Cobalt Sulfate Market Size 2024-2028

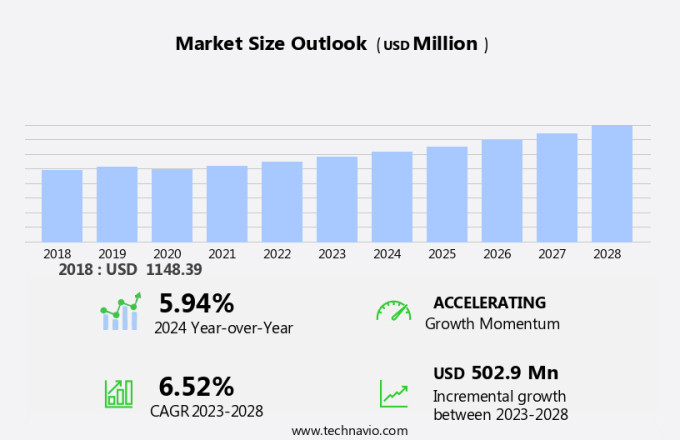

The cobalt sulfate market size is forecast to increase by USD 502.9 billion at a CAGR of 6.52% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for this compound in the electric vehicle industry. The rising popularity of electric vehicles (EVs) and their increasing adoption in North America is driving the market's growth. Additionally, the emergence of primary cobalt mines, particularly in countries like the Democratic Republic of Congo, is increasing the supply of cobalt sulfate. However, the market is also facing challenges, including the rising price of cobalt sulfate due to its high demand and limited supply. This trend is expected to continue, making it crucial for market players to adopt strategic initiatives to mitigate the impact of price volatility and ensure a stable supply chain. Overall, the market is poised for strong growth in the coming years, driven by the electric vehicle industry and the increasing production of primary cobalt mines.

What will the size of the market be during the forecast period?

- The market is witnessing significant growth due to its extensive applications in various industries. Cobalt sulfate, an inorganic salt, plays a crucial role in diverse sectors, including material science, chemical additives, battery technology, and coating materials. In material science, cobalt sulfate is used as a precursor in the synthesis of advanced ceramic materials. Its unique properties make it an essential component in the production of high-performance ceramics. In the realm of chemical additives, cobalt sulfate finds extensive use as a colorant and a catalyst in various industries. The battery industry is the largest consumer of cobalt sulfate. Its use in lithium-ion batteries is primarily driven by the increasing demand for clean energy and energy transition. The growing battery industry, fueled by the need for energy independence and the reduction of battery costs, is expected to boost the market. Cobalt sulfate is also used in coating materials, particularly in the production of high-performance coatings. Its excellent adhesion properties make it an ideal choice for various applications in surface treatment and metal processing.

- Moreover, cobalt sulfate is used as an inorganic pigment in various industries, including paint and plastics. Its vibrant colors and high stability make it a preferred choice for artists and manufacturers. The market dynamics of cobalt sulfate are influenced by several factors. The scarcity of cobalt resources and the ethical sourcing of raw materials are critical issues that are gaining increasing attention. The battery industry's reliance on cobalt for battery technology is a significant factor driving the market. However, the exploration and development of cobalt alternatives, such as nickel and manganese, are expected to challenge the market's growth. The market for cobalt sulfate is also influenced by the battery industry's growth. The increasing demand for green battery solutions, battery life cycle management, and safety regulations are driving the market

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Battery

- Pigment

- Others

- Grade Type

- Battery grade

- Industrial grade

- Agriculture and feed grade

- Geography

- APAC

- China

- India

- Japan

- Europe

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

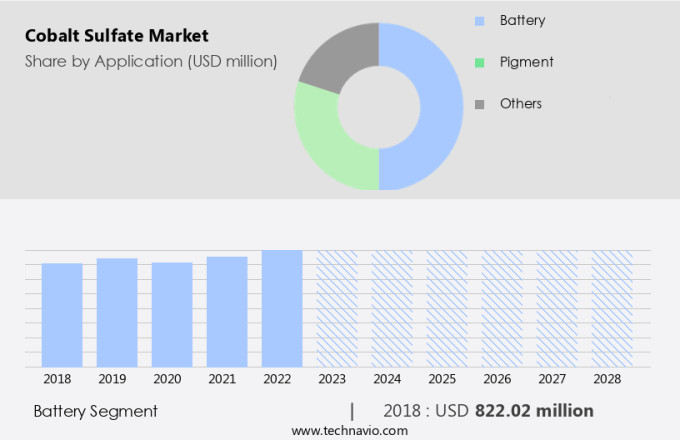

- The battery segment is estimated to witness significant growth during the forecast period.

The market for cobalt sulfate in the United States is witnessing substantial growth, particularly in the battery sector. This inorganic compound, which is a divalent cobalt salt, is an integral part of alloys and storage batteries, including lithium-ion batteries. The latter are widely utilized in electric vehicles (EVs), energy storage systems, and portable electronic devices. The expanding EV industry, driven by the increasing focus on sustainable transportation, is a significant growth driver for the market in the US. Cobalt sulfate enhances the efficiency and energy density of lithium-ion batteries, making it indispensable for the EV sector. In addition to batteries, cobalt sulfate is also employed as a coloring agent in various industries and as a foliar spray in agriculture.

Furthermore, it is used in electroplating processes due to its cost-effectiveness and excellent performance characteristics. However, the potential health concerns associated with the carcinogenicity of cobalt and its compounds may pose challenges to market growth. Nonetheless, ongoing research and development efforts are expected to mitigate these concerns and drive the market forward.

Get a glance at the market report of share of various segments Request Free Sample

The battery segment was valued at USD 822.02 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

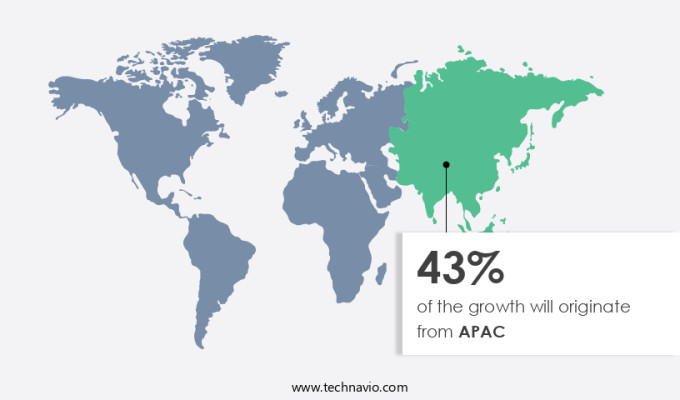

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is primarily driven by the expanding electric vehicle (EV) industry, particularly in Asia Pacific. China, being the world's largest market for electric vehicles, holds significant potential for market growth. According to the International Energy Agency (IEA), China accounted for approximately 60% of global electric vehicle sales in 2020. With the Chinese government having surpassed its 2025 target for new energy vehicle sales, the country is anticipated to continue leading the EV market. The battery industry, a major consumer of cobalt sulfate, is experiencing significant growth due to the increasing demand for energy storage systems in electric vehicles. The battery-grade cobalt sulfate is essential for manufacturing lithium-ion batteries, which are widely used in electric vehicles.

Additionally, the recycling of cobalt is also gaining traction as a sustainable solution to reduce the dependence on primary sources. The US Environmental Protection Agency (EPA) and the European Union (EU) have implemented regulations to promote cobalt recycling. In summary, the growing EV market, particularly in China, and the increasing focus on battery storage systems and cobalt recycling are key factors driving the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Cobalt Sulfate Market ?

Increased demand for cobalt sulfate due to growth of electric vehicle industry is the key driver of the market.

- The market is primarily driven by the battery industry, with a significant focus on lithium-ion batteries used in electric vehicles. The growing trend towards sustainable energy and stricter emission norms are fueling the demand for electric vehicles, leading to increased consumption of cobalt sulfate. Many countries, including China, India, Norway, France, and the UK, have announced plans to phase out the production and sale of gasoline and diesel cars in the future. This shift towards electric vehicles is expected to boost the demand for battery-grade cobalt sulfate. Cobalt sulfate is also used as a drying agent in various industries, including ceramics, electroplating, and varnishes, inks & dyes. In the electroplating industry, cobalt sulfate is used as an electroplating bath component, while in the ceramic industry, it is used as a pigment. In the chemical industry, cobalt sulfate is used as a precursor in the production of cobalt oxide and other alloys.

- The market for cobalt sulfate is subject to price fluctuations due to supply chain interruptions and ethical issues surrounding the mining of cobalt, which is primarily sourced from the Democratic Republic of Congo. The battery industry's reliance on cobalt-based cathode materials and the increasing demand for energy storage systems in consumer electronics, solar, and wind energy, and electric vehicles are expected to drive the growth of the market. However, concerns over the carcinogenicity and environmental impact of cobalt and the availability of substitutes, such as nickel and copper, may limit the market's growth.

What are the market trends shaping the Cobalt Sulfate Market?

Increased emergence of primary cobalt mines is the upcoming trend in the market.

- The market is experiencing significant growth due to the increasing demand for cobalt in various industries, particularly in the battery sector. Cobalt sulfate is a crucial component in the production of battery-grade cobalt, which is essential for manufacturing electroplating baths, cathode materials for rechargeable batteries, and other electrochemical industries. The rising demand for consumer electronics, electric vehicles, and renewable energy storage systems has led to an increase in the battery volume demand, resulting in a higher requirement for cobalt sulfate. However, the low supply of cobalt, which is primarily sourced from mining, has caused price fluctuations and ethical issues due to the labor-intensive and environmentally harmful mining practices.

- To mitigate these challenges, efforts are being made to explore new sources of cobalt, such as recycling, and develop eco-friendly alternatives. Some companies are also focusing on producing cobalt from hard materials like ceramics and alloys, while others are investigating the use of substitutes like copper and nickel. Moreover, governments are implementing regulations to ensure the ethical sourcing of cobalt and reduce its environmental impact.

What challenges does the Cobalt Sulfate Market face during the growth?

The rising price of cobalt sulfate is a key challenge affecting the market growth.

- The market is experiencing significant challenges due to the escalating cost of this essential compound. Cobalt sulfate plays a crucial role in various industries, such as battery manufacturing, ceramics, and chemical synthesis. In the battery sector, it is a vital component for producing lithium-ion batteries, which power electric vehicles (EVs) and energy storage systems. The rising demand for EVs and renewable energy solutions has led to a wave in the demand for cobalt sulfate. However, this increased demand has put pressure on the supply chain, leading to price fluctuations and scarcity. The primary source of cobalt sulfate is the mining of cobalt ores, which can be ethically contentious and subject to supply chain interruptions.

Moreover, the health consciousness of consumers and government regulations have increased the focus on eco-friendly products, leading to the exploration of substitutes for cobalt sulfate. In the ceramics industry, cobalt sulfate is used as a drying agent and as a pigment. In the electroplating industry, it is used as a passivation process agent. In the chemical industry, it is used as a divalent cobalt salt in various applications, including varnishes, inks & dyes, and as a feed additive. The solar and wind energy sectors also use cobalt sulfate in energy storage systems. The price of cobalt sulfate has a significant impact on the battery industry, where it is a critical component of battery-grade cobalt sulfate used in battery system manufacturing.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anglo American plc

- Australian Mines Ltd.

- Dalian Aote Cobalt Nickel New Material Manufacturing Co.

- DECCAN SULPHATE

- Dhruv Chemicals

- Freeport McMoRan Inc.

- Ganzhou Tengyuan Cobalt New Materials Co. Ltd.

- GEM Co. Ltd.

- Hunter Chemical LLC

- INCASA SA

- Jervois Global Ltd.

- Merck KGaA

- Nantong Xinwei Nickel and Cobalt Hightech Development Co. Ltd.

- PARSHVA CHEMICALS

- Parth Industries

- PJSC MMC Norilsk Nickel

- Umicore SA

- Vedanta Ltd

- Zhangjiagang Huayi Chemical Co. Ltd.

- Zhejiang Huayou Cobalt Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cobalt sulfate market is experiencing significant growth due to its essential role in lithium-ion battery technology, particularly in EV batteries and battery industry growth. As battery cost reduction and battery safety regulations become critical factors, cobalt compounds like industrial grade cobalt sulfate are crucial for enhancing battery stability and performance. The demand for cobalt in lithium-ion batteries is driven by the increasing need for efficient energy storage, including solar energy and battery recycling initiatives.

However, concerns over cobalt resource scarcity and ethical challenges in cobalt mining have spurred innovation towards cobalt-free batteries, cobalt-reduced batteries, and cobalt-free cathode materials. This shift is also driving the search for cobalt substitutes and improved cobalt extraction methods. A sustainable cobalt supply chain and cobalt sustainability are key to addressing future challenges, alongside the growing interest in cobalt-free technology and cobalt-free energy storage solutions. Cobalt market analysis indicates an increasing focus on cobalt-free future options, as cobalt applications expand in fields like agricultural chemicals, animal feed additives, and industrial chemicals.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.52% |

|

Market growth 2024-2028 |

USD 502.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.94 |

|

Key countries |

US, China, Japan, India, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch