3D Computer Aided Design (CAD) Software Market Size 2025-2029

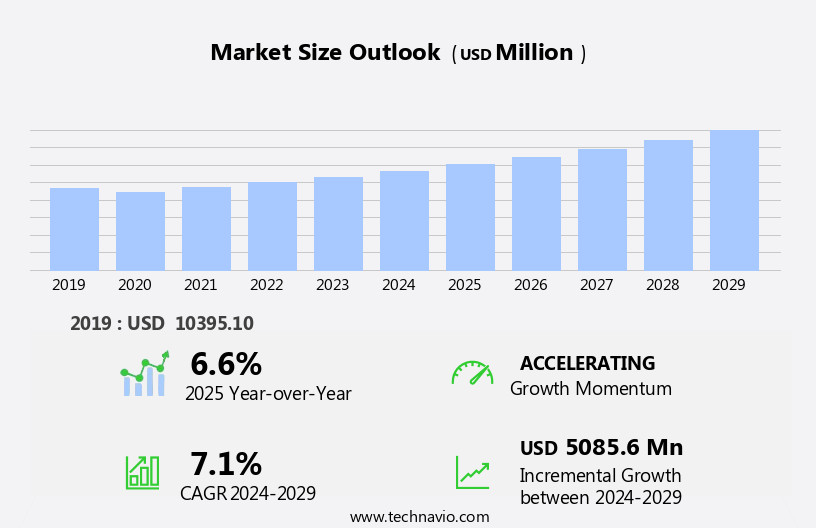

The 3d computer aided design (cad) software market size is forecast to increase by USD 5.09 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is witnessing significant growth, driven by the high adoption of these solutions in optimizing production value chains across various industries. The integration of 3D CAD software in design, engineering, and manufacturing processes enhances productivity, reduces errors, and improves product quality. Moreover, the emergence of new technologies, such as cloud computing, virtual reality, and the Internet of Things (IoT), is revolutionizing the global 3D CAD software market. These advancements enable real-time collaboration, remote access, and improved data management, making design and manufacturing processes more efficient and agile.

- However, the increasing availability of open-source and free versions of 3D CAD software poses a challenge for market players. These alternatives cater to small businesses and individual users, potentially disrupting the market dynamics and pricing structures. Companies must differentiate themselves by offering unique features, superior customer support, and seamless integration with other business applications to maintain their competitive edge.

What will be the Size of the 3D Computer Aided Design (CAD) Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The 3D Computer-Aided Design (CAD) software market continues to evolve, driven by the dynamic interplay of various sectors and applications. Medical devices, for instance, benefit from CAD's precision in designing intricate components, while subtractive manufacturing optimizes production processes through solid modeling. Design review and quality control ensure product excellence, with industrial design and electrical engineering sectors reaping significant advantages. Computer-aided engineering (CAE) and version control facilitate seamless collaboration and iteration, enabling design automation and reverse engineering. The integration of AI-assisted design, CAM software, and parametric design propels innovation in consumer products and engineering plastics. Augmented Reality (AR) and Virtual Reality (VR) technologies merge CAD with immersive experiences, revolutionizing design thinking and design validation.

Additive manufacturing and topology optimization transform manufacturing processes, while generative design and digital manufacturing streamline production. CAD software's continuous evolution encompasses mesh processing, surface modeling, and design verification, fostering process optimization and tolerance analysis. Collaboration tools, API integration, and engineering plastics further expand its applicability. The CAD landscape remains vibrant, with ongoing advancements in design automation, digital twin, and cloud computing shaping the future of product design.

How is this 3D Computer Aided Design (CAD) Software Industry segmented?

The 3d computer aided design (cad) software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- Application

- Manufacturing

- AEC

- Automotive

- Healthcare

- Others

- Sector

- Large enterprises

- Small and medium enterprises (SMEs)

- Freelancers and individual designers

- Pricing Scheme

- Subscription-based (SaaS)

- Perpetual license

- Pay-per-use

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

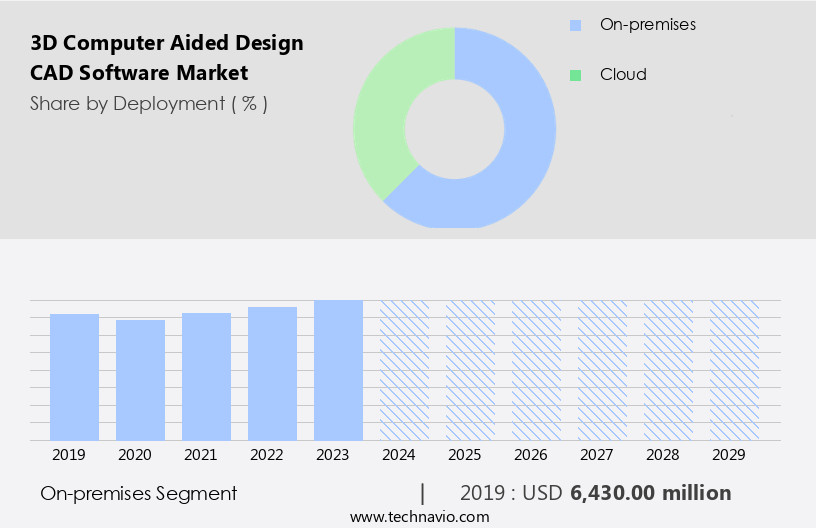

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

In the realm of Computer-Aided Design (CAD), on-premises 3D CAD software represents the traditional model, installed and operated on local computers or servers. This software's advantages lie in its customizability and optimization, catering to unique business requirements. Suitable for enterprises with robust IT capabilities, on-premises 3D CAD software allows for complete control over the software, including its setup and configuration. The integration of design thinking, 3D modeling, and design validation within this software enables companies to streamline their product development process. Additionally, supply chain management and design for manufacturing capabilities ensure efficient production and collaboration.

Solid modeling and parametric design facilitate precise and accurate product design, while human-machine interface (HMI) and design automation enhance user experience and productivity. Material science and tolerance analysis contribute to the creation of high-quality consumer products, while additive manufacturing and generative design offer innovative solutions for manufacturing processes. Augmented reality (AR) and virtual reality (VR) technologies provide immersive design experiences, while topology optimization and digital manufacturing optimize production processes. Engineering plastics, design for assembly, and collaboration tools facilitate efficient product design and development. CNC machining, process optimization, and version control ensure manufacturing accuracy and efficiency.

Furthermore, software engineering and API integration enable seamless integration with other systems, while mechanical, electrical, and computer-aided engineering applications cater to various industries. Cloud computing and technical documentation streamline data management and knowledge sharing, allowing for more effective collaboration and design review. Quality control, industrial design, and medical devices industries particularly benefit from the advanced capabilities of on-premises 3D CAD software.

The On-premises segment was valued at USD 6.43 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The global 3D CAD software market is witnessing significant growth due to the integration of advanced technologies such as design thinking, AI-assisted design, and topology optimization. These innovations enable more efficient design processes, improved product quality, and enhanced collaboration between teams. North America is currently the largest market for 3D CAD software, driven by the presence of a robust manufacturing sector and established companies like Boeing, General Motors, and General Electric. The region's aerospace and defense industry is a significant consumer, utilizing 3D CAD software for product design, manufacturing, and research and development. Other industries, including consumer products, medical devices, and electrical engineering, also contribute to the market's growth.

The software is essential for design validation, tolerance analysis, and design for manufacturing, enabling process optimization and digital manufacturing. Additionally, technologies like additive manufacturing, CNC machining, and 3D printing are expanding the application areas of 3D CAD software. Furthermore, collaboration tools, API integration, and version control facilitate seamless workflows and ensure design automation. Cloud computing and virtual reality are also transforming the 3D CAD software landscape, offering increased flexibility and immersive design experiences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The 3D computer-aided design (CAD) software market is a dynamic and innovative industry, continually pushing the boundaries of design technology. This sector caters to professionals and enthusiasts alike, offering robust solutions for architectural, mechanical, and product design. Advanced features include parametric modeling, solid modeling, rendering, and animation. Leading CAD software brands prioritize user-friendly interfaces, ensuring accessibility for designers of all skill levels. Integration with Building Information Modeling (BIM) and collaboration tools enhances productivity and streamlines workflows. Moreover, the market is witnessing significant growth due to the increasing adoption of Industry 4.0 and the Internet of Things (IoT) in manufacturing processes. Additionally, the rise of cloud-based solutions and virtual reality technologies further expand the market's potential. Overall, the 3D CAD software market is a vibrant and evolving landscape, providing essential tools for design professionals and shaping the future of innovation.

What are the key market drivers leading to the rise in the adoption of 3D Computer Aided Design (CAD) Software Industry?

- The high adoption of 3D Computer-Aided Design (CAD) software plays a pivotal role in optimizing production value chains, thereby serving as the primary driver for the growth of the market.

- Three-dimensional Computer Aided Design (3D CAD) software is a valuable tool for businesses seeking process optimization and product innovation. This technology enables designers and engineers to create intricate, detailed models of their designs, enhancing the initial stages of production. By utilizing 3D CAD, companies can visualize the interior and exterior of their prototypes, defining their physical attributes, functionality, dimensions, materials, tolerances, and final appearance. 3D CAD software streamlines the design process, increasing efficiency and reducing time spent on manual drafting. It is widely adopted across various industries, including electronics, manufacturing, aerospace, and automobiles, to design individual components or entire products.

- Additionally, it supports design for assembly, generative design, digital manufacturing, CNC machining, collaboration tools, parametric modeling, surface modeling, design verification, mesh processing, and API integration, all essential elements in mechanical engineering. This technology is crucial for businesses aiming to stay competitive in today's market. It allows for faster prototyping, more accurate designs, and improved collaboration between teams, ultimately resulting in higher-quality products and shorter time-to-market. By embracing 3D CAD software, businesses can innovate, optimize, and streamline their design and manufacturing processes.

What are the market trends shaping the 3D Computer Aided Design (CAD) Software Industry?

- The global 3D CAD software market is experiencing an emergence of new technologies, representing a significant market trend. Innovations in this sector are shaping the future of design and engineering applications.

- The 3D Computer-Aided Design (CAD) software market is experiencing significant advancements, aligning with technological innovations. One notable trend is the Internet of Things (IoT) integration, which enhances manufacturing processes. IoT-CAD collaboration streamlines tasks such as planning, design, and marketing strategies. IoT is a network of connected devices that exchange data, enabling improved engineering and design practices. This integration offers numerous benefits, including increased efficiency, accuracy, and real-time collaboration. Additionally, CAD software supports various industries, including medical devices, industrial design, electrical engineering, and computer-aided engineering (CAE).

- Features like version control, digital twin, and technical documentation facilitate quality control and manufacturing process optimization. Furthermore, cloud computing allows for remote access to CAD tools and data, fostering flexibility and collaboration. Product design teams can leverage these advancements to create innovative solutions and maintain version control, ensuring the highest standards of quality.

What challenges does the 3D Computer Aided Design (CAD) Software Industry face during its growth?

- The proliferation of open-source and complimentary 3D Computer-Aided Design (CAD) software poses a significant challenge to the industry's growth by increasing competitive pressure and potentially undermining the market for proprietary solutions.

- In today's business landscape, the adoption of open-source 3D Computer-Aided Design (CAD) software is gaining momentum due to the increasing demand for digitalization. Open-source software offers a variety of business analytics tools and applications, accessible for free on the Internet. This is particularly beneficial for Small and Medium-sized Enterprises (SMEs), as the purchasing and licensing costs of commercial software can be prohibitive. Key features of 3D modeling, data management, design thinking, and design validation are available in most open-source 3D CAD software. Some popular options include FreeCAD, Fusion 360, Onshape, and DraftSight. These tools support solid modeling, human-machine interface (HMI), design for manufacturing, additive manufacturing, and AI-assisted design.

- Furthermore, they offer parametric design capabilities and are compatible with CAM software. Open-source 3D CAD software plays a crucial role in various industries, including consumer products, by enabling efficient supply chain management and design validation. The software's immersive and harmonious user experience streamlines the design process, emphasizing productivity and accuracy. In conclusion, open-source 3D CAD software offers a cost-effective and feature-rich alternative to commercial software, making it an essential tool for businesses seeking to innovate and compete in the market.

Exclusive Customer Landscape

The 3d computer aided design (cad) software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 3d computer aided design (cad) software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 3d computer aided design (cad) software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Altair Engineering Inc. - This company specializes in providing advanced 3D CAD software solutions for design, manufacturing, and engineering applications. Among the offerings are Altair Inspire Studio for creating 3D designs, generating manufacturing drawings, and morphing geometries. Additionally, Altair Sulis Design is provided for Additive Manufacturing Design for Manufacturing and Assembly (DfMA) and CAD tools, enabling swift geometry creation for intricate lattice and fluid flow structures. These solutions empower users to streamline their design processes and enhance overall productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altair Engineering Inc.

- ANSYS Inc.

- Autodesk Inc.

- Bentley Systems Inc.

- Caddie Ltd.

- Constellation Software Inc.

- Corel Corp.

- Dassault Systemes SE

- Graebert GmbH

- Hexagon AB

- IMSI Design LLC

- IronCAD LLC

- Jytra Technology Solutions Pvt. Ltd.

- Nemetschek SE

- PTC Inc.

- Siemens AG

- SketchList

- SolidCAM GmbH

- Trimble Inc.

- ZWSOFTÂ CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 3D Computer Aided Design (CAD) Software Market

- In January 2024, Autodesk, a leading CAD software company, announced the launch of its new cloud-based 3D CAD solution, Autodesk Fusion 360 Cloud, aimed at small and medium-sized businesses. This new offering expanded Autodesk's product portfolio and targeted a previously underserved market segment (Autodesk Press Release, 2024).

- In March 2024, PTC and Siemens Digital Industries Software entered into a strategic partnership to integrate PTC's Creo CAD software with Siemens' product lifecycle management (PLM) solution, Teamcenter. This collaboration aimed to provide customers with a more comprehensive product development solution (PTC Press Release, 2024).

- In May 2025, Dassault Systèmes, a global leader in 3D design software, acquired IQMS, a manufacturing ERP software provider, for approximately USD365 million. This acquisition was intended to strengthen Dassault Systèmes' offering in the manufacturing industry by integrating IQMS' solutions with its SolidWorks 3D CAD software (Dassault Systèmes Press Release, 2025).

- In the same month, SOLIDWORKS, a Dassault Systèmes brand, introduced its new 3D CAD software version, SOLIDWORKS 2026, with advanced AI-driven design capabilities. This technological advancement was expected to significantly improve the design process efficiency for engineers and designers (SOLIDWORKS Press Release, 2025).

Research Analyst Overview

- In the dynamic 3D Computer-Aided Design (CAD) software market, digital fabrication technologies, such as additive and subtractive manufacturing techniques, are revolutionizing product development. Material selection and product certification are crucial aspects of this process, with data analytics enabling informed decisions. The circular economy is gaining traction, driving the demand for design for sustainability and product testing. Simulation software, including Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), plays a significant role in product cost analysis and quality assurance. CNC machine tools and 3D printing materials continue to dominate traditional manufacturing processes, while additive manufacturing techniques offer new possibilities.

- Virtual prototyping and Product Lifecycle Management (PLM) software facilitate design collaboration platforms, production planning, and manufacturing cost analysis. Supply chain optimization and inventory management are essential components of efficient manufacturing processes. Automation software and CAM tools streamline production, enhancing overall productivity. Product testing and design for sustainability are key trends, with circular economy principles driving the need for efficient material usage and reduced waste. The integration of BIM software and PDM software further supports the digital transformation of manufacturing, enabling seamless collaboration and data sharing.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 3D Computer Aided Design (CAD) Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 5085.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Canada, China, Japan, India, UK, Germany, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 3D Computer Aided Design (CAD) Software Market Research and Growth Report?

- CAGR of the 3D Computer Aided Design (CAD) Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 3d computer aided design (cad) software market growth of industry companies

We can help! Our analysts can customize this 3d computer aided design (cad) software market research report to meet your requirements.