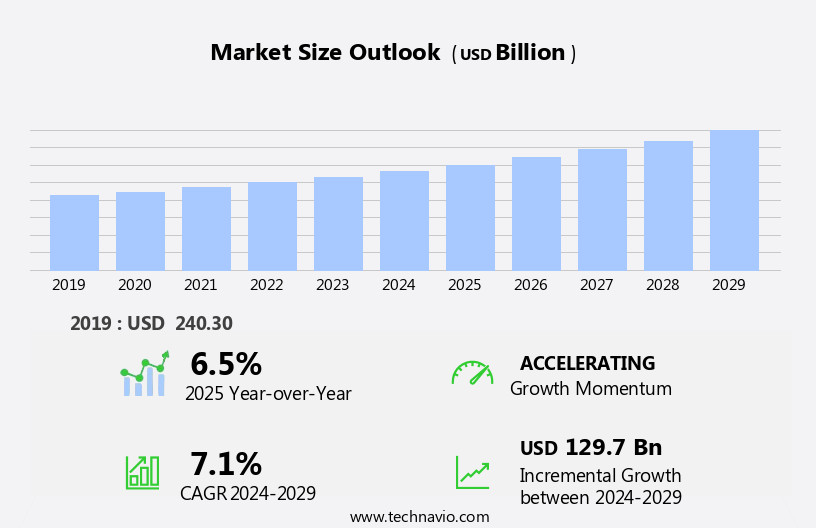

Bread Market Size 2025-2029

The bread market size is forecast to increase by USD 129.7 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising urbanization and changing consumer preferences towards healthier food options. The increasing demand for organic and gluten-free bakery products reflects this trend, as consumers seek more nutritious and customized food choices. However, the market is not without challenges, as fluctuating raw material prices pose a significant threat to profitability. Bakery businesses must navigate these price fluctuations and adapt to evolving consumer demands to capitalize on the market's growth opportunities. Strategic sourcing, product innovation, and operational efficiency will be key differentiators for companies seeking to stay competitive in this dynamic market.

- Effective supply chain management and collaboration with suppliers will be crucial to mitigating the impact of raw material price volatility. Additionally, investing in research and development to create innovative, health-conscious bakery products will help companies meet the evolving needs of health-conscious consumers and capture market share. Overall, the market presents a compelling growth opportunity for businesses that can effectively navigate these trends and challenges.

What will be the Size of the Bread Market during the forecast period?

- The market encompasses a wide range of baked goods, including whole meal bread and specialty bread, with e-commerce sales increasingly driving growth. Consumers' preferences for healthier options have led to the popularity of bread with high protein content and the incorporation of legumes like lentils. Sustainability is a key trend, with recycled plastic packaging gaining traction. Organic bread and value-added products, such as functional food items and fillings, are also in demand. The bread industry caters to household staples and convenience-seeking consumers, with private labels and e-commerce platforms playing significant roles.

- Natural and functional ingredients, regional bread specialties, and clean label bread are other noteworthy trends. Delivery methods and innovation in filling and specialty bread continue to shape the market dynamics. Bread manufacturers are focusing on meeting the evolving needs of health-conscious consumers by offering products with natural ingredients and functional benefits.

How is this Bread Industry segmented?

The bread industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Artisan bread

- Packaged bread

- Others

- Distribution Channel

- Offline

- Online

- Variant

- Conventional

- Gluten free

- Type

- Fresh

- Frozen

- Geography

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- Europe

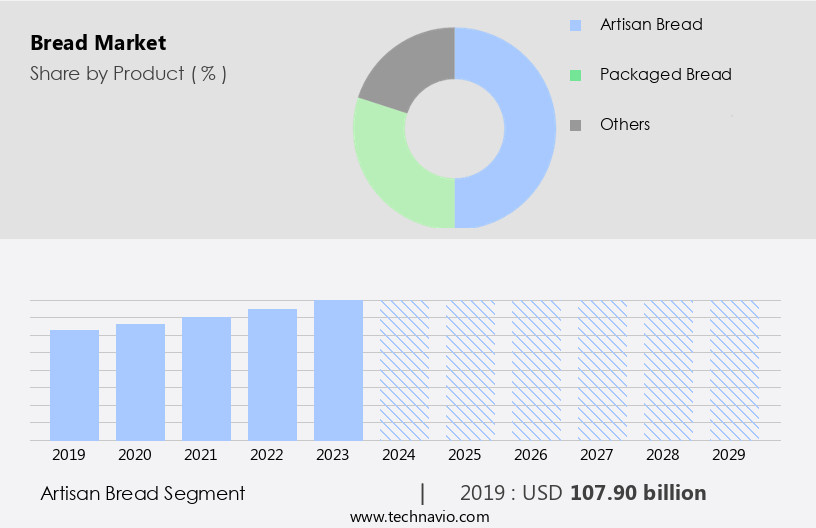

By Product Insights

The artisan bread segment is estimated to witness significant growth during the forecast period.

The artisan the market is experiencing consistent growth due to the increasing preference for specialty bakery items among health-conscious consumers. Artisan bread, including ethnic varieties, is often sold within a short timeframe after manufacturing, adding to its appeal. Supermarkets and hypermarkets now stock a variety of artisan bread, making it easily accessible to consumers. The segment's expansion is further fueled by the trend of multiple purchasing and the availability of various artisan bread types. Moreover, the use of natural and functional ingredients, such as soy, in artisan bread production caters to the demand for wholesome and healthy food options.

Additionally, the aging population and changing consumer behavior towards convenience and sustainable practices are contributing factors to the market's growth. Artisan bread manufacturers focus on direct consumer relationships, offering high-protein and whole grain options, as well as clean label and fortified bread. The market also includes organic bread and household staples, such as whole meal bread, which cater to diverse consumer lifestyles and dietary requirements. E-commerce sales and home delivery services are increasingly popular, with e-commerce platforms offering a wide range of bread types and regional specialties. Recycled plastic packaging is also gaining traction as a sustainable practice in the bread industry.

Overall, the artisan the market is evolving to meet the demands of consumers seeking healthy, convenient, and sustainable baked goods.

Get a glance at the market report of share of various segments Request Free Sample

The Artisan bread segment was valued at USD 107.90 billion in 2019 and showed a gradual increase during the forecast period.

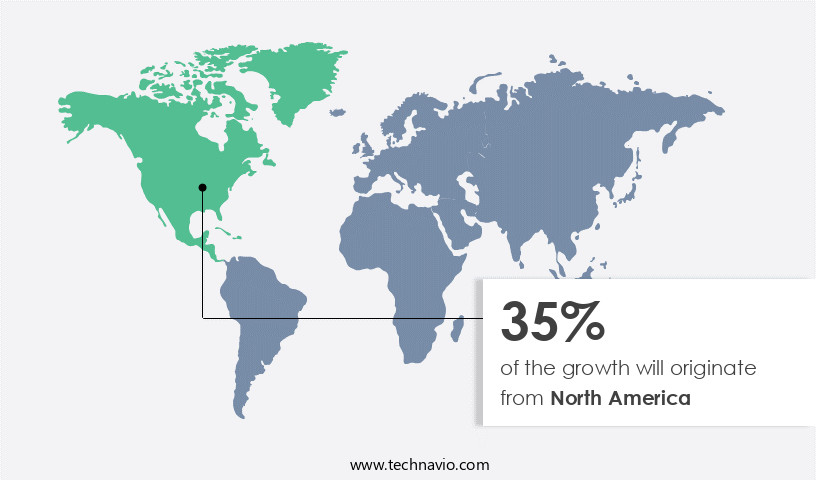

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the European the market, private labels are gaining significant traction, particularly in Western Europe. This trend is driven by discounts offered by grocery retailers, which have stimulated the sales of both established and new private label products. Consumers in Europe are increasingly seeking preservatives and additives-free and gluten-free bread options. Artisan bakeries hold a strong presence in countries like France, Turkey, and Italy, but their popularity is less pronounced in Germany and the UK. Gluten-free bread recipes have become popular among European consumers. Stringent regulations in many European countries have led manufacturers to reduce the salt content in their bread products.

Furthermore, health-conscious consumers are demanding bread with functional ingredients, such as whole grains, legumes like lentils, and chickpeas, as well as supplemental nutrients for weight management and cholesterol reduction. In response, manufacturers are producing value-added products, such as bread with high protein content, whole meal bread, organic bread, and natural ingredients. Home delivery services and e-commerce platforms are also transforming the way consumers purchase bread and bakery items. Sustainable practices, such as the use of recycled plastic packaging, are becoming increasingly important to consumers. These trends reflect the evolving consumer lifestyle and the growing demand for convenient, healthy, and sustainable food options.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bread Industry?

- Rising urbanization and changing consumer lifestyles is the key driver of the market.

- The market is experiencing significant growth due to several key factors. The expanding urban population and shifting consumer preferences towards convenient, on-the-go food options are primary drivers of this market. With increasing urbanization and improved living standards, disposable income has risen, leading consumers in emerging economies to seek out bread products. However, hectic lifestyles and unhealthy eating habits have resulted in a growing demand for high-protein bread options that cater to the nutritional needs of consumers. Central and South America and APAC regions are expected to offer attractive opportunities for market growth during the forecast period.

- Despite the benefits, it is essential to note that the rise in urbanization and changing diet habits have led to concerns regarding health and lifestyle disorders. As such, the market for bread that addresses these concerns, such as whole grain or high-protein options, is poised for continued expansion.

What are the market trends shaping the Bread Industry?

- Increasing demand for organic and gluten-free bakery products is the upcoming market trend.

- The bakery industry is experiencing a trend towards the use of healthy baking ingredients, driven by consumers' increasing health consciousness. These ingredients include aluminum-free baking powder, gluten-free flour, and organic baking flour. While organic bread is pricier due to its higher manufacturing and raw material costs, its popularity among health-conscious consumers is expected to boost demand. Gluten, a protein found in wheat, barley, and rye, is commonly used in the production of multigrain bread and other bakery items.

- The shift towards healthier options is influencing the baking industry positively, with a growing preference for gluten-free and organic baking ingredients. Despite the higher cost, the demand for these products is anticipated to continue increasing due to their health benefits.

What challenges does the Bread Industry face during its growth?

- Fluctuating raw material prices is a key challenge affecting the industry growth.

- The production of bread and rolls involves key raw materials such as flour, sugar, salt, and milk. The rising costs of these essential components pose a significant challenge for manufacturers. The increasing production expenses are attributed to the escalating prices of these food materials. Adverse weather conditions, s, governmental regulations, national emergencies, natural disasters, and supply shortages can impact the availability of raw materials, further increasing costs. Consequently, bread prices experience an upward trend. This trend poses a challenge for marketers looking to introduce new product varieties with unique ingredients to enhance taste and attract consumers.

- Despite these challenges, the market for bread and rolls continues to grow, driven by consumer preferences for convenience and taste. Manufacturers must navigate these cost pressures to maintain profitability and competitiveness in the market.

Exclusive Customer Landscape

The bread market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bread market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bread market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Mauri UK Ltd. - The company introduces a diverse range of bread products under the brand names Panesse, Scrocchiarella, Holgran, and Fleming Howden. These brands represent the company's commitment to delivering high-quality, authentic bread varieties to consumers worldwide. With a focus on innovation and tradition, the company's offerings cater to diverse tastes and preferences, enhancing the overall bread category.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Mauri UK Ltd.

- AGROFERT AS

- Angel Bakeries

- ARYZTA AG

- Bakers Delight

- Bakkerij Borgesius

- Barilla G and R Fratelli Spa

- Braces Bakery Ltd.

- Britannia Industries Ltd.

- Campbell Soup Co.

- Corporativo Bimbo SA de CV

- Finsbury Food Group Plc

- Flowers Foods Inc.

- Fuji Baking Group

- Modern Food Enterprises Pvt. Ltd.

- Monginis Foods Pvt. Ltd.

- Pasco Shikishima Corp.

- The J.M. Smucker Co.

- Warburtons Ltd.

- Yamazaki Baking Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The bread industry continues to evolve, with various trends shaping its growth and consumer preferences. One significant trend is the increasing demand for gluten-free and functional bread options. Consumers are becoming more health-conscious and are seeking out bread products made with wholesome flour blends and functional ingredients, such as legumes like lentils and chickpeas. Online grocery shopping is another trend that is gaining momentum in the market. With the convenience of e-commerce sales and home delivery services, consumers can easily access a wide range of bread options, including specialty breads and bakery items. Freezing technology also plays a crucial role in the online grocery market, ensuring that consumers can enjoy fresh bread products even after they have been delivered.

Changing consumer behavior is a key driver of growth in the market. An aging population and a growing preference for convenient, ready-to-eat foods are leading to an increase in demand for bread products with added value, such as high protein content, fortified bread, and clean label options. Consumers are also seeking out bread products with sustainable practices and eco-friendly packaging, such as recycled plastic or biodegradable materials. Private labels and organic bread are also popular choices in the market. Consumers are increasingly looking for bread products that offer transparency in their ingredients and production methods.

Brands that can establish direct consumer relationships and offer natural, clean label bread options are likely to succeed in this market. Functional food products, such as bread with supplemental nutrients and sugar control, are also gaining popularity. These products cater to consumers who are seeking out bread options that offer health benefits beyond basic nutrition. Fillings in bread, such as vegetables or fruits, are also becoming more popular as consumers look for ways to add more nutrients to their diets. The market is diverse, with regional bread specialties and artisanal bread options adding to its appeal.

Consumers are increasingly seeking out unique and authentic bread products that reflect different cultural and regional traditions. Protein content and cholesterol reduction are also important considerations for consumers, leading to the development of bread products that cater to these health concerns. In , the market is dynamic and evolving, with various trends shaping its growth and consumer preferences. From gluten-free and functional bread options to online grocery shopping and sustainable practices, the bread industry is adapting to meet the changing needs and demands of consumers. As consumer lifestyles continue to evolve, the market is expected to remain a significant and growing sector in the food industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 129.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, The Netherlands, China, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bread Market Research and Growth Report?

- CAGR of the Bread industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bread market growth of industry companies

We can help! Our analysts can customize this bread market research report to meet your requirements.