Computer-Aided Design Market in the Civil and Construction Industry Size 2024-2028

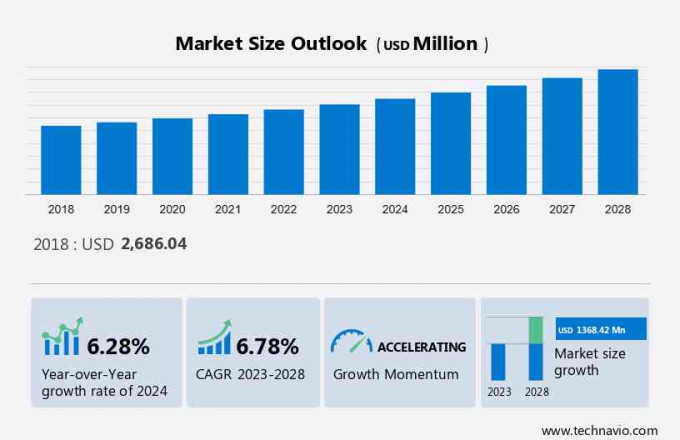

The Computer-Aided Design Market in the Civil and Construction Industry size is estimated to grow by USD 1.36 billion, at a CAGR of 6.78% between 2023 and 2028. The growth of the market depends on several factors including the growing need to automate the design development processes, the growth of the global construction industry and the increasing need for a reduction in design time. CAD software in the civil and construction industry is designed for contractors, builders, engineers, and architects to design their projects. This kind of software serves as a tool for designing mechanical designs and their documentation. This type of software is a tool that is used to design mechanical design and documentation. It is an alternative method for manual drafting and an automated method of mechanical designing or structural design.

The research report on the CAD market in the civil and construction industry offers industry forecasts and segmentation based on component including software and services. It also segments the market by product, which comprises both 3D design and 2D design. Geographically, the report covers North America, Europe, APAC, South America, and the Middle East and Africa. The market size, historical data (2018-2022), and future forecasts are presented in terms of value (in USD billion) for all these mentioned segments.

For More Highlights About this Report, Download Free Sample in a Minute

Market Dynamics

The market in the civil and construction industry is witnessing a transformative shift with the integration of advanced design tools and electronic design automation (EDA). Computer aided design (CAD) solutions, especially cloud-based offerings, are becoming indispensable for architects, engineers, and designers. These tools leverage smart design technologies, augmented reality (AR), and virtual reality (VR) to enhance the design review process and visualize complex models in 3D settings. CAD software's adaptability supports diverse applications in product layouts, conceptual design, and assembly processes, optimizing manufacturing and development processes. Furthermore, CAD solutions play a crucial role in generating environment-based impact reports, essential for assessing sustainability in construction projects. As IoT and 2D functionalities continue to evolve, CAD remains a valuable asset in streamlining workflows and improving efficiency across the industry.

Key Market Driver

The growth of the global construction industry is notably driving the market growth. The global construction industry has experienced drastic changes in the past decade. Developed economies such as the US and the UK are currently facing the problem of ageing infrastructure. Maintenance and restoration operations, along with a shift to sustainable building development and retrofitting practices, are driving the growth of the construction market in these countries. Moreover, green and sustainable building developments have garnered significant investments and technological innovations. The overall development of the world economy is supporting the growth of the global construction industry. Governments of various countries like India, Saudi Arabia, and Qatar are investing heavily in the development of smart cities.

However, smart cities provide better transportation facilities, smart grids, improved healthcare facilities, advanced technologies, and enhanced traffic management systems. For example, the Government of Saudi Arabia is planning to invest in the development of King Abdullah Economic City (smart city), for which the total project cost is estimated to be USD 90 billion. Thus, the increasing investments in the construction industry will drive the growth of the market during the forecast period.

Significant Market Trends

Shift from a perpetual license model to a subscription model is an emerging trend shaping the market growth. The market in the civil and construction industry is moving from perpetual CAD licenses to periodic CAD subscriptions/licenses. The high ROI on subscriptions will encourage CAD vendors to gradually reduce the sale of perpetual CAD licenses before finally discarding them. The benefits of the subscription model over the perpetual license model are the key reason for the shift. The subscription model is simple and provides a better user experience to customers. Vendors can provide updated software versions with bug patches. In addition, the upfront cost is also low in this model. On-premises CAD software and services could be subscribed based on terms decided by the user. This flexibility, coupled with up-to-date software, has made the subscription model a preferred option among end-users.

In addition, autodesk decided to stop providing perpetual CAD licenses for all its product suites in 2016. It will focus on periodical subscriptions to boost revenue from end-users. This transition offers benefits such as lower upfront costs, increased flexibility, and access to the latest updates and features, which will increase the adoption of CAD solutions in the civil and construction industry and, in turn, will propel the growth of the market during the forecast period.

Major Market Restrain

Resistance to adopting new technology is a significant challenge hindering market growth. The construction sector is facing challenges in adopting modern technologies. Many project teams are reluctant to adopt new technologies, and most construction firms use 2D drawings and CAD software. However, with the emergence of technology, firms are facing difficulties in transitioning from traditional applications to advanced CAD solutions, including 3D and 4D design technology. The emergence of new technologies brings an increased level of responsibility, and companies must remain updated to adopt these new technologies. The resistance among construction firms to shift to a new version of software poses a major challenge to this market. CAD software solutions involve advanced features, more functionalities, and compatible features.

However, since these are complex solutions, proper technical training is needed for their optimal utilization in any organization. Professionals also need adequate training to implement any upgrades in the existing system. The training and product costs of these solutions are very high. This often discourages companies from investing in CAD and compels them to opt for counterfeit or open-source CAD software instead. Such factors will hamper the growth of the market during the forecast period.

Market Segmentation

By Component Segment

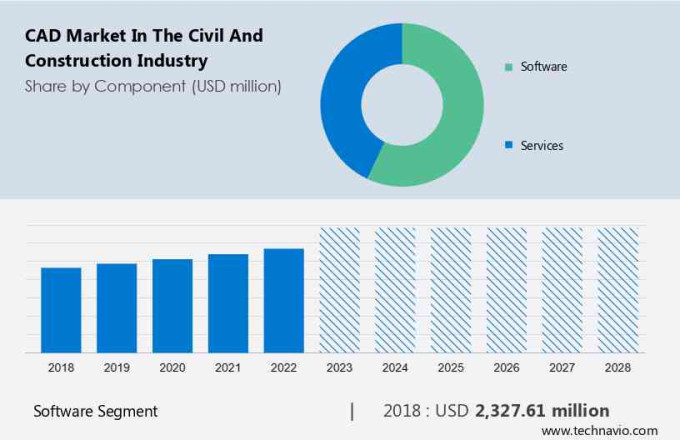

The market share growth by the software segment will be significant during the market growth and forecasting period. The software segment accounts for the majority of the computer-aided design (CAD) market in the civil and construction industry in 2023, owing to the increasing adoption of CAD software by civil and construction companies such as Bouygues, Larsen & Toubro, among others, to improve their design and construction processes.

Get a glance at the market contribution of various segments Download the PDF Sample

The software segment was the largest and was valued at USD 2.33 billion in 2018. Moreover, companies in the market are offering innovative CAD software solutions to increase their share in the CAD market in the civil and construction industry in the civil and construction industry. For instance, Autodesk is a leading provider of CAD software for the civil and construction industry. Autodesk offers a wide range of CAD software products, such as AutoCAD Civil 3D, Revit, and InfraWorks. Similarly, Dassault Systemes is another leading provider of CAD software for the civil and construction industry. Dassault Systemes offers a wide range of CAD software products, such as CATIA, SIMULIA, and DELMIA. These software products are used by civil and construction companies to design and construct a wide range of infrastructure projects, such as roads, bridges, airports, and buildings. Thus, increasing adoption of CAD software solutions will drive the growth of the CAD market in the civil and construction industry in the software segment during the market research and growth period.

By Product

3D CAD software solutions standardize the construction process by enabling the simplified and streamlined management of labour, site events, data capture, information, and material costs. With the deployment of this software, engineers and architects will see a rise in the profitability and efficiency of their projects. Complex structures, frames, forms, and fabrication details of materials have been made easier by the array of 3D models that can be made by the 3D CAD software. Moreover, the increasing demand for advanced and precise design capabilities in construction projects, which allows for better visualization and simulation of structures, the adoption of BIM practices in the construction industry, which rely heavily on 3D design software for integration and collaboration among stakeholders, and the benefits of 3D design in reducing errors, improving construction efficiency, and optimizing resources utilization will spur the growth of the 3D design segment of the global CAD market in the civil and construction industry during the market forecasting period.

Regional Overview

For more insights on the market share of various regions Download PDF Sample now!

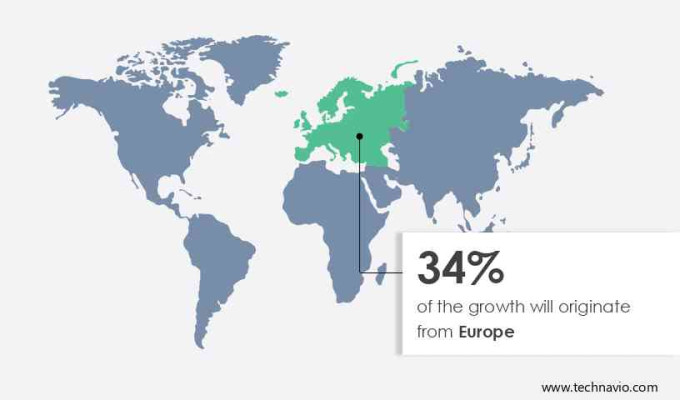

Europe is estimated to contribute 34% to the growth of the global market during the market forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. North America has always been a lucrative market for vendors as the region is an early adopter of advanced technologies across all the end-users of CAD software in the civil and construction industry. The construction industry in the Americas is technologically mature owing to the early adoption of technologies. The strong existence and penetration of the top vendors raise the overall CAD market in the civil and construction industry growth in the region. The region has some of the most advanced and developed economies in the world, which boosts the rate of infrastructure development in North America. CAD software plays an integral role in simplifying the flow of information technology and services with real-time tracking to monitor building and construction development. Moreover, the benefits of using CAD software are increasing its demand from the manufacturing-intensive industries in North America.

As a result, it is expected that the growth momentum of the computer-aided design (CAD) market in the civil and construction industry in North America will accelerate slightly during the forecast period. American companies have started investing in manufacturing automation technologies such as 3D printing and robot-assisted production. These automation technologies use the data output from CAD systems, which are an integral part of the designing and execution activities in the manufacturing industries. Such factors will drive the growth of the regional market during the market growth analysis period.

Key Market Customer Landscape

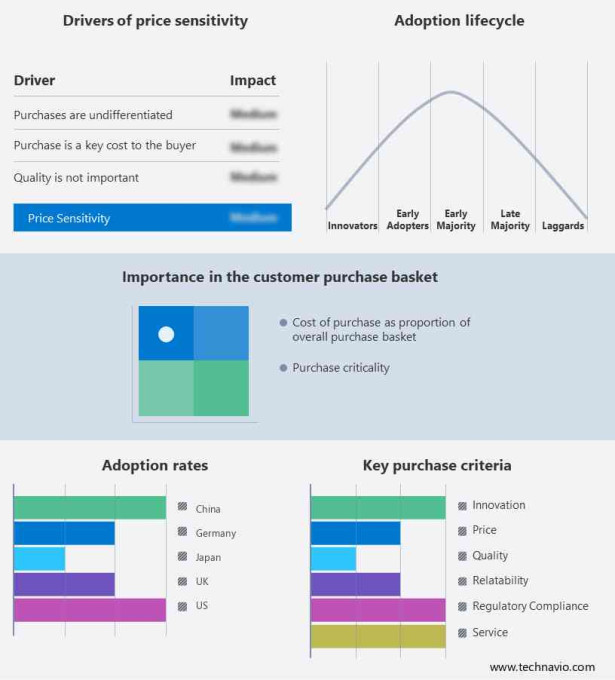

The CAD Market in the Civil and Construction Industry report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global CAD Market in the Civil and Construction Industry Customer Landscape

Who are the Major CAD Market in the Civil and Construction Industry Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alibre LLC - The company offers CAD software with customizable UI, precise sketching, robust modelling and realtime CPU driven rendering.

Autodesk Inc. - The company offers CAD software under the brand name AutoCad, to create high quality designs, optimize projects and improve predictability in field to maximize constructability and coordination.

Bentley Systems Inc. - The company offers CAD software for 3D modeling, design, and analysis applications for transportation, land development, water, and civil projects.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- CAD International

- Caddie Ltd.

- Corel Corp.

- Dassault Systemes SE

- DATACAD LLC

- ESI Group SA

- Gstarsoft Co. Ltd.

- Hexagon AB

- IMSI Design LLC

- Nanosoft AS

- Nemetschek SE

- PTC Inc.

- Schneider Electric SE

- Siemens AG

- SmartDraw Software LLC

- Trimble Inc.

- ZWSOFT CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Component Outlook

- Software

- Services

- Product Outlook

- 3D design

- 2D design

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also be interested in:

- 3D Computer Aided Design (CAD) Software Market - 3D Computer Aided Design (CAD) Software Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, China, Japan, Germany, UK - Size and Forecast

- Computer Integrated Manufacturing Market - Computer Integrated Manufacturing Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

- Computer Aided Engineering (CAE) Market - Computer Aided Engineering (CAE) Market Analysis Europe, North America, APAC, South America, Middle East and Africa - US, Germany, China, France, Japan - Size and Forecast

Market Analyst Overview

The market continues to evolve with advancements in cloud-based solutions, integrating AR and VR elements that enhance the design process across various industries. These technologies are becoming valuable assets, offering adaptability in CAD software to cater to diverse needs from automotive to aerospace and defense sectors. Cloud based CAD solutions provide flexibility compared to on-premises options, addressing environmental concerns and optimizing hardware specifications and software updates. CAD supports surface modeling, reverse engineering, and drafting detailing, crucial for vehicle propulsion, including electric vehicles. It plays a pivotal role in end-use verticals like electrical and electronics, industrial equipment, and media and entertainment, replacing traditional manual drafting methods. As IoT and BIM influence design types, CAD remains integral in shaping 3D segments and supporting complex models crucial for manufacturing and development processes in today's competitive landscape.

Also, Computer-Aided Design (CAD) is pivotal in modern engineering and design processes, with both cloud-based and on-premises solutions offering significant advantages. Cloud-based CAD solutions are increasingly preferred for their scalability and accessibility, overcoming the limitations of on-premises software. This adaptability of CAD software caters to diverse needs across various industries, enhancing efficiency in surface modeling, design reviews, and utilizing advanced design tools, electronic design automation (EDA), and smart technologies like augmented reality (AR) and virtual reality (VR). These AR and VR elements revolutionize the design review process, allowing for immersive 3D settings that streamline manufacturing and development processes. CAD's role extends to building information management, robotics, and IoT integration, supporting environmental impact assessments and optimizing energy and materials usage in end-use verticals. As technology evolves, CAD remains integral in shaping design types and operating systems, driving innovation in the 3D segment of engineering and beyond.

|

CAD Market In The Civil And Construction Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market Growth 2024-2028 |

USD 1.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.28 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alibre LLC, Autodesk Inc., Bentley Systems Inc., CAD International, Caddie Ltd., Corel Corp., Dassault Systemes SE, DATACAD LLC, ESI Group SA, Gstarsoft Co. Ltd., Hexagon AB, IMSI Design LLC, Nanosoft AS, Nemetschek SE, PTC Inc., Schneider Electric SE, Siemens AG, SmartDraw Software LLC, Trimble Inc., and ZWSOFT CO. LTD. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this CAD Market In The Civil And Construction Industry Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.