Coiled Tubing Market Size 2024-2028

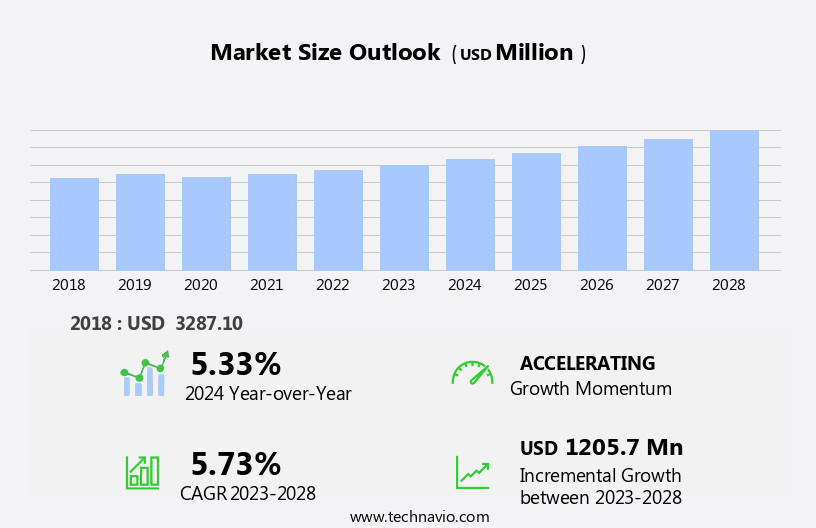

The coiled tubing market size is forecast to increase by USD 1.21 billion at a CAGR of 5.73% between 2023 and 2028.

What will be the Size of the Coiled Tubing Market During the Forecast Period?

How is this Coiled Tubing Industry segmented and which is the largest segment?

The coiled tubing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Service

- Well intervention

- Drilling services

- Others

- Geography

- North America

- Canada

- US

- Middle East and Africa

- Europe

- APAC

- China

- South America

- North America

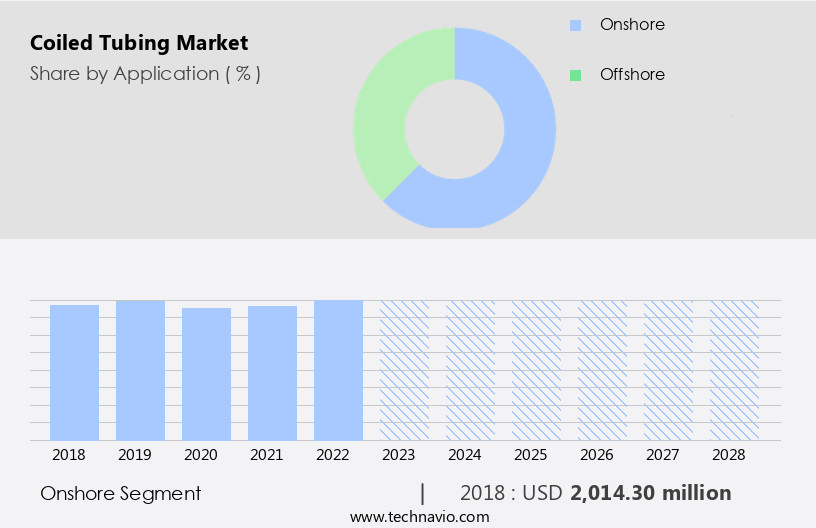

By Application Insights

- The onshore segment is estimated to witness significant growth during the forecast period.

The market expansion In the onshore sector is driven by the escalating energy demand, leading oil and gas companies to explore and drill deeper into reservoirs with challenging geographical conditions. The exploration of unconventional resources, including tar sands and shale gas, is projected to boost market growth. While offshore activities gain attention, onshore activities are anticipated to continue dominating the market due to the increasing focus on unconventional resources and the production tubing of depleted gas wells. Coiled tubing is utilized in various applications, such as drilling, oil well intervention, stimulation, reperforation, fluid pumping, fishing, sand control, and well cleanout, among others.

Technological advancements in coiled tubing, including smart control systems, nitrogen pumping, saturation monitoring, and subsea applications, are further fueling market growth. The market encompasses diverse industries, including crude oil, petrochemicals, hydrocarbon exploration, and industrialization, among others. Coiled tubing is essential for conventional fuels, such as coal power stations and gas power stations, as well as for gas vehicles. Despite challenges from operational damage, corrosion, and mechanical damage, the market is expected to continue its growth trajectory.

Get a glance at the Coiled Tubing Industry report of share of various segments Request Free Sample

The Onshore segment was valued at USD 2.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is experiencing significant growth due to the region's status as the largest consumer of crude oil worldwide, driven by the transportation sector In the US and Canada. Despite the oil price slump in 2020, which led to the shutdown of several oil and gas E&P companies, the subsequent recovery in crude oil demand saw the US become the top producer and consumer. Coiled tubing plays a crucial role in various applications such as drilling, oil well intervention, stimulation, reperforation, fluid pumping, fishing, sand control, and well cleanout In the exploration and production of crude oil, natural gas, and unconventional resources.

Technological advancements in coiled tubing, including nitrogen pumping, saturation monitoring, and smart control systems, are enhancing operational efficiency and safety in deeper wells and offshore fields. Additionally, the use of coiled tubing in petrochemicals, shale oil extraction, hydrocarbon exploration, and industrialization is expanding its application scope. The market is further boosted by the increasing demand for petroleum products in conventional fuels, coal power stations, gas power stations, and gas vehicles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Coiled Tubing Industry?

Rising global oil and gas demand is the key driver of the market.

What are the market trends shaping the Coiled Tubing Industry?

Growing demand for new-generation automated drilling rigs is the upcoming market trend.

What challenges does the Coiled Tubing Industry face during its growth?

Fluctuating prices of raw materials is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The coiled tubing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coiled tubing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coiled tubing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Altus Intervention - The market encompasses a range of services, including annular fracturing and catenary CT. The former involves the application of hydraulic pressure to enhance oil and gas production, while the latter refers to the deployment of coiled tubing in a suspended, catenary state. Additionally, advanced coiled tubing software, such as CIRCA, assists in optimizing operations and enhancing efficiency. These solutions cater to various industries and applications, providing operators with effective and versatile methods for enhancing production and maximizing resource recovery.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altus Intervention

- Baker Hughes Co.

- Forum Energy Technologies Inc.

- Halliburton Co.

- HandyTube Corp.

- National Energy Services Reunited Corp.

- NexTier Oilfield Solutions Inc.

- NOV Inc.

- Oceaneering International Inc.

- RPC Inc.

- Sandvik AB

- Schlumberger Ltd.

- STEP Energy Services Ltd.

- Superior Energy Services Inc.

- Tenaris SA

- Trican Well Service Ltd.

- Trident Steel Corp.

- Weatherford International Plc

- Webco Industries Inc.

- Yantai Jereh Petroleum Equipment and Technologies Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The coiled tubing industry plays a vital role In the energy sector, providing essential services for pipeline handling, drilling, and oil well intervention. This market is characterized by continuous advancements in technology, which have led to improved work performance, well control, and safety. Coiled tubing is a versatile solution for various applications, including stimulation, reperforation, fluid pumping, fishing, sand control, and well cleanout. Its flexibility and adaptability make it an ideal choice for both onshore and offshore fields, enabling efficient and cost-effective operations. Technological advances have significantly impacted the coiled tubing industry. For instance, the integration of smart control systems has enhanced operational efficiency and productivity.

Nitrogen pumping and saturation monitoring have become essential practices to ensure the integrity of wells and pipelines, especially in deeper wells and subsea environments. The importance of safety and environmental protection cannot be overstated In the coiled tubing industry. Operational damage, corrosion, and mechanical damage are common challenges that must be addressed to minimize risks and ensure sustainable operations. Nitrogen compressor equipment plays a crucial role in maintaining well integrity and reducing the risk of operational damage. The energy landscape is evolving, with an increasing focus on unconventional resources such as shale oil extraction and hydrocarbon exploration. Coiled tubing services have become indispensable In these applications, providing cost-effective and efficient solutions for drilling and well intervention.

The petrochemical industry also benefits from coiled tubing technologies. Coiled tubing drills are used extensively In the production of petrochemicals, while metal pipes are employed in various applications, including the transportation of crude oil and petroleum products. The coiled tubing industry's technological advancements have also extended to conventional fuels, with applications in coal power stations and gas power stations. Furthermore, the use of coiled tubing in gas vehicles is gaining popularity as the world transitions to cleaner energy sources. Industrialization and the growth of infrastructure have led to an increased demand for coiled tubing services. The industry's ability to adapt to changing market dynamics and technological advancements positions it for continued growth and success.

In conclusion, the coiled tubing industry is a dynamic and innovative market that plays a crucial role In the energy sector. Its versatility and adaptability have made it an essential solution for various applications, from drilling and well intervention to pipeline handling and hydrocarbon exploration. The industry's commitment to safety, environmental protection, and technological advancements ensures its continued relevance and growth In the evolving energy landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.73% |

|

Market growth 2024-2028 |

USD 1205.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.33 |

|

Key countries |

US, Russia, China, Saudi Arabia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coiled Tubing Market Research and Growth Report?

- CAGR of the Coiled Tubing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, Europe, APAC, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coiled tubing market growth of industry companies

We can help! Our analysts can customize this coiled tubing market research report to meet your requirements.