Charcoal Market Size 2025-2029

The charcoal market size is forecast to increase by USD 769.8 million at a CAGR of 2.1% between 2024 and 2029.

- The market is driven by the increasing regulations aimed at reducing greenhouse gas (GHG) emissions and the growing adoption of bioenergy in heating systems. These factors create a significant opportunity for the charcoal industry, particularly for those producing biocharcoal, as it offers a more sustainable alternative to traditional coal. However, the market faces challenges in attracting new investments due to the industry's reputation for high environmental impact and the rise in deforestation practices for charcoal production. These challenges necessitate the adoption of innovative technologies and sustainable production methods to ensure the long-term viability and growth of the market. Regulations on reducing greenhouse gas emissions are increasing, which may discourage new investments in the coal industry.

- Additionally, the use of bioenergy in heating systems are increasing, which can further impact the market growth. Companies seeking to capitalize on market opportunities must focus on sustainable production and compliance with environmental regulations, while also addressing the challenges posed by deforestation and securing investments. The strategic landscape requires a balance between environmental responsibility and economic viability, offering opportunities for companies that can effectively navigate these complexities.

What will be the Size of the Charcoal Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses various applications, from charcoal sketching and charcoal smoking to charcoal fuel for industrial processes. Traditional charcoal production methods, such as kiln and pit production, continue to coexist with modern techniques like charcoal gasification and pyrolysis. Charcoal's versatility extends to industries like water filtration and air purification through activated charcoal and charcoal filters. Charcoal's role as a fuel source is significant, with charcoal biomass contributing to energy generation and charcoal briquettes used for grilling and cooking. In the construction industry, charcoal is used as a fuel for brick kilns and cement production. Climate change concerns have brought carbon emissions and greenhouse gas emissions from charcoal production under scrutiny. In response, charcoal sustainability and certification schemes have emerged, promoting eco-friendly production methods.

- Moreover, the market extends to the realm of renewable energy, with charcoal being a sustainable alternative to traditional fossil fuels. Charcoal's applications in art, such as charcoal drawing and charcoal painting, showcase its artistic potential. Meanwhile, charcoal's use in industries like carbon capture and climate change mitigation underscores its relevance in the modern world. Charcoal's multifaceted role, from charcoal sketching to charcoal energy, makes it a vital component in numerous industries.

How is this Charcoal Industry segmented?

The charcoal industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Households

- Metallurgical industry

- Others

- Distribution Channel

- Offline

- Online

- Product Type

- Charcoal briquettes

- Lump charcoal

- Japanese charcoal

- Sugar charcoal

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Indonesia

- Rest of World (ROW)

- North America

By End-user Insights

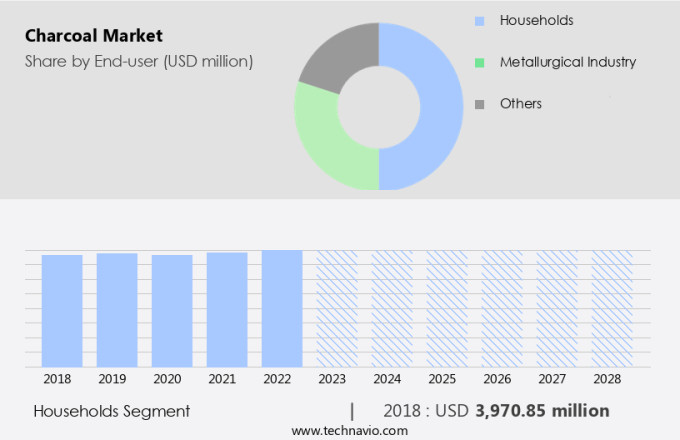

The households segment is estimated to witness significant growth during the forecast period. The market encompasses a wide array of applications in the households segment, serving as a versatile fuel source for cooking, heating, and outdoor recreation. Consumers prioritize convenience and efficiency, driving demand for dependable charcoal options. Factors influencing this segment include shifting consumer habits, availability of alternative fuel sources, and regional economic conditions. Market players are focused on ensuring product accessibility, maintaining consistent supply, and adhering to environmental regulations. Distribution channels significantly impact consumer purchasing patterns, with both traditional retail outlets and digital platforms expanding market reach. Quality assurance is paramount, with certifications and testing playing a crucial role in consumer trust.

Charcoal production methods, such as kiln technology and carbonization process, impact product quality and environmental impact. Natural charcoal alternatives, like coconut shell charcoal and sustainable charcoal, are gaining popularity due to their eco-friendly production and lower emissions. Pellet grills and bulk packaging cater to outdoor cooking enthusiasts, while hardware stores and outdoor recreation stores offer a diverse range of charcoal products. Pricing strategies and brand loyalty influence consumer decisions, with online retailers and home improvement centers offering competitive pricing and a broad selection. Charcoal research and new product development continue to shape the industry, with advancements in flame intensity, carbon capture, and moisture content.

Safety standards and laboratory analysis ensure consumer safety and product quality. Forest management and environmental impact are increasingly important considerations, with wood pellets and bamboo charcoal offering more sustainable alternatives. Marketing and advertising, calorific value, and consumer preferences shape the market landscape. Charcoal alternatives, such as natural gas and gas grills, offer competition, while charcoal certifications and regulations impact market share analysis and supply chain management. Ultimately, the market is a dynamic and evolving industry, driven by consumer preferences, technological advancements, and regulatory considerations.

The Households segment was valued at USD 4.33 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

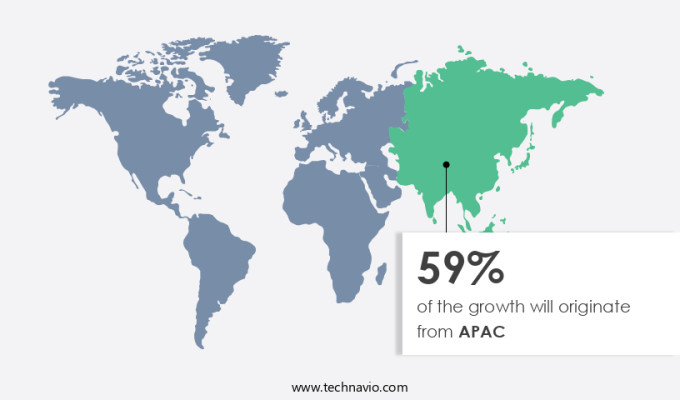

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is witnessing substantial growth due to the increasing population and urbanization. Charcoal is a preferred fuel source for cooking, especially among small businesses and households in urban and peri-urban areas. Its usage extends beyond domestic applications, finding a place in industrial processes such as metallurgy and water treatment. APAC's dominance in crude steel production, with China leading the way, fuels the demand for charcoal as a metallurgical fuel. The region's rapid urbanization and infrastructure expansion, particularly in India and China, are driving the need for steel production, thereby increasing the demand for charcoal. In the pharmaceutical industry, charcoal is used as a binder in pills and tablets due to its binding properties.

Quality assurance is a significant concern in the charcoal industry, with various certifications and testing ensuring consumer safety and environmental sustainability. Coconut shell charcoal and sustainable charcoal are gaining popularity due to their eco-friendly production methods. Hardware stores and outdoor recreation stores are major retailers, while online retailers and home improvement centers offer bulk packaging for consumers. Charcoal alternatives, such as natural gas and pellet grills, are also emerging, influencing pricing strategies. The production process involves carbonization, which can be achieved through various methods like kiln technology or the carbonization process. Charcoal briquettes and lump charcoal are popular product forms, with the latter offering superior flame intensity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Charcoal market drivers leading to the rise in the adoption of Industry?

- The regulations mandating the reduction of greenhouse gas (GHG) emissions and the utilization of bioenergy in heating systems serve as the primary market drivers. Charcoal, a carbon-rich form of carbonized wood, is widely used for various applications, including cooking and industrial processes. The market is witnessing significant growth due to increasing research and development in kiln technology, flame intensity, and charcoal certifications. Charcoal retailers are focusing on pricing strategies to cater to the varying consumer preferences for lump charcoal and pellet grills. The charcoal industry is continually evolving, with a growing emphasis on carbon sequestration and sustainable production methods. The EPA's regulatory initiatives to reduce greenhouse gas emissions have led to advancements in charcoal production techniques, ensuring a more efficient and eco-friendly process.

- Charcoal testing and retail packaging have also gained importance, with certifications such as the Forest Stewardship Council (FSC) and the Program for the Endorsement of Forest Certification (PEFC) becoming increasingly popular. The market is driven by the increasing demand for sustainable and eco-friendly products. Charcoal producers are investing in research and development to improve flame intensity and reduce emissions, making charcoal a more attractive alternative to traditional fossil fuels. Additionally, the growing popularity of pellet grills and the convenience they offer have further boosted the market's growth.

What are the Charcoal market trends shaping the Industry?

- The trend toward decreased investment in coal is a significant development in the industry. Charcoal, derived from the carbonization process of organic materials, continues to be a popular alternative fuel, particularly in outdoor recreation and cooking applications. Charcoal briquettes, a common form of charcoal, offer consistent quality and longer burn times compared to traditional charcoal. However, the global coal industry has undergone significant changes, with coal and coke increasingly replacing charcoal in industrial applications due to environmental concerns and government policies. The market dynamics are influenced by various factors, including charcoal quality, supply chain management, and safety standards. Charcoal briquettes are often subjected to laboratory analysis to ensure consistent quality and adherence to safety standards.

- Online retailers and outdoor recreation stores are key distribution channels for charcoal briquettes. Market share analysis indicates that natural gas and gas grills have gained popularity due to their convenience and environmental benefits. However, brand loyalty and consumer preferences continue to drive demand for charcoal briquettes. Ensuring a reliable and efficient supply chain is crucial for charcoal producers to maintain market share. Carbon capture technologies are gaining traction as a potential solution to reduce the environmental impact of charcoal production. This trend is expected to influence the market in the coming years. Overall, the market is subject to various market forces and requires continuous monitoring and adaptation to maintain competitiveness.

How does Charcoal market face challenges during its growth?

- The escalating prevalence of deforestation poses a significant challenge to the expansion and growth of the industry. Charcoal, derived from the process of burning wood, serves various applications including outdoor cooking, industry fuel, metallurgical use, glass making, pencils, medicine, and utensils. Its affordability and ability to generate income and employment in developing countries have led to increased usage, particularly in regions with improving living standards. However, charcoal production, often carried out in an unsustainable manner, contributes to deforestation and forest management concerns. The environmental impact of charcoal production and use is a significant issue, with high ash content and moisture limiting its calorific value. New product development in the market includes alternatives such as bamboo charcoal and wood pellets, which offer potential solutions to these challenges.

- Marketing and advertising efforts focus on the environmental benefits and consumer preferences for cleaner, more efficient fuel sources. Charcoal lighter fluid, a common accompaniment to charcoal grilling, is also under scrutiny for its environmental impact and potential health hazards. Overall, the market dynamics require a balance between affordability, sustainability, and consumer demands.

Exclusive Customer Landscape

The charcoal market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the charcoal market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, charcoal market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bricapar SA - This company specializes in providing high-quality charcoal options for various applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bricapar SA

- Dorset Charcoal Co. Ltd.

- Duraflame Inc.

- Fire and Flavor

- Fogo Charcoal

- Gryfskand sp zoo

- Kamado Joe Co. Inc.

- Kingsford Products Co.

- Maurobera SA

- Mesjaya Abadi Sdn Bhd

- Namchar Pty. Ltd.

- Parker Charcoal Co.

- Rancher Charcoal

- Royal Oak Enterprises LLC

- Sagar Charcoal and Firewood Depot

- The Big Green Egg Inc.

- The Saint Louis Charcoal Co. LLC

- Timber Charcoal Co. LLC

- Two Trees Products

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Charcoal Market

- In February 2024, British Charcoal Company, a leading charcoal producer, announced the launch of its new eco-friendly charcoal product, BioChar, made from agricultural waste. This innovative solution addresses the growing demand for sustainable and environmentally friendly alternatives to traditional charcoal (British Charcoal Company Press Release).

- In May 2024, Siemens Energy and Charbax, a charcoal producer, signed a strategic partnership to develop a carbon capture and utilization plant in South Africa. This collaboration aims to reduce greenhouse gas emissions from charcoal production and create a more sustainable charcoal industry (Siemens Energy Press Release).

- In August 2024, CarbonCure Technologies, a carbon utilization technology provider, raised USD12 million in a Series C funding round. This investment will be used to expand the company's production capacity and accelerate the adoption of its technology in the charcoal industry, which reduces carbon emissions during the production process (Business Wire).

Research Analyst Overview

The market continues to evolve, driven by dynamic market trends and applications across various sectors. The carbonization process underpins the production of charcoal briquettes and natural charcoal, which finds usage in outdoor recreation stores, bulk packaging, and even in industrial processes. The quality of charcoal is a significant consideration, with consumers and industries prioritizing factors such as burning time, emission standards, and calorific value. Outdoor cooking enthusiasts seek charcoal for its flame intensity, with gas grills and BBQ equipment offering alternative cooking methods. Laboratory analysis and safety standards ensure product consistency and consumer safety. Brand loyalty and online retailers play a crucial role in market share analysis, while supply chain management and carbon capture strategies shape industry trends.

Natural gas and alternative charcoal options, such as bamboo charcoal and wood pellets, are gaining traction due to their environmental impact and sustainability. Carbon sequestration and new product development are key areas of focus for charcoal producers, as they strive to meet evolving consumer preferences and regulations. Market dynamics continue to unfold, with charcoal retailers adopting various pricing strategies and certifications to differentiate themselves. Kiln technology and charcoal testing are essential components of charcoal production, ensuring consistent quality and adherence to emission standards. Moisture content and ash content are critical factors influencing charcoal's performance and overall value proposition.

The charcoal market continues to evolve with advancements in modern charcoal production, ensuring efficiency and sustainability. Industries utilize charcoal pyrolysis to generate charcoal gas and charcoal electricity, contributing to renewable energy solutions. High-quality wood charcoal remains essential for charcoal cooking, while creative industries explore charcoal art and charcoal sculpture. Strict charcoal certification schemes regulate production, ensuring compliance with charcoal regulations and addressing charcoal industry trends. Efficient charcoal packaging and charcoal distribution enable widespread availability in grocery stores, meeting consumer demand for fire starters and specialized filters like charcoal dust and charcoal filter. Fine charcoal powder enhances diverse applications, further expanding the market's influence. The industry's innovations drive sustainability and versatility across global sectors.

Forest management and sustainable charcoal production are increasingly important considerations for the charcoal industry, as it navigates the complex interplay of market forces and environmental concerns. The charcoal industry remains a vibrant and evolving market, with ongoing research and innovation shaping its future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Charcoal Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2025-2029 |

USD 769.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

China, US, India, Indonesia, Australia, Canada, Germany, UK, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Charcoal Market Research and Growth Report?

- CAGR of the Charcoal industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the charcoal market growth of industry companies

We can help! Our analysts can customize this charcoal market research report to meet your requirements.