Cleansing Lotion Market Size 2025-2029

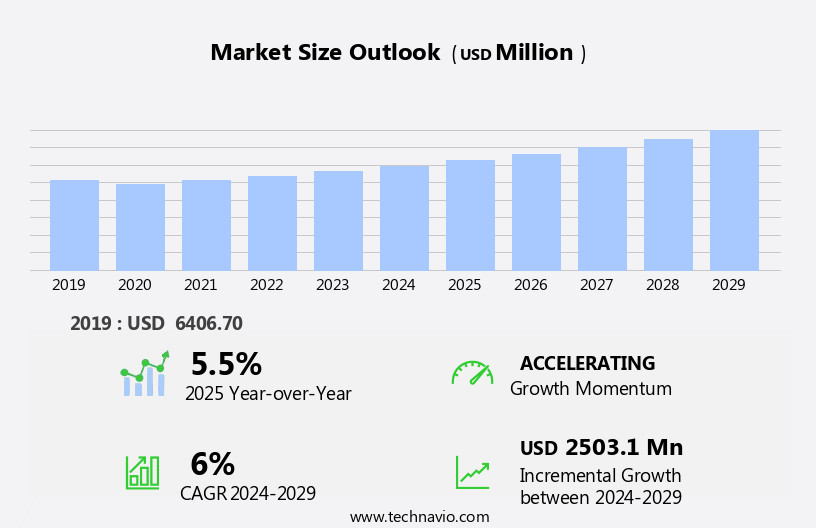

The cleansing lotion market size is forecast to increase by USD 2.5 billion at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of e-commerce platforms and the multifunctional use of these products. With the rise of online shopping, consumers have greater access to a wider range of cleansing lotions, leading to increased sales. Moreover, the versatility of cleansing lotions as a skincare essential and a makeup remover has made them a staple in many households. However, market growth faces challenges. Regulatory hurdles impact adoption, as stringent regulations regarding the safety and quality of personal care products necessitate rigorous testing and certification processes. Supply chain inconsistencies also temper growth potential, as ensuring a consistent supply of high-quality ingredients is essential for maintaining customer trust and loyalty.

- Companies seeking to capitalize on market opportunities must navigate these challenges effectively, investing in research and development to meet regulatory requirements and establish robust supply chains. By doing so, they can differentiate themselves in a competitive market and meet the evolving demands of consumers.

What will be the Size of the Cleansing Lotion Market during the forecast period?

- In the dynamic US skincare market, nourishing cleansing lotions have emerged as a popular choice for consumers seeking to address skin concerns caused by environmental pollutants and UV exposure. These organic, vegan cleansing lotions offer a gentle alternative to traditional foam-based cleansers, effectively removing dirt and excess oil without stripping the skin of its natural moisture or collagen. Skin cancer and sunburns are serious disorders that have increased the demand for daily cleansing creams and face creams that protect against harmful UVA and UVB rays. Retail pharmacies and beauty industry players are capitalizing on this trend by launching social media campaigns and advertisements, promoting the benefits of nourishing cleansing lotions for elevating skin health.

- Consumers are increasingly conscious of the impact of pollution on their skin and are turning to these cleansers to mitigate the damage. The beauty industry is expected to continue innovating in this space, with new products and formulations that cater to various skin types and concerns. Skincare products that contain natural ingredients, such as spinach extract, are gaining popularity due to their antioxidant properties and ability to combat free radicals. As consumers become more health-conscious, they are seeking out products that align with their values, leading to an increase in demand for nourishing, organic cleansing lotions.

- The market for these products is projected to grow significantly, as consumers prioritize hygiene and self-care in their daily routines.

How is this Cleansing Lotion Industry segmented?

The cleansing lotion industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Household

- Commercial

- Product

- Cream-based

- Foam-based

- Gel-based

- Oil-based

- Others

- Application

- Facial cleansing lotions

- Body cleansing lotions

- Eye makeup remover cleansing lotions

- Lip cleansing lotions

- Type

- Normal skin

- Oily skin

- Dry skin

- Sensitive skin

- Combination skin

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

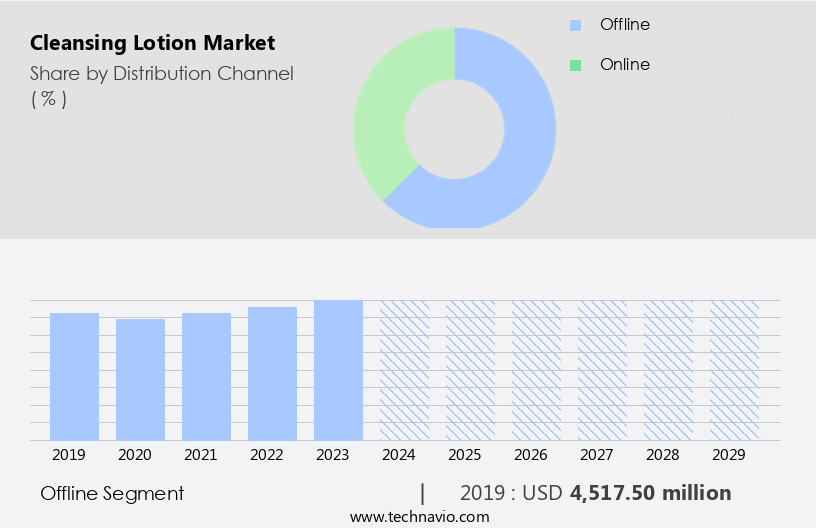

The offline segment is estimated to witness significant growth during the forecast period.

The market for cleansing lotions is witnessing significant growth, driven by the rising population and increasing awareness for healthy skin. Skin concerns, such as acne, excess oil, and skin disorders, continue to fuel demand for these products. Aloe vera and green tea are popular natural ingredients used in cleansing lotions for their repairing and balancing properties. The beauty industry is leveraging social media campaigns to reach a broader audience, with male customers increasingly adopting personal grooming routines. Foam-type cleansing lotions are gaining popularity due to their ability to effectively cleanse pores and remove impurities. Retail pharmacies, hospital pharmacies, and drug stores are key distribution channels, offering a wide range of cleansing lotions for various skin types and concerns.

Consumers are increasingly seeking organic and vegan products, as well as those that address environmental pollutants and UV exposure. Cleansing lotions are an essential part of daily skincare regimes, with face creams, serums, and face washes complementing their use. Despite the fragmented market, brands are innovating with ingredients like hemp seed oil, mulberry, and pomegranate extract to elevate skin health and address specific skin issues. The offline segment continues to dominate, with department stores, supermarkets, and hypermarkets offering a wide selection and enabling direct customer interactions.

The Offline segment was valued at USD 4.52 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The cleansing lotions market is experiencing significant growth due to several factors. Aloe vera and other natural ingredients, such as green tea and hemp seed oil, are increasingly popular for their ability to soothe and repair damaged skin. Social media campaigns have played a pivotal role in promoting these products, reaching a large and diverse consumer base. The rising population and increasing awareness of skin health have led to an increase in demand for skincare products, including cleansing lotions. Skin disorders, excess oil, and environmental pollutants are common concerns, driving the market for nourishing and balancing cleansing lotions. Males and females of all ages are embracing personal grooming and incorporating cleansing lotions into their skin care regimes.

Organic and vegan products are gaining popularity as consumers seek to address skin concerns in a more natural and ethical way. Retail pharmacies, hospital pharmacies, and drug stores are key distribution channels, making these products readily available to consumers. The market is fragmented, with both established international companies and regional players vying for market share. Beiersdorf AG, The Procter and Gamble Co., and Unilever Group are major players with a significant presence in the region. Cleansing lotions come in various forms, including foam and liquid, catering to different consumer preferences. Skin issues such as acne, hyperpigmentation, sunburns, and skin cancer are serious concerns, and cleansing lotions are an essential part of daily skincare routines for addressing these conditions.

Skincare awareness and the desire for improved lifestyles have led to an increase in demand for cleansing lotions and other skincare products. The beauty industry is constantly evolving, with new innovations and trends emerging regularly. Cleansing lotions are no exception, with advancements in technology leading to the development of products that effectively address a wide range of skin concerns while maintaining a gentle and nourishing formula. Consumers are increasingly seeking out these high-quality products, driving the growth of the market. Despite the many advancements, challenges remain, including the need to address the negative effects of UV exposure, pollution, and other environmental factors on skin health.

Companies are responding by developing products that not only cleanse and nourish the skin but also protect it from these harmful elements. Collagen, Vitamin C, and other active ingredients are being used to address the signs of aging and promote healthy, radiant skin. In conclusion, the cleansing lotions market is a dynamic and evolving industry, driven by consumer demand for effective and natural skincare solutions. Companies are responding by investing in research and development, partnerships with distribution channels, and the use of innovative ingredients and technologies to meet the changing needs of consumers. The future of the market looks bright, with continued growth expected as consumers prioritize self-care and seek out high-quality, effective skincare products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Cleansing Lotion market drivers leading to the rise in the adoption of Industry?

- The significant growth in the popularity of e-commerce is the primary factor fueling the sales of cleansing lotions within the market.

- The global skincare treatments market, specifically cleansing lotions, has experienced significant growth due to increasing consumer awareness towards skin health and the prevalence of skin issues caused by UV exposure and natural skin damage. Female consumers, in particular, are the primary target demographic for these products, as they prioritize hygiene and seek solutions for various skin concerns. The market for cleansing lotions is fragmented, with a wide range of offerings from drug stores and beauty brands. Natural and herbal products, such as those containing mulberry or pomegranate extract, have gained popularity due to their hydrating and nourishing properties.

- Improved lifestyles and the desire for healthy, radiant skin have further fueled the demand for these products. The ease of purchasing cleansing lotions online has contributed significantly to the market's growth. The increasing penetration of smartphones and electronic devices has made online shopping more convenient, allowing consumers to access a wide range of products from the comfort of their homes. This trend is expected to continue, as e-commerce platforms offer benefits such as ease of payment, discounts, and a vast selection of products.

What are the Cleansing Lotion market trends shaping the Industry?

- The use of multifunctional cleansing lotions is gaining popularity in the market due to their versatility. These products offer the benefits of cleansing, toning, and moisturizing in a single application, making them a convenient and cost-effective choice for consumers.

- Cleansing lotions have gained popularity in the beauty and personal care market due to their multifunctional properties. Consumers are increasingly seeking products that offer more than one benefit, making cleansing lotions a desirable choice. These products come in various forms, including wipes, scrubs, and masks, each with unique functionalities. Manufacturers produce cleansing lotions using a range of ingredients, such as sage and thyme, oat milk, kaolin, cocoa butter, sunflower and grapeseed oils, glycerin, lecithin, beeswax, vitamin C, chamomile, lemon oil, and essential oils.

- These ingredients provide customers with benefits, including the removal of makeup and blackheads, as well as increasing skin porosity by eliminating impurities like dust. The use of these cleansing lotions offers a comprehensive cleansing experience, making them a valuable addition to any skincare routine.

How does Cleansing Lotion market faces challenges face during its growth?

- Ensuring safety and quality in the production of personal products is a significant challenge that mandates rigorous adherence to industry standards, as this critical aspect not only impacts business growth but also maintains consumer trust and confidence.

- In the realm of skin care, cleansing lotions have gained significant popularity due to their ability to provide natural moisture and maintain healthy skin. Aloe vera, green tea, and foam types are among the preferred ingredients for those seeking repair and balancing of their skin. With the rising population and increasing awareness of personal grooming, the demand for these products is on the rise. However, addressing skin disorders such as excess oil and acne remains a key concern for consumers.

- To cater to this demand, companies are focusing on creating effective and safe cleansing lotions. Regulatory bodies are implementing stricter regulations to ensure product quality and safety, making it essential for companies to comply with these standards to maintain customer loyalty and avoid product recalls. Social media campaigns are also being utilized to reach a wider audience and engage with consumers, making the market an exciting space to watch.

Exclusive Customer Landscape

The cleansing lotion market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cleansing lotion market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cleansing lotion market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Beiersdorf AG - This company specializes in providing gentle and non-irritating cleansing lotions, such as Nivea Sensitive Cleansing Lotion and Eucerin DermoPure Cleansing Lotion, specifically formulated for individuals with sensitive skin.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beiersdorf AG

- Chanel Ltd.

- Colgate Palmolive Co.

- D R Harris and Co. Ltd.

- Edgewell Personal Care Co.

- Gary Pharmaceuticals P Ltd.

- Groupe Clarins

- Herbacin Cosmetic GmbH

- Johnson and Johnson

- Kao Corp.

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Mountain Valley Springs India Pvt. Ltd.

- Natura and Co Holding SA

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Himalaya Drug Co.

- The Procter and Gamble Co.

- Unilever PLC

- Zoic Pharmaceuticals Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cleansing Lotion Market

- In February 2024, L'Oréal, the global cosmetics leader, introduced a new line of micellar cleansing lotions, infused with hyaluronic acid, to cater to the growing demand for skincare products that offer multiple benefits (L'Oréal press release, 2024). This expansion represents a strategic response to the increasing consumer preference for multifunctional skincare products.

- In March 2025, Unilever, the Anglo-Dutch consumer goods corporation, partnered with Estée Lauder Companies to co-create a new cleansing lotion brand, combining Unilever's manufacturing expertise with Estée Lauder's marketing prowess (BusinessWire, 2025). This collaboration is expected to strengthen both companies' positions in the competitive the market.

- In July 2024, Kao Corporation, the Japanese personal care company, announced a significant investment of USD100 million in its manufacturing facility in Thailand to boost its production capacity for cleansing lotions, addressing the rising demand in the Asia Pacific region (Nikkei Asia, 2024). This expansion underscores Kao's commitment to catering to the growing market and expanding its global footprint.

- In October 2025, the European Commission approved the use of a new natural preservative, derived from red tea, for use in cleansing lotions (European Commission press release, 2025). This approval marks a significant shift towards more sustainable and natural ingredients in personal care products, aligning with evolving consumer preferences and regulatory requirements.

Research Analyst Overview

Cleansing lotions have emerged as a popular choice in the dynamic and evolving skincare market, catering to various skin concerns and disorders. These lotions offer a gentle and effective cleansing experience, making them an integral part of a healthy skin care regime for individuals seeking to maintain a radiant and nourished complexion. Aloe vera, a natural ingredient renowned for its soothing properties, is a common component in many cleansing lotions. Its ability to repair and balance the skin makes it an ideal addition to the formulation. Green tea, another natural ingredient, is known for its antioxidant properties, which help protect the skin from environmental pollutants and UV rays.

The rise in population and increasing awareness of personal grooming have led to a surge in demand for skincare products, including cleansing lotions. Social media campaigns and beauty influencers have played a significant role in promoting these products and creating a buzz around them. Foam-type cleansing lotions have gained popularity due to their ability to effectively cleanse the skin while maintaining its natural moisture. However, there is a growing trend towards no foam type cleansing lotions, which offer a gentler cleansing experience and are preferred by those with sensitive skin or skin disorders such as acne. Skin disorders, including acne, hyperpigmentation, and sunburns, are common concerns that cleansing lotions aim to address.

They help remove excess oil, dirt, and impurities from the skin, leaving it clean and refreshed. Cleansing lotions are also effective in addressing serious disorders such as skin cancer, as they help remove environmental pollutants that can contribute to skin damage. Male consumers have increasingly become a significant market for cleansing lotions, recognizing the importance of taking care of their skin. Retail pharmacies, drug stores, and hospital pharmacies stock a wide range of cleansing lotions, catering to various skin types and concerns. Natural and organic products have gained popularity in recent years, with consumers seeking to avoid harsh chemicals and synthetic ingredients.

Cleansing lotions made from herbal products, such as spinach and mulberry extract, are gaining popularity for their nourishing properties. The beauty industry continues to innovate and introduce new cleansing lotions with unique ingredients and benefits. Vitamin C, collagen, hemp seed oil, and pomegranate extract are some of the latest additions to the market. Consumers are increasingly seeking out these products to address specific skin concerns and improve their overall skin health. Despite the fragmented market, trust in skincare brands and products remains high. Consumers are willing to invest in daily cleansing creams, face creams, serums, and cleansing milks to maintain their facial appearance and elevate their skin health. The beauty industry continues to adapt and evolve, with new trends and innovations emerging regularly.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cleansing Lotion Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

269 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 2503.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, Japan, China, Canada, India, South Korea, UK, Germany, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cleansing Lotion Market Research and Growth Report?

- CAGR of the Cleansing Lotion industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cleansing lotion market growth of industry companies

We can help! Our analysts can customize this cleansing lotion market research report to meet your requirements.