Bike Car Rack Market Size 2025-2029

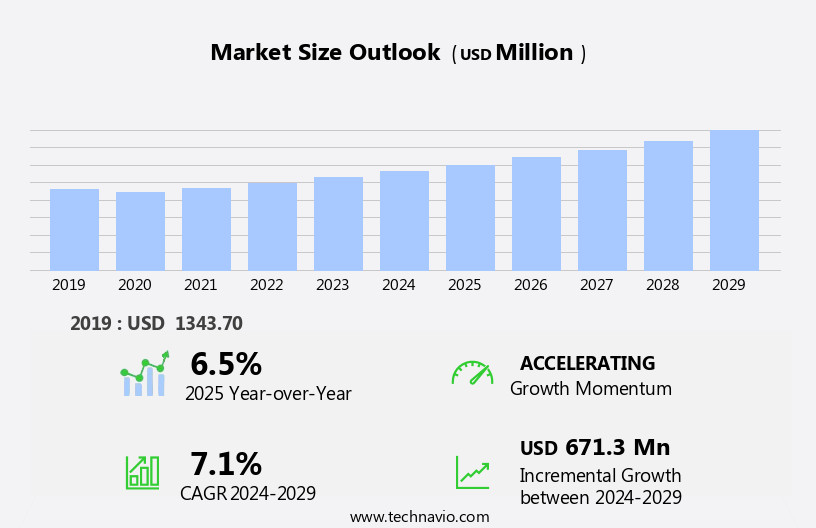

The bike car rack market size is forecast to increase by USD 671.3 million at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing popularity of adventure tourism and the rise of self-guided tours. These trends have led to a demand for bike car racks, enabling travelers to explore new destinations while transporting their bikes efficiently. However, the market faces challenges as well. The reduced fuel efficiency of vehicles is a major concern for consumers, as bike racks can add significant aerodynamic drag, leading to increased fuel consumption. This challenge may necessitate the development of more fuel-efficient rack designs or alternative transportation methods for bikes. Materials like aluminum and steel ensure durability, while crossbars and gear mounts provide customizable solutions for various gear types.

- Companies in the market must address this issue while continuing to innovate and meet the growing demand for bike car racks to capitalize on the opportunities presented by the adventure tourism industry and self-guided tours.

What will be the Size of the Bike Car Rack Market during the forecast period?

- The market continues to evolve, with dynamic market activities unfolding across various sectors. Roof mount racks, featuring anti-rattle mechanisms, remain popular for their corrosion resistance and wind resistance. Hybrid bikes and tandem bikes find their place in this market, requiring versatile and adjustable design solutions. Bike transportation for road bikes and mountain bikes necessitates easy installation and fuel efficiency. Trunk mount racks offer convenience, while hitch mount racks cater to larger bikes and increased carrying capacity. Locking systems ensure bike security, and quick release mechanisms facilitate ease of use. Foldable designs cater to compact car models, and bike rack accessories like fork mounts and frame mounts accommodate various bike types.

- Weather resistance and vibration reduction are essential considerations for outdoor use. The market also caters to electric bikes, with weight capacity and bike attachment being crucial factors. Bike rack installation processes continue to improve, with the focus on ease and efficiency. The ongoing development of bike rack technology ensures a seamless driving experience, even with multiple bikes attached. Theft prevention and bike security remain top priorities, with innovative locking systems and adjustable designs addressing these concerns. Bike storage solutions, whether for short trips or extended bike touring, require a balance between cargo space and bike capacity.

- The market responds with a diverse range of offerings, ensuring that every cyclist's needs are met.

How is this Bike Car Rack Industry segmented?

The bike car rack industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Hitch-mounted rack

- Trunk-mounted rack

- Roof-mounted rack

- Material

- Steel

- Aluminum

- Plastic and composite

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

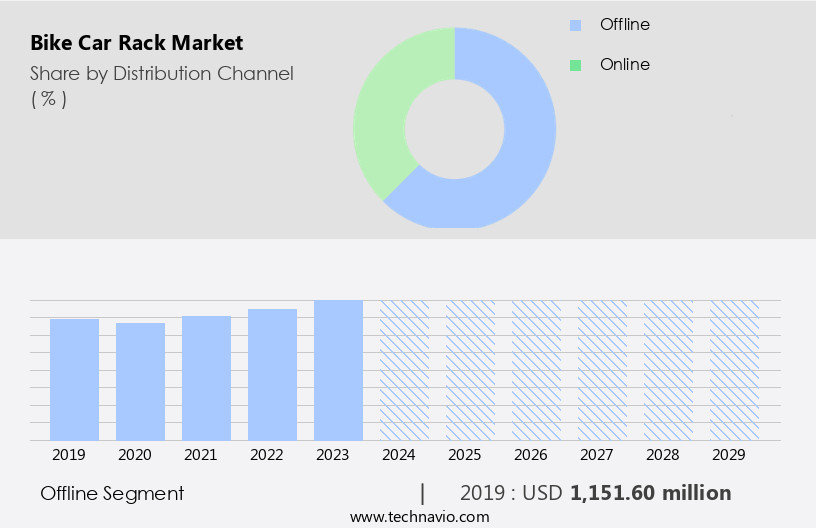

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market for bike car racks caters to various bike types, including hybrid, mountain, road, tandem, electric, and folding models. Roof racks, a popular choice for transporting bikes, offer wind resistance, ease of installation, and a versatile design. Anti-rattle mechanisms ensure a smooth ride, while corrosion resistance and weather resistance enhance durability. Hitch mounts, trunk mounts, and fork mounts are common types, each with distinct advantages. Hitch mounts provide high carrying capacity and quick release, while trunk mounts are compact and easy to install. Foldable designs offer convenience for smaller vehicles and urban use. Bike storage solutions, such as bike rack accessories and frame mounts, enable efficient use of cargo space.

Bike touring and racing enthusiasts prioritize bike attachment and vibration reduction. Theft prevention and bike security are crucial considerations, with locking systems and adjustable designs offering peace of mind. Car models with large cargo spaces and fuel efficiency are preferred for bike transportation. Overall, the market for bike car racks continues to evolve, catering to diverse customer needs and preferences.

The Offline segment was valued at USD 1.15 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing a deceleration due to the economic downturn and shifting consumer preferences. Despite this, the industry continues to innovate, offering solutions that cater to various bike types and user needs. Roof racks with anti-rattle mechanisms and wind resistance remain popular for transporting road bikes and hybrid models. Trunk mounts and hitch racks provide versatility for tandem bikes, mountain bikes, folding bikes, and electric bikes, ensuring cargo space efficiency. Corrosion resistance and easy installation are essential features in bike carriers, especially for outdoor use. Locking systems and theft prevention measures enhance bike security, while adjustable designs cater to different car models and bike capacities.

Quick release mechanisms and foldable designs facilitate ease of use, making bike transportation a seamless experience. Bike rack accessories, such as fork mounts and wheel mounts, cater to specific bike types, while frame mounts and vibration reduction systems ensure a smooth driving experience. The market also offers bike storage solutions for those who prefer not to transport their bikes, providing options for indoor and outdoor storage. Bike touring enthusiasts continue to seek bike racks with high carrying capacity, accommodating multiple bikes. Fuel efficiency remains a consideration for consumers, as they look for bike racks that do not significantly impact their vehicle's performance.

The market's evolution reflects the growing demand for bike transportation solutions that cater to diverse user needs and preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bike Car Rack Industry?

- The increase in popularity for adventure tourism significantly drives the market's growth. With an increasing number of travelers seeking thrilling experiences, the demand for adventure tourism offerings continues to escalate, propelling the industry forward. The market for car racks, specifically those designed for bikes, experiences significant growth due to the increasing popularity of cycling as a form of adventure tourism. Bike storage solutions have become essential for those embarking on trips involving hybrid bikes, mountain bikes, tandem bikes, and even trunk-mounted racks for easier transportation. Key features of these car racks include anti-rattle mechanisms to prevent bike-to-bike contact, ensuring a quiet and stable journey. Additionally, corrosion resistance is a crucial factor, as the racks are often exposed to harsh weather conditions. Wind resistance is another essential consideration, particularly for long-distance bike touring. The market caters to the growing demand for transporting outdoor adventure gear, such as bicycles, kayaks, skis, and other recreational equipment, during travel.

- The demand for bike racks is driven by the changing lifestyle trends, with more people seeking experiential travel and outdoor activities. The versatility of bike racks caters to various bike types, making them a valuable investment for adventure enthusiasts. Furthermore, the locking systems provide security and peace of mind during travel. The market for bike car racks is witnessing steady growth due to the increasing popularity of cycling as a form of adventure tourism. Features such as anti-rattle mechanisms, corrosion resistance, and wind resistance cater to the specific needs of cyclists, making bike racks an indispensable accessory for those seeking adventure.

What are the market trends shaping the Bike Car Rack Industry?

- Self-guided tours are gaining popularity as the latest market trend. This trend signifies a shift towards more independent and flexible travel experiences for consumers. The self-guided tour market, particularly self-guided cycling tours, has experienced significant growth due to the increasing preference for flexible and independent travel experiences among consumers in Europe and the US. This trend has led to a rise in demand for bike car racks as travelers seek convenient and efficient ways to transport their folding bikes or those with quick-release mechanisms. Bike car racks come in various designs, including hitch mount and fork mounts, catering to different car models and bike capacities. Foldable designs are increasingly popular due to their versatility and ability to save cargo space.

- Weather resistance is another essential feature for bike rack accessories to ensure the safety and protection of the bikes during transportation. Quick release mechanisms enable easy loading and unloading of bikes, making bike carriers a practical choice for self-guided travelers. As the popularity of self-guided tours continues to rise, the demand for bike racks is expected to remain strong, offering a promising market opportunity for businesses. The millennial generation's preference for adventure sports and eco-friendly mobility options, such as electric bikes and scooters, is driving demand for car racks to transport these items.

What challenges does the Bike Car Rack Industry face during its growth?

- The reduction in fuel efficiency of vehicles poses a significant challenge to the growth of the automotive industry. Bike transportation solutions, such as wheel mounts and trunk racks, are essential for avid bike racers and road bike owners. These racks enable easy installation and adjustable designs to accommodate various bike sizes. However, they add weight to vehicles, impacting fuel efficiency. Each additional 100 pounds (lbs.) in a vehicle can decrease fuel efficiency by 1% in miles per gallon. Roof-mounted bike racks, in particular, can reduce fuel efficiency by up to 9% due to increased weight and aerodynamic drag.

- Despite this drawback, bike car racks offer convenience and ease of use, making them a popular choice for bike enthusiasts. Additionally, they provide theft prevention and bike security, ensuring peace of mind during transportation. When considering bike car rack options, it's essential to evaluate the trade-off between convenience, ease of use, and fuel efficiency.

Exclusive Customer Landscape

The bike car rack market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bike car rack market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bike car rack market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

1UP USA - The company specializes in providing a range of high-quality bike racks, including the Quik Rack Single, Super Duty Double, and Recon Rack.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 1UP USA

- Allen Sports USA

- Alpaca Carriers Inc.

- Atera GmbH

- Car Mate Mfg Co Ltd

- CRUZBER SAU

- Heininger Holdings LLC

- Hollywood Racks

- Kuat Innovations LLC

- LCI Industries

- Mont Blanc Group AB

- Rhino Rack Pty Ltd.

- RockyMounts Inc.

- Saris Cycling Group Inc.

- SportRack

- Swagman

- Thule Sweden AB

- Uebler GmbH

- VDL Groep BV

- Yakima Products Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bike Car Rack Market

- In February 2023, Thule Group, a leading manufacturer of cargo carriers, announced the launch of its new T2 Pro XT2 bike rack, featuring an innovative tilt function and an integrated bike lock system (Thule Press Release, 2023). This development showcases Thule's commitment to providing advanced, secure, and user-friendly bike rack solutions for consumers.

- In May 2024, Yakima, another prominent bike rack manufacturer, entered into a strategic partnership with Trek Bikes, the world's second-largest bicycle manufacturer, to co-brand and co-develop bike racks (Yakima Press Release, 2024). This collaboration aims to cater to the growing demand for integrated bike rack solutions and expand both companies' market reach.

- In August 2024, Saris Cycling Group, a major player in the bike rack industry, completed a significant acquisition of Swagman, a well-known bike rack manufacturer, to strengthen its product portfolio and market position (Saris Cycling Group Press Release, 2024). The acquisition brought Saris an additional 15% market share and expanded its offerings to cater to a broader customer base.

Research Analyst Overview

The bike rack industry continues to evolve, with trends shaping the market through advanced designs, security features, and certifications. Bike rack manufacturers prioritize functionality and safety, integrating technology to enhance cargo capacity and payload. Bike rack dealers and retailers cater to diverse consumer needs, offering various types, including hitch-mount, roof-mount, and trunk-mount racks. Bike rack brands compete on innovation, with some focusing on security and others on ease of use. Regulations and standards ensure safety, with certifications such as TS009 and SAE J1280 guiding manufacturing processes. Warranty offerings and pricing strategies also influence consumer decisions. The market includes roof racks for luggage, bicycles, and other gear, as well as towers, fitting pieces, crossbars, and gear mounts.

The Bike Car Rack Market is evolving with diverse bike rack types, catering to different vehicle models and user preferences. Modern designs bike rack functionality and bike rack features, ensuring ease of use. Continuous bike rack innovation enhances user experience with foldable and lightweight options. Enhanced bike rack safety and bike rack security are priorities, incorporating sturdy locks and anti-theft mechanisms. Competitive bike rack pricing drives affordability while maintaining quality. Emerging bike rack trends include eco-friendly materials and smart tracking. Strict bike rack regulations, bike rack standards, and bike rack certifications ensure compliance. Leading brands offer extended bike rack warranty, boosting consumer confidence. Expanding distribution networks bring diverse bike rack retailers to global markets, ensuring accessibility and choice.

Bike rack design continues to prioritize cargo capacity, with some racks accommodating up to four bikes. Payload capacity is a crucial consideration, with many racks capable of carrying weights up to 150 pounds. Bike rack technology, such as tilt-away features and integrated locks, adds convenience and security. Bike rack brands invest in research and development to meet the evolving demands of consumers and regulatory bodies. This focus on innovation and safety ensures the bike rack market remains a dynamic and essential sector for the automotive industry. Moreover, the tourism sector, including car rental, taxi services, and commercial car racks, is a significant consumer base for the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bike Car Rack Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 671.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Germany, France, Canada, China, UK, India, Italy, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bike Car Rack Market Research and Growth Report?

- CAGR of the Bike Car Rack industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bike car rack market growth of industry companies

We can help! Our analysts can customize this bike car rack market research report to meet your requirements.