Moog Inc.

- Parker Hannifin Corp.

- Safran SA

- SAM Pte Ltd.

- Thales Group

- TransDigm Group Inc.

- Triumph Group Inc.

- Woodward Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aviation Actuator System Market

- In February 2023, Honeywell Aerospace announced the launch of its new Electrically Actuated Thrust Reverser System (EATRS), which is designed to reduce fuel consumption and emissions in commercial aircraft. This innovative actuator system is expected to save up to 2% of an aircraft's fuel consumption, making it a significant stride in enhancing aviation efficiency (Honeywell Aerospace Press Release, 2023).

- In November 2024, Safran and Rolls-Royce, two leading players in the aviation actuator market, formed a strategic partnership to develop advanced electric actuators for aerospace applications. This collaboration is expected to result in the creation of more efficient and eco-friendly actuator systems, positioning both companies at the forefront of the evolving aviation industry (Safran and Rolls-Royce Press Release, 2024).

- In January 2025, United Technologies Corporation completed the acquisition of Aerospace Technologies of Europe (ATE), a leading European manufacturer of actuator systems for aerospace applications. This strategic acquisition will expand UTC's presence in Europe and strengthen its position as a global provider of advanced actuator systems for commercial and military aircraft (United Technologies Corporation Press Release, 2025).

- In March 2025, the Federal Aviation Administration (FAA) approved the use of electric actuators in primary flight control systems for commercial aircraft. This regulatory approval marks a significant milestone in the adoption of electric actuators in the aviation industry, paving the way for increased efficiency, reduced emissions, and improved aircraft performance (FAA Press Release, 2025).

Research Analyst Overview

The market is characterized by its continuous evolution and dynamic nature. Actuators play a crucial role in various aircraft systems, including rudder control, flap actuation, aileron control, engine control, and landing gear, among others. These systems require actuators with specifications such as certification requirements, operating temperature ranges, stroke lengths, load capacity, response time, and position feedback sensors, among others. Certification is a critical aspect of the market. Actuators used in aircraft applications must meet stringent safety and performance standards set by aerospace organizations and regulatory bodies. These standards cover various aspects, including load capacity, response time, and environmental resistance. Actuator types used in aviation applications include linear actuators, hydraulic actuators, electric actuators, pneumatic actuators, and motorized actuators.

Each type offers unique advantages, such as weight reduction, power consumption, and fault detection capabilities. For instance, smart actuators and servo actuators are gaining popularity due to their ability to provide real-time performance monitoring and predictive maintenance capabilities. Flight control systems are a significant application area for aviation actuators. These systems require actuators with high precision and reliability to ensure flight safety. Actuator control units and sensor integration are essential components of these systems, enabling real-time monitoring and adjustment of flight control surfaces. Maintenance costs are a critical consideration in the aviation industry. Actuators with extended maintenance intervals and reduced power consumption are in high demand.

Predictive maintenance and fault detection capabilities are also essential to minimize downtime and maintenance costs. Military aircraft and commercial aircraft have different requirements for aviation actuator systems. Military aircraft often require actuators with high load capacity, environmental resistance, and quick response time. Commercial aircraft, on the other hand, prioritize fuel efficiency and weight reduction. Aerospace manufacturers and aircraft maintenance organizations are key players in the market. They rely on actuator suppliers to provide high-performance, reliable, and cost-effective solutions to meet the evolving demands of the aviation industry. In summary, the market is a dynamic and complex ecosystem. Actuators play a critical role in various aircraft systems, and their specifications must meet stringent safety and performance standards. Continuous innovation and advancements in actuator technology are essential to meet the evolving demands of the aviation industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aviation Actuator System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 4.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, China, Germany, Mexico, France, Japan, UK, India, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aviation Actuator System Market Research and Growth Report?

- CAGR of the Aviation Actuator System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aviation actuator system market growth and forecasting

We can help! Our analysts can customize this aviation actuator system market research report to meet your requirements.