Cloud Performance Management Market Size 2024-2028

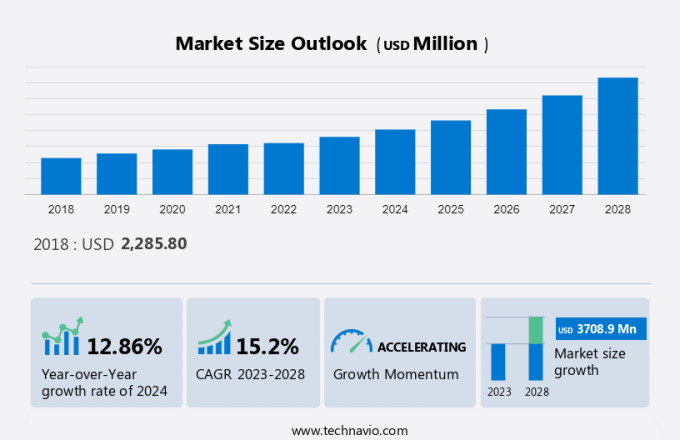

The cloud performance management market size is estimated to grow by USD 3.71 billion at a CAGR of 15.2% between 2023 and 2028. The digital transformation trend continues to gain momentum, with an increased adoption of cloud performance management solutions in various industries. This shift towards cloud-based technologies is driven by several factors, including the penetration of artificial intelligence (AI) and the growing spending on cloud-based solutions. Cloud performance management enables organizations to optimize their cloud infrastructure, ensuring optimal resource utilization, and improving application performance. AI plays a crucial role in this context by providing predictive analytics and automating performance tuning. The investment in cloud-based solutions is expected to grow significantly, as businesses seek to enhance agility, reduce costs, and improve operational efficiency. In this dynamic landscape, staying informed about the latest trends and best practices in cloud performance management is essential for organizations to stay competitive.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

The market is driven by the need for faster product development and automatic scaling to manage varying computing power demands and unexpected spikes in usage. Embracing a cloud computing model addresses the challenges of fluctuating demand effectively. Cloud computing technologies enhance operational efficiency, supported by Machine learning for predictive analytics. Smooth Data migration and robust Identity validation mitigate risks from Administration errors. Access control security and advanced Cloud security architecture ensure data integrity. APIs facilitate seamless integration, empowering Data governance teams to uphold regulations like those by the Federal Bureau of Investigation (FBI) and international standards. IT service providers cater to diverse Compliance requirements amid varied IT spending in the Services sector. IoT augments connectivity, shaping the future landscape under stringent Internet of Things (IoT) frameworks. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increased adoption of cloud performance management in various industries is notably driving market growth. In 2022, the market for cloud performance management experienced rapid expansion. Some of the factors causing the significant growth of the market include the need to evaluate the business performance data of enterprises, increased adoption by small- and medium-sized enterprises (SMEs), and increased adoption of cloud-based solutions.

Applications for performance management are being used by BFSI companies to efficiently plan, budget, and forecast business strategies. As a result, during the forecast period, the market will grow due to the increasing adoption of cloud performance management by end-users in the BFSI sector. Cloud performance management solutions support network performance, accelerate product development and delivery, and enable automatic performance upgrades. Digitization gives businesses a competitive advantage over their rivals by facilitating better performance and coordinating business strategies with financial plans. This leads to cost reduction, improved customer engagement, and business expansion. Therefore, the growing adoption of cloud performance management among end-users may positively impact the growth of the global market during the forecast period.

Significant Market Trends

The growing demand for cloud solutions is an emerging trend in the market growth. Businesses are rapidly realizing the need for cloud performance management services, as cloud computing and related technologies such as IoT, edge computing, and serverless architecture are gaining popularity. The primary factors influencing the growth of the cloud performance management services market are the expanding user- and infrastructure-centric approaches to controlling IT performance, as well as organizations' interest in tracking IT services for mobile users.

The services are essential for managing and maintaining software and solutions, installing the software in the infrastructure of the company, and training employees. Companies that employ consultants, software experts, and project management teams with a focus on developing and offering critical decision support tools, services, and software make use of these services. Thus, the growing adoption of cloud solutions will boost the growth of the global market during the forecast period.

Major Market Challenge

The high cost associated with implementation is a major challenge impeding market growth. Prices of performance management software also include costs for system design and customization, implementation, training, and maintenance. Businesses must hire IT personnel for the proper software implementation after purchasing the software license.

Organizations should train their staff members on how to use the application effectively. Cloud performance management software needs ongoing updates to stay updated with industry trends once it has been put into place. Hence, all these costs are expected to impede the growth of the global market during the forecast period.

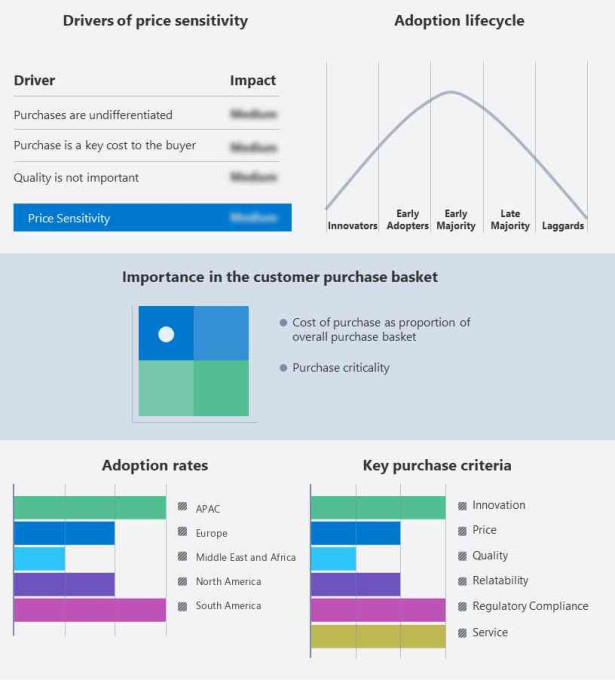

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Nastel Technologies Inc. - The company offers infrastructure management delivering middleware, monitoring, tracking, and analytics solutions. The key offerings of the company include cloud performance management services such as IT as a business enabler, enterprise modernization, and agile cloud adoption.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- BMC Software Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Cognizant Technology Solutions Corp.

- Datadog Inc.

- Dynatrace Inc.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Micro Focus International Plc

- Microsoft Corp.

- NetApp Inc.

- New Relic Inc.

- Nutanix Inc.

- Oracle Corp.

- Riverbed Technology Inc.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

The market share growth by the BFSI segment will be significant during the forecast period. Modern financial services companies place a strong emphasis on providing superior customer experiences, which is fueling segment growth. To ensure the performance of customer-facing systems, end-users need visibility across numerous applications and platforms that are supported by both venerable legacy systems and cutting-edge cloud infrastructure.

Get a glance at the market contribution of various segments View the PDF Sample

The BFSI segment was valued at USD 562.30 million in 2018. As potentially millions of customers access banking websites and mobile apps from a variety of devices, financial services companies generate an enormous amount of data about the customer experience. With the aid of cloud performance management tools, BFSI companies can monitor application performance and customer experience for millions of customers globally and instantly drill down to the experience of a single user. It is possible to immediately send detailed information about any customer issues to customer support teams in real time or feed it into ticketing systems. Since cloud performance management directly enhances financial performance, service quality, productivity, and customer satisfaction, its demand is surging in the BFSI sector. Therefore, such factors are expected to boost the growth of the global market in focus during the forecast period.

By Region

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Due to the increasing need for regulatory compliance and the growing acceptance of cloud-based cloud performance management tools, the market in North America is anticipated to expand steadily. In terms of infrastructure development, innovation and development, and research and development activities, the US is one of the key regions. The majority of cloud service providers in the US assist all types of businesses and aid in their rapid expansion. Major cloud providers such as Microsoft, AWS, and IBM have their corporate headquarters in the US, which helps the market in North America grow. These solutions are primarily being used by North American businesses to address problems that are affecting their business models, such as gathering financial documents, managing third-party risks, and data protection. The end-user industries in this region will be the ones driving investments in the adoption of cloud performance management solutions, as they seek to incorporate cutting-edge technologies such as blockchain, AI applications, and data analytics into their current offerings. Hence, all these factors will boost the regional market growth during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application Outlook

- BFSI

- Telecom and IT

- Manufacturing

- Healthcare

- Retail

- Others

- Deployment Outlook

- Public cloud

- Private cloud

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

You may also interested in below market reports:

-

Application Performance Management Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Japan, UK, Germany - Size and Forecast

-

Cloud Product Lifecycle Management (PLM) Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Germany, Japan, UK - Size and Forecast

-

Enterprise Performance Management (EPM) Application Market by End-user, Deployment and Geography - Forecast and Analysis

Market Analyst Overview

The market is pivotal in enabling organizations to handle capacity challenges while enhancing conferencing services and integrating virtual reality experiences. It thrives on fostering new partnerships with telecom providers to leverage telco cloud offerings for enhanced cloud-based digital work and remote work solutions. The market supports the seamless execution of digital events and live meetings through robust streaming services and operational support systems. Addressing threats like compromise and minimizing losses and consumer dissatisfaction, cloud performance platforms offer critical cloud monitoring capabilities, identifying potential threats and vulnerabilities such as data breaches. With encryption methods and stringent data security protocols managed by cybersecurity professionals, organizations ensure cloud system management solutions uphold reliability, scalability, and flexibility for improved productivity and affordability in a secure, compliant hybrid cloud environment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2024-2028 |

USD 3.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.86 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 53% |

|

Key countries |

US, Canada, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BMC Software Inc., Broadcom Inc., Cisco Systems Inc., Cognizant Technology Solutions Corp., Datadog Inc., Dynatrace Inc., Hewlett Packard Enterprise Co., International Business Machines Corp., Lumen Technologies Inc., Open Text Corporation, Microsoft Corp., Nastel Technologies Inc., NetApp Inc., New Relic Inc., Nutanix Inc., Oracle Corp., Riverbed Technology Inc., SAP SE, Splunk Inc., and VMware Inc. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch