Building Information Management System Market Size 2024-2028

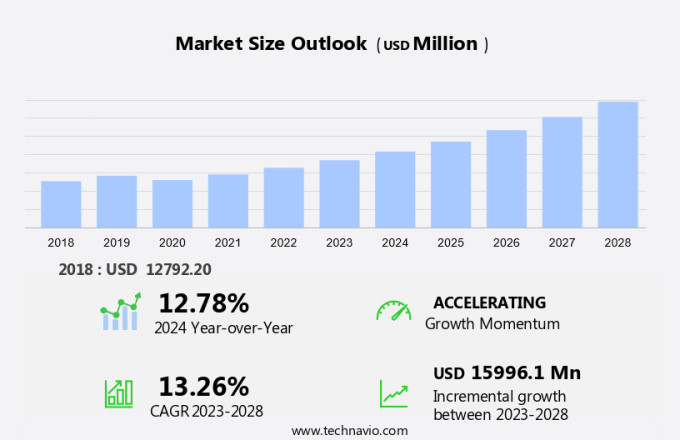

The building information management system market size is forecast to increase by USD 16.00 billion at a CAGR of 13.26% between 2023 and 2028. Building Information Management Systems (BIMS) has gained significant traction in various sectors, including residential, commercial, and industrial, due to the increasing number of construction projects worldwide. The integration of cloud-based solutions has facilitated real-time collaboration and improved project efficiency. However, the high implementation and operational costs remain a challenge for market growth. Professional services and managed services have emerged as crucial solutions to mitigate these costs and ensure effective system utilization. Commercial buildings and residential premises have been the major adopters of BIMS, with the industrial sector following suit. The market is expected to continue its expansion, driven by the need for enhanced project management, increased focus on energy efficiency, and the growing demand for smart buildings.

What will the size of the market be during the forecast period?

The Building Information Management (BIM) system market is rapidly evolving, driven by advancements in digital building design tools and technologies like AI, IoT, and cloud computing. These tools enable the creation of detailed 3D models, which streamline the design, construction, and operation of buildings. BIM systems, integrated with Building Management System (BMS) technologies, optimize energy use, maintenance, and overall building efficiency. As the demand for smart, sustainable buildings grows, the IT sector is increasingly adopting BIM solutions to enhance collaboration and reduce costs. The ability to track and analyze building performance in real-time leads to improved return on investment (ROI) for developers and owners. BIM's integration of cutting-edge technologies ensures long-term value by optimizing operational workflows and supporting data-driven decision-making.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Sector

- Commercial

- Residential

- Industrial

- Institutional

- Type

- Software

- Hardware

- Geography

- Europe

- Germany

- UK

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Sector Insights

The commercial segment is estimated to witness significant growth during the forecast period.The Building Information Management System (BIMS) market in the United States is experiencing significant growth as commercial structures, including office buildings, educational institutions, airport and railways, factories, production plants, distribution facilities, and warehouses, adopt advanced technologies for enhanced operational efficiency and sustainability. BIMS integrates various building functions, such as energy management, security, and HVAC, into a unified platform, allowing for real-time monitoring and data-driven decision-making. This results in substantial cost savings and improved performance. Notably, in March 2022, GridPoint, a leading energy management technology company, raised USD75 million in funding. The investment, led by the Sustainable Investing Group at Goldman Sachs Asset Management and backed by Shell Ventures, aims to accelerate GridPoint's initiatives in decarbonizing commercial buildings and modernizing the grid. This investment underscores the increasing importance of BIMS in the US commercial real estate sector.

Get a glance at the market share of various segments Request Free Sample

The commercial segment accounted for USD 4.89 billion in 2018 and showed a gradual increase during the forecast period.

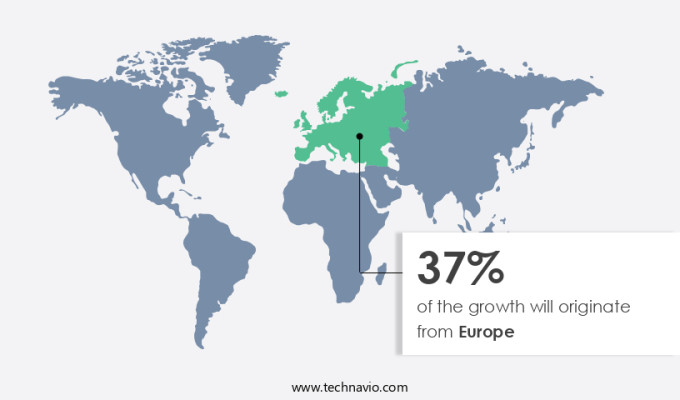

Regional Insights

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Building Information Management System (BIM) market in Europe is experiencing significant expansion due to the increasing adoption of digital technologies in infrastructure projects and smart city initiatives. This growth is driven by several factors, including the demand for sustainable and energy-efficient buildings, stringent construction regulations, and the need for advanced project management tools. European countries are committed to reducing carbon footprints and improving building lifecycle management, making BIM systems an ideal solution. These systems enhance accuracy, collaboration, and efficiency throughout a building's design, construction, and operational phases. Horizon Europe, the European Union's research and innovation program, plans to invest around â¬350 million (USD396 million) from 2021 to 2027 in research and innovation actions focused on missions such as mobility, energy, and urban planning.

The goal is to develop 100 climate-neutral and smart cities by 2030. Computer-controlled production and digital twin technology are also gaining popularity in the European construction industry, further fueling the growth of the BIM market. Facility management is another area where BIM systems are proving to be beneficial, enabling real-time monitoring and analysis of building performance. In conclusion, the European BIM market is poised for continued growth, driven by the need for advanced project management tools, sustainable construction, and smart city initiatives.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in global construction projects is the key driver of the market. The Building Information Management System (BIMS) market experiences significant growth due to the increasing construction projects worldwide. Infrastructure development, urbanization, and the push for smart city initiatives are key drivers for the adoption of advanced technologies in the construction sector. For instance, Neom, a groundbreaking USD500 billion project in Saudi Arabia, is transforming the Red Sea Desert into a technologically advanced urban hub. Led by Crown Prince Mohammed bin Salman, this project aims to diversify the economy and revolutionize urban living through innovative features such as cloud-seeding technology for rainfall, artificial moons, and flying taxis. In the realm of infrastructure, BIMS technologies are increasingly being utilized in the transportation sector to optimize operations and maintenance.

Utilities are also embracing these systems to improve energy efficiency and reduce costs. HVAC and lighting systems are significant areas of focus, with IoT integration enabling real-time monitoring and predictive maintenance. The adoption of these advanced technologies is set to revolutionize the construction sector, enhancing project efficiency, reducing costs, and promoting sustainability.

Market Trends

Integration of cloud-based solutions for real-time collaboration is the upcoming trend in the market. In the Building Information Management System (BIM) market, the adoption of cloud-based solutions is a significant trend. Cloud technology enables architects, engineers, and construction experts to collaborate effectively in real-time, irrespective of their locations. This integration offers instantaneous data updates and access to shared information, thereby enhancing productivity and minimizing errors. Moreover, it supports flexible and scalable project management, enabling teams to respond swiftly to modifications and coordinate efficiently throughout the project's various phases. Notable market participants providing cloud-based BIM solutions include Autodesk Inc. (Autodesk). Their offering, BIM 360, is a cloud-based platform that streamlines real-time collaboration and project management across different construction stages.

By utilizing these tools, industry professionals can optimize their workflows, improve communication, and ensure project success.

Market Challenge

High implementation and operational costs for building information management systems is a key challenge affecting the market growth. Building Information Management Systems (BIMS) are essential tools for managing and optimizing energy spending, preventive maintenance, facility management, security management, infrastructure management, and emergency management in businesses. The upfront investment for implementing a BIMS can be substantial, with costs ranging from USD20,000 to USD5 million, depending on the complexity and scale of the project. This investment covers the purchase of advanced software, infrastructure upgrades, and integration with existing systems.

