Digital Transformation In Oil And Gas Industry Market Size 2025-2029

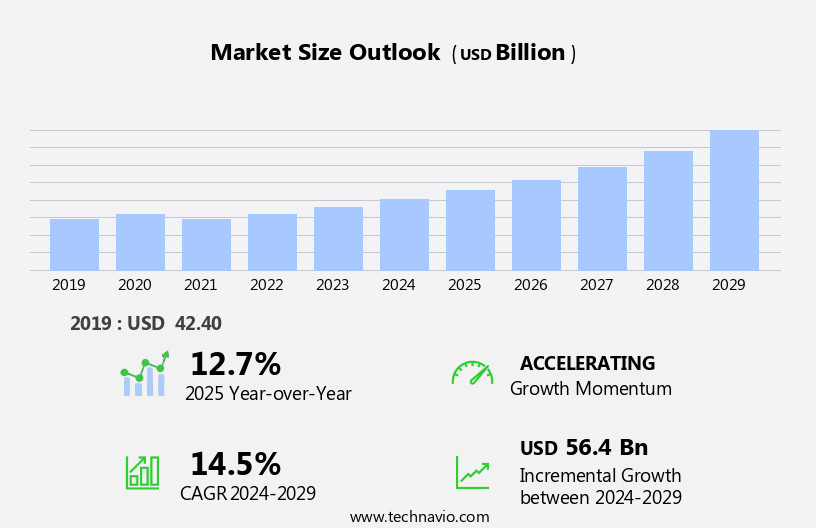

The digital transformation in oil and gas industry market size is forecast to increase by USD 56.4 billion, at a CAGR of 14.5% between 2024 and 2029.

- The Digital Transformation in the Oil and Gas Industry Market is witnessing significant momentum, driven by increasing investments and partnerships to leverage technology for operational efficiency and cost savings. Notably, the adoption of digital twin technology is transforming the industry, enabling real-time monitoring and predictive maintenance of assets, enhancing productivity and safety. However, the market faces a significant challenge: the lack of skilled labor to implement and manage these advanced technologies. As the industry continues to digitize, companies must invest in training and upskilling their workforce to remain competitive.

- The successful integration of digital solutions will require a strategic approach, balancing the benefits of innovation with the need for a skilled workforce. Companies that effectively navigate these challenges will be well-positioned to capitalize on the opportunities presented by the Digital Transformation in the Oil and Gas Industry Market.

What will be the Size of the Digital Transformation In Oil And Gas Industry Market during the forecast period?

The adoption of process optimization techniques and digital workforce deployment is accelerating efficiency across oilfield operations. Companies are increasingly relying on production forecasting models and data-driven decision making to enhance planning accuracy and asset performance. With the rise of remote expert collaboration, expertise can be delivered instantly, minimizing downtime and improving field execution. Effective asset lifecycle management combined with robust pipeline safety systems ensures long-term operational integrity and risk mitigation.

Through comprehensive operational risk analysis and advanced analytics applications, firms are streamlining resource allocation and identifying performance bottlenecks. Strategies such as well testing optimization and completion optimization techniques are becoming key to maximizing output, supported by accurate reservoir characterization methods and Enhanced Oil Recovery technologies. Advanced fluid dynamics modeling and petroleum engineering software enable more reliable simulations and predictive insights.

Automation is further advancing with field automation systems, sensor data integration, and detailed well intervention planning, while workforce training programs and regulatory compliance software help maintain industry standards. Insights from geological data analysis feed into integrated operations centers, where Data Security strategies and environmental monitoring systems are critical for both compliance and sustainability in energy production.

How is this Digital Transformation In Oil And Gas Industry Industry segmented?

The digital transformation in oil and gas industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- IoT

- Big data and analytics

- Cloud computing

- Artificial intelligence

- Others

- Sector

- Downstream

- Upstream

- Midstream

- Component

- Software

- Hardware

- Services

- Deployment Type

- On-premises

- Cloud-based

- Hybrid

- Technology Specificity

- Blockchain

- Robotics

- Digital Twins

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

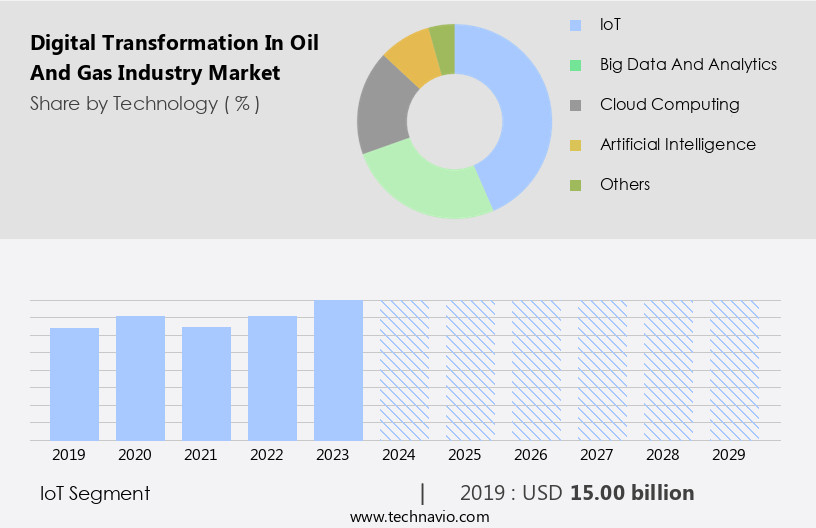

The iot segment is estimated to witness significant growth during the forecast period.

In the oil and gas industry, companies face significant challenges due to disparities in demand and supply, as well as volatile global energy prices. To address these issues, they are focusing on maximizing the value of existing assets and exploring new reserves. The adoption of digital transformation technologies, such as Virtual Reality (Vr) and augmented reality (AR), is revolutionizing various aspects of the industry. For instance, VR is used for training personnel on complex processes like well completion and drilling optimization, while AR enhances maintenance and repair activities on offshore platforms and subsea engineering projects. Artificial intelligence (AI) and machine learning (ML) are being employed for process optimization and production enhancement, including reservoir simulation and seismic imaging.

Digital twins are created to monitor and manage facilities, enabling real-time data analysis and predictive maintenance. Edge computing and remote monitoring facilitate regulatory compliance and risk management, while smart sensors and data visualization tools improve facility management and emissions reduction. Midstream operations, including natural gas processing and pipeline monitoring, benefit from big data and data analytics, enabling more efficient supply chain management and downstream operations. Renewable energy integration and carbon capture are becoming increasingly important, with blockchain technology providing secure and transparent transactions. Upstream operations, including hydraulic fracturing, are also optimized through digital solutions, ensuring efficient and effective production.

Cloud computing and refining processes are essential for data management and analysis, ensuring the industry remains competitive and adaptive to the ever-changing market conditions. Overall, the oil and gas industry's digital transformation is enabling more efficient, cost-effective, and sustainable operations, ensuring long-term growth and profitability.

The IoT segment was valued at USD 15.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

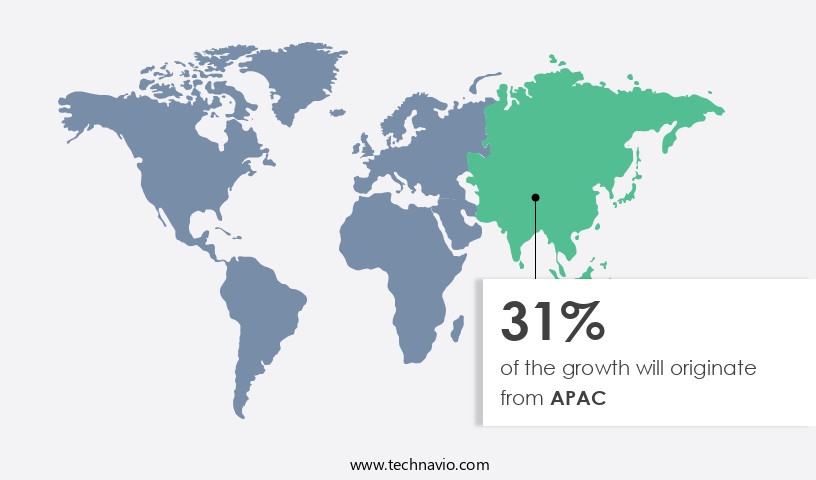

APAC is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic oil and gas industry, digital transformation is driving innovation and optimizing operations in APAC. Companies are leveraging technologies such as virtual reality (VR) and augmented reality (AR) for training and maintenance on offshore platforms, enhancing well completion and drilling processes with artificial intelligence (AI) and machine learning, and optimizing midstream operations with edge computing and remote monitoring. Natural gas processing and LNG production are benefiting from digital twins and data visualization, while subsea engineering and hydraulic fracturing are being revolutionized with process optimization and seismic imaging. Regulatory compliance is being streamlined with smart sensors and digital record-keeping, and risk management is being improved with predictive analytics and real-time data analytics.

Upstream operations are being enhanced with reservoir simulation and production enhancement, while downstream processes are being optimized with big data, data analytics, cloud computing, and renewable energy integration. Carbon capture and blockchain technology are also gaining traction for emissions reduction and supply chain management. The oil and gas sector is embracing digital transformation to increase efficiency, reduce costs, and meet the growing demand for energy products worldwide.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The oil and gas industry is undergoing a digital transformation, with technologies like real time data acquisition pipeline monitoring and ai powered predictive maintenance oil and gas leading the way in operational efficiency. The implementation of digital twin application reservoir management allows for accurate forecasting and performance tracking, while cloud based data storage oil and gas industry supports scalable, secure data handling. Within remote operation center workflow optimization, real-time coordination is improved through centralized oversight and automation.

Advanced systems such as advanced process control gas processing plants and iot sensor integration oil and gas operations enhance equipment responsiveness and data flow. The use of machine learning algorithms production forecasting and subsurface data analytics reservoir simulation strengthens decision-making under complex geologic conditions. Innovations like augmented reality applications well intervention and digital work management platform implementation are improving both field execution and collaboration.

Data interpretation is more precise through geophysical data processing seismic interpretation, enabling proactive pipeline integrity management risk assessment. Tools for asset performance monitoring kpi dashboard and real-time data visualization oilfield operations drive transparency and rapid insights. Production efficiency is further bolstered by production optimization tools well performance and well integrity assessments advanced technology.

Strategic adoption of downtime reduction strategies predictive modeling, energy efficiency improvements industrial automation, and drilling automation systems efficiency gains continues to evolve the industry's infrastructure, enabling more intelligent and sustainable energy development.

What are the key market drivers leading to the rise in the adoption of Digital Transformation In Oil And Gas Industry Industry?

- The market's growth is primarily fueled by increasing investments and partnerships.

- The oil and gas industry is experiencing a notable surge in digital transformation investments and collaborations. This trend is pivotal as it fosters technological advancements while addressing operational challenges, including efficiency, sustainability, and safety. Companies are increasingly adopting digital technologies, such as artificial intelligence, the internet of things, and big data analytics, to optimize midstream and downstream operations and reduce costs. Moreover, there is a heightened focus on sustainability initiatives, with digital tools being employed to minimize emissions and improve energy efficiency. Technology firms and oil and gas companies are forming strategic partnerships to access innovative solutions and expertise, thereby driving digital transformation in the sector.

- This transformation is crucial for the industry's growth and competitiveness in today's market. Companies are implementing edge computing, remote monitoring, and smart sensors for facility management and risk management purposes. Data visualization tools are being used to gain valuable insights from the vast amounts of data generated, enabling informed decision-making. Digital transformation is an essential aspect of the industry's evolution, and its impact is being felt across all aspects of operations.

What are the market trends shaping the Digital Transformation In Oil And Gas Industry Industry?

- Digital twin technology is gaining significant traction in the market as an emerging trend. This innovative approach involves creating virtual replicas of physical assets or processes for improved efficiency, optimization, and predictive maintenance.

- The oil and gas industry is embracing digital transformation to optimize processes and reduce production costs. Digital twin technology, a virtual representation of physical assets, is a key component of this shift. Companies are utilizing digital twins to compare actual and ideal conditions, fostering a safe learning environment and driving innovation in oil and gas production. Additionally, digital technology enables disparate views of sub-surface and surface systems. Drilling optimization, pipeline monitoring, hydraulic fracturing, seismic imaging, carbon capture, and process optimization are among the various applications of digital technology in the industry.

- Machine learning and blockchain technology are also being integrated to enhance production efficiency and ensure transparency in transactions. Overall, digital transformation is revolutionizing the oil and gas sector by providing immersive and harmonious solutions to address complex challenges.

What challenges does the Digital Transformation In Oil And Gas Industry Industry face during its growth?

- The scarcity of skilled labor poses a significant challenge to the expansion and growth of various industries.

- Advanced technologies, including AI, ML, and IoT solutions, are increasingly being adopted by oil and gas producers to boost their returns on investments. Big data, driven by the growing awareness of data-driven solutions, is a significant trend in this industry. However, transforming vast datasets into valuable insights necessitates advanced technology and analytics expertise. Identifying the pertinent data for storage and processing is a major challenge. Analyzing unstructured data requires additional effort from professionals. Real-time data analytics, facilitated by big data and cloud-based software solutions, presents oil and gas companies with innovative opportunities. These solutions enable the industry to enhance oil production process efficiency, reduce costs and risks, ensure regulatory compliance, improve safety, and make informed decisions.

- Big data analytics plays a crucial role in upstream operations, refining processes, production enhancement, and supply chain management. It also aids in reservoir simulation, offering valuable insights for optimizing oil and gas production.

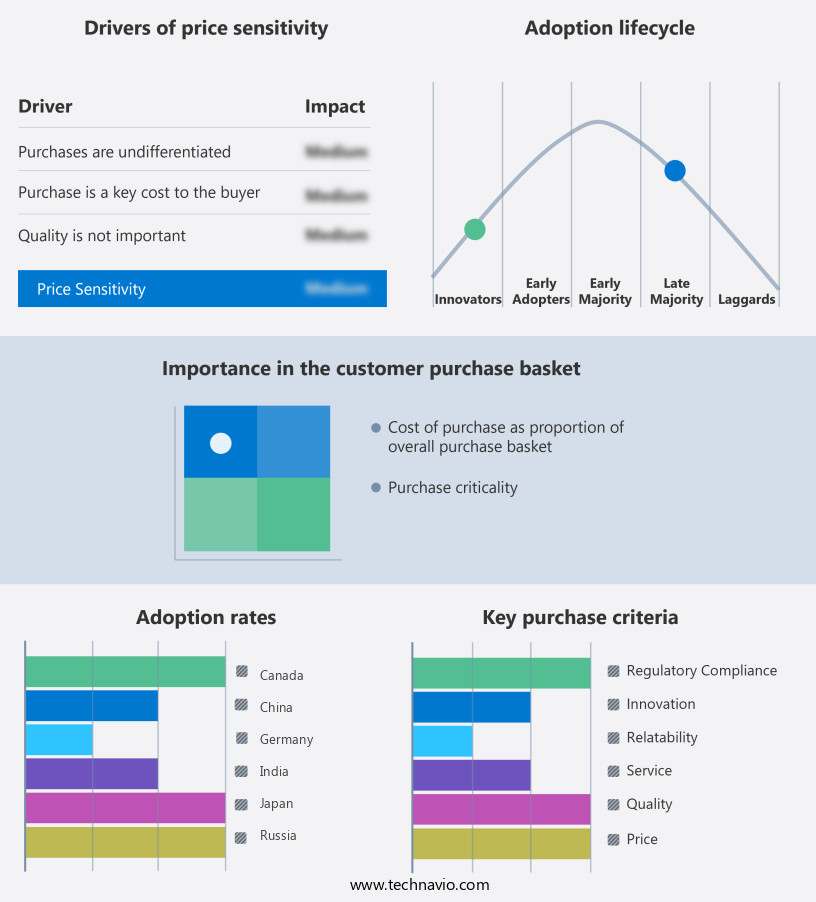

Exclusive Customer Landscape

The digital transformation in oil and gas industry market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital transformation in oil and gas industry market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital transformation in oil and gas industry market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - In the dynamic oil and gas sector, we deliver cutting-edge digital solutions. Our offerings encompass digital twin technology, intelligent digital platforms, and Industry 4.0 architecture. These advanced tools streamline operations, enhance productivity, and optimize resources. By embracing digital transformation, businesses can stay competitive and adapt to market demands.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Amazon.com Inc.

- AVEVA Group Plc

- Emerson Electric Co.

- General Electric Co.

- Halliburton Co.

- Informatica Inc.

- Intel Corp.

- International Business Machines Corp.

- Microsoft Corp.

- NVIDIA Corp.

- Oracle Corp.

- Rockwell Automation Inc.

- SAP SE

- Siemens AG

- Sierra Wireless Inc.

- Tata Consultancy Services Ltd.

- Teradata Corp.

- TIBCO Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Transformation In Oil And Gas Industry Market

- In January 2024, Schlumberger, a leading oilfield services company, announced the launch of its new digital platform, "Oilfield Data Hub," aimed at enhancing operational efficiency and data management in the oil and gas industry. The platform integrates real-time data from various sources to provide actionable insights for exploration and production activities (Schlumberger press release).

- In March 2024, Baker Hughes, a GE company, and Microsoft Corporation signed a strategic partnership to accelerate digital transformation in the oil and gas sector. The collaboration focused on implementing Microsoft's Azure cloud platform and advanced analytics tools to optimize operations and reduce costs for Baker Hughes' customers (Baker Hughes press release).

- In May 2024, Equinor, a Norwegian energy company, announced a significant investment of USD1.2 billion in its digital transformation journey. The funds were allocated to digitalize its upstream, downstream, and renewable energy businesses, including the implementation of advanced analytics, automation, and artificial intelligence technologies (Equinor press release).

- In April 2025, Saudi Aramco, the world's largest oil company, received regulatory approval from the Saudi Arabian General Authority for Civil Aviation to operate its drone fleet for survey and inspection activities in the oil and gas sector. The deployment of drones for digital inspections is expected to increase operational efficiency and reduce costs (Saudi Aramco press release).

Research Analyst Overview

- Oilfield digital twins are transforming operations by providing real-time virtual representations of physical assets, enabling proactive insights and performance monitoring. The use of predictive maintenance models helps reduce unplanned downtime by forecasting equipment failures before they occur. Advanced reservoir simulation software is being deployed to optimize field development strategies and improve recovery rates. Integrated IoT sensor networks and AI-driven drilling optimization enable seamless data collection and smarter decision-making in the field.

- A centralized remote operations center facilitates coordination and control of field assets, supported by cloud-based data storage for scalable access and analysis. The evolution of digital oilfield architecture includes the adoption of augmented reality overlays to support training and maintenance workflows. Automated vehicle systems like gas processing automation and SCADA system upgrades ensure operational efficiency and safety.

- Key infrastructure includes production data management, robust cybersecurity protocols, and unified data integration platforms. These work alongside remote monitoring systems to maintain consistent oversight. Efforts in hydrocarbon exploration and well construction efficiency are supported by specialized risk management software to minimize hazards. Across the board, the drive for operational efficiency gains, enhanced fluid flow simulation, and innovation in unconventional resource recovery is reshaping the modern energy landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Transformation In Oil And Gas Industry Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.5% |

|

Market growth 2025-2029 |

USD 56.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.7 |

|

Key countries |

US, China, Saudi Arabia, Russia, India, Japan, Canada, UK, Germany, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Transformation In Oil And Gas Industry Market Research and Growth Report?

- CAGR of the Digital Transformation In Oil And Gas Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Middle East and Africa, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital transformation in oil and gas industry market growth of industry companies

We can help! Our analysts can customize this digital transformation in oil and gas industry market research report to meet your requirements.