US Casino Gaming Market Size 2024-2028

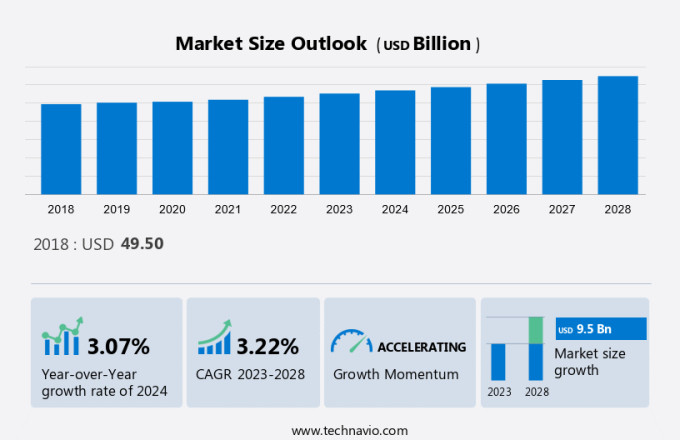

The US casino gaming market size is estimated to grow by USD 9.5 billion accelerating at a CAGR of 3.22% between 2023 and 2028. The online casino industry is experiencing significant growth due to several key factors. Firstly, the increasing spending capability of customers, driven by economic stability and disposable income, is fueling a rise in demand for online gaming. Secondly, the penetration of online casino platforms has expanded exponentially, making gaming more accessible than ever before. Lastly, the easing of government regulations in various jurisdictions has allowed for the legalization and normalization of online casino gaming, further boosting its popularity. These factors combined are creating a favorable environment for the continued growth and success of the online casino industry.

Get Additional Information on this Report, Request Free Sample in PDF

Market Dynamics

The market is a dynamic and evolving industry, characterized by various gaming options and innovative technologies. The market caters to diverse end-use segments, including online and offline casinos, sports betting, lotteries, and gaming arcades. The market's growth is driven by several factors, including customer preferences for convenience and immersive gaming experiences. In terms of gaming options, the market offers a wide range, from traditional table games like poker and blackjack to slot machines and electronic games. The use of advanced technology, such as virtual reality and augmented reality, is becoming increasingly popular, providing players with a more engaging and interactive experience. The market also prioritizes sustainability, with a focus on eco-friendly packaging options and regulatory compliance. Sustainable packaging materials, such as bioplastics and paper, are gaining popularity, while regulatory pressure and customer awareness are driving the adoption of sustainable practices in the industry. The market is segmented based on end-use and closure options. Closure options include spout closures, which are commonly used in ready-to-drink beverages, and standard closures, which are used in various packaged food and beverage applications. The market also offers various treatment types, such as metal, plastic, and paper, to cater to diverse customer preferences.

Key Market Driver

The growth in spending capability of customers is a key driver boosting the market. The surge in dual-income households in the US signifies higher per capita disposable income, boosting affordability for luxury items and spending capacity. Globally, the workforce's female representation has risen substantially. In 2022, over 57% of US women were employed, and 70% of mothers with children under 18 were part of the workforce, elevating income levels. This economic empowerment has led to increased expenditure on recreational activities like sports betting, also becoming a status symbol among the affluent. The casino gaming market in the US is experiencing significant growth due to rising income levels, increased awareness, and enhanced security measures on online platforms.

Significant Market Trends

The public image enhancement is a key trend shaping the growth of the market in US. The US casino gaming market grapples with a tarnished public perception, leading to bans in certain states based on moral or religious grounds. The industry is often associated with fraud, prompting government monitoring to ensure vendor legitimacy and equal player opportunities. To rebuild trust, increased contributions to social welfare and developmental initiatives are being emphasized. These measures aim to enhance market credibility and encourage player confidence, fostering growth in the forecasted period.

Major Market Challenges

The difficulties in securing online payments is a key factor hindering the growth of the market in US. Most US casino gaming firms process payments via credit or debit cards, necessitating compliance with the Payment Card Industry Data Security Standard (PCI-DSS) to safeguard customers' financial information and minimize fraud. Adhering to PCI-DSS is crucial in reducing the risk of financial losses resulting from card-related fraud. Security solution providers like Thales Solutions offer end-to-end encryption services to enhance payment security for casino gaming companies. However, varying security budgets among companies may limit widespread implementation of external security services, presenting a substantial challenge to the US casino gaming market in the forecast period.

Market Segmentation

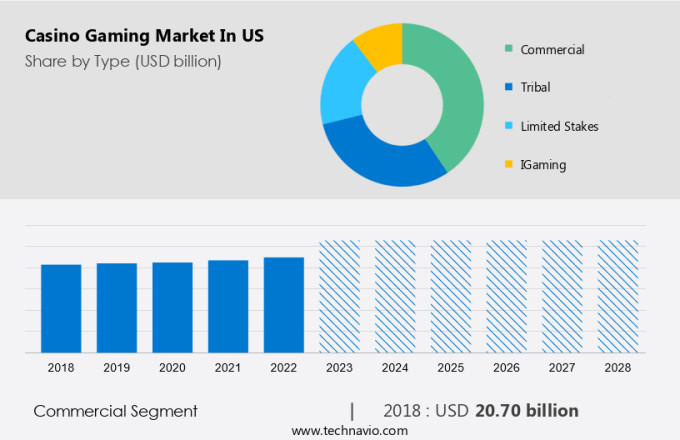

The commercial segment is set for significant growth in the US casino gambling market. Dominated by major players like commercial casinos, these establishments offer diverse gaming options, including traditional table games and the latest video slots. Many commercial casinos go beyond gaming, featuring luxury hotels, restaurants, and entertainment venues for a complete experience. Their success lies in attracting a broad customer base, from high rollers with VIP areas to casual players. Loyalty programs, offering perks like free games and hotel stays, contribute to customer retention. Overall, the commercial segment's strategic approach ensures a comprehensive and appealing entertainment experience for various audiences.

Get a glance at the market contribution of various segments Request Free Sample

The commercial segment was valued at USD 20.70 billion in 2018. The growth of commercial casinos in the US can also be attributed to the adoption of technology. Many casinos have integrated digital gaming options such as online slots and mobile betting to appeal to younger audiences who prefer gaming on mobile devices. In addition, advances in gaming software are making casinos more immersive and visual. Therefore, the factors mentioned above are expected to drive the growth of the commercial segment of the US Casino Gaming Market during the forecast period.

Casino Gaming Market In US Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- Commercial

- Tribal

- Limited stakes

- iGaming

- Platform Outlook

- Traditional

- Online

You may also be interested in:

- Casino Gaming Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, Canada, China, France, Germany - Size and Forecast

- Casino Gaming Equipment Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, China, UK, Germany, Canada - Size and Forecast

- Philippines Casino Gaming Market by Type, Product, and Geography - Forecast and Analysis

Market Analyst Overview

The casino gaming industry is continually evolving, with new games, technologies, and marketing tactics emerging to attract and retain customers. One area of innovation that has gained significant attention is sustainable packaging in the ready-to-eat (RTE) food sector. Instead of focusing on traditional transportation vehicles, casinos are now adopting eco-friendly packaging solutions for their snacks, beverages, and other RTE food offerings. Stand-up pouches made of lightweight, plastic-based materials like Polyethylene, Polypropylene, Polyethylene Terephthalate, polyhydroxyalkanoates, and polylactic acid are increasingly popular. These materials offer advantages such as flexibility, easy transportation, and reduced carbon footprint. Biodegradable materials, such as those derived from plant-based sources, are also gaining traction. Companies like Omniplast are leading the way with their innovative packaging solutions for the pet food industry. Closure options, such as reusable or recyclable metal and paper alternatives, are also being explored to further reduce waste. Marketing these sustainable packaging options effectively is crucial. Casinos can emphasize the ecological rating of their packaging and the regulatory pressure driving the shift towards sustainable solutions. Printed images of natural environments or eco-friendly messaging can be used to appeal to customers' growing awareness of sustainability. Food processing processes can also be highlighted as part of the marketing strategy. For instance, casinos can showcase how their use of sustainable packaging contributes to the frozen packaged industry's standardization and the overall growth of the packaged food market.

In conclusion, sustainable packaging is an effective marketing tactic for casinos looking to attract and retain customers. By offering RTE food and beverages in eco-friendly packaging, casinos can differentiate themselves from competitors, meet regulatory requirements, and align with customers' evolving values. The casino gaming market is diversifying with advancements in packaging machinery and flexible packaging products tailored for various needs. Packaging manufacturers are exploring innovations in plastic-based packaging products, including recyclable pouches and bioplastic materials like PHAs and PLA. This trend is evident in the alcoholic beverages and baby food products sectors, where plastic material and closure types enhance portability and food waste management. The frozen packaged industry and ready-to-eat meals benefit from flat pouch and small-sized packs solutions. Personal care and cosmetic applications also leverage plastic resins for packaging. Organized retail penetration and transportation vehicles play a role in distributing CPG products such as dried fruits, confectionery, and dairy products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.22% |

|

Market growth 2024-2028 |

USD 9.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.07 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Angel Group Co. Ltd., Aristocrat Leisure Ltd., Bet365 Group Ltd., Caesars Entertainment Inc., Churchill Downs Inc., DraftKings Inc., Eclipse Gaming Systems, Entain Plc, Everi Holdings Inc., Fertitta Entertainment Inc., Incredible Technologies Inc., International Game Technology plc, INTRALOT SA, Kindred Group Plc, Konami Group Corp., Light and Wonder Inc., PENN Entertainment Inc., PlayAGS Inc., Rye Park LLC, and Universal Entertainment Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market forecasting report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Casino Gaming Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market growth and trends, market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across the US

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.