Staff training is also a significant investment, with costs varying based on the number of users and the depth of training required. Despite these costs, the benefits of BIMS, such as improved energy efficiency, enhanced facility management, and increased security, make the investment worthwhile for businesses seeking to streamline operations and reduce expenses.

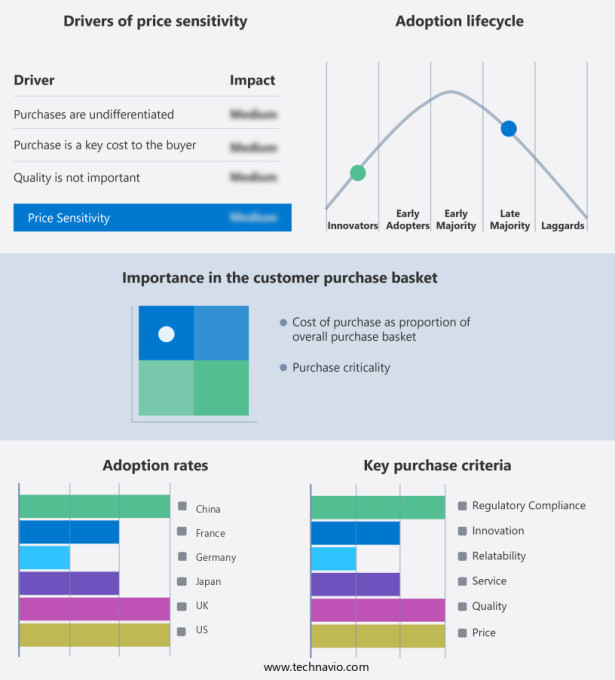

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ACCA software Spa - The company offers Building Information Management System such as usBIM, for the digitization of constructions and infrastructures in a simple, secure and shared workflow.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accruent

- Acuity Brands Inc.

- Autodesk Inc.

- Azbil Corp.

- Bentley Systems Inc.

- Bricsys NV

- Delta Controls Inc.

- Eleco Plc

- Honeywell International Inc.

- Johnson Controls International Plc.

- Nemetschek SE

- Procore Technologies Inc.

- RIB Software GmbH

- Schneider Electric SE

- Siemens AG

- Trane Technologies plc

- Trimble Inc.

- Vantage-BMS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Building Information Management System (BIMS) market is witnessing significant growth due to the increasing adoption in infrastructure projects and smart city initiatives. These systems enable computer-controlled production and facilitate the management of utilities, transportation, and various other facilities in the global construction industry. The integration of IoT sensors, AI, and machine learning technologies in BIMS is revolutionizing the way building owners manage HVAC, lighting systems, energy spending, preventive maintenance, security management, and emergency management. BIMS is not limited to commercial buildings but is also gaining popularity in residential premises, office buildings, educational institutes, airport and railways, factories, production plants, distribution facilities, and warehouses.

Further, the market is witnessing a wave in demand from various sectors, including construction, civil engineers, architects and consultants, construction supervisors, and building contractors. Cloud platforms and software solutions are the backbone of BIMS, providing easy access to digital transformation models of buildings, enabling real-time monitoring and analysis of energy consumption, and ensuring efficient facility management. The integration of AI and machine learning algorithms further enhances the capabilities of BIMS, enabling predictive maintenance and optimizing energy management.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.26% |

|

Market growth 2024-2028 |

USD 16.00 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.78 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 37% |

|

Key countries |

US, China, UK, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ACCA software Spa, Accruent, Acuity Brands Inc., Autodesk Inc., Azbil Corp., Bentley Systems Inc., Bricsys NV, Delta Controls Inc., Eleco Plc, Honeywell International Inc., Johnson Controls International Plc., Nemetschek SE, Procore Technologies Inc., RIB Software GmbH, Schneider Electric SE, Siemens AG, Trane Technologies plc, Trimble Inc., and Vantage-BMS |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch