Oil And Gas Storage Service Market Size 2025-2029

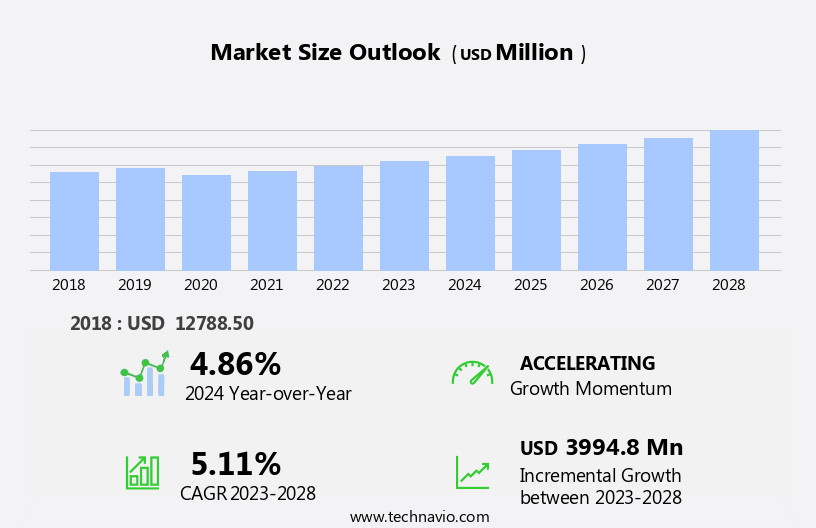

The oil and gas storage service market size is forecast to increase by USD 4.62 billion, at a CAGR of 5.6% between 2024 and 2029.

- The market is driven by the increasing global demand for oil and gas, necessitating the expansion of storage capacity to accommodate growing inventories. A notable trend in the market is the adoption of solidification technology for natural gas storage, enabling the efficient and safe storage of large volumes of natural gas. However, the market faces challenges due to the volatility in oil and gas prices, which can impact the profitability of storage projects. Natural gas and crude oil storage systems enable power plants to maintain a steady supply of fuel during peak load periods and unexpected outages. Companies specializing in oil and gas tank storage, LNG storage and regasification, and CNG storage are actively seeking innovative solutions to optimize their operations and mitigate the risks associated with price fluctuations.

- Additionally, the development of floating storage and regasification units (FSRUs) offers opportunities for expansion into new markets and the provision of flexible storage solutions to meet the evolving energy demands of industries and consumers. In the power sector, oil and gas storage solutions are indispensable for peaking and backup power generation.

What will be the Size of the Oil And Gas Storage Service Market during the forecast period?

- The market encompasses various solutions, including asset management, underground and above-ground storage options, and cryogenic storage. Technology adoption in this sector is on the rise, with digital twins and advanced safety systems, such as pressure relief valves, explosion protection, and flame arrestors, becoming increasingly common. Compliance auditing and environmental permitting are crucial aspects of the market, ensuring adherence to safety performance metrics and environmental performance metrics. Storage capacity planning is essential for operational efficiency, with demand forecasting and vapor pressure control playing significant roles. Cost optimization is a key trend, driving the use of inventory turnover, safety training, and emergency drills.

- Hazard analysis and gas detection are integral components of safety performance, while rupture disks and salt cavern storage offer enhanced safety and cost benefits. Market players focus on optimization and efficiency, with technology advancements in storage utilization rates and operational efficiency. Regulatory compliance and safety remain top priorities, with ongoing efforts to improve safety performance metrics and environmental performance metrics.

How is this Oil And Gas Storage Service Industry segmented?

The oil and gas storage service industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Power plants

- Oil refineries

- Chemical plants

- LNG storage facilities

- Service

- Storage services

- Ancillary services

- Type

- Underground storage

- Aboveground storage

- Geography

- North America

- US

- Canada

- Europe

- Russia

- Middle East and Africa

- Iran

- Qatar

- UAE

- APAC

- China

- India

- Singapore

- Rest of World (ROW)

- North America

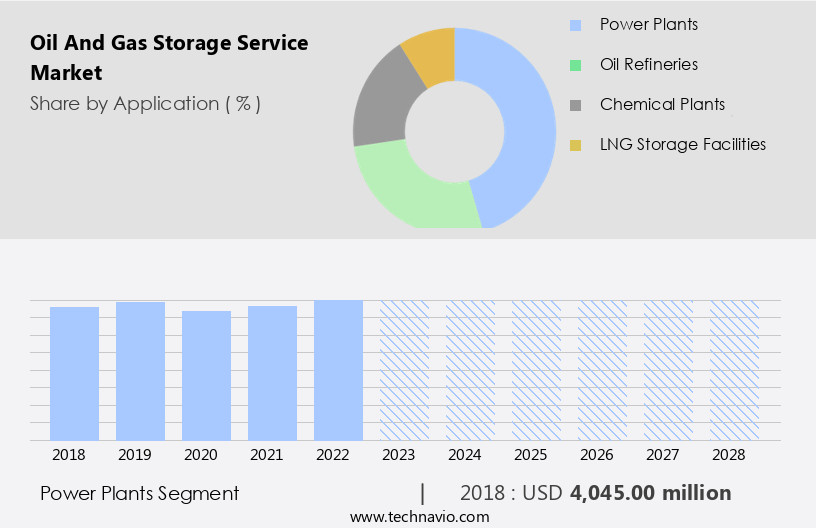

By Application Insights

The power plants segment is estimated to witness significant growth during the forecast period. The market encompasses a range of essential solutions for pipeline infrastructure, terminal operations, and power plants. Pipeline infrastructure necessitates tank coatings, temperature monitoring, and leak detection systems to ensure the safe and efficient transportation of oil and natural gas. Terminal operations rely on railcar loading, level monitoring, and inventory management to facilitate the transfer of petroleum products between various modes of transportation. Data security is a growing concern, as digitalization increases the need for robust cybersecurity measures.

These facilities incorporate advanced technologies such as artificial intelligence (AI), big data analytics, and remote monitoring to optimize capacity utilization and improve energy efficiency. Environmental protection is a critical concern in the oil and gas storage industry, with fire suppression systems, vapor recovery systems, and corrosion control measures ensuring safety and minimizing the carbon footprint. Logistics and transportation, including marine loading and third-party logistics, streamline the movement of petroleum products and facilitate just-in-time delivery. Storage tank maintenance, tank cleaning, and risk management practices ensure the longevity and safety of storage facilities. Digital transformation and SCADA systems enable real-time monitoring and control of storage facilities, while contract logistics and lease agreements facilitate flexible storage solutions.

The Power plants segment was valued at USD 4.18 billion in 2019 and showed a gradual increase during the forecast period.

Pressure relief devices and sustainable storage solutions cater to the evolving demand for renewable energy integration and reduced carbon emissions. Innovations in storage tank design, insulation systems, and product blending further enhance the market's growth. Security systems, pricing models, and emergency response plans ensure the safe and efficient operation of oil and gas storage facilities, while tank inspection and access control maintain the highest standards of quality and safety.

The industry is investing in advanced storage technologies, such as underground storage and liquefied natural gas (LNG) storage, to meet the growing demand for cleaner energy sources. The oil and gas storage market is subject to various challenges, primarily driven by crude oil price volatility. However, the industry is adapting to these challenges by implementing advanced technologies, focusing on environmental protection, and optimizing logistics and transportation. The digital transformation, including the adoption of big data analytics and remote monitoring, is also playing a significant role in improving storage efficiency and reducing operational costs.

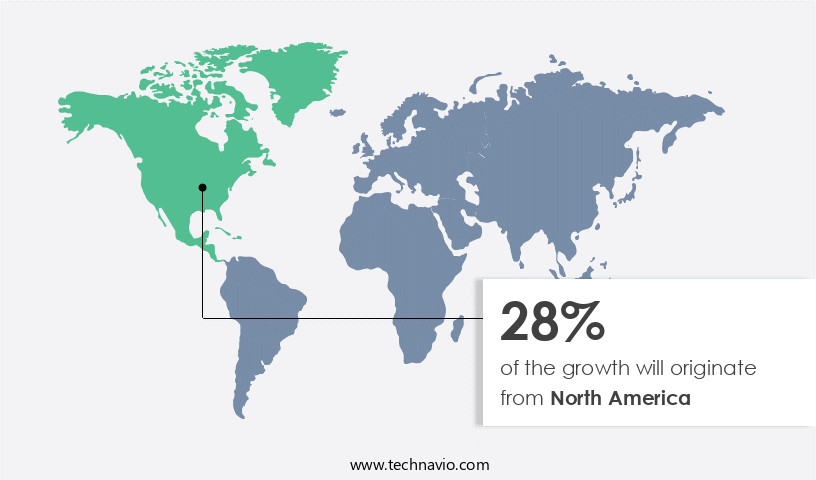

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American oil and gas storage market is experiencing significant growth due to the region's status as a leading producer and consumer of petroleum products. With the largest oil and gas storage capacity in the world, the US and Canada are at the forefront of this market. Increasing petroleum consumption, driven by production output growth from unconventional methods like shale drilling in the US and oil sands in Canada, necessitates storage expansion. This expansion creates demand for various services, including terminal operations, tank coatings, temperature monitoring, product traceability, fire suppression systems, railcar loading, level monitoring, artificial intelligence, inventory management, vapor recovery systems, third-party logistics, storage tank maintenance, energy efficiency, crude oil storage, environmental protection, marine loading, storage agreements, tank farms, leak detection systems, refining, natural gas storage, logistics and transportation, remote monitoring, big data analytics, capacity utilization, storage tank design, digital transformation, SCADA systems, corrosion control, process control systems, tank cleaning, risk management, contract logistics, insulation systems, product blending, security systems, lease agreements, pricing models, tank inspection, emergency response plans, carbon footprint reduction, storage optimization, petroleum product storage, pressure relief devices, sustainable storage solutions, construction materials, sampling and analysis, quality control, access control, tank refurbishment, automated tank gauging, renewable energy integration, and storage capacity, data acquisition systems.

These services are essential for ensuring efficient, secure, and environmentally friendly oil and gas storage and transportation. The integration of advanced technologies, such as artificial intelligence, big data analytics, and remote monitoring, is driving digital transformation in the market. Additionally, the focus on energy efficiency, environmental protection, and sustainable storage solutions is becoming increasingly important as concerns over carbon footprint reduction and risk management grow. The oil and gas storage market in North America is expected to continue growing during the forecast period, providing opportunities for companies offering innovative and efficient storage solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Oil And Gas Storage Service market drivers leading to the rise in the adoption of Industry?

- The market is primarily driven by the increasing demand for these resources on a global scale. The global demand for energy, driven by urbanization and industrialization in developing countries, has significantly increased the consumption of petroleum products and natural gas. According to The World Bank Group, the urban population in China grew by 6.25% in 2023, leading to a rise in energy demand. The US Energy Information Administration (EIA) reports that global liquid fuel consumption reached 1.6 million barrels per day (mbpd) in 2023 and is projected to reach 1.7 mbpd in 2024. This growing demand for fossil fuels, particularly in transportation, is driving the need for comprehensive oil and gas storage services.

- These services encompass various aspects such as pressure relief devices, sustainable storage solutions, construction materials, sampling and analysis, quality control, access control, tank refurbishment, automated tank gauging, renewable energy integration, and data acquisition systems. Pressure relief devices ensure safety, while sustainable storage solutions minimize environmental impact. Construction materials provide durability, and sampling and analysis ensure product quality. Access control and tank refurbishment maintain security and extend storage life, while automated tank gauging and data acquisition systems optimize operations and enhance efficiency. Renewable energy integration facilitates the transition to cleaner energy sources. The market is expected to grow as the world continues to urbanize and the demand for energy increases.

What are the Oil And Gas Storage Service market trends shaping the Industry?

- The emergence of solidification technology represents a significant market trend in the natural gas storage industry. This innovative technology enables the conversion of natural gas into a solid state for efficient and safe storage solutions. Natural gas storage services play a crucial role in the energy sector by ensuring a stable supply of this essential fuel. The primary methods of natural gas storage include underground facilities, such as depleted aquifers, salt caverns, and oil or gas fields, and aboveground facilities, where gas is stored in its gaseous or liquefied form. In underground facilities, natural gas is stored under pressure, while aboveground facilities employ various technologies, such as temperature monitoring, product traceability, and inventory management, to maintain optimal storage conditions. Pipeline infrastructure is integral to the natural gas storage value chain, as it facilitates the transportation of natural gas to and from storage facilities.

- Terminal operations, including railcar loading and vapor recovery systems, are essential components of aboveground storage facilities. To ensure safety and efficiency, these facilities incorporate advanced technologies like fire suppression systems, tank coatings, and artificial intelligence (AI) for predictive maintenance. Energy efficiency is a significant concern in natural gas storage, and various measures are being taken to minimize energy consumption. For instance, vapor recovery systems are used to capture and reuse the natural gas that would otherwise be vented during tank loading and unloading. Third-party logistics (3PL) providers offer specialized services to manage the complexities of natural gas storage and transportation.

How does Oil and Gas Storage Service market face challenges during its growth?

- The volatility in oil and gas prices poses a significant challenge to the industry's growth trajectory, requiring continuous adaptation and risk management strategies to mitigate the financial impact on operations. The oil and gas storage market faces significant challenges due to the volatile nature of crude oil prices. Price uncertainty can negatively impact new exploration and production investments, refinery expansions, and contract prices, ultimately affecting the demand for oil and gas storage services. Over the last decade, crude oil prices have displayed an inconsistent trend, with periods of low prices leading to the cancellation or delay of oil and gas projects. Between 2023 and 2024, crude oil prices continued to exhibit considerable volatility, influenced by supply dynamics, geopolitical tensions, and evolving demand patterns. To mitigate these challenges, the oil and gas storage industry is focusing on various strategies.

- These include environmental protection measures, advanced storage tank designs, digital transformation, and logistics and transportation optimization. For instance, the implementation of leak detection systems and SCADA systems ensures efficient and safe storage operations. Additionally, big data analytics and remote monitoring enable better capacity utilization and improved maintenance scheduling. Marine loading facilities also play a crucial role in ensuring efficient logistics and transportation. Natural gas storage is another critical aspect of the oil and gas storage market. With the increasing focus on reducing greenhouse gas emissions, natural gas storage is becoming an essential component of the energy transition.

Exclusive Customer Landscape

The oil and gas storage service market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil and gas storage service market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil and gas storage service market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Brooge Energy Ltd. - The company specializes in providing comprehensive oil and gas storage solutions through the operation of sophisticated bulk liquid storage facilities, featuring 14 strategically placed tanks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brooge Energy Ltd.

- Buckeye Partners LP

- Burns and McDonnell

- Compagnie Industrielle Maritime

- Emirates National Oil Co. Ltd. LLC.

- Enbridge Inc.

- Energy Transfer LP

- Exolum Corp. S.A.

- Fluor Corp.

- IMTT

- Kinder Morgan Inc.

- Koninklijke Vopak NV

- LBC Tank Terminals

- Marquard and Bahls AG

- McDermott International Ltd.

- NOV Inc.

- NuStar Energy L.P.

- Odfjell SE

- ONEOK Inc.

- Plains All American Pipeline

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oil And Gas Storage Service Market

- In February 2023, Shell and Qatar Petroleum announced a strategic collaboration to develop the Salalah LNG Expansion Project in Oman, which includes the construction of a new LNG storage facility with a capacity of 1.2 million cubic meters. This partnership marks a significant expansion for both companies in the LNG storage sector.

- In August 2024, Plains All American Pipeline completed the acquisition of Magellan Midstream Partners' 50% stake in the West Texas LPG Export Terminal in Corpus Christi, Texas. This acquisition strengthened Plains All American Pipeline's position in the growing U.S. LPG export market and expanded its storage capacity.

- In November 2024, Eni and Saipem successfully demonstrated the world's first floating storage and regasification unit (FSRU) powered by renewable energy. This technological advancement represents a crucial step towards decarbonizing the oil and gas storage industry.

- In January 2025, India's Oil and Natural Gas Corporation (ONGC) signed a Memorandum of Understanding with Woodside Energy to explore opportunities for collaboration in the oil and gas storage sector. This agreement marks ONGC's entry into the international market and opens up opportunities for strategic partnerships and knowledge sharing.

Research Analyst Overview

The market is characterized by its continuous evolution and dynamic nature, with various sectors integrating advanced technologies and solutions to optimize operations and enhance efficiency. Pipeline infrastructure and terminal operations are at the core of this industry, with tank coatings and temperature monitoring ensuring the protection and preservation of stored products. Product traceability and fire suppression systems are crucial components in maintaining safety and regulatory compliance. Railcar loading and level monitoring enable seamless logistics and transportation, while artificial intelligence (AI) and inventory management systems facilitate data-driven decision-making and capacity utilization. Vapor recovery systems contribute to environmental protection and energy efficiency, making them essential in the petroleum product storage sector.

Third-party logistics (3PL) and storage tank maintenance services ensure optimal performance and reduce operational risks. Digital transformation, including SCADA systems, big data analytics, and remote monitoring, is revolutionizing the industry by enabling real-time insights and predictive maintenance. Corrosion control, process control systems, tank cleaning, and risk management are essential components of storage tank design and operations. Contract logistics, insulation systems, product blending, and security systems are integral to the effective management of storage facilities. Lease agreements, pricing models, tank inspection, emergency response plans, carbon footprint reduction, and storage optimization are ongoing concerns for market participants. The integration of renewable energy sources and sustainable storage solutions is a growing trend, reflecting the industry's commitment to reducing its environmental impact.

Construction materials, sampling and analysis, quality control, access control, tank refurbishment, automated tank gauging, and renewable energy integration are all critical aspects of the market, demonstrating its ongoing dynamism. The integration of advanced technologies such as automation, IoT, and predictive analytics can enhance operational efficiency and improve the overall competitiveness of these companies in the market.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oil And Gas Storage Service Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 4.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Saudi Arabia, Canada, UAE, Iran, Singapore, India, Qatar, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil And Gas Storage Service Market Research and Growth Report?

- CAGR of the Oil And Gas Storage Service industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, APAC, Europe, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil and gas storage service market growth of industry companies

We can help! Our analysts can customize this oil and gas storage service market research report to meet your requirements.