Casino Gaming Market Size 2025-2029

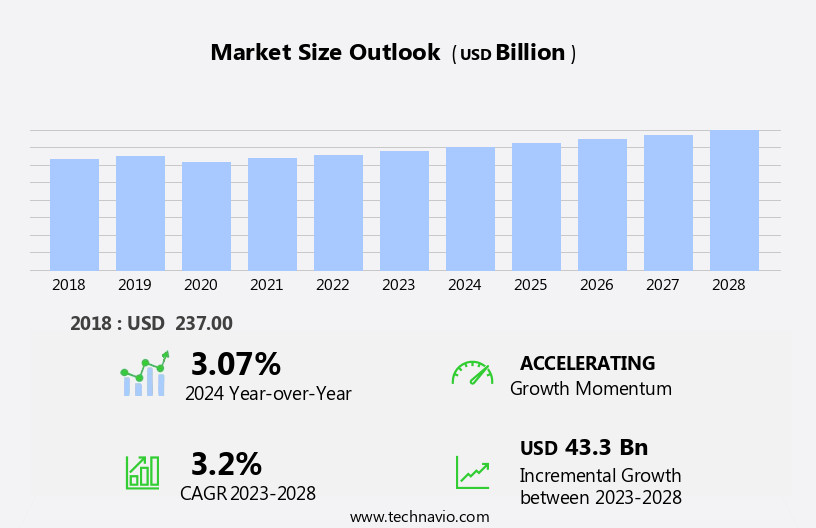

The casino gaming market size is forecast to increase by USD 45.9 billion, at a CAGR of 3.3% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing spending capability of customers. This trend is fueled by the rising disposable income and the growing popularity of casino gaming, both online and offline.

Major Market Trends & Insights

- North America dominated the market and contributed 40% to the growth during the forecast period.

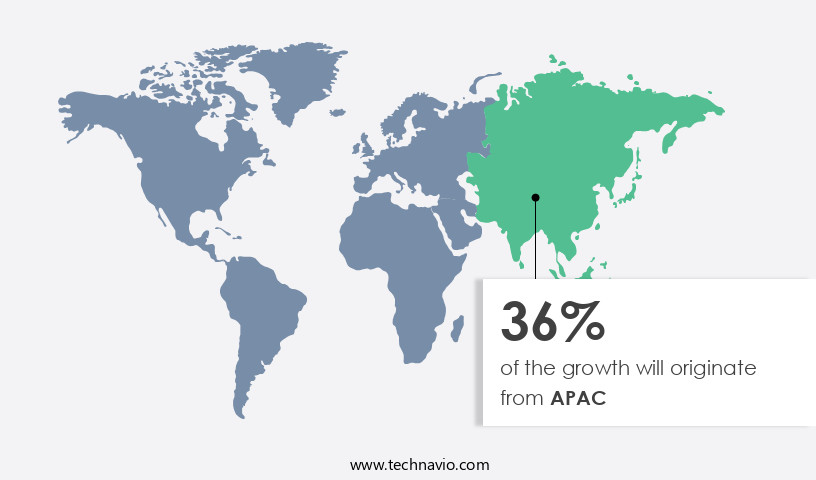

- The market is expected to grow significantly in APAC region as well over the forecast period.

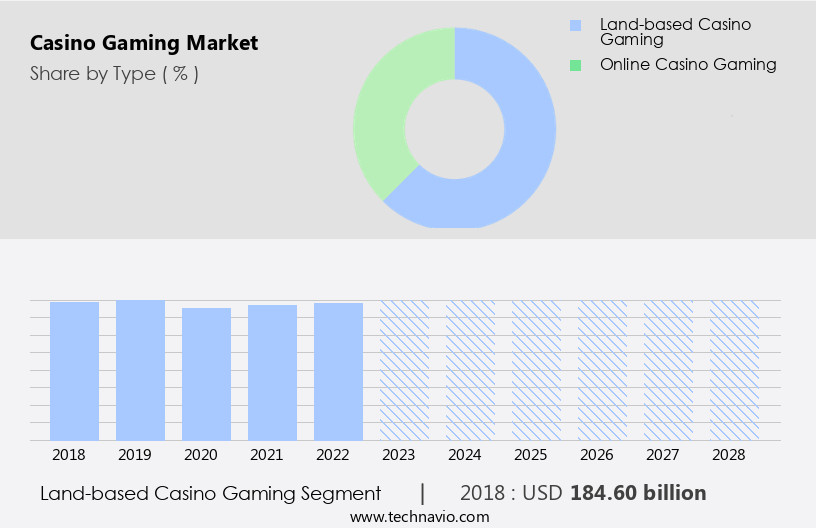

- Based on the Type, the land-based casino gaming segment led the market and was valued at USD 189 billion of the global revenue in 2023.

- Based on the Product, the slot machines segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 26.92 Billion

- Future Opportunities: USD 45.9 Billion

- CAGR (2024-2029): 3.3%

- North America: Largest market in 2023

A key driver is the increasing use of social media marketing by casino operators to attract and engage customers. This digital marketing strategy is proving effective in reaching a larger audience and generating interest in casino games. However, the market is not without challenges. One of the most pressing issues is the difficulties in securing online payments. With the rise of cybercrime and data breaches, ensuring the safety and security of online transactions is a major concern for both customers and casino operators. This challenge requires innovative solutions to protect sensitive information and build trust in the online gaming industry. Effective implementation of advanced security measures, such as encryption and multi-factor authentication, can help mitigate these risks and maintain customer confidence. Companies that successfully navigate these challenges and capitalize on market opportunities will be well-positioned for growth in the market.

What will be the Size of the Casino Gaming Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with innovations in technology and consumer preferences shaping its dynamics. A prime example of this is the integration of advanced fraud detection systems to ensure fair play and maintain trust among players. Moreover, VIP player management and account management systems enable casinos to offer personalized experiences and retain high-value customers. Virtual reality and augmented reality casino experiences are gaining traction, offering immersive gaming environments that attract a new demographic. The market's growth is expected to reach double digits in the coming years, with industry analysts projecting a 12% increase in revenue by 2025. A bonus payout system, integrated with a data analytics dashboard, allows casinos to optimize their bonus round triggers and player tracking systems, enhancing the overall gaming experience.

Player authentication systems ensure secure access to casino platforms, while random number generators maintain fairness and transparency. Compliance audit systems and gaming regulation compliance are essential components of the market, ensuring that casinos adhere to strict industry standards. CRM integration, game server architecture, and paytable configuration are other critical aspects of casino operations that continue to evolve. An online casino implemented a responsible gaming feature, reducing the number of problem gamblers by 20%. This initiative not only improved player satisfaction but also ensured regulatory compliance and enhanced the casino's reputation. The market's technological advancements extend to live dealer streaming, jackpot probability calculations, and cashless payment gateways.

Game development kits and RTP calculation methods enable developers to create engaging and profitable casino games. Roulette wheel bias detection and betting limit enforcement systems maintain fairness and prevent fraudulent activities. In conclusion, the market's continuous evolution is driven by technological advancements, changing consumer preferences, and regulatory requirements. These trends are shaping the industry's future, with innovations in virtual and augmented reality, player experience, and security leading the way.

How is this Casino Gaming Industry segmented?

The casino gaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Land-based casino gaming

- Online casino gaming

- Product

- Slot machines

- Lottery ticket machines

- Electronic roulette

- Multiplayer game stations

- Gaming servers

- End-user

- High rollers

- Casual gamblers

- Tourists local

- Residents

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The land-based casino gaming segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 189 billion in 2023. It continued to the largest segment at a CAGR of 2.49%.

The market encompasses both land-based and online platforms, each offering unique experiences for players. Land-based casinos, with their atmospheric neon lights and social interaction, continue to attract tourists worldwide. Modern technologies integrated into these establishments include fraud detection systems for security, VIP player management for personalized experiences, and player tracking systems for tailored marketing strategies. Online casinos, meanwhile, provide convenience and accessibility with mobile gaming platforms and virtual reality experiences. Customer loyalty programs, payment processing systems, and responsible gaming features ensure player satisfaction and regulatory compliance. Advanced technologies such as augmented reality gaming, live dealer streaming, and poker hand evaluators add to the immersive experience.

The market is expected to grow significantly, with industry experts estimating a 15% increase in online casino revenue by 2025. Innovations like cashless payment gateways, game development kits, and real-time paytable configuration further enhance the gaming experience. Security remains a priority, with robust game security protocols, random number generators, and compliance audit systems ensuring fair play and player protection. For instance, a leading casino operator reported a 30% increase in online revenue following the implementation of a data analytics dashboard, allowing for real-time player behavior analysis and targeted marketing strategies. The market continues to evolve, harmoniously blending technology and entertainment for a captivated global audience.

The Land-based casino gaming segment was valued at USD 187.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 45.9 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is a significant contributor to the region's economy, with a high concentration of casinos offering both traditional land-based and modern online gaming options. The industry's steady growth is driven by the increasing demand for entertainment and leisure activities. Advanced technologies, such as fraud detection systems, VIP player management, virtual reality casinos, and account management systems, have harmoniously integrated into casino operations, enhancing the player experience. Furthermore, mobile gaming platforms, customer loyalty programs, payment processing systems, and responsible gaming features cater to evolving player preferences. The market's growth is expected to continue, with industry analysts projecting a 10% increase in revenue over the next five years.

Innovations like augmented reality gaming, live dealer streaming, and cashless payment gateways are expected to strike a chord with tech-savvy consumers, emphasizing the market's dynamic nature. Compliance audit systems, game security protocols, and gaming regulation compliance ensure a fair and secure gaming environment for players. The integration of CRM systems, game server architecture, and poker hand evaluators streamlines casino operations and improves efficiency. Jackpot probabilities and rtp calculation methods are essential components of casino game design, ensuring a balanced and engaging player experience. Betting limit enforcement and online casino security measures maintain a responsible gaming environment. In conclusion, the North American market's evolution is characterized by the harmonious integration of advanced technologies, player-centric innovations, and regulatory compliance, driving steady growth and setting new industry standards.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Casino Gaming Market enhances player experience through design of user-friendly casino interfaces and development of robust mobile gaming platforms. Implementation of responsible gambling measures and regulatory compliance for online gambling operations ensure trust and safety. Integration of cashless payment solutions and implementation of fraud detection systems in casinos streamline transactions and security. Use of artificial intelligence in casino gaming and advanced data analytics dashboard implementation optimize managing player loyalty programs effectively. Optimization of game server performance ensures seamless gameplay, fostering engagement. By aligning innovation with compliance, the market delivers immersive, secure, and responsible gaming experiences, driving growth and player satisfaction globally.

The market is experiencing significant growth and innovation as operators strive to provide engaging experiences for players while prioritizing responsible gambling measures. One key area of focus is the implementation of cashless payment solutions, allowing for seamless transactions and enhanced security. Additionally, the development of progressive jackpot systems continues to drive player engagement, with large prizes attracting a global audience. To create a user-friendly experience, casinos are investing in the design of intuitive interfaces, optimizing game server performance, and enhancing casino game security protocols. Effective management of player loyalty programs is also crucial, with personalized offers and rewards helping to retain customers and encourage repeat business. The integration of artificial intelligence in casino gaming is another major trend, with AI used to analyze player behavior and preferences, optimize marketing efforts, and improve customer support.

Fraud detection systems are also being implemented to ensure the integrity of online gambling operations, while regulatory compliance remains a top priority. Streamlining payment processing systems in online casinos is essential for providing a seamless player experience. Advanced data analytics dashboards are being used to gain insights into player behavior and preferences, enabling operators to make data-driven decisions and improve overall performance. Robust mobile gaming platforms are increasingly important as more players access casinos on their devices. Improving live dealer streaming quality and security is also a focus, as this type of gaming continues to gain popularity. Effective customer support integration strategies are crucial for addressing player queries and concerns in a timely and efficient manner. Overall, the market is constantly evolving, with operators investing in innovation to stay competitive and meet the demands of a global audience.

What are the key market drivers leading to the rise in the adoption of Casino Gaming Industry?

- The growth in customers' spending capability serves as the primary catalyst for market expansion.

- The market has experienced significant growth due to the increasing number of double-income households and the rising disposable income of individuals in developed countries. This trend is a result of the growing number of women in the workforce, with approximately 57.5% of women in the US participating in the labor force as of March 2025 (US Bureau of Labor Statistics). This increase in income levels has enabled consumers to spend more on leisure activities, including casino gaming and sports betting. Furthermore, casino gaming has become a status symbol for high-income individuals, contributing to the market's continued expansion.

- According to industry reports, the market is expected to grow by over 5% annually in the coming years, reflecting its strong market dynamics. For instance, the legalization of sports betting in several countries has led to a surge in revenue for casino operators, with some reporting an increase of up to 30% in sports betting revenue.

What are the market trends shaping the Casino Gaming Industry?

- The increasing utilization of social media marketing is a mandated market trend. This professional observation reflects the growing importance of leveraging social media platforms for marketing purposes.

- The market is experiencing a significant surge in growth due to the increasing adoption of social media marketing strategies by operators, both online and offline. With the burgeoning use of smartphones and improved Internet connectivity, social media platforms such as Facebook, Instagram, and Twitter have become increasingly popular among consumers. In fact, consumers spend an average of one to three and a half hours on these platforms daily. This robust trend presents a valuable opportunity for casino operators to engage with their audience and promote their offerings.

- Social media marketing allows for targeted advertising, real-time interaction, and the ability to reach a large and diverse audience. As a result, the market is expected to continue growing at a steady pace in the coming years.

What challenges does the Casino Gaming Industry face during its growth?

- The growth of the industry is significantly hindered by the complexities and challenges in processing secure online payments.

- In the market, securing financial transactions is a top priority for companies to maintain customer trust and prevent financial losses from fraudulent activities. Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is essential for securing cardholder data and reducing financial risks. However, the implementation of external digital security services may not be feasible for all casino gaming companies due to varying security budgets. For instance, in 2020, a major lottery company experienced a data breach, resulting in over USD 50 million in losses.

- To mitigate such risks, companies invest in robust internal security measures, ensuring the protection of sensitive customer information. The market is expected to grow by over 10% annually, driven by advancements in technology and increasing consumer demand for convenient and secure gaming experiences.

Exclusive Customer Landscape

The casino gaming market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the casino gaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, casino gaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbiati Casino Equipment S.r.l. - The company, a leading provider of casino gaming solutions, operates through its subsidiaries Edict Egaming and Blueprint Gaming Ltd.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbiati Casino Equipment S.r.l.

- ADP GAUSELMANN GMBH

- AMATIC Industries GmbH

- APEX pro gaming s.r.o

- Aristocrat Leisure Ltd.

- Caesars Entertainment Inc.

- Eclipse Gaming Systems

- Everi Holdings Inc.

- Incredible Technologies Inc.

- Interblock dd

- International Game Technology plc

- Jackpot Digital Inc.

- Konami Group Corp.

- Light and Wonder Inc.

- NOVOMATIC AG

- PlayAGS Inc.

- Pockaj d.o.o.

- Rye Park LLC

- TCSJOHNHUXLEY

- Universal Entertainment Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Casino Gaming Market

- In January 2024, international casino gaming operator Melco Resorts & Entertainment announced the launch of its innovative "City of Dreams Mediterranean" integrated resort in Riviera, Spain (Melco Resorts & Entertainment press release). This marked the company's entry into the European market, expanding its global footprint.

- In March 2024, Scientific Games Corporation and International Game Technology (IGT) joined forces to create a strategic partnership, merging their lottery and gaming solutions businesses (Scientific Games Corporation press release). This collaboration aimed to enhance their combined offerings and better serve the global gaming industry.

- In May 2024, MGM Resorts International secured a major regulatory approval to expand its operations in the US state of Texas (MGM Resorts International press release). The company was granted a license to build a casino resort in the city of Fort Worth, marking a significant milestone in its growth strategy.

- In April 2025, Aristocrat Leisure Limited, a leading casino gaming technology provider, showcased its groundbreaking "Marquee Cabinet" at the Global Gaming Expo in Las Vegas (Aristocrat Leisure Limited press release). This technological advancement featured advanced graphics and immersive gameplay, setting a new standard for casino gaming experiences.

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in technology and player preferences shaping its dynamics. Player segmentation strategies are increasingly important, as casinos strive to tailor offerings to specific demographics. Server load balancing ensures seamless gameplay, while customer data protection is paramount for maintaining trust. Game testing methodologies employ various techniques, including database management systems, user interface designs, and security vulnerability assessments, to deliver high-quality gaming experiences. Three-dimensional graphics rendering and progressive jackpot management attract players with immersive experiences and substantial rewards. Loyalty point redemption and artificial intelligence enhance customer engagement, while bonus game development and financial transaction security provide added value.

- System integration testing, risk management strategies, and customer support integration ensure operational efficiency. Game engine optimization, performance benchmark testing, compliance reporting systems, and responsible gambling tools contribute to regulatory compliance and player safety. Network infrastructure design, machine learning algorithms, statistical modeling gaming, data encryption methods, player behavior analysis, sound design integration, and security vulnerability assessments are essential components of the evolving casino gaming landscape. According to recent market research, the market is expected to grow by over 10% annually. For instance, a leading casino chain reported a 15% increase in online gaming revenue due to enhanced user experience and security features.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Casino Gaming Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 45.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, China, France, Japan, India, Germany, UK, South Korea, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Casino Gaming Market Research and Growth Report?

- CAGR of the Casino Gaming industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the casino gaming market growth of industry companies

We can help! Our analysts can customize this casino gaming market research report to meet your requirements.