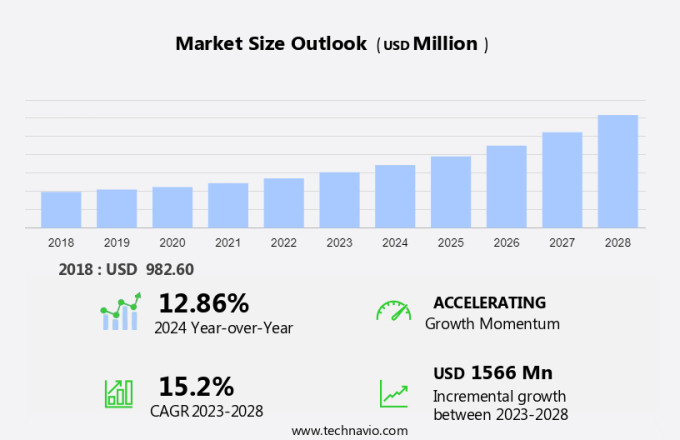

US Compliance Training Market Size 2024-2028

The US Compliance Training Market size is forecast to increase by USD 1.57 billion, at a CAGR of 15.2% between 2023 and 2028. The market is experiencing significant growth due to the increase in demand for customized courses and personalized learning, which drives institutions to tailor their offerings to individual student needs. Simultaneously, there is a continuous need for compliance with federal regulations, ensuring that institutions adhere to evolving standards and maintain accreditation. Additionally, the rise in the international student population further fuels market expansion as schools and universities strive to attract and support a diverse student base. Together, these factors contribute to a dynamic educational landscape where institutions must adapt and innovate to meet both regulatory requirements and the growing expectations of a global student community.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market has gained significant traction due to the increasing demand for ensuring food safety and maintaining the quality of perishable items, particularly raw fish. Companies like Allwin Roto Plast cater to this need by providing insulated tubs, fish boxes, and fish containers made of high-density polyethylene, fiberglass, and stainless steel. These containers prioritize integrity, durability, and longevity to ensure fresh fish during transportation and handling. Size and capacity, hygiene, and cleaning are crucial factors in the selection of these containers. Monsoons and other environmental factors necessitate the use of containers that can withstand harsh conditions. Plastic pallets, fabric-lined containers, and fish boxes with stackability features facilitate efficient storage and ease of handling. Raw fish processors rely on these compliance training and adherence to regulations to maintain their business operations and customer trust. The market is expected to grow due to the increasing focus on food safety and the need for sustainable and eco-friendly packaging solutions.

Key Market Driver

Increase in demand for customized courses and personalized learning is notably driving market growth. The compliance training market is experiencing significant growth due to the increasing demand for customized courses in various sectors, particularly in higher education. In this context, institutions in the US have unique regulatory requirements based on factors such as size, employee count, student enrollments, and types of courses offered. These differences necessitate customized compliance training programs, as off-the-shelf courses may not effectively address the specific needs of each institution.

Consequently, vendors like Skillsoft and Campus Answers are providing tailored solutions to cater to the diverse requirements of educational institutions. This trend is driven by the shift towards circular economy projects, which prioritize the reduction and management of ocean plastic waste, including that derived from polystyrene. Customized compliance training plays a crucial role in ensuring adherence to the regulations and codes of conduct associated with these projects. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Increasing emphasis on microlearning is the key trend in the market. Compliance training is evolving with the adoption of microlearning, a platform that delivers training content in short, easily digestible modules. This approach is particularly effective for ocean plastic and polystyrene compliance training, as it allows learners to absorb complex information through short videos, animations, infographics, and other multimedia formats. The flexibility of microlearning caters to diverse learning styles and schedules, enhancing retention rates without compromising learner motivation.

Further, organizations can leverage this method to deliver accurate and timely information, aligning with their circular economy projects and sustainability initiatives. Microlearning's adaptability and convenience make it an indispensable tool for effective and efficient compliance training. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Lack of adequate funding and infrastructure is the major challenge that affects the growth of the market. The compliance training market has seen varying growth trends due to numerous factors. One significant challenge is the financial constraints faced by educational institutions, particularly in the United States. In 2017, weak state tax revenue growth led to budget deficits for many states. Reduced grant funding for colleges and universities, coupled with increasing student debt, has affected the market's growth. These circumstances have resulted in disparities in tax budgets, employee salaries and pensions, and student enrollments with scholarships across different states.

In the context of environmental sustainability, this situation may hinder the implementation of circular economy projects, such as those focused on reducing ocean plastic waste or repurposing materials like polystyrene. Despite these challenges, the compliance training market continues to evolve, offering solutions to help organizations navigate complex regulatory landscapes and promote sustainable practices. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ACPA - The company offers compliance training solutions such as COMPLIANCE.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blackboard Inc.

- City and Guilds Group

- EVERFI Inc.

- GP Strategies Corp.

- LRN Corp.

- Maximus Consulting Ltd.

- Porzio Compliance Services LLC

- Skillsoft Corp.

- Vector Solutions

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Type

The market share growth by the offline learning segment will be significant during the forecast period. The Compliance Training Market in the packaging sector, particularly for raw fish processors, is experiencing significant growth due to the importance of maintaining temperature control, hygiene standards, and integrity during the transportation and handling of seafood. Companies like Allwin Roto Plast offer insulated tubs, fish boxes, and containers made of high-density polyethylene, fiberglass, stainless steel, and fabric-lined materials to ensure optimal temperature control and prevent bacterial growth. These containers are available in various sizes and capacities, making them suitable for fishermen, wholesale markets, restaurants, and other stakeholders in the seafood industry.

Get a glance at the market share of various regions Download the PDF Sample

The offline learning segment was valued at USD 592.90 million in 2018. In this segment, the market is expected to record a steady growth rate during the forecast period. Online learning platforms are increasingly popular in this market due to their convenience and cost-effectiveness. While offline learning through classroom-based courses still has its merits, online training allows learners to access content at their own pace and reduces the need for physical resources. However, it is crucial that online courses maintain the same level of hygiene and cleaning standards as offline courses to ensure the freshness and quality of fish. Durability and longevity are essential factors in the selection of fish containers. Materials like high-density polyethylene and fiberglass offer excellent durability and can withstand harsh conditions, including monsoons and humidity. Stackability is another essential feature, as it allows for efficient storage and transportation. Energy efficiency is also a consideration, with some containers utilizing expanded polystyrene insulation to minimize energy consumption. Lastly, recycling and reducing litter are essential considerations in the seafood industry, making containers that can be easily recycled a desirable option. Therefore, the market for online learning is expected to gain prominence during the forecast period.

Segment Overview

The market research report provides comprehensive data, with forecasts and estimates in "usD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- Offline learning

- Online learning

- End-user Outlook

- Academic staff

- Students

You may also interested in below market reports:

- Corporate Compliance Training Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, UK, Germany, Canada - Size and Forecast

- US Compliance Training Market by Courses and Delivery Mode - Forecast and Analysis

- Governance Risk and Compliance (GRC) Platform Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, UK, China, Germany, India - Size and Forecast

Market Analyst Overview

The market is a significant and growing area of focus, particularly for raw fish processors. Companies like Allwin Roto Plast provide insulated tubs, fish boxes, and containers made of high-density polyethylene and other materials to ensure temperature control during transportation and storage. These containers help maintain the freshness of fish, preventing bacterial growth and ensuring hygiene standards. The seafood industry places great importance on integrity, durability, and longevity in their packaging solutions. Plastic fish crates, fish tubs, and fish containers are popular choices due to their stackability and size and capacity options. However, other materials like fiberglass, stainless steel, and fabric-lined containers are also used depending on the specific needs of the application.

Further, monsoons and other environmental factors can pose challenges to food storage, making energy efficiency and recycling essential considerations. Humidity, bacteria, fungi, and other factors can affect the quality and safety of fish. Proper handling and transportation are crucial to prevent damage and ensure freshness. Plastic pallets, expanded polystyrene, and other packaging solutions are used in wholesale markets, restaurants, and other sectors of the seafood industry. Energy consumption, litter, and other sustainability concerns are increasingly important factors in the design and implementation of packaging solutions. Compliance training plays a vital role in ensuring that all stakeholders in the seafood supply chain understand and adhere to the latest regulations and best practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

111 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2024-2028 |

USD 1.57 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

12.86 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ACPA, Blackboard Inc., City and Guilds Group, EVERFI Inc., GP Strategies Corp., LRN Corp., Maximus Consulting Ltd., Porzio Compliance Services LLC, Skillsoft Corp., and Vector Solutions |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies