Cement Market Size 2024-2028

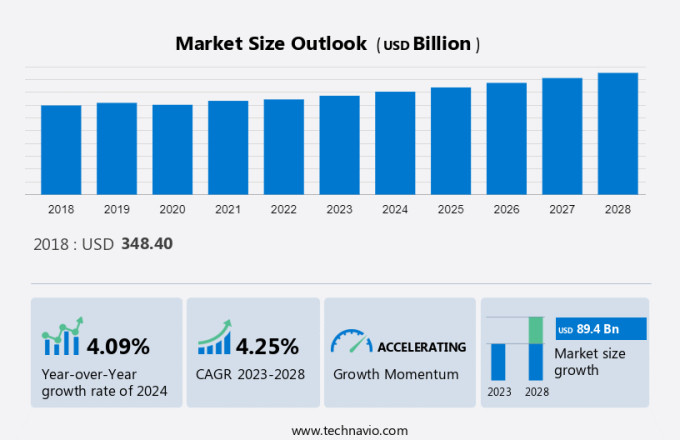

The cement market is estimated to grow by USD 89.4 billion at a CAGR of 4.25% between 2023 and 2028. The market is experiencing significant growth, driven by increasing investments in road and highway infrastructure projects, particularly in the highway sectors. This trend is fueled by government initiatives to improve connectivity and boost economic development. The market is expanding rapidly due to increased construction activities, with rising demand for high-quality cement products driving advancements in production technologies and sustainable building practices. Another key trend is the adoption of alternative fuels in cement manufacturing, such as waste materials and biomass, to reduce carbon emissions and improve sustainability. Additionally, rising construction costs are pushing cement producers to increase efficiency and reduce production costs through technological advancements and economies of scale. These factors, along with population growth and urbanization, are expected to continue driving market growth in the coming years.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Segmentation

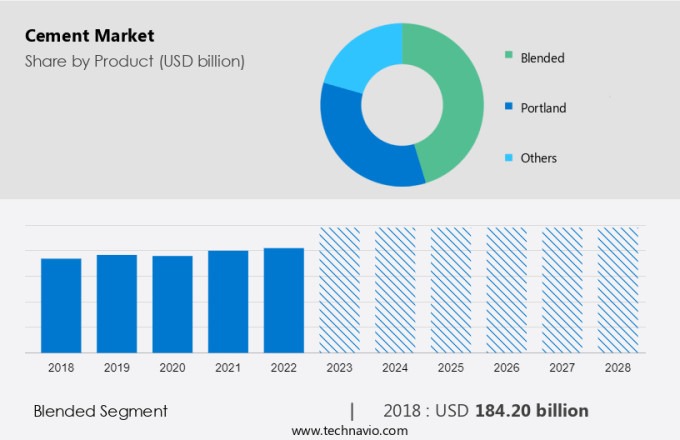

By Product

The market share growth by the blended segment will be significant during the forecast period. Blended cement is a product in which part of the clinker is substituted with other materials. The market plays a pivotal role in the infrastructure and construction sectors, particularly in the development of airports, bridges, commercial projects, and buildings. Cement consumption is driven by the demand for concrete in various applications, including the construction of healthcare centers, hospitals, housing, and dams. Cement formulations have evolved to include eco-friendly options, such as blended cement and green cement, which help reduce carbon emissions and the environmental footprint.

Get a glance at the market contribution of various segments Request a PDF Sample

The blended segment was valued at USD 184.20 billion in 2018. The production of this product involves interring one or more additives, in various proportions, at the grinding stage. Thus, blended cement can be defined as the uniform mix of portland cement and blending materials such as silica fumes, fly ash, limestone, and slag to enhance its properties for different applications. The consumption of this product is increasing as it can improve the workability, strength, durability, and chemical resistance of concrete. Additionally, water consumption is less, which makes it easy to work with and shape. This product can also be used in functions such as domestic construction, engineering projects, mining applications, and road construction. Therefore, the increase in various infrastructural development projects will drive the demand for blended cement and, contribute to the growth of the market in focus during the forecast period.

By Region

For more insights on the market share of various regions Request PDF Sample now!

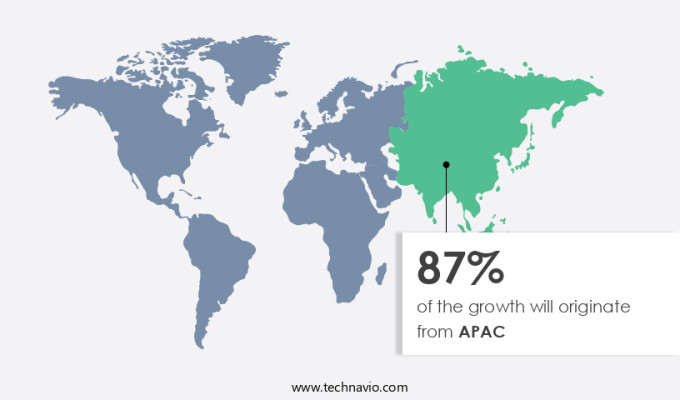

APAC is estimated to contribute 87% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In 2022, APAC accounted for the largest share of the global market in terms of consumption. The market in APAC is dominated by China, Japan, India, Australia, South Korea, and Indonesia. The factors responsible for the growth of the market in APAC are growing industrialization, rapid urbanization, and increasing infrastructure development. APAC is leading the market as it is home to some of the leading manufacturing and export-oriented countries. Several countries in APAC are witnessing rapid economic growth, which is boosting the industrial sector and increasing the urbanization rate. China, India, Japan, and Australia significantly contribute to the growth of the market in APAC.

Moreover, in APAC, population growth will also fuel the demand for cement during the forecast period. The Smart City Mission by the Government of India has increased infrastructure development in the country. The ongoing infrastructure projects across the country will drive the demand during the forecast period. Such projects require cement, which will drive the growth of the market in APAC during the forecast period. The construction industry in several Asian countries is also growing. Developing countries, including India, Vietnam, Indonesia, and Malaysia, where residential housing constructions are growing exponentially due to a rise in household incomes and increasing urbanization, are expected to be significant contributors to the growth of the market in APAC during the forecast period.

Market Dynamics and Customer Landscape

The market witnesses robust growth driven by worldwide demand in both the industrial and institutional sectors and the infrastructure sector. From residential buildings to public infrastructure like healthcare centers and hospitals, emerging economies fuel expansion. Embracing sustainability initiatives and eco-friendly construction practices, the market thrives on concrete homes and non-residential buildings. Cement formulations evolve to meet stringent environmental regulations, aligning with modern construction trends in both residential and commercial projects. With ample availability of resources like clay, iron ore, and bauxite, the industry remains pivotal in global development. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The use of energy-efficient technologies is notably driving market growth. Manufacturing requires a huge amount of energy, and carbon dioxide is released in high volumes during the process. This emission of carbon dioxide can be conserved and used in different aspects. To conserve energy efficiently, the manufacturing units have created new technologies that can bring better results in the future. This will be a driver for the growth of the industry in the future.

Additionally, the level of carbon dioxide emission will also decrease, as companies have created new technologies such as fillers and cement additives like DOW latex powder. In recent years, the production of composite cement has been increasing due to reasons such as process economics, energy reduction, ecology (mostly reduction of CO2 emission), conservation of resources, and product quality/diversity. Energy-efficient grinding systems are also used in cement manufacturing at present. Thus, the use of energy-efficient technologies will drive the market to focus during the forecast period.

Significant Market Trend

The rising demand for green cement is a major trend in the market. The increase in construction and building activities is the primary factor for the growth of the global market. Green cement demand is accelerating the growth of alternative fuels that are derived from waste materials such as solid recovered fuels, foundry sand, used oils, sewage sludge, animal meals, filter cakes, and fly ash. The urgent need to reduce carbon dioxide emissions encourages the use of alternative fuels. Governments promoting green architecture can gain quick footholds in the market to ensure sustainable construction.

Moreover, the durability offered by green cement for various construction projects compared to OPC for a less alkaline mixture is expected to play an important role in the development of the market. Future projects such as nuclear power plants, the construction of bridges and pavements, and other infrastructure projects are expected to lead to high demand for lucrative opportunities across the market. The main reason for the increase in demand for green cement in construction is also its lower water consumption. They offer excellent thermal insulation and excellent fire resistance. Thus, increasing demand for green cement will drive the market during the forecast period.

Major Market Challenge

The increase in construction cost is a major factor impeding the market. Building materials such as stainless steel, hardened steel, cast iron, cement, concrete, brick, aggregate, and other building materials are used in the construction industry. The price of cement is about 1-15% of the construction costs, the price of steel is about 8-10% of the construction costs, and the share of other materials is 25-30% of the construction costs.

However, the availability of these materials creates a cycle of variable price, where an increase in the price of one building material increases the total cost of construction, which leads to the need for additional investment in the total cost of construction. For example, a building needs bricks, cement, mortar, steel, and other materials. When steel prices rise, construction costs rise; as a result, construction costs also increase. An increase in the cost of one segment increases the total construction cost, which can be a big challenge for builders and construction companies. Construction companies in European countries such as the UK, France, and Germany are financially strong and able to withstand price increases for ongoing construction projects. However, African countries such as Nigeria and Namibia are unable to contain such price increases due to the unstable economies of these countries. Thus, the aforementioned factors make it difficult for the consolidation of the market during the forecast period.

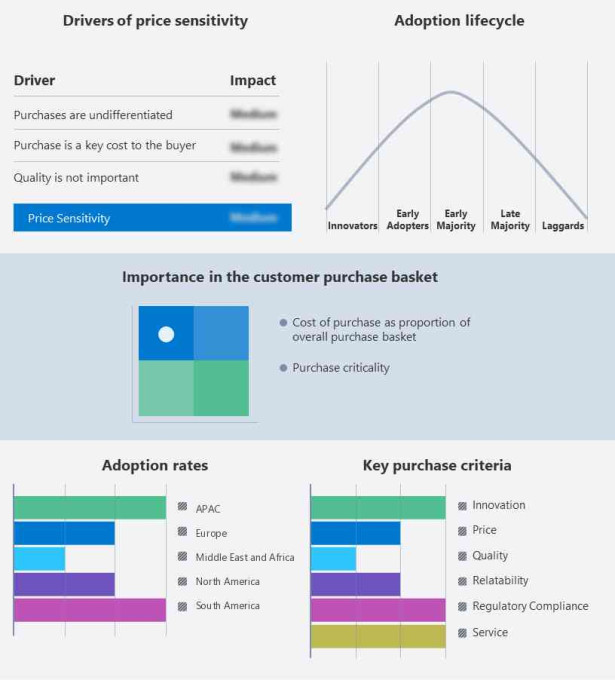

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

GRUPO ARGOS S.A. - The company?offers cement solutions through its subsidiary ARGOS.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Adbri Ltd.

- Al Safwa Ltd.

- Buzzi Unicem SpA

- Cementir Holding NV

- CEMEX SAB de CV

- China National Building Material Co. Ltd.

- Drake

- Epcco Publishing Group Ltd.

- Fujairah Cement Industries PJSC

- HeidelbergCement AG

- Holcim Ltd.

- INTERCEMENT PARTICIPACOES SA

- PPC Ltd.

- Siam Cement PCL

- Taiheiyo Cement Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Blended

- Portland

- Others

- End-user Outlook

- Residential

- Non-residential

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

Market Analyst Overview

The market remains a significant economic driver, propelled by rising government investments in infrastructural projects like airports, dams, and railways. With a focus on sustainable construction practices, demand for eco-friendly building materials and green buildings surges. Solar-powered cement production and innovations like Synhelion reduce carbon emissions and environmental footprints. Amid labor and material shortages, construction activities continue to drive cement consumption, supporting the construction of megastructures such as shopping malls, Industrial and Institutional sector, and office buildings. Regulatory reforms and societal emphasis on societal well-being further shape the future of the cement industry.

Furthermore, the market plays a pivotal role in constructing mega structures like seaports and public buildings, meeting construction project volumes, and adhering to carbon emission targets. With a focus on energy efficiency and environmental footprint, demand for sustainable buildings rises, driving innovation in logistics and raw materials sourcing. Hima Cement and other industry leaders contribute to the production of precast products and panels, while residential projects and schools benefit from advancements in beams and Fundi masonry products. As the industry projects future growth, it continues to address challenges such as sulfur dioxide emissions and carbon footprint reduction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.25% |

|

Market growth 2024-2028 |

USD 89.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.09 |

|

Regional analysis |

APAC, Middle East and Africa, Europe, North America, and South America |

|

Performing market contribution |

APAC at 87% |

|

Key countries |

China, India, US, Turkey, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adbri Ltd., Aditya Birla Management Corp. Pvt. Ltd., Al Safwa Ltd., Buzzi SpA, Cementir Holding NV, CEMEX SAB de CV, China National Building Material Co. Ltd., Drake, Epcco Publishing Group Ltd., GRUPO ARGOS S.A, Heidelberg Materials AG, Holcim Ltd., INTERCEMENT PARTICIPACOES SA, PPC Ltd., Siam Cement PCL, Sumitomo Osaka Cement Co. Ltd., Taiheiyo Cement Corp., Taiwan Cement Corp, and Votorantim SA |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